ALLVISIONN/iStock via Getty Images

Investment Thesis

Warner Bros. Discovery, Inc. (NASDAQ:WBD) guided that its DTC streaming segment in the US would only break even by 2024, with a projected $1B in EBITDA and 130M of global subscribers by FY2025. It is apparent that monetization of its streaming segment remains challenging post-reopening cadence, given the myriad choices in the market. Thereby, extending the company’s cash burn ahead from the profitable Networks segment.

In the meantime, the WBD management has proven to be highly decisive in its profit strategies, given the massive product restructuring and cost-cutting measures. Assuming fruition, we are relatively confident in its eventual leveraging and profitability, though unlikely as soon as FY2024. It remains to be seen how the company would perform over the next two years, as consumers continue to tighten their belts over discretionary spending. In the meantime, we rate WBD as a Hold.

WBD Remains Largely Unprofitable With Colossal Debt Burdens

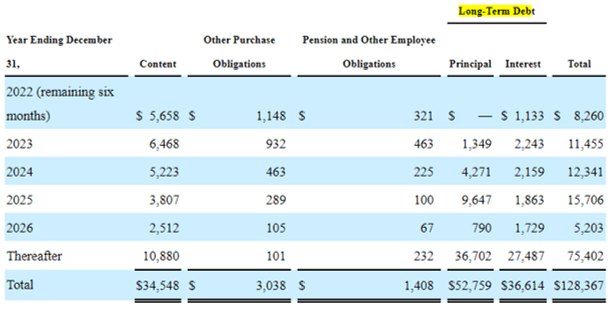

In FQ2’22, WBD first reported its combined revenues of $9.82B and gross margins of 32.6%. In contrast, the company reported a lower GAAP EBITDA of $647MB, with EBITDA margins of 6.6% then. Otherwise, an adj. EBITDA of $1.66B and EBITDA margins of 16.8%. Since these numbers obviously represent a massive underperformance against previous guidance of up to $10.7B annually, we are not surprised by the stock’s plunge of -19.7% post-earnings call.

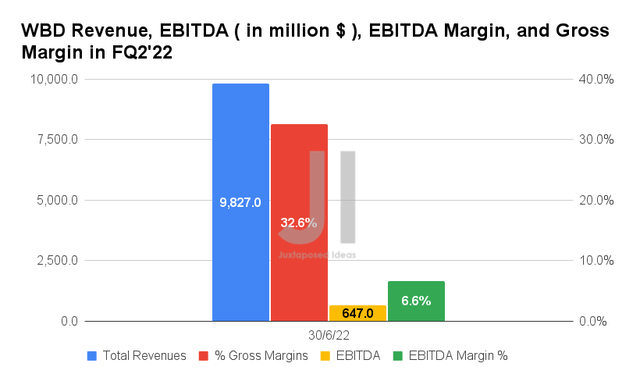

Based on the chart above, it is easy to see which segment is the dead horse. The DTC, i.e. the streaming segment, remains unprofitable with a negative EBITDA of -$518M and an EBITDA margin of -23.28% in FQ2’22, despite the introduction of ad-supported HBO Max in 2021. Therefore, it is not hard to see why WBD made the decision to ax Batgirl then, given the unsatisfactory test screenings potentially triggering even more losses ahead. Even CNN+ was not spared, indicating the management’s hardline approach to restructuring and profitability in the short term. In the meantime, WBD continues to report minimal profitability from its studio segment, with an EBITDA of $239M and an EBITDA margin of 8.55% then.

In the short term, we do not expect to see much improvement in WBD’s financial performance, given the intense competition in the streaming industry and the major shift in consumer behavior for the theatrical screening market. Even Netflix (NFLX) had struggled with FCF profitability and subscription growth, given the constant need to produce new streaming content, or as termed by WBD, “domestic decline due to content seasonality”.

Therefore, it is likely that WBD will continue relying on its Networks segment for capital, since it remains the company’s only saving grace, with an EBITDA of $2.26B and an EBITDA margin of 39.39% in FQ2’22.

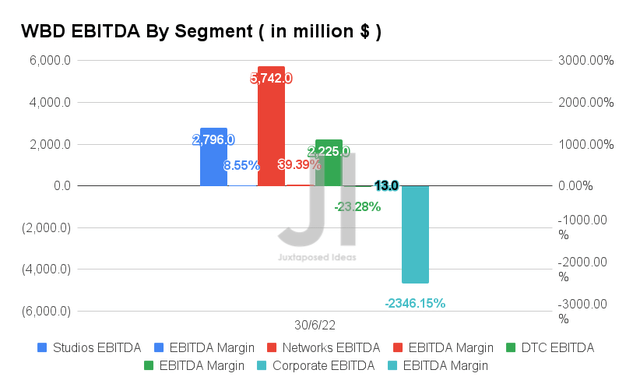

Its elevated operating expenses were one of the main reasons why WBD’s profitability was impacted in FQ2’22. The company reported total operating expenses of $4.81B, representing 49.1% of its revenues and 150.6% of its gross profits then. As long as operating expenses remain high, we may see WBD continuously reporting a massive cash burn moving forward. In the intermediate term, we may expect to see some operating synergies as the management irons out the kinks post-merger, with up to $3B in annual savings expected by FY2024. We shall see.

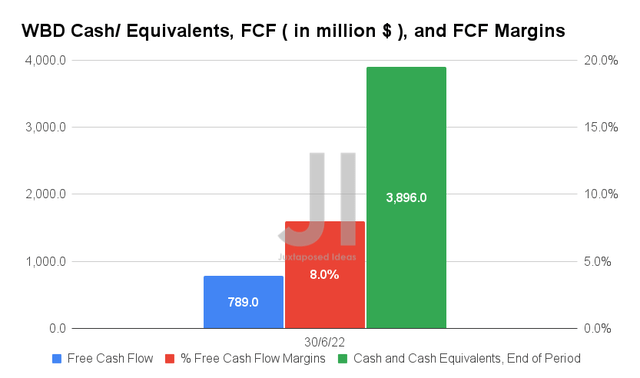

At the same time, WBD also reported a lower Free Cash Flow (FCF) generation of $789M and an FCF margin of 8%, with a $3.89B of cash and equivalents on its balance sheet in FQ2’22. The FCF was undoubtedly much lower than expected, since the two separate entities used to generate a total of $10B in FCF in FY2021.

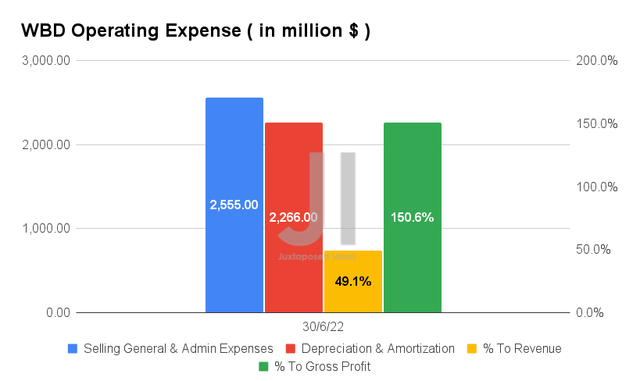

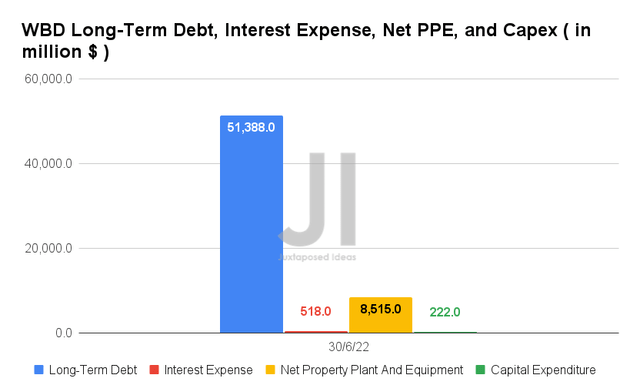

As with most divestitures, WBD also reported a gargantuan long-term debt of $51.38B with $0.51B in quarterly interest expenses in FQ2’22, or the equivalent of $2.04B in annual interest expenses. Combined with $0.22B in capital expenditure in FQ2’22 or the estimated equivalent of $0.88B annually, it is apparent that WBD will continue to face headwinds in its profitability moving forward.

WBD Long-Term Debt Maturity

S&P Capital IQ

In addition, if we were to study WBD’s long-term debts, we can see that the company has a notable $3.58B of debt obligations (principal and interest) due FY2023, $6.42B due FY2024, and an immense sum of $11.51B due FY2025, on top of its current $1.13B due FY2022. Due to the company’s minimal cash and equivalents in FQ2’22 and lowered FCF generation for the next two years, it is a chance that WBD would have to rely on debt refinancing in the intermediate term.

We are also unconvinced by WBD’s extremely optimistic guidance for reducing its gross leverage target to 2.5x-3x by FY2024, given the company’s current total debt/ EBITDA ratio 18.13x. That would obviously take a herculean effort, if not more. The bulls may remain on, however, since that speculative event would certainly trigger a huge stock rally then. In the event that you’re looking for a bullish analysis, Livy Investment Research’s is a good place to start.

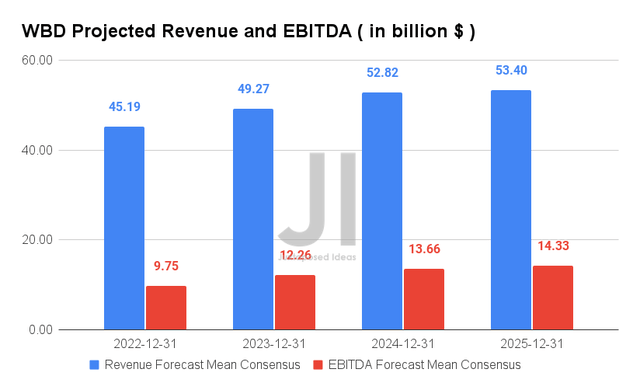

Over the next four years, WBD is expected to report revenue and EBITDA growth at a CAGR of 5.72% and 13.7%, respectively. It is apparent that consensus estimates are optimistic about the company’s long-term profitability, given the improvement in its EBITDA margins, from 21.5% in FY2022, 24.8% in FY2023, and finally to a projected 26.8% in FY2025.

Nonetheless, WBD would have to weather the storm in the short term, given its reduced FY2022 and FY2023 EBITDA guidance of up to $9.5B and $12B, compared to the original guidance of $10.7B and $14B, respectively. These would directly translate to a lower FCF profitability of $3B in FY2022 and $6B in FY2023, thereby impacting its stock valuations further, due to its colossal debt load. Therefore, investors who are hoping for a quick buck or recovery should definitely look elsewhere.

So, Is WBD Stock A Buy, Sell, or Hold?

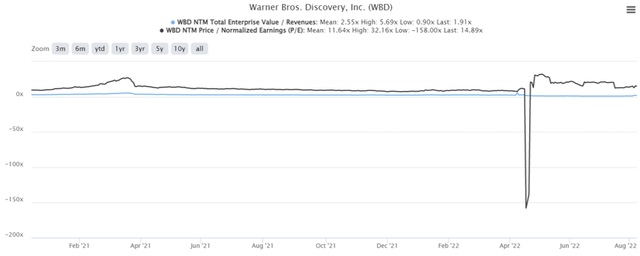

WBD 1Y EV/Revenue and P/E Valuations

WBD is currently trading at an EV/NTM Revenue of 1.91x and NTM P/E of 14.89x, lower than its 1Y EV/Revenue mean of 2.55x though elevated from its 1Y P/E mean of 11.64x. The stock is also trading at $14.02, down 42.6% since the completion of its merger on 08 April 2022 at $24.43. The sell-off was undoubtedly overdone, given the unusually elevated 3-fold trading volume post-merger and post-FQ2’22 earnings call on 04 August 2022.

WBD 1Y Stock Price

Therefore, despite the consensus estimate’s attractive buy rating with a price target of $24.57 and a 75.25% upside, we are unconvinced of WBD’s short and intermediate-term recovery. The company would need to tread the murky waters carefully over the next few quarters as it struggles with the unprofitable and highly competitive streaming segment, while dealing with an eye-watering total debt/ EBITDA ratio of 18.13x.

As a result, it is not far-fetched to surmise that the time of maximum pain is not even here yet, since the stock may potentially retrace to single-digits by the end of FY2022 or FY2023. Furthermore, its cash-burn situation will likely be worsened by the potential recession and the Fed’s continuous hike in interest rates. Existing investors with a lower tolerance for risk may want to consider reducing their positions in WBD, given the potential downside.

In the meantime, we rate WBD stock as a Hold for now.

Be the first to comment