sanfel/iStock Editorial via Getty Images

Shares of Dick’s Sporting Goods (NYSE:DKS) have rallied back significantly from their June lows, but they do remain about 10% lower from last year. This company was a tremendous beneficiary of COVID-19 as spending on sporting goods soared. The question now is how much of its revenue gains does it give back over the next 12-18 months as spending patterns normalize. I expect the company has about $7 in earnings power, so at 16x earnings, I would use the recent recovery to sell shares and look for value elsewhere.

While 2021 clearly represented the peak in the business, the company is still performing well, particularly when results are benchmarked to pre-COVID levels. In the company’s second quarter, same-store sales fell 5.1%, and revenue was down 5% to $3.1 billion. This level is still 39% than in 2019. Some of this is clearly price, given significant inflation, but volumes are also higher, likely as the company has gained share, perhaps as some smaller retailers closed for good during lockdowns.

Thanks to a higher sales rate, the company is more profitable than ever, in part because retailers have significant operating leverage, given the fact items like rent are largely fixed. Its pre-tax operating margin of 13.7% was double 2019. In the quarter, it earned $3.68 in adjusted EPS, which was down from $5.08 last year. However, this $3.68 in EPS is equal to 2019’s total earnings for the entire year. Dick’s is selling more items than pre-COVID, and it is making more on each item. This is a reason the stock price is trading at more than double its pre-COVID level.

With the strong cash flow of the past eighteen months, it has been aggressively returning cash to shareholders. In fiscal 2021, it repurchased $1.1 billion in stock. So far in 2022, it has repurchased $392 million in stock. Since the end of fiscal 2019, it has reduced its share count by about 20%, which also supports a higher stock price than then.

The business is moderating, and management expects that to continue, though a bit more slowly than previously thought. For the full year, Dick’s is guiding to -2% to -6% same store sales, and it raised its EPS guidance from $9.75-$11.70 to $10-$12. At the midpoint, EPS will likely be down about 30% from last year. I would also note the company has done $6.50 in EPS in H1, so this implies $4.50 in H2 at the mid-point. That would mean Dick’s earns 41% of its profits in the second half of the year, a bit below the 43% last year. In other words, it is seeing a bit of deceleration in the second half.

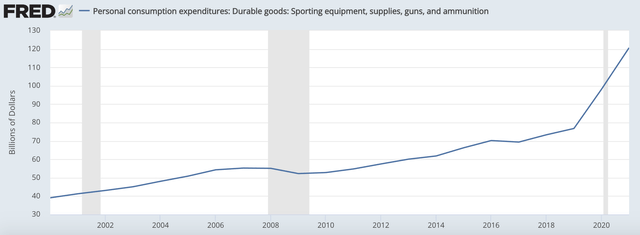

As Dick’s results show, there was a surge in sporting goods purchases over the past two years that is unlikely to be sustained forever. Sporting equipment sales surged 58% from 2019 to 2021, and they are more than 25% above the pre-COVID trend. From February 2020 to January 2022, Dick’s revenue rose by 40%, tracking much of this gain. Sporting goods account for about 44% of Dick’s sales with apparel 34%, and footwear 21% the remainder.

Now, there may be a permanent uplift to the pre-COVID trends. Some individuals may have picked up golf or tennis who never would have and will now spend more on sporting equipment, but the overshoot is so dramatic that further declines beyond just the 5% revenue drop Dick’s experienced last quarter appears highly likely in my view. We also must consider the fact that high inflation has squeezed real disposable incomes, which will be a headwind for discretionary purchases like sporting goods and associated apparel.

Beyond the revenue decline, the other key question is how much margins retrace. Cost of goods sold was 64% last quarter, but in 2019 it was 70.8%, and in 2018, it was 71%. The company argues it has improved its promotions strategy, grown its own brands, which are higher margin, has scaled up e-commerce (now 21% of the business), and is taking costs out via lease renegotiation, though companies like Kimco (KIM) are reporting rising lease rates in outdoor shopping centers, which is where Dick largely operates its 860 stores.

Admittedly, how much these arguments are true is a bit unknowable until there is a downturn. It clearly has built more e-commerce scale and grown its vertical brands, so “normal” margins should be better than pre-COVID. At the same time, promotional activity is likely to be higher than now when demand is still so strong, so margins should be somewhat lower than they are today. I also would note inventories are up 49% this year. This large inventory growth during a period of declining sales does make me worry about increased promotions.

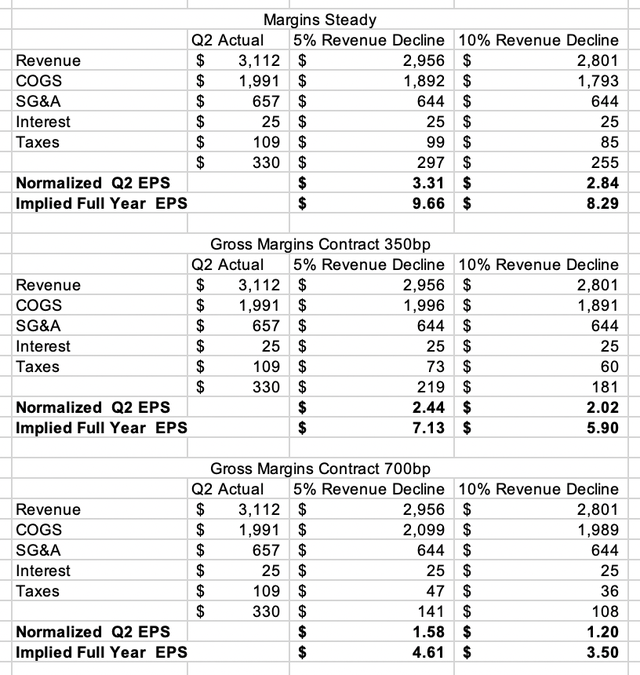

In the table below, I use Q2 results to model out what normalization could look like as results normalize. I use a 5% and 10% revenue decline, given my view that sporting goods sales have to converge toward the trend but not necessarily get all the way there (even a 10% decline would leave sales 25% above 2019 levels). I then map those two revenue scenarios assuming it holds gross margins flat, they contract 350bp (i.e. halfway between the present and 2019), or they contract 700bp and return to 2019 levels. As moderating demand should reduce headcount needs, I assumed a 2% reduction in SG&A, which given wage growth I view as an optimistic estimate.

My base case is the 5% revenue decline/350bp margin contraction combination. Given the headwinds it faces and inventory it needs to move, margins are likely to contract, but there are some structural improvements vs 2019. Consumers are still spending, and Dick’s appears to have been a share gainer, so absent a recession, the further 10% revenue decline strikes me as pessimistic. It is notable in my worst-case scenario where all of its margin gains erode and sales fall 10%, it nearly matches 2019 earnings. What was once a great result is now the worst case—this alone is indicative of the improvements the company has made.

My $7 go-forward earnings estimates may explain why the stock found a floor in the low $70’s as that was 10x 2023 earnings, a level where you are being compensated for the uncertainty of buying into a company with declining earnings. It has now rebounded to a 15-16x multiple against my base case.

Considering the uncertainty of declining earnings and markets’ tendency to extrapolate declines out into the future, I have felt that investors should restrict their holdings in these types of companies to ones with prospective P/Es below 10x, which is why I’ve recommended names like AutoNation (AN), Nucor (NUE), and Capital One (COF). These companies all face the same “normalization” after artificially strong post-COVID results but trade at much lower multiples. While DKS is not an expensive stock, given the headwinds and uncertainty it faces, I would take advantage of the rebound to sell shares and look at cheaper stocks.

Be the first to comment