Photo Beto/iStock Unreleased via Getty Images

Introduction

On December 4, 2021, I wrote an article titled “Why 9% Of My Money Is In Union Pacific”, in which I explained why I went overboard in buying America’s largest stock-listed railroad. As we slowly head into the second quarter of this year, I want to re-assess the situation as we did not get a buyable dip yet. On the contrary, the stock made a new high, rallying 24.6% over the past 12 months, and adding 2% year-to-date. The S&P 500 is down 12%, so that’s a remarkable short-term outperformance. Based on these numbers and economic developments, I am going to dive into Union Pacific (UNP) again and tell you what I expect to happen this year, especially with regard to buying more as I always like to buy this stock at a discount whenever possible.

So, let’s get to it!

2022 Is Looking Good-ish

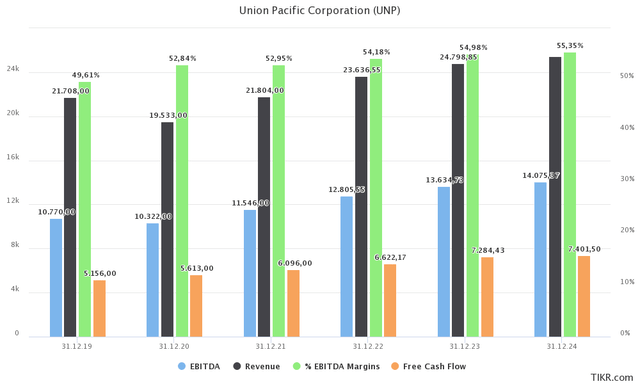

First of all, I know that “good-ish” isn’t a word, but I had to use it as 2022 is sending me some mixed signals. But before I discuss that, I’m going to start this article with a load of financial numbers. Analysts expect that Union Pacific will do close to $23.6 billion in revenue this year. That would be a new all-time high. Analysts also expect profitability to improve with expected EBITDA margins of 54.2%. This would also be an all-time high and imply an EBITDA result of $12.8 billion. This translates to a 10.9% EBITDA growth rate. Down from 11.9%. That tiny difference is remarkable as 2021 was compared to 2020, one of the worst quarters since the Great Financial Crisis.

Needless to say, expectations are prone to uncertainty. Nobody predicted the pandemic, nobody predicted the Ukraine war, and nobody will predict the next big thing – whether it’s bullish or bearish.

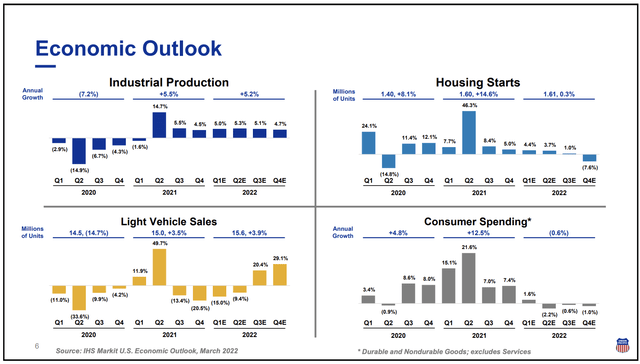

All we can do is rely on current trends and connect the dots. In the case of Union Pacific, we’ll likely see rebounding light vehicle sales. Last year, light vehicle sales did poorly. In 2Q21, sales were up as 2Q20 saw massive plant closures due to the pandemic. All other quarters were down due to supply chain shortages. Producers didn’t have enough semiconductors to finish vehicles. After all, the automotive industry is a low-margin industry for chip producers. They prefer high-tech stuff like iPhones and whatnot.

In the second half of this year, the company expects a significant rebound in light vehicle sales. Industrial production is expected to be up by 5.2% – similar to 2021. Housing starts are expected to be 1.61 million units. That would be an increase of just 0.3% after a 14.6% surge in 2021. Yet, it should provide the company with stable income in that segment (lumber and related).

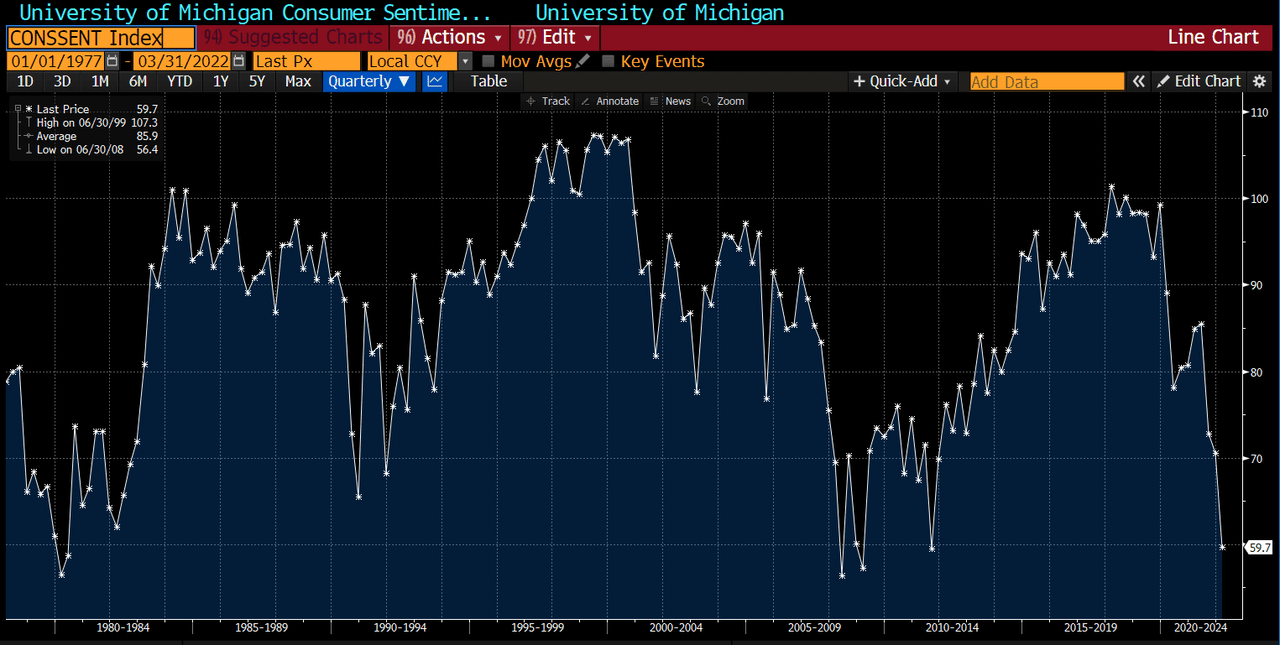

Consumer spending is expected to be down. The consumer-driven economy isn’t running smoothly anymore. This is caused by sky-high inflation, which is doing a number on consumer confidence as the graph below shows (University of Michigan Consumer Confidence).

Bloomberg

In other words, while intermodal was pressured in 2021 due to supply issues at major ports as well as related labor shortages, 2022 will likely see intermodal weakness due to lower demand.

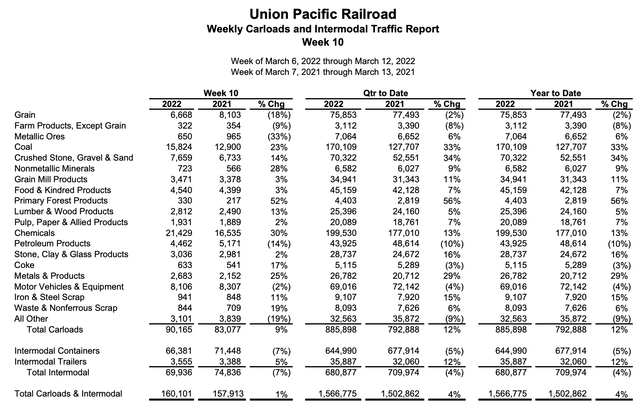

So far this year, the company has increased total carloads and intermodal by 4%. That’s a very satisfying number and I hope the company can maintain it. The company’s own outlook regarding volumes was “full-year volume growth exceeding industrial production”. This would imply a volume growth rate of more than 5%. As total revenue is expected (analysts) by 8.4%, we do get a scenario that makes sense based on 5% volume growth and pricing gains.

What’s interesting is that total carloads are up 12% this year. Metals are doing well, stone, clay, and related, as well as coal, which is up 33%. Earlier this month, I wrote an article covering the coal tailwind for railroads, in this case, CSX Corp. (CSX), which applies to UNP as well. I highly recommend it as it explains why coal is doing well. Weakness continues to come from intermodal containers, which implies ongoing supply chain issues. Intermodal trailers are improving with 12% growth. The company is benefiting from more efficient operations in that space, a tight trucking market, and sky-high fuel prices.

All of these numbers are absolutely fantastic. 5% volume growth this year would be welcomed and provide close to $6.6 billion in free cash flow according to estimates. Union Pacific has a $164 billion market cap, which would imply a 4.0% free cash flow yield. A number like that would pave the way for higher dividend growth, which I will address as well.

The problem is that economic pressure is mounting. Hence I went with “good-ish”.

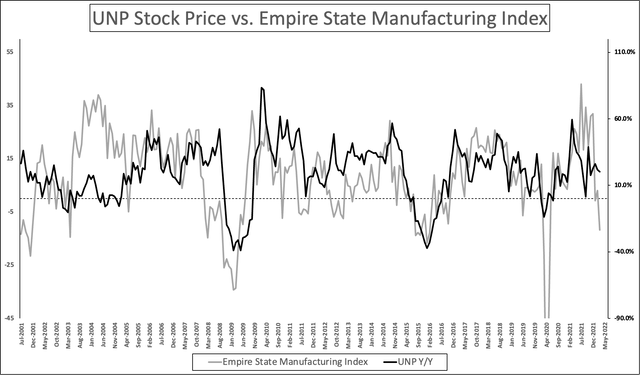

The Empire State Manufacturing Index, which is a forward-looking survey conducted by the New York Federal Reserve has fallen to -11.8 points. Down from 3.1 points in February. I’ve referred to this index in a lot of articles as it is highly correlated to cyclical stocks. Union Pacific is one of them as it’s tied to industrial production and consumer demand.

My theory is that the divergence is caused by factors like the war in Ukraine. Russia is basically isolated from the rest of the world, which means coal exports from the US are more important. The same goes for agriculture products, metals, and related materials. I believe that this will go on until the very complex situation in East Europe has been solved.

The company also benefited from the fact that the S&P was hurt by the tech sell-off. UNP is a value (with some growth) stock. Investors like value stocks more than stocks that generate negative net income in times of accelerating inflation.

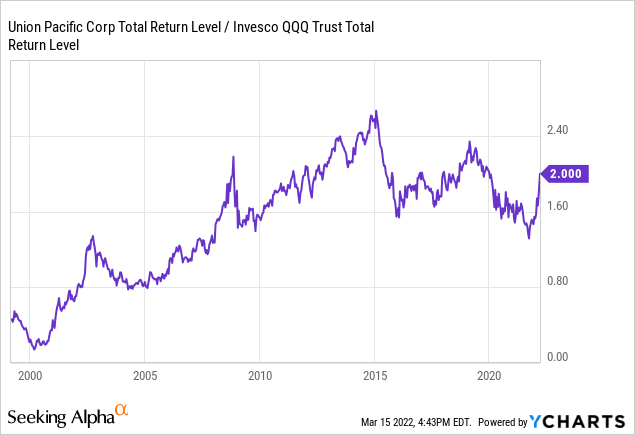

The graph below shows the ratio between the Union Pacific total return and the tech-heavy ETF (QQQ) total return. Although QQQ is widely loved because of its stellar performance, UNP investors have done very well compared to QQQ.

However, it does not mean that Union Pacific will continue to rally. Based on these numbers, I would not be surprised if $270 is a ceiling for at least 2-3 quarters until economic growth improves again.

Hence, for 2022, I think we are dealing with a trading range of $220-$270. We could see a breakout in 4Q22, but only if economic growth has bottomed by then. I’m very confident in this range. However, do not use this as an opportunity to go short at $270 if we get there. I only ever recommend people to invest in UNP long-term. Buy weakness, but do not short or sell high prices.

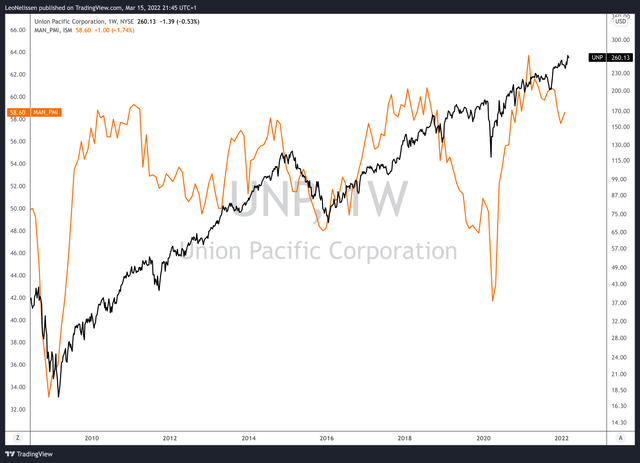

The graph below shows the ratio between Union Pacific and the ISM manufacturing index. I expect the ISM index to fall after seeing the Empire State Manufacturing survey numbers. As I said, if history is any indication, we could be looking at stock price weakness as a result.

With that said, let’s take a look at the valuation, which does confirm my expected trading range.

Valuation

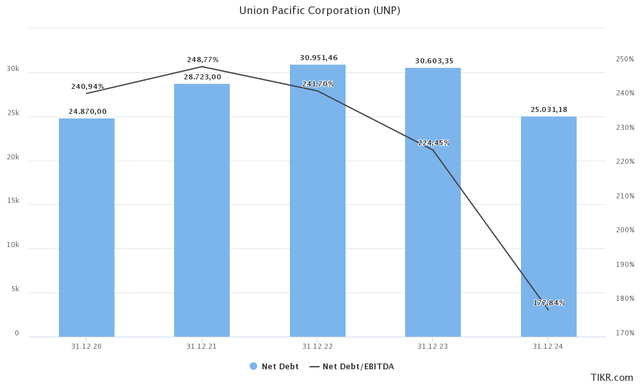

Union Pacific has a market cap of roughly $164 billion. The company is expected to end this year with $31 billion in net debt. On a side note, that’s 2.4x EBITDA, which indicates low balance sheet risks. Going forward, the net leverage ratio is expected to fall to 1.8x EBITDA, which I doubt as the company tends to buy back stocks aggressively. What this tells us is that the company has an enterprise value of $195 billion.

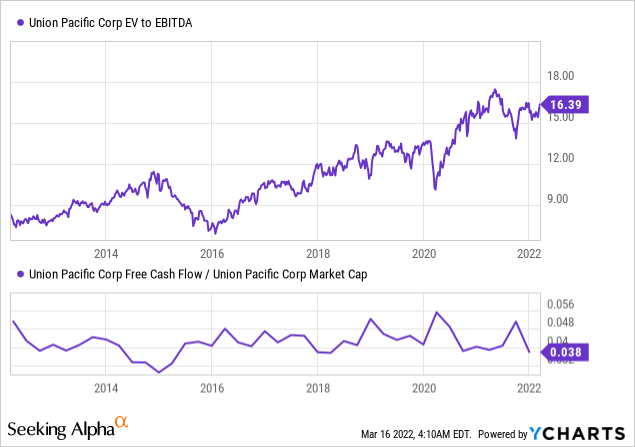

Using EBITDA expectations of $13.6 billion, we get an EV/EBITDA multiple of 14.3x. That’s not cheap. It’s neither very overvalued, but also far from deep value – which only tends to happen during severe market sell-offs. I also added the free cash flow yield to the chart below. The 4.0% implied yield I calculated is close to the lower bound of the range, which does confirm my $240-$270 expected trading range.

Dividend

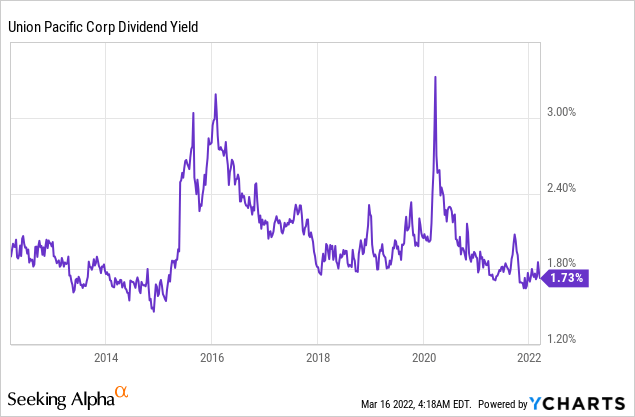

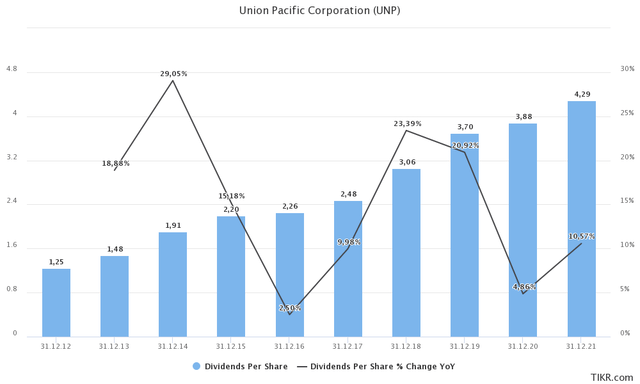

On December 10, 2021, the company hiked its dividend by 10.3%. The company did the same on May 13, 2021 – 2 hikes in one year. Seeking Alpha gives the company an A+ dividend growth rating (compared to other industrials). Please note that the second hike in 2021 is not included in the chart below because the dividends were paid in 2022.

Over the past 10 years, the dividend has been hiked by 15.4% per year, on average. Over the past 5 years, that number has dropped to 14.3% (still impressive). The three-year average is 11.9%, which I take any day.

As I already briefly mentioned, a 4.0% implied free cash flow yield (and a move to 5% in the years after that) imply that there is room to maintain high dividend growth with buybacks.

With that said, it’s not a rule of thumb in general, but I like to add UNP shares when the dividend yield crosses 2.0%. I’ve done that in the past few years, and it has worked quite well. In this case, it makes sense as it falls right in my (expected) trading range. However, please be aware that a lot of websites do not display the correct yield. Use the annualized dividend of $4.72 to calculate the right yield if you’re unsure (currently 1.83%).

Takeaway

While I was bullish, I did not expect Union Pacific to rise more than 2% year-to-date while the S&P 500 is down 12%. However, the ongoing war is increasing expected export demand from the US in various categories that benefit Union Pacific. It also helped that mainly tech stocks sold off, which caused money to flow towards value stocks.

Unfortunately, we’re dealing with increasing economic risks as manufacturing sentiment is falling along with consumer sentiment. I’m not predicting a recession, but the risks are rising.

Hence, I believe that UNP will continue to be in a $240-$270 trading range for the time being. I believe that the stock is a buy towards the lower bound of that range but not a sell at $270. UNP is a long-term investment with significant dividend growth, a healthy balance sheet, and high odds of a stock price acceleration when economic sentiment bottoms. The company will also benefit from a much-needed increase in automotive production that will offset weakness in other areas if it occurs.

Hence, I believe that UNP investors continue to be in a terrific spot this year and I cannot wait to buy some more if the yield crosses 2.0% again.

(Dis)agree? Let me know in the comments!

Be the first to comment