jetcityimage

Thesis

We updated in our early July article that we were not convinced of buying the dips on leading insurer Prudential Financial, Inc. (NYSE:PRU) stock yet, as we have yet to assess a constructive bottoming process.

However, our observation of PRU’s price action since our article has convinced us that PRU has likely bottomed. Therefore, we view the recent pullback from its August highs as constructive for investors to add exposure.

We surmise that the market has likely anticipated Prudential’s underwhelming Q2 release, as it was hampered by some significant one-time charges, most notably in its Individual Life unit. However, management clarified that such charges are not expected to be carried forward into Q3’s performance.

Prudential has also felt the effects of significant macro headwinds relating to the rate hikes, equity market downturn, and widening credit spreads. As a result, the impact on its business was broad-based in Q2, which CEO Charles Lowrey alluded to as an “unusual confluence.”

Notwithstanding, Prudential’s adjusted operating earnings growth is expected to have reached its nadir in Q2. Coupled with constructive price action since July, we are confident that investors can consider adding more positions through this pullback.

Accordingly, we revise our rating on PRU from Hold to Buy.

Prudential Investors Need to Look Past Q2’s Performance

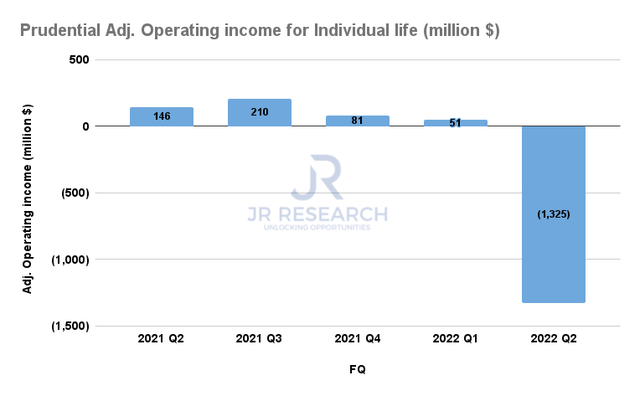

Prudential adjusted operating income for Individual Life (Company filings)

Prudential’s Q2 was married by a broad-based slowdown across its critical business segments due to the worsening macro conditions. Furthermore, the revision in its Individual Life reserves also led to a $1.33B adjusted operating loss in its Individual Life business. Management clarified the changes were necessary to reflect the updates to its assumptions on policy persistency and mortality. However, management’s commentary suggests that investors should consider it a one-time impact when modeling Q3’s performance. CFO Ken Tanji accentuated:

To get a sense for how our third quarter results might develop, we suggest adjustments for the following items. First is an adjustment for 2 onetime items that net to a charge of $571 million in the second quarter. Our annual assumption update and other refinements resulted in a net charge of $1.4 billion, primarily driven by our Individual Life business. (Prudential FQ2’22 earnings call)

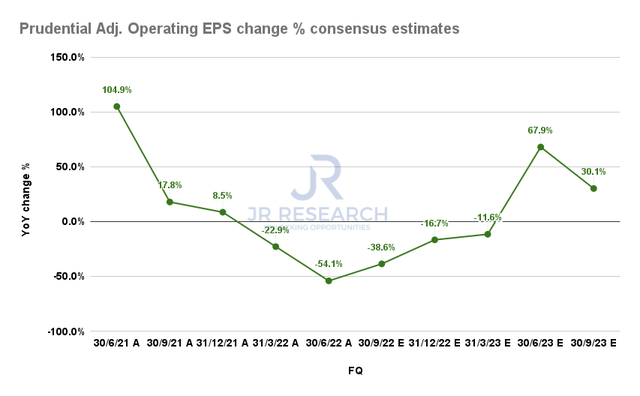

Prudential adjusted operating EPS change % consensus estimates (S&P Cap IQ)

Therefore, we are confident that the consensus estimates (neutral) are credible, as it projects Prudential’s adjusted operating EPS growth should have reached a bottom in Q2. Furthermore, Prudential should experience less challenging comps moving ahead as it laps its FY21 performance.

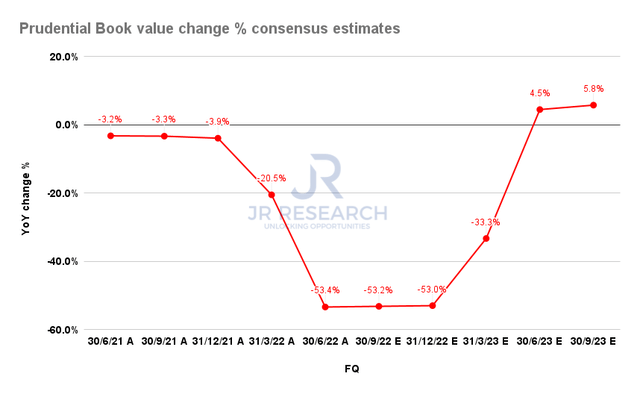

Prudential BVPS change % consensus estimates (S&P Cap IQ)

Consequently, Prudential’s book value per share (BVPS) growth should also emerge from its malaise in FQ4, as it fell to $74.72 in Q2. Hence, we are confident that the improvement in Prudential’s operating performance through FY23 should also undergird investors’ confidence, lifting its buying sentiments, despite the macro headwinds.

PRU’s Valuation Seems Reasonable

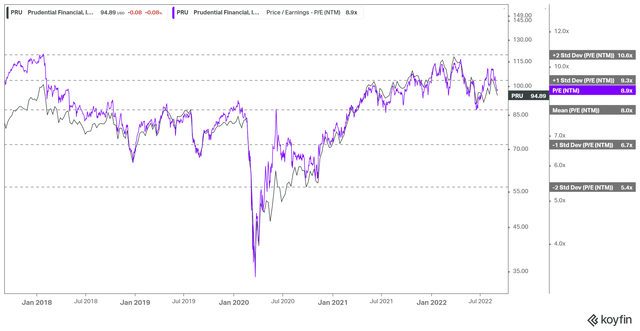

PRU NTM P/E valuation trend (koyfin)

PRU last traded at an NTM P/E of 8.9x, in line with its 10Y mean, as seen above. Therefore, we believe it’s arguable that PRU doesn’t seem to be undervalued at the current levels.

Notwithstanding, PRU appears to have been supported along its 10Y mean since the start of 2021, including the recent bottom in July. Therefore, it appears that buying support consistently returned to undergird PRU’s buying upside at its 10Y mean. Moreover, given PRU’s bottom in its underlying operating metrics in Q2, we are confident its recent bottom should hold. Therefore, we deduce that adding close to its 10Y mean seems reasonable.

Is PRU Stock A Buy, Sell, Or Hold?

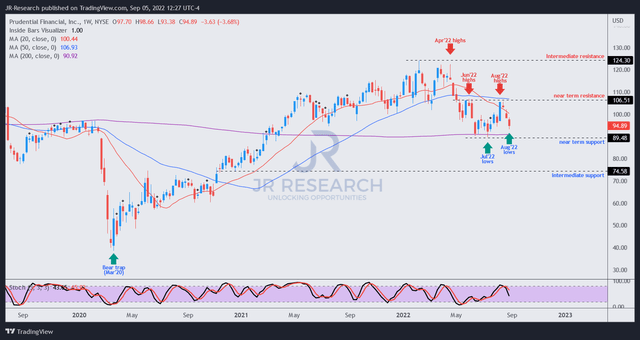

PRU price chart (weekly) (TradingView)

We think there’s little doubt that PRU has been de-rated, as it has fallen nearly 24% from its February 2022 highs. Furthermore, PRU has struggled to regain its medium-term bullish bias, as its buying momentum was rejected decisively at the critical $105 resistance level again at its recent August highs.

Therefore, PRU has lost all its August gains, as it closes in on its July lows. However, as we are confident that PRU’s July bottom should hold, we believe the current entry levels offer investors another opportunity to add exposure. While the price action is far from ideal, it’s still possible for investors to consider layering in, as we believe PRU should form a sustainable bottoming process.

Otherwise, a steeper drop toward its intermediate support should de-risk the entry levels further, improving the reward-to-risk profile for investors. Therefore, given the relatively well-balanced valuation for PRU, we urge investors to be cautious with their exposure allocation.

Accordingly, we revise our rating on PRU from Hold to Buy.

Be the first to comment