SimonSkafar

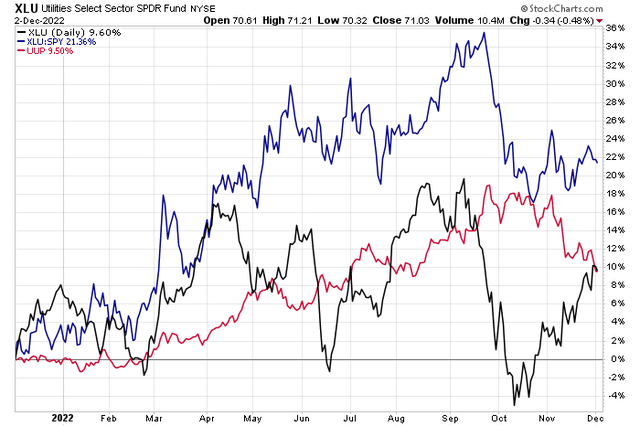

Utilities may have peaked relative to the S&P 500 back in September. The domestically oriented group performed well as the U.S. dollar rose, but the defensive sector has endured a tough stretch in the last two-plus months. I see valuations still elevated in the space, but one name features a P/E that is at a slight discount to the SPX. Is Evergy a buy as a result? Let’s shed some light on this one.

Utilities: Relative Strength & Weakness With USD Moves

According to Bank of America Global Research, Evergy (NYSE:EVRG) was formed in 2018 by the merger of Westar and Great Plains with primary operations in Missouri and Kansas. It operates through its subsidiaries Westar Energy, Kansas City Power & Light (KCP&L), and Great Missouri Operations (GMO). Evergy serves approximately 1.6Mn electric customers with over 11GW of owned generation using over 13,000 miles of transmission and 52,000 miles of distribution assets.

The Missouri-based $13.4 billion market cap Electric Utilities industry company within the Utilities sector trades at a near-market 16.9 trailing 12-month GAAP price-to-earnings ratio and pays a high 4.2% dividend yield, according to The Wall Street Journal.

Evergy has risks around its ability to pass through rate increases to its load base. As such, the stock was cut to a sell by BofA back on November 23 and double-downgraded by Credit Suisse the next week. The bearish news came after a relatively strong Q3 earnings report that beat analysts’ estimates. Evergy also raised its guidance and boosted its dividend.

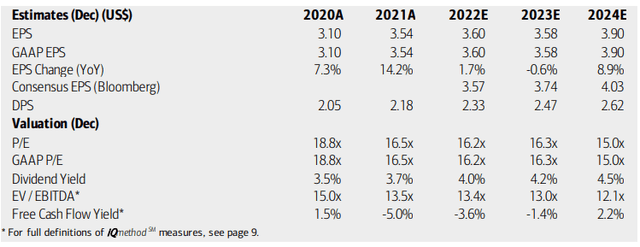

On valuation, analysts at BofA see earnings rising just modestly in 2022 before falling ever so slightly next year. 2024 per-share profits are seen as rising at a solid rate. The Bloomberg consensus forecast calls for slightly stronger EPS than what BofA sees.

Both Evergy’s operating and GAAP earnings multiples are near to slightly below those of the market, which is actually somewhat cheap compared to the sector. Many of Evergy’s Midwest utility peers trade at premium multiples. The firm’s dividend yield is seen as holding steady near just above 4% in the coming quarters. Seeking Alpha rates Evergy’s valuation at a B, and I’d generally agree.

Evergy: Earnings, Valuation, Dividend Forecasts

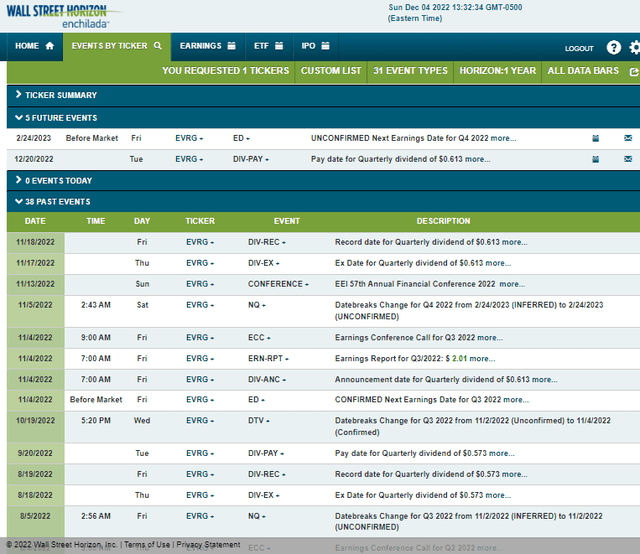

Looking ahead, corporate event data provided by Wall Street Horizon shows an unconfirmed Q4 2022 earnings date of Friday, February 24 BMO. Before that, Evergy has a dividend pay date of Tuesday, December 20.

Corporate Event Calendar

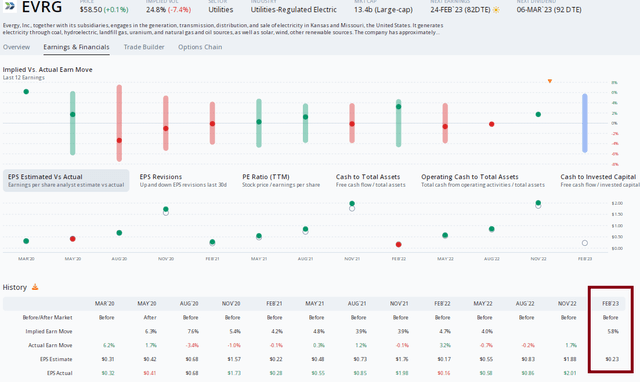

Data from Option Research & Technology Services (ORATS) show a consensus Q4 EPS forecast of $0.23 which would be a material increase from $0.16 of per-share profits earned in the same quarter a year ago. The options market has priced in a relatively high 5.8% stock price swing post-earnings using the nearest-expiring at-the-money straddle. With implied volatility near 25%, I would sell that straddle at current prices based on historical earnings moves, but it’s still early.

Evergy: Strong Q4 Earnings Expected

The Technical Take

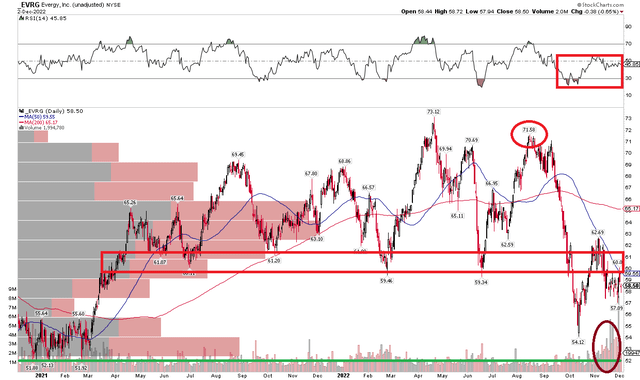

EVRG has gotten hit hard on an absolute basis and relative to the broad market in the last few months. Utilities were hammered back in September as rates jumped above the yields on so many utilities. I see a broad resistance zone in the $59 to $62 range, and the stock is importantly below that area now. I’d avoid the stock as a result. There is perhaps some support near $52 – the late 2020 and early 2022 lows along with a significant amount of volume by price in that range.

Also notice how EVRG’s RSI is now mired in the bearish 20 to 60 zone – the bulls want to see shares rise above $63 on stronger momentum to break this downward trend since August. What concerns me is unusually high volume in the last month as the stock has generally been stuck near recent lows – that is likely a bearish harbinger.

EVRG: Shares Below a Key Resistance Zone

The Bottom Line

I think the valuation on Evergy is more compelling than some of its peers, but dismal EPS growth next year along with a bearish chart make me included to have a sell recommendation for now.

Be the first to comment