Sundry Photography

For quite some time, it appeared that the pandemic would claim Eventbrite (NYSE:EB) as one of its key tech-company casualties. The online ticketing vendor shriveled in 2020 as events dried up, and even a temporary surge in virtual events was not enough to salvage ticket sales.

Yet rather than trying to sink good money after bad, Eventbrite made the wise decision to drastically scale down its corporate operations – which is something that very few tech companies that are still founder-led (as Eventbrite is, by its co-founder and CEO Julia Hartz) ever choose to do.

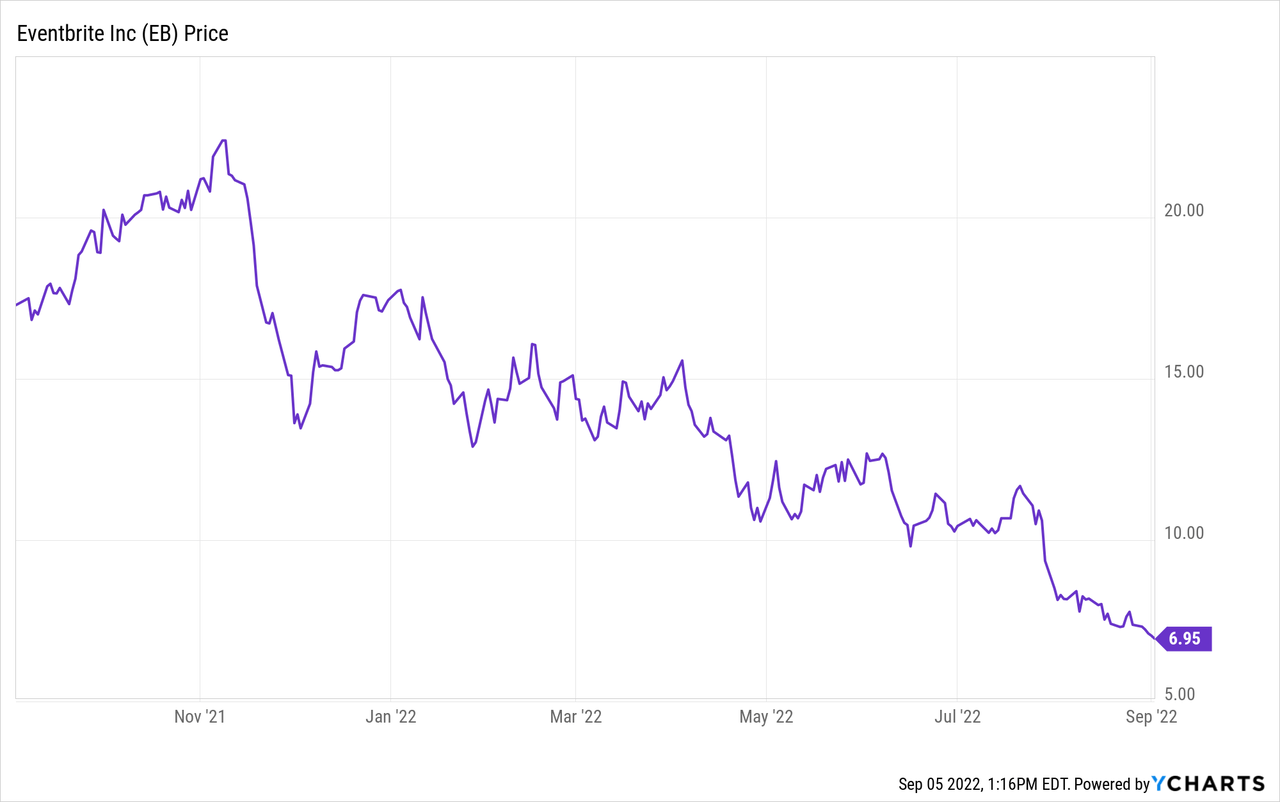

Despite the strong emergency-mode execution from Eventbrite this year, needless to say, investors aren’t taking chances with risky small-cap plays. Eventbrite is down ~60% year to date:

I remain neutral on Eventbrite. I tremendously applaud the company’s giant cost cuts and the fact that it has been able to maintain adjusted EBITDA profitability for the past four quarters – a feat very few companies of Eventbrite’s scale are capable of managing. I also find the company’s growth in ticketing trends as well as the expansion of its creator base to be positive signals.

Looking ahead to the “bigger picture,” however, there are elements that give me pause. Especially since the pandemic began, Eventbrite has doubled-down on its orientation toward smaller, entrepreneurial creators. Ticketed “events” on Eventbrite can be as small as several dozen people logging into a virtual show. At the end of the day, I worry that this format is not sufficiently sustainable to hold Eventbrite’s business model up to true scalability – especially as short-form video continues to rise in popularity and consumers have infinite choices for free entertainment online.

In addition, I think Eventbrite’s chances of becoming a ticket vendor for larger events and A-list performers got decimated when Spotify (SPOT) started testing the waters for ticket sales. Spotify, needless to say, already has deep-seated and established relationships with the largest and most famous creators in the world thanks to its ubiquitous streaming platform, and in recent years the company has signaled its ambitions to become more of a one-stop-shop “artist services” platform (which is one of Eventbrite’s key strategies to improve its monetization for small creators as well). One of the reasons I remain neutral on Eventbrite is because I do think it’s possible for the company eventually to be acquired by Spotify or another large ticketing operator like LiveNation. However, I do think this is the only catalyst for Eventbrite to spark a substantial rebound, and I’m not comfortable making an investment case on that alone.

From a valuation perspective, at current share price near $7, Eventbrite trades at a market cap of $683 million. After we net off the $670.8 million of cash and $695.4 million of debt and funds due to creators off Eventbrite’s most recent balance sheet, the company’s resulting enterprise value is $708 million.

Versus Wall Street’s consensus FY23 revenue projection of $331.7 million (+27% y/y; data from Yahoo Finance), Eventbrite trades at 2.1x EV/FY23 revenue. That’s certainly cheap (and another reason why I’m neutral and not bearish), but cheap for a reason given both competitive risks and doubts on whether Eventbrite can truly scale.

The bottom line here: while Eventbrite has certainly avoided the worst of the pandemic through smart execution, I’m still more comfortable on the sidelines here.

Q2 download

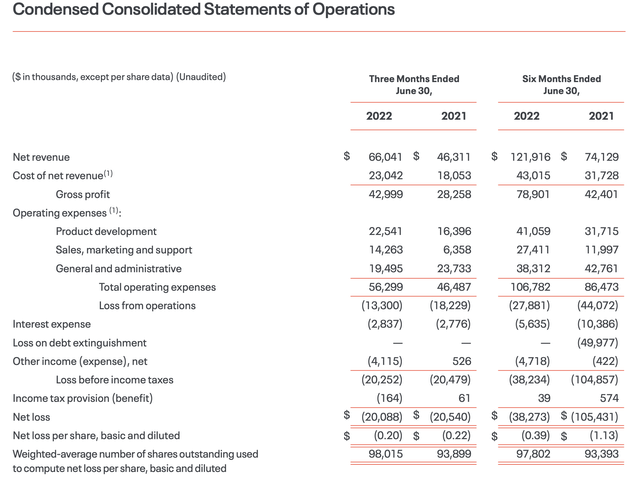

Let’s now cover Eventbrite’s latest Q2 results in greater detail. The Q2 earnings summary is shown below:

Eventbrite Q2 results (Eventbrite Q2 shareholder letter)

Eventbrite’s revenue grew 43% y/y to $66.0 million, a reflection of the company’s post-pandemic recovery. This came in at the high end of the company’s outlook set in Q1. In the back half of 2021, the company had cited some overhang on ticket sales due to lingering Omicron-variant concerns; but this headwind has subsided.

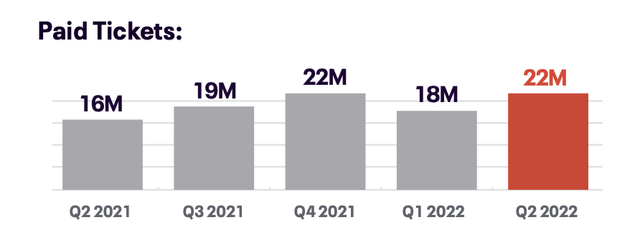

Paid tickets grew to 22 million in the quarter, hitting the seasonally high peak that the company achieved in Q4. The company noted that in Q2, 10 million unique buyers attended events managed through Eventbrite. Management also noted that while Q2 saw typical seasonal declines in the April through June months, the seasonality that it saw this year was slightly ahead of the pre-pandemic curve.

Eventbrite Q2 ticket trends (Eventbrite Q2 shareholder letter)

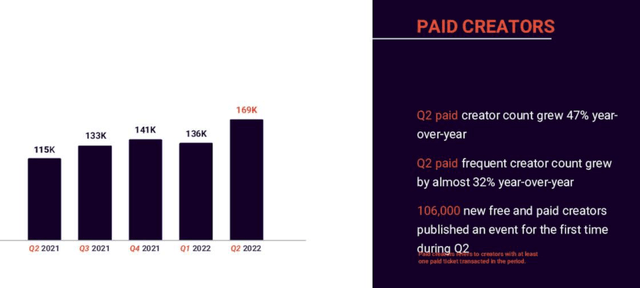

Creator growth was another key avenue to boosting ticket sales on Eventbrite. The company added 100k total creators to its platform in Q2, as well as 33k paid creators – bringing the paid creator base up 47% y/y to 169k, which the company noted is closing the gap to pre-pandemic levels.

Eventbrite Q2 creator trends (Eventbrite Q2 shareholder letter)

We will continue to emphasize, however, that Eventbrite’s bastion remains with smaller events and smaller creators. The company’s average revenue per ticket sold in Q2 was $3.02 – slightly up from last year, and roughly in-line with pre-pandemic trends (the gross ticket sales price average, meanwhile, was $39).

Eventbrite’s take rate on total ticket sales also jumped 40bps to 7.8%, as the company improves its monetization through additional features available to creators. The company has shipped a slew of new releases and is on track for many more in the back half of the year, according to CEO Julia Hartz’s prepared remarks on the Q2 earnings call:

Since we last saw you in June, we shipped 10 major product releases to our creators, I’m really proud of that effort. In the second quarter, our focus was on consumer conversion, report creator efficiency, and Eventbrite Boost. We added Google Pay as a payment option to improve checkout conversion. We introduced a new dashboard for creators which built on earlier work we’ve done to overhaul the navigation experience and makes it easier to manage many events.

And Boost received its 12th update since we launched it a year ago. With each update, Boost becomes easier to use them more robust for creators. We reduced the steps required to launch a social ad campaign from eight down to four, which resulted in a 16% increase in campaign creation.

And we’ve launched a closed beta release of Eventbrite Ads, which will give creators the ability to advertise to the high intent audience searching for events on our platform.

The team is on track to release more than 50 new features and product enhancements in the year, and that includes major launches for all four technical and product pillars we shared at Investor day. These improvements will better align our capabilities with our creator needs, which we think is key to driving sustainable and profitable growth in the long run.”

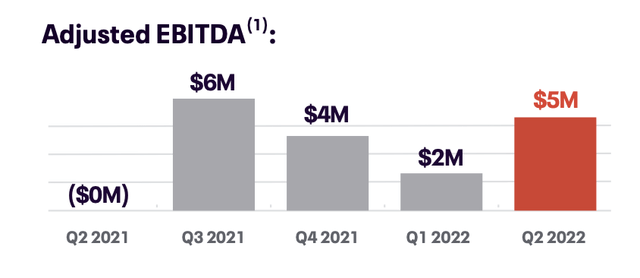

Eventbrite also noted $4.6 million of adjusted EBITDA this quarter, hitting a 7% adjusted EBITDA margin – up eight points from -1% in the year-ago Q2, and as previously mentioned, the fourth straight quarter of adjusted EBITDA profitability.

Eventbrite adjusted EBITDA (Eventbrite Q2 shareholder letter)

The company noted that its long-term target of maintaining >20% y/y revenue growth on top of 20% adjusted EBITDA margins remains unchanged, but it did not guide as to whether it would remain profitable on an adjusted EBITDA basis in Q3, citing cost inflation and a continued need to invest in R&D alongside uncertain macro trends.

Key takeaways

Eventbrite is no longer in crisis management mode, but I think the company has locked itself into a niche of small events and small creators, which will ultimately make it difficult for the company to hit its long-term targets of sustaining 20% growth on 20% adjusted EBITDA margins. Especially in a volatile market environment, I don’t think the long-term bull case for this stock is compelling enough to buy it on the dip.

Be the first to comment