A stockphoto/iStock via Getty Images

Dear Readers,

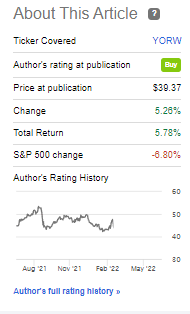

In this article, we’ll do an update on the York Water Company (NASDAQ:YORW). I wrote about this business a few months back in April, and since that time, the company has actually held back the impact of the downturn rather well, confirming my overall bullish thesis on this company.

York Water Company Article (Seeking Alpha)

The York Water Company is the company with the oldest, still-active dividend in the world. It’s the quintessential dividend stock. It’s the oldest investor-owned water utility in the United States of America, and you’ll find it operating in Pennsylvania, with continuing operations ever since 1816, making it a company with a 200-year-old dividend history. Not many companies have histories this long – a few – but no company in existence today has the history this one does.

What, if anything, has happened since my last article to cause this company to remain as stable as this?

York Water Company – Recent results

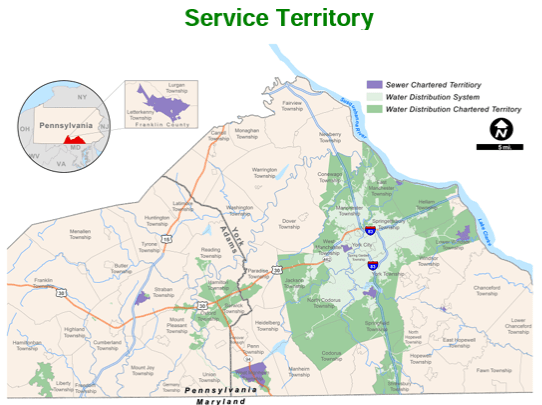

As I mention in my initial piece on this business, the company’s operations are deceptively simple. They impound and purify drinking water for certain geographical areas. Aside from this, they own three wastewater collection systems and five wastewater collection and treatment systems. They do this in 51 municipalities within three counties. It is, in no way, a global empire.

As such, it remains relatively insulated from macro events, because all it does is provide water to customers in a relatively limited geographical area.

York Water Area (YORW IR)

It doesn’t serve tens of millions of people, not even a million or half a million. The company’s service area is around 200,000 individuals, give or take a few thousand people. This includes a very mixed customer base, including very classic residential and some basic industrial/commercial with the manufacturing of fixtures, furniture, electrical machinery, and many other areas.

As a water company, YORW’s business has environmental dependencies; specifically, rainfall. Revenue impacts can be particularly heavy during periods of dryness, and dry spells can create supply imbalances where more water is used for water, washing, golf courses, and other things which can lead to government-instituted drought policies.

All of this is quite logical, even if the environmental impacts can be said to be more severe today than they were a decade, or a few decades ago, given the slight climate shifts we’ve been experiencing.

On the capital side of things, YORW is not a very capital-heavy or intensive company and does not require large amounts of working capital to run its business. It’s also not, in the least, dependent on any one specific customer. Its fully regulated and commission-controlled nature given its superb earnings visibility and stability is very similar to an electric utility in terms of how its rates are raised and worked with.

These things make the company a safe, and non-volatile sort of investment. To call these operations time-tested would be an understatement given, again, more than 200 years worth of profitable history.

It also doesn’t really have any market cap worth speaking of. At less than a billion, this is a small company, and it has debt of over 40%+ of cap. Despite this, S&P Global has assigned this unique business an A- credit rating, something that’s otherwise reserved for businesses in the hundreds of billions. This should show you how the market views this company, and the dividend safety it could potentially provide you with.

YORW has also been an excellent investment on a historical basis. If you had invested money in the company at 21X P/E back in 2002, your Annualized RoR would today even considering recent declines, be close to 9%, or 450% RoR in total.

So – invested at the right time and with the right timeframe in mind as a goal, this business can really deliver some absolutely solid alpha, despite its size and usual overvaluation.

Those are strong numbers for a company that essentially gives you a sub-2% dividend, but the longest consistent dividend in history. Keep in mind what I said though – consistent dividend does not mean the longest growth. York Water Company does not hesitate to cut this time-tested dividend when needed. They did so in 2006 and again in 2008 – but since then, it’s been on a growth streak to where it currently sits close to a 2% yield.

As I mentioned in my last piece – everyone needs water. This entire business segment is represented by a lack of competition, and a complete lack of commissions and regulators to even allow for any sort of competition here. Generally speaking, market times or movements don’t really matter to Water companies – people always need water anyway. This is a characteristic the company shares with things such as electrical utilities, food, gas, and the like.

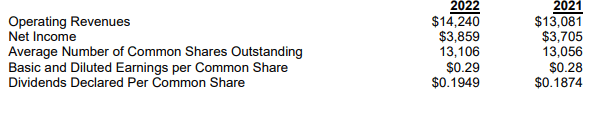

Recent results more or less confirm this. The company issued its 606th consecutive dividend. It also reported 1Q22 revenues of around $14.24M, up double digits YoY, and net income on that $14M+ of around $3.859M. The way these numbers and releases are structured is interesting, as this is one of the very few larger companies that still reports its earnings on the basis of single dollars.

In short, the company saw the slight YoY bump across the board that investors are used to expecting from YORW, including a slight bump in every relevant metric, including the dividends declared.

YORW IR (YORW IR)

It’s pretty fair to say this company is really only a viable investment for the most patient and long-term investors. Those of us with decades in the market ahead of us, who can wait for that 1-2% YoC to turn to 3-5%, and that are interested in this sort of conservative utility investing.

Fortunately, that’s the sort of investor that I am.

York Water Company Valuation

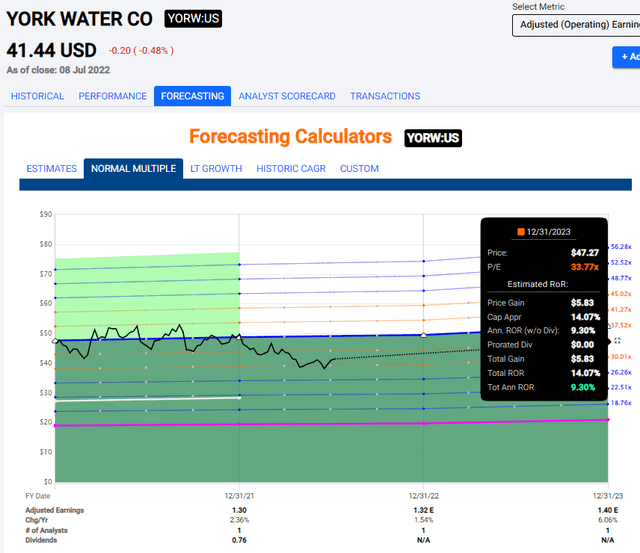

YORW continues to trade at a predictably massive premium valuation due to its history. Water companies are never cheap, and YORW is a good example of this. The 10-year average valuation for this company is close to 33.5X P/E, which is above its 20-year and 30-year average. Given that the company actually grew more expensive since my last article, the upside is slightly less now than it once was.

However, as I mentioned in the article when I went bullish on YORW, what we’ve been seeing is a dropdown to levels not seen for 4-5 years, and this is where the company could become interesting.

Provided that you accept the company’s 10-year premium of 33.5X or even a 5-year average premium of 37X, there’s an upside to be had here in the company. At a forward valuation of 33.5X based on a 4% EPS growth until 2023E, the upside here is now near double digits at 9.3% annually, not including dividends.

York Water Company Upside (F.A.S.T graphs)

You can still call this a conservative upside if you expect the company to perhaps revert to that 38-40X multiple or so. The question becomes how much you want to assign a premium to a company like this. My response to that is “not quite that much”. I’ll give the company a 30-33X P/E – and when considering this, it’s important to recall that in times of trouble 20 years ago, the company did trade around 20X P/E. The downside potential if this were to repeat itself is significant – you could lose over 25-30% of your investment for some time, even if I believe an eventual upswing would come.

Would this mean the company is “bad”? No. Just that it would take time for you to recoup that investment.

In my investing, I try to find the safest possible, highest upsides available on the market. York Water Company is an upside – but based on premium. To call it “safe” would be an exaggeration. The company is safe – the upside might not be. It’s a relatively safe yield, as I don’t see the company cutting it. The market/segment is also safe – water is water, and people need water.

This company goes into the same basket as other massive premium companies. Those companies include things like Adidas (OTCQX:ADDYY) or LVMH (OTCPK:LVMUY). Those are companies where I happily pay 25X+ P/E multiples. YORW is, oddly enough, in a similar position, and I’d happily pay that premium for getting access to investments in water infrastructure for the foreseeable future.

This still isn’t as clean-cut investment or bullish thesis as I might like to present. Any time a company trades above 30X, the demands on those cash flows and those safeties are extreme. However, For the time being, I consider this company to have a valid, fair-value upside to a 33X P/E.

S&P Global only has one analyst following the company. Apparently this is considered enough. This analyst has stuck to a share price of $53-$55 for a very long time, and thus considers the company more than 35% undervalued here. These targets haven’t shifted for some time.

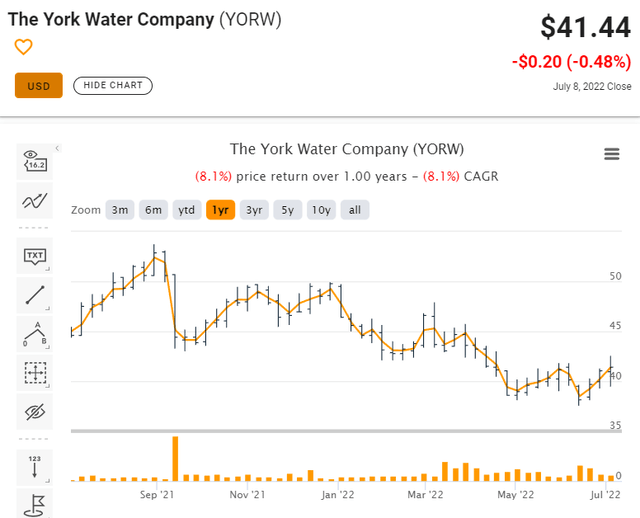

My own PT is closer to a 33X P/E and comes to $45/share – and that is where I would consider the company too expensive to buy. The company has underperformed for the past year, having lost around 8% of its value – but this is still better than most investments today.

York Water Company Price (TIKR/S&P Global)

So, it’s not the cheapest business or the highest upside – but it’s definitely safe, and a company you most definitely can trust.

Thus my thesis is “BUY” with a $45 PT. Based on today’s share price, the company is still somewhat undervalued and buyable here.

Thesis

My thesis for York Water Company is the following

- This is the oldest consistently dividend-paying company in existence. It’s trading at a significant premium but may well deserve some of this premium.

- My target for YORW is a 33X P/E, accepting the 10-year P/E average, giving us a PT of $45/share.

- YORW may not be the highest upside or the safest, cheapest bet, but it’s a good one, and I consider it a “BUY” here.

Thank you for reading.

Be the first to comment