Scott Olson

Domino’s Pizza (NYSE:DPZ) has been a great long-term investment due to its consistent revenue growth over the years. The company has a strong track record of delivering high-quality pizza and excellent customer service, which has helped it to attract and retain a loyal customer base. In addition, Domino’s has implemented innovative technology, such as online ordering and mobile apps, to make it easier for customers to place orders and track their deliveries. This has helped the company to remain competitive in an increasingly crowded market.

Company Outlook

Domino’s Pizza is the number one pizza delivery company in the United States, based on reported consumer spending. The company also has a significant international presence and is one of the largest pizza companies in the world in terms of units and sales. Domino’s operates over 19,500 units in more than 90 markets, and nearly 98% of its stores are franchised.

Despite generating strong free cash flows, Domino’s also carries a significant net debt load. While this burden is manageable, the company’s annual interest expenses could become a challenge if the company experiences any setbacks.

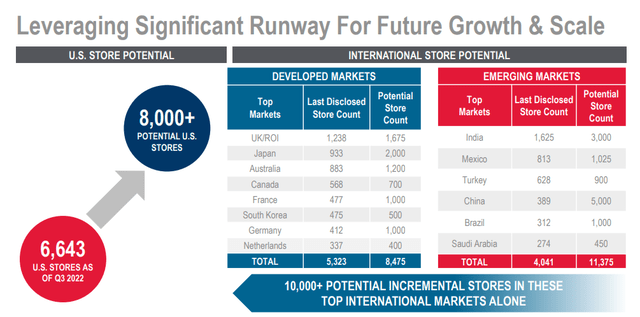

Domino’s sees potential to add over 15,000 additional restaurant locations to its operations across its top 15 markets worldwide. Their plans are focused heavily on developing nations like India, Mexico, and China.

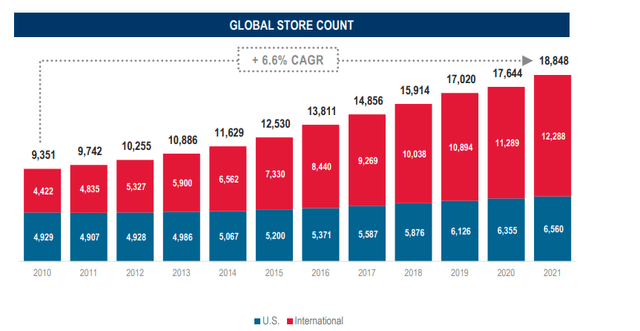

The company’s growth runway is extensive in both developed and developing markets. In the US, Domino’s predicts it could grow its total store count to around 8,000, a significant increase from current levels. This would only continue a long-term positive trend.

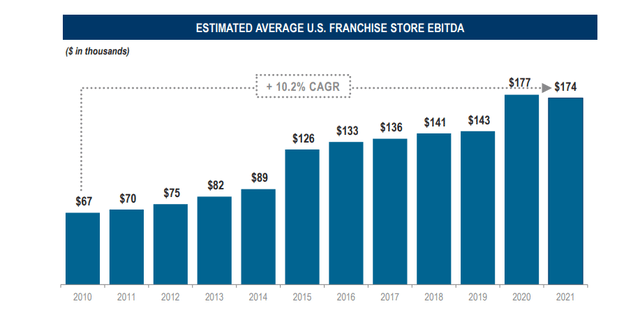

The company’s franchise-oriented business model and global focus are probably its most attractive features. Its strong pricing power has helped offset inflationary headwinds, and its digital platform and home delivery operations are key competitive advantages. This can be seen in the strong Franchise EBITDA trends topping a 10% CAGR.

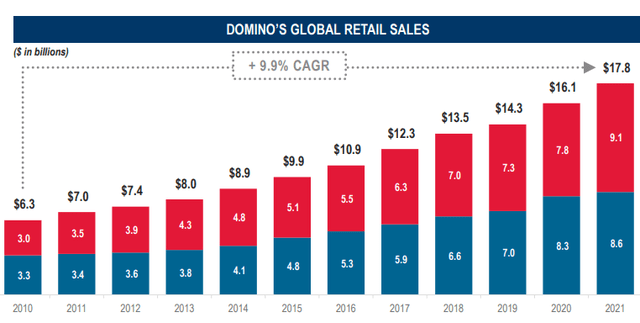

The strong EBITDA is crucially driven by strong Global sales growth.

Despite a recent slowdown, Domino’s return on invested capital remains impressive, and the company is expected to continue its growth through new store expansion and EBITDA improvements.

Industry Outlook

Domino’s Pizza is facing strong competition from other delivery options as consumers increasingly turn to a variety of sources for their food delivery needs. In recent years, the rise of food delivery apps and services has disrupted the traditional restaurant industry, and pizza delivery is no exception. Domino’s, which has long been a dominant player in the pizza delivery space, is now facing competition from a growing number of rivals.

One major source of competition for Domino’s is the proliferation of food delivery apps, such as Uber Eats (UBER), Grubhub, and DoorDash (DASH). These apps allow customers to order from a wide range of restaurants and have their food delivered to their doorstep, giving them more options for their delivery needs. This has made it more difficult for Domino’s to maintain its dominance in the pizza delivery market, as customers have more options to choose from.

In addition to food delivery apps, Domino’s is also facing competition from other pizza chains that have expanded their delivery capabilities. Many of these chains, such as Pizza Hut (YUM) and Little Caesars, have invested in their own delivery infrastructure and are now able to offer customers the convenience of delivery without relying on third-party apps. This has made it easier for these chains to compete with Domino’s and grab a share of the growing delivery market.

Strong Earnings

Domino’s Pizza reported strong third-quarter earnings for 2022, with global retail sales increasing by almost 5% and 200 net new stores being opened. The company’s same-store sales in the US increased by 2% in the quarter, and its carryout business saw same-store sales increase by 20%. CEO Russell Weiner highlighted the continued strong demand for the brand and the growth potential in the company’s carry-out business. The company’s digital channels also performed well, with digital sales increasing by 26% in the quarter. Domino’s continues to focus on expanding its store network and growing its digital capabilities.

Valuation and Forward-Looking Commentary

Domino’s has consistently grown its revenue over the years by focusing on providing high-quality pizza and excellent customer service. The company has also implemented innovative technology, such as online ordering and mobile apps, to make it easier for customers to place orders and track their deliveries. In addition, Domino’s has expanded its menu to include a wide variety of items beyond just pizza, such as sandwiches and salads, which has helped to attract new customers and increase sales.

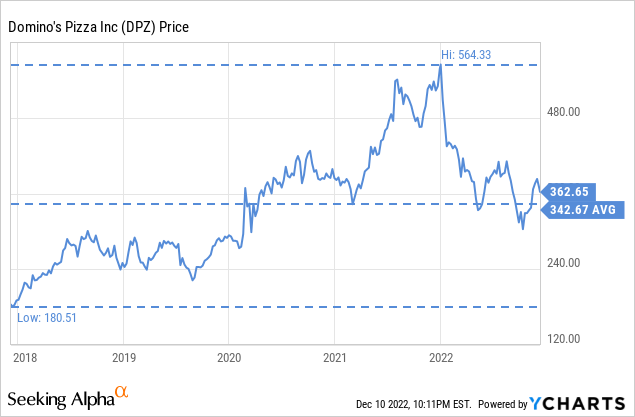

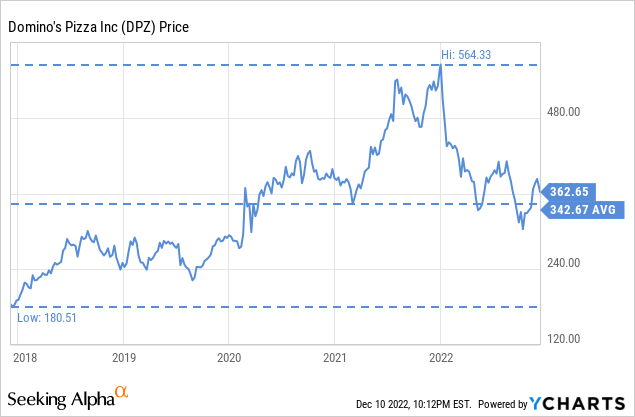

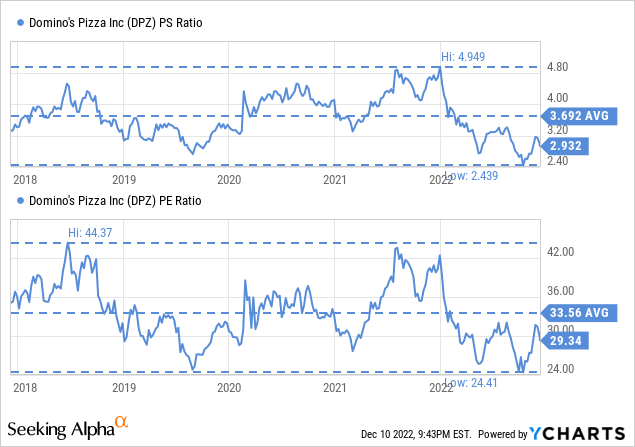

While some investors may consider Domino’s stock to be cheap due to its low price-to-sales (PS) ratio of 2.9, others may argue that it is fairly priced. The PS ratio is a measure of the price of a stock relative to its revenue, and a low ratio can indicate that the stock is undervalued compared to its peers. However, in the case of Domino’s, its PS ratio is actually lower than the five-year average of 3.7, which suggests that the stock may be fairly priced. In other words, investors may be willing to pay a similar amount for Domino’s stock as they would for other stocks in the pizza industry.

Additionally, Domino’s has a high price-to-earnings (PE) ratio of 29.3, which could be seen as evidence that the stock is fairly priced. The PE ratio is a measure of the price of a stock relative to its earnings, and a high ratio can indicate that the stock is overvalued compared to its peers. In the case of Domino’s, its PE ratio is actually higher than the sector median of 10 but lower than its five-year average, which suggests that investors may be willing to pay a premium for the company’s stock. Therefore, while some investors may view Domino’s stock as cheap, others may consider it to be fairly priced based on its PS and PE ratios.

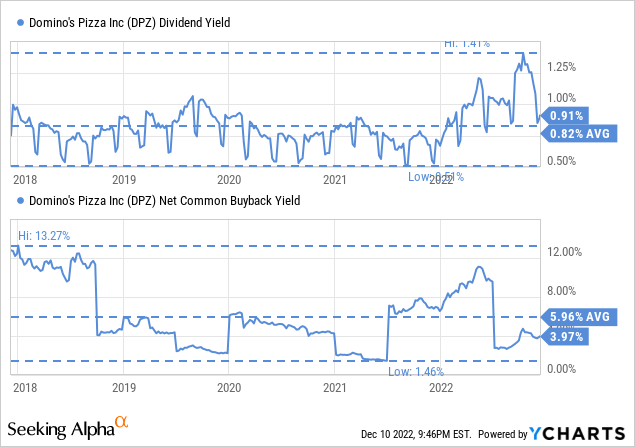

Domino’s has an excellent track record of returning capital to shareholders through dividend payments and share buybacks. The company has consistently increased its dividend payments over the years, and it currently offers a quarterly dividend of $1.1 per share.

In addition, Domino’s has also implemented several share buyback programs, which involve repurchasing its outstanding shares to reduce the number of shares available on the market. These buybacks can help to increase the value of the remaining shares and boost shareholder returns.

The Takeaway

Domino’s Pizza has been a successful long-term investment due to its consistent revenue growth and strong track record of delivering high-quality pizza and excellent customer service. The company’s focus on innovative technology and expanding its menu have helped it remain competitive in an increasingly crowded market. Domino’s has a significant international presence and sees potential for growth through the addition of over 15,000 additional restaurant locations across its top 15 markets worldwide. However, the company is facing competition from food delivery apps and other pizza chains, which could impact its growth in the future. Despite this, Domino’s recent strong earnings and impressive return on invested capital suggest that it is well-positioned for continued growth. For this reason, I rate the stock a Buy.

Be the first to comment