Fokusiert

Due to higher interest rates aimed at combating inflation, as well as general concerns about the state of the economy moving forward, pretty much anything related to the construction space has been looked upon with a jaundiced glance by investors. But one company in this market that seems to be performing extraordinarily well is Installed Building Products (NYSE:IBP). As an enterprise that’s dedicated to offering services centered around insulation installation, as well as other offerings like waterproofing, garage doors, rain gutters, and more, this might be the type of firm that investors who are worried about the construction space and the economy in general might want to stay away from. However, sales continue to grow and both profits and cash flows have been following suit. Add on top of this the fact that shares of the company still look cheap despite rising nicely in recent months, and I cannot help but to keep the ‘buy’ rating I had on the enterprise previously.

Building value

Back in September of this year, I wrote an article that reaffirmed my ‘buy’ rating on Installed Building Products. In that article, I talked about the strong top line and bottom line performance of the company up to that point. I did acknowledge that the general market was pessimistic about the firm and about this space in general. But at the end of the day, I felt as though even weaker financial performance would still necessitate upside for shareholders eventually. This made me conclude that the company offered investors a solid risk-to-reward opportunity that was difficult to ignore. So in response to all of that, I felt comfortable keeping it rated a ‘buy’. Since then, the company has not disappointed. While the S&P 500 is up 9.2%, shares of Installed Building Products have seen upside of 11.2%.

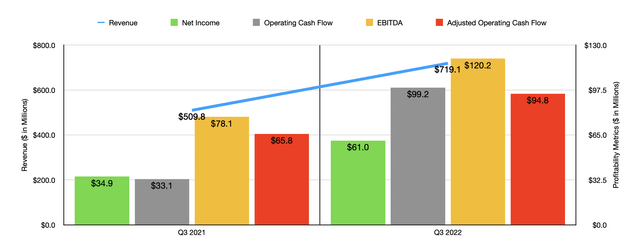

Over a longer period of time, such a return disparity might not be considered all that significant. By considering how short a time we are dealing with, I would argue that the company has achieved my definition of success for the rating I signed it. But make no mistake. This return disparity was not without cause. To see what I mean, we need only look at financial results covering the third quarter of the company’s 2022 fiscal year. This is the only quarter for which we now have data available that was not available when I last wrote about it. During that quarter, sales came in strong at $719.1 million. That’s 41.1% higher than the $509.8 million the company generated only one year earlier. This increase in sales was driven by robust volume growth and price and product mix growth. For instance, at same-branch locations, volume growth for the company jumped by 7.5% while pricing and product mix helped to the tune of 27.1%. This was backed by robust completions in the housing market. Total completions in the latest quarter were 6.5% higher than they were one year earlier. This was made up by a 5.6% increase in completions associated with multifamily properties and an 8.1 percent increase involving single-family properties. The company has also benefited from various acquisitions. So far this year, the company has made acquisitions that should bring on $78 million in additional revenue per year. That places it well on its way to the $100 million or more that management has been pushing for.

Naturally, such a nice increase in revenue brought with it improved profits. Net income jumped from $34.9 million in the third quarter of 2021 to $61 million the same time this year. This came in part from a rise in the company’s gross profit margin from 30.6% to 30.8%. But the larger contributor was a significant drop in selling and administrative costs from 18.1% of revenue to 16.1%. When applied to the company’s sales in the third quarter, this change alone would have impacted pre-tax profits to the tune of $14.4 million. Other profitability metrics followed suit. Operating cash flow nearly tripled from $33.1 million to $99.2 million. If we adjust for changes in working capital, it would have risen from $65.8 million to $94.8 million. And over that same window of time, we also saw a nice improvement in EBITDA, with that metric growing from $78.1 million to $120.2 million.

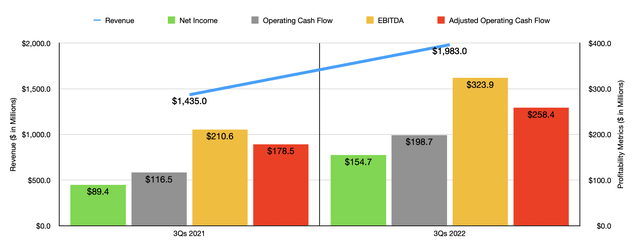

Thanks to the strong results achieved in the third quarter, the company has continued to report strong results for the first nine months of the 2022 fiscal year as a whole. Revenue of $1.98 billion beat out the $1.44 billion reported the same time last year. Net income nearly doubled from $89.4 million to $154.7 million. Operating cash flow grew from $116.5 million to $198.7 million, while the adjusted figure for this increased from $178.5 million to $258.4 million. And finally, even EBITDA has continued to improve, jumping from $210.6 million to $323.9 million.

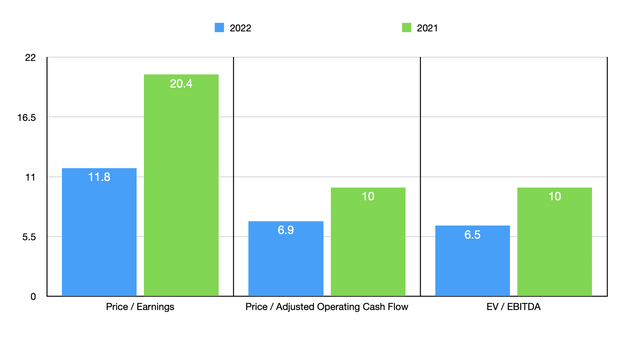

We don’t really know what to expect when it comes to the 2022 fiscal year in its entirety. Management has not provided any real guidance. But if we annualize results experienced so far, we should anticipate net income of $205.6 million, adjusted operating cash flow of $349.9 million, and EBITDA of $470.5 million. Based on these figures, the company would be trading at a forward price to earnings multiple of 11.8, at a forward price to adjusted operating cash flow multiple of 6.9, and at a forward EV to EBITDA multiple of 6.5. By comparison, using the data from 2021, these multiples would be 20.4, 10, and 10, respectively. As part of my analysis, I also compared the enterprise to five similar businesses. On a price-to-earnings basis, these companies ranged from a low of 6.5 to a high of 23.8. Two of the five companies were cheaper than Installed Building Products. Using the price to operating cash flow approach, the range was from 12.6 to 27.5. And using the EV to EBITDA approach, the range was from 6.6 to 14.1. In both of these cases, our prospect was the cheapest of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Installed Building Products | 11.8 | 6.9 | 6.5 |

| Masonite International Corporation (DOOR) | 10.9 | 12.6 | 6.6 |

| CSW Industrials (CSWI) | 23.8 | 26.1 | 14.1 |

| Griffon Corp (GFF) | 6.5 | 27.5 | 9.2 |

| JELD-WEN Holding (JELD) | 18.1 | 25.7 | 8.3 |

| Gibraltar Industries (ROCK) | 18.5 | 21.0 | 11.2 |

Takeaway

Based on what data we have available today, I will say that I continue to be impressed fundamentally by Installed Building Products. The company is performing exceptionally well in this environment. Near term, management expects strength to continue, likely through at least the first six months of its 2023 fiscal year. Though they do think that the second half of next year could be soft. Even if financial performance does weaken though, shares still look cheap enough on both an absolute basis and relative to similar firms to justify the ‘buy’ rating I assigned to the company previously.

Be the first to comment