grinvalds

Hook

As a shareholder of Etsy (NASDAQ:ETSY), I thought it would be great to review the company’s most recent earnings. While I am a tad bit late, as the old saying goes: better late than never. With that being said, I will reiterate my “Buy” recommendation on Etsy and review why the second quarter demonstrated the strength of Etsy’s business model.

Recap of Last Article

In my last Etsy article, I discussed why the niche e-commerce player wasn’t just a pandemic-driven investment. Rather, the company’s user growth, strong moat, and strategic acquisitions fuel robust growth for Etsy. Coupled with strong financials and a below-average industry multiple, Etsy remains a buy as I continue to add to my position as of Q2 earnings.

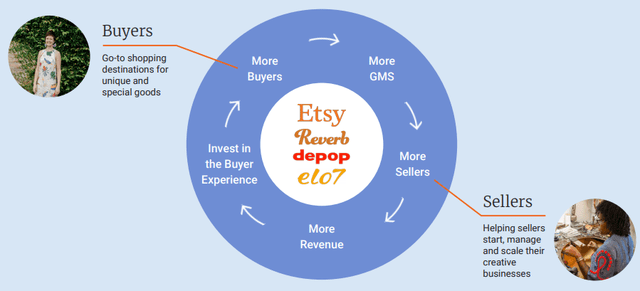

Etsy already has a very attractive business model that is capital-light and high-margin (see below). As Etsy continues to pull the right levers for growth, it will supercharge its growth flywheel and provide investors with excellent returns.

Business Model (Q2 Presentation)

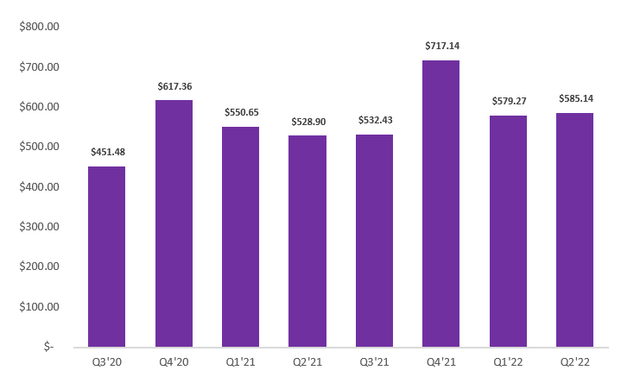

While the second quarter report did have some negative numbers (we’ll run through these later), Etsy defied the Street’s odds and beat estimates with a better-than-expected quarter. Despite macroeconomic headwinds and reduction in GMS, Etsy remained profitable. The chart below depicts Etsy’s revenue over the last 8 quarters, showing 10.8% YoY growth in Q2.

Author Created (Company Filings)

Earnings Summary

Posting EPS of $0.94 (beat by $0.24) and revenue of $585 (beat by $28.33M), Etsy’s Q2 earnings beat analyst estimates and showed once again why the e-commerce player was not reliant on the pandemic to fuel and sustain growth.

Despite GMS (gross merchandise sales) declining ever so slightly on a YoY basis due to macro headwinds, ETSY was still able to post superb results.

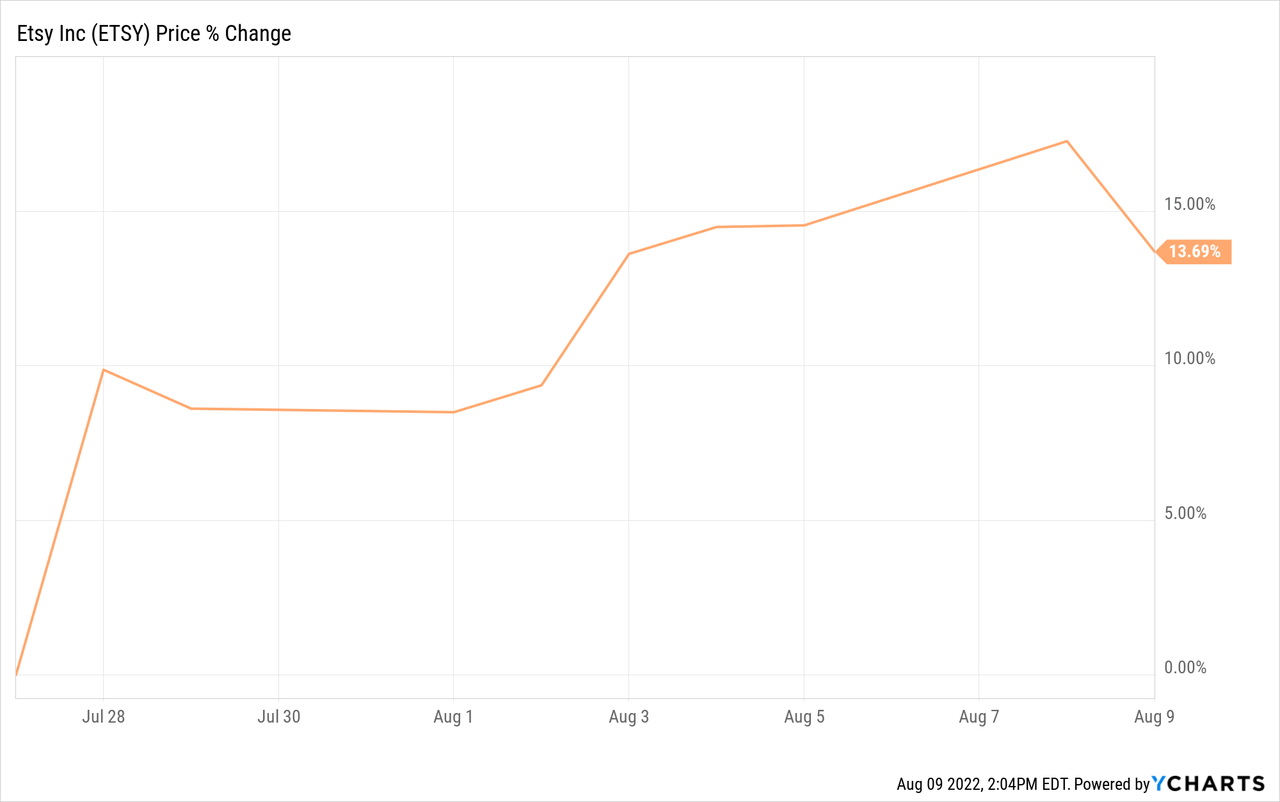

Post-earnings to date, Etsy is up around 14% as of this writing, and the bulls on the street have had some fun adding to their positions. Currently, 12 of 24 analysts on the Street have ETSY as a Strong Buy, with 9 indicating a hold.

Analyst Ratings (Seeking Alpha)

According to MarketBeat, the average analyst price target is now $129.95, indicating an implied upside of 19.4% based on today’s share price.

Ads Will Be Big

Starting at the macro level, competition is crucial for e-commerce marketplaces. Without competition in a marketplace, the underlying marketplace will not 1) hold any value due to lack of selection and 2) be an attractive business model for the underlying marketplace.

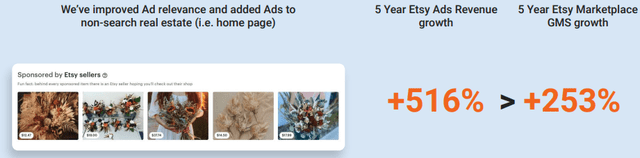

Currently, Etsy provides value to both buyers and sellers. For buyers, it has carved out a niche in the >$400 billion e-commerce space to provide a platform to purchase handmade and custom goods that cannot be found elsewhere. For sellers, Etsy provides creative artists with a quintessential platform to monetize their passion for creating handmade goods. As more sellers realize the dream of starting their own business or side hustle on Etsy, competition will become stiffer. Thus, Etsy will be the direct beneficiary resulting in high-margin advertising revenue. Currently, Etsy has experienced monster growth in its advertising business over the 5-year period (see below).

Ad Revenue (Q2 Presentation)

Etsy considers this a win-win, as sellers are able to invest in themselves by purchasing ads to increase the odds of converting a sale. As Etsy continues to improve its ad relevance for sellers, it will continue generating high-margin incremental revenue. Year-to-date, seller ad budgets are up a whopping 80%, indicative of healthy seller demand with respect to purchasing ads on Etsy. In his prepared remarks, CEO Josh Silverman commented, stating that:

This product has been a win, win, win for our sellers, buyers and Etsy. Etsy Ads revenue has grown 516% over the last five years, even faster than Etsy Marketplace’s 253% GMS growth. We’ve continued to close the semantic gap by leveraging new machine learning techniques to capture intrinsic styles and properties, thereby providing more relevant ad inventory for buyers without compromising conversion rate.

We also recently expanded Etsy Ads inventory to the homepage, while maintaining listing relevance consistent with organic search results. Seller budgets are up 80% year to date and we’re maintaining strong rows for them as well. We’ve ramped our investments meaningfully in Etsy Ads, as it’s an area where we see a long runway for continued growth.

Etsy is also focused on re-engaging low-frequency buyers with its ads to pose a reminder that Etsy awaits them and to improve buyer retention.

More engaged or habitual users are generally more adapted coming up with ideas and/or finding what they’re looking for, which is generally not how a low frequency buyer experiences Etsy. By making Etsy more accessible and hence giving novice buyers and experienced closer to that of habitual power users, we believe we can unlock significant frequency gains over time. And we’ve been making encouraging progress.

Amazon (AMZN) is a prime example of an e-commerce business that thrives off of its $31 billion advertising business. Millions of sellers compete and bid for ad placement on Amazon.com to be the first search result. As Etsy continues to ramp up and improve its ad offering, more sellers will be inclined to purchase ads to boost sales. As I mentioned in my previous article, Etsy’s competitive advantage, or moat, is driven by network effects, in that the underlying business becomes stronger the more users there are.

Competitive advantages for most social media and marketplace companies are built on network effects – in that the overall product becomes stronger the more users/participants are involved…… Hence, in order for Etsy to establish a stronger moat, the growth of both its buyers and sellers is vital.

While the comment above was referring to the entire business model, the same logic can be applied to the ads business. Higher ad spending will drive more competition, and more competition will drive higher ad spending across the board. The more sellers that engage it Etsy’s ad tools and increase their budgets, the more valuable the underlying tool becomes. Ultimately, this creates a robust flywheel effect that will continue to supercharge this segment of Etsy’s growth.

Strength Despite Headwinds

Despite macroeconomic headwinds caused by inflation and input cost increases, ETSY was still able to produce an exceptional quarter. As previously mentioned, GMS remaining essentially flat YoY is a sign that macro headwinds are directly impacting ETSY and the consumer discretionary industry as a whole. Nevertheless, ETSY demonstrated the strength of its customer base and grew revenue slightly over 10% on a YoY basis.

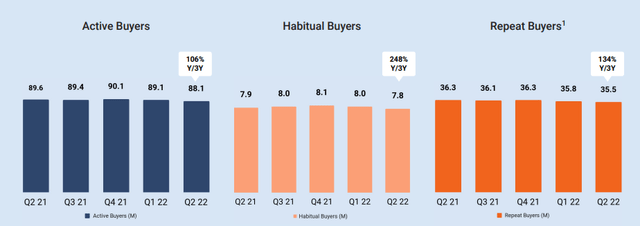

Buyer Trends (Q2 Presentation)

While there is a downward trend in the three buyer charts above, it appears that the Street had priced in a lot worse. CEO Josh Silverman also mentioned that regardless of some negative growth rates, the numbers in the second quarter were reassuring given the current economic climate.

So if you look at the total number of people who bought in the second quarter and divide the GMS from them by the number of buyers that were active. Year-over-year, it’s about flat. And we think that’s actually really encouraging in spite of reopening and in spite of inflation and all of the other economic headwinds, the buyers that are buying with us are spending about as much year-over-year. And that’s roughly flat. We are seeing a very slight decline in the number of active buyers in Q2 relative to trailing 12 month.

And again, no surprise that when people have a lot more options for where to shop and their pocket books are tighter, we might see some contraction in the number of active buyers, but actually all things considered were pretty encouraged by how those trends are holding up as well.

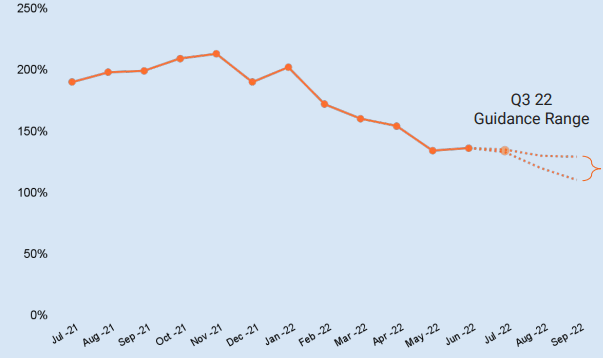

Naturally, as the world gets back to normal and disposable income becomes tighter, there was no doubt Etsy’s GMS would take a hit and growth would taper. However, as depicted below, management noted that the deceleration in GMS (3yr) began to flatten in June and should carry over to the third quarter.

GMS 3yr Growth (Q2 Presentation)

Final Takeaways

Of course, while one good (or bad) quarter is not enough to back an entire thesis, it is important to get a sense of direction and gauge a company’s focus. Short-term numbers do still hold value; however, one cannot make an investment decision relying on the performance of a single quarter (most of the time).

While cyclicality and macroeconomic conditions will impact businesses, I believe Etsy’s second-quarter earnings demonstrated its anti-fragility and reiterated the initial thesis to purchase the company. The capital-light, high-margin, profitable business model remains strong and intact. Coupled with long-term industry tailwinds and an attractive business model, I will reiterate a “Buy” recommendation for Etsy.

Be the first to comment