Melpomenem

The market is devastated by the new Lumen Technologies (NYSE:LUMN) capital allocation strategy, but the news is far more disappointing than devastating. With long-time communications industry leader Jeff Storey on his way out, investors were already fearing the BoD would cut the dividend before the new CEO starts next week. My investment thesis remains Bullish on the stock, but the company isn’t doing investors any favor in the short term.

Dividend Elimination By Lumen Technologies

Lumen announce CEO Jeff Storey was leaving the company back on September 13 and the stock has absolutely collapsed during this period. New CEO Kate Johnson starts on November 7 with the stock now down over 35% heading into the start of her tenure.

The telecom company announced the following changes to the capital allocation plan:

- Eliminated stock dividend, there will be no dividend paid in the fourth quarter of 2022

- Authorized an up to $1.5 billion, two-year share repurchase program

- Investing in growth initiatives while remaining relatively net leverage neutral

The key is that Lumen is swapping out a $1 annual dividend payment amounting to ~$1.0 billion in annual dividend payments for a plan to repurchase up to $1.5 billion in shares over 2 years. Lumen is swapping out a guaranteed $2.0 billion in dividend payments over the next 2 years for the possibility of buying $1.5 billion worth of shares.

The good part of the dividend elimination causing the stock to crater below $6.50, or the equivalent of a market cap of $6.5 billion, is that the proposed buyback would repurchase 23% of the outstanding stock. At the current stock valuation, the market cap will fall below $5.0 billion on the completion of this share buyback.

The company plans to invest more in growth initiatives with the cash saved from the switch in capital allocation plans. Not to mention, Lumen could definitely increase the buybacks due to the flexibility offered by share buybacks.

Ultimately, Lumen is better off not being tied to large dividend payouts for a high capex company with tons of debt. These companies always struggle due to feeding the different requirements for capital.

In the short term though, the better solution by management was to not place long-term shareholders in this painful situation of cutting the dividend again causing the stock price to crater. The best solution to existing shareholder value was to repeatedly pay the dividend and reward those holding the stock.

Lots Of Cash

Another problem with cutting the dividend here is that Lumen didn’t need to make a cut. The company guided up free cash flows for the year and announced another deal to sell a division for $1.8 billion.

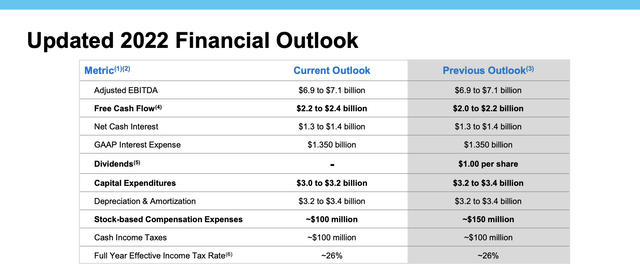

Lumen now forecasts FCF of $2.3 billion this year, up from $2.1 billion in the prior guidance. The $200 million increase is basically boosted by a reduction in capital expenditures from $3.3 billion to only $3.1 billion.

Source: Lumen Q3’22 presentation

The telecom maintained adjusted EBITDA targets for the year at $6.9 to $7.1 billion. The financial picture hasn’t changed and in fact, Lumen has announced $2.0 billion in additional cash coming into the business with the $200 million in additional FCF and the $1.8 billion transaction with Colt Technology Services to sell the EMEA business.

Lumen ended Q3’22 with net debt of ~$25.0 billion. Since the end of the quarter, the company closed the 20-state ILEC deal and collected $5.6 billion in pre-tax cash proceeds along $1.5 billion of debt payments to Brightspeed and quickly repaid $3.2 billion in additional debt.

Again, the company doesn’t lack the cash to continue the dividend, nor has the financial position deteriorated to the point where Lumen couldn’t continue paying the dividend. In the last quarter, the company produced $1.66 billion in adjusted EBITDA, for an annualized rate of $6.64 billion.

The stock only trades at 1x EBITDA with the dip and the EV is close to 4x EBITDA after accounting for the deal closed on October 3. Naturally, a stock buyback makes more sense at this low valuation, but the stock market doesn’t always welcome logic when the move comes to eliminating the dividend. The lack of confidence that occurs during a period of eliminating dividends offsets the financial benefits.

With stock buybacks coming from ongoing free cash flows, the EV would dip to closer to $24 billion with the buybacks with the EV/EBITDA multiple dipping close to only 3.5x.

Takeaway

The key investor takeaway is that Lumen is crazy cheap here, but the dividend elimination won’t help the stock much in the short term due to the turmoil in the shareholder base. As the telecom repurchases a substantial amount of shares over the next year, the stock should start rallying with the reduced share count and confidence from realizing the CEO change wasn’t related to any financial problems.

Be the first to comment