cofotoisme

Investment Thesis

Upstart’s (NASDAQ:UPST) business model is not aligned with investors’ expectations. Ultimately, the stock is still overvalued. Even though I recognize that the stock has now fallen more than 90% from its previous highs, I don’t believe that looking back to where it was once, offers much insight into where it’s now heading.

On a positive note, the multiple has now fully collapsed and the stock is priced at 2x forward sales. Clearly not an egregious multiple.

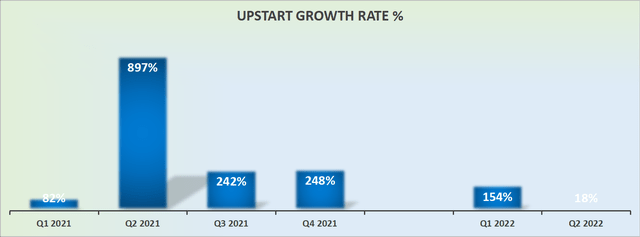

On the other side, its Q2 2022 revenues point to circa 20% y/y CAGR. When compared with last year’s Q2 when its revenues were up nearly 900%, this is a serious level of deceleration.

Naturally, this begs the question, what sort of sustainable growth rates can Upstart generate. Until we get a clear conviction of Upstart’s sustainable growth rates, through the cycle, I’m rating the stock a sell.

My Background With Upstart

Author’s coverage

A few months ago I wrote an article titled Disappointing Ending. At the time, readers couldn’t possibly see why I would be willing to throw the towel on an investment that was down so significantly to $34 per share.

At the time it had been a really tough call to make. In hindsight, it turns out that was the right call to make.

Indeed, for Upstart’s stock to return to the same price as when that article was written, Upstart will need to see its share price increase by 25% — just to return to that point when I issued my original sell rating.

Upstart’s Revenue Growth Rates Slow Down

Upstart’s revenue growth rates

The bear thesis on Upstart is that the business model hadn’t ever been tested during a weak economic environment. And now that it is being tested in this macro environment you can see the difference with last year’s revenue growth rates.

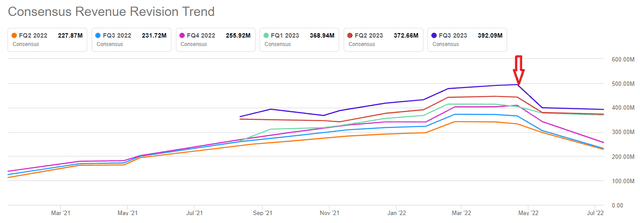

As an investor of a high-growth company, what you should not do is invest in a company where analysts are downwards revising their revenue estimates for your company.

You want to be positively surprised, as your company finds new ways of growing its revenues, and for analysts to be busy upwards revising their revenue estimates. What’s happening with Upstart is the opposite.

Through the Cycle Business Model?

Upstart’s pre-announced earnings note that lower loan origination volumes are plaguing its revenue growth rates.

This obviously begs the question, what sort of sustainable growth rates is Upstart likely to report in 2022?

A business that we once viewed as a leading AI lending platform that enabled its partners to underwrite superior loans is now being viewed with a substantially more questionable lens.

Is Upstart actually significantly better than FICO scores, (Fair Isaac Corp (FICO))?

Or perhaps, the reason why Upstart had the appearance of lower fraud and loss rates and thereby facilitating superior loan quality, had more to do with the favorable macro-environment that it was in last year?

Being able to confidently quantify how much Upstart was benefiting from the environment last year versus what is its secular growth opportunity is, will be the key to getting a firm grasp on its upside potential.

For now, I do not believe that Upstart is the secular growth story I previously thought it was.

UPST Stock Valuation – Difficult to Value

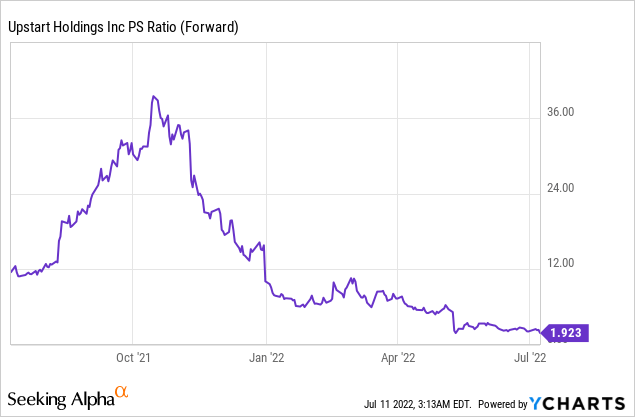

From its previous highs, Upstart is down 90%. Yet, the business is clearly not going bankrupt. That’s not the issue here. The issue here is what sort of multiple should investors put on its stock?

Is the business a high-growth lender facilitator that has simply hit a temporary headwind? Or are Upstart’s problems more structural? Namely, that Upstart isn’t able to scale as its growth rates are more cyclical than we previously assumed?

As you can see above, this time last year Upstart’s multiple went from 12x forward sales to more than 36x forward sales. Whereas right now, Upstart’s multiple has compressed to just 2x forward sales.

There’s little doubt that this is a lot cheaper than it was. But just because something is cheaper than it was, doesn’t necessarily mean that it’s cheap relative to where it’s headed.

The Bottom Line

Upstart’s shareholders have been on the receiving end of a consistent stream of bad news. There’s been so much bad news hitting the stock over the past year that it gets to a point where investors are only investing for ”salvage” value.

That being said, until there’s a clear understanding amongst investors as to what the sustainable revenue growth rates of Upstart are, there’s going to be a lot of uncertainty and a significant amount of nervous investors.

Lastly, investors that held onto the stock over the past several months will now look to exit the stock, as the narrative has meaningfully changed relative to where it was when they invested. Consequently, with a lot of its shareholder base looking to exit, this will provide an overhang on the stock, as its shareholder base has to rotate and a new shareholder base has to be found.

In conclusion, there are still too many uncertainties facing Upstart, particularly given this new challenging macro environment. What was once viewed as a leading and innovative AI lending platform, is now struggling to find sustainable traction. Hence, I rate the stock a sell.

Be the first to comment