simpson33

The Trade Desk’s 2Q22 earnings puts the company in its own league.

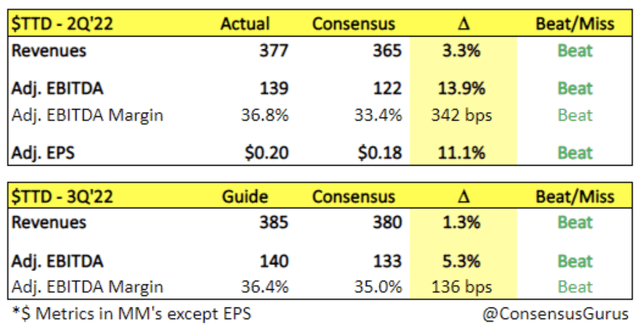

Just when the entire world was convinced that digital advertising has dramatically slowed down in a post-COVID world characterized by 40-year-high inflation, war and a looming recession, The Trade Desk (NASDAQ:TTD) reported astonishingly positive 2Q22 results where both the top and bottom line surprised the Street to the upside. Having previously received such gloomy/uncertain forward-looking statements from the likes of Snap (SNAP), Meta (META), Pinterest (PINS), Roku (ROKU) and Google (GOOG), markets were mentally prepared for another man down going into Trade Desk’s Q2 earnings. Instead, the independent demand-side platform [DSP] reported revenue of $377 million (+35% YoY) on top of an exceptionally strong 2Q21 where revenue grew 101% and generated adjusted EBITDA of $139 million that beat consensus estimates by a wide margin.

Consensus Guru

There’s a lot to like about Trade Desk’s top-line growth in Q2. First, growth was broad-based across all channels and verticals. In fact, all verticals that make up at least 1% of platform ad spend grew double digits in the quarter, where travel and pets more than doubled, and food & drink and technology were also strong. Again, CTV was the largest growth driver with strong performance in North America and spend also more than doubled in Europe. Management highlighted positive early results from developing a forward marketplace product for CTV ad buying/selling where advertisers and publishers can both get the benefits of higher visibility.

In Q2, Video (incl. CTV) made up low 40’s % (vs. 40% previously) of total platform ad spend in Q2; while Mobile was in the high 30’s % (vs. 40% previously); Display 15%; and Audio 5%. 90% of spend was in North America, indicating a relatively healthy US digital ad market. This was quite different from what many peers have been telling investors.

The bottom line didn’t disappoint analysts despite travel expenses and live company events are now back. Though YoY OPEX growth (ex-stock-based compensation) of 45% in Q2 was higher than previous quarters, management was able to deliver an adjusted EBITDA margin of 37%, a highly enviable margin in the tech sector where margins for most companies are either not very meaningful or virtually nonexistent. Further, Trade Desk generated free cash flow of $86 million and finished the quarter with $1.2 billion in cash and no debt.

Q3 guidance surprised to the upside, while peers expect little/no/negative growth

Trade Desk is usually the last digital advertising name to report earnings so it’s conceivable that both buy/sell-side expectations for Q3 guidance were already low as peers who reported earlier painted a rather gloomy picture. To everyone’s surprise, Trade Desk actually guided to the upside with Q3 revenue of at least $385 million vs. $380 million consensus, indicating YoY growth of 28% on top of 39% growth in 3Q21. For perspective, here’s what peers have for their Q3 outlook:

- Meta: revenue of $27 billion at midpoint (-6% YoY/flat ex-FX), 10% below $30 billion consensus (analysis here).

- Snap: pulled guidance and said in July that growth had been flat thus far in Q3 (here). Note that 2Q22 revenue growth of 13% decelerated dramatically from 38% in 1Q22.

- Pinterest: revenue to grow mid-single digits YoY vs. 8.15% consensus.

- Roku: revenue of $700 million (+3% YoY), 22% below $903 million consensus. Pulled full year 2022 guidance.

- Google: no concrete guidance as usual but used the word “uncertainty” multiple times to describe the outlook.

Evidently, Trade Desk is in an enviable spot as it is well positioned to ride the CTV wave and is relatively safe from the impact of Apple’s IDFA that, for example, will cost an estimated $10 billion in lost revenue for Meta in 2022. While Google is determined to get rid of 3rd party cookies (delayed until 2H24), cookies only affect Trade Desk’s Display business which represents 15% of platform ad spend. In areas like mobile and CTV, cookies are virtually irrelevant as they are only used to track user activities within web browsers. Additionally, UID2 (an industry alternative to cookies) has been gaining significant traction with support from behemoths like Amazon’s (AMZN) AWS, Oracle, Adobe, Salesforce, Nielsen, and a host of other supply-side platforms [SSP] and data providers.

Last but not least, retail media is the new black as device IDs and cookies continue to step into irrelevance. Thus far, Trade Desk has partnered with major retailers including Walmart (WMT), Albertsons (ACI), and Walgreens (WBA) to allow advertisers to leverage shopper data to run targeted ads on the Trade Desk platform (analysis here). Having witnessed what Amazon can do with on the advertising front with its own customer data, retailers are increasingly seeing the need to leverage their proprietary shopper data to unlock their advertising capabilities. Per a study by BCG, retail media is a high margin business with a gross margin of 70%-90%.

Solimar, AWS partnership, and MSFT+NFLX,

Solimar has reached 100% adoption where management noted average channel usage was up 50% and AI/ML usage was also up 50% against the older platform. Not too long ago, Trade Desk announced a partnership with AWS, which happens to be one of the largest marketing data aggregators in the world. The partnership allows advertisers already using AWS to create identifiers with UID2 without leaving the AWS ecosystem.

CEO Jeff Green also touched on the partnership between Netflix (NFLX) and Microsoft (MSFT) with a positive tone, seeing the collaboration as a great step for the open Internet. Microsoft’s Xandr will likely be the primary ad tech platform behind Netflix advertising and functions as both a SSP and a DSP. However, Green noted that Xandr is primarily focused on the supply side and has a very small exposure on the demand side (ranked #10 in terms of DSP scale and captures <10% of demand), so Xandr will likely represent Netflix as a SSP while advertisers can still purchase inventory in the open Internet. On the other hand, Netflix has mentioned it’s still early days for its venture into advertising, so this is something to watch going forward.

Valuation stretched following the 35% rally, risk/reward no longer attractive

Trade Desk remains a wonderful story in digital advertising with the best balance between growth and profitability. The company surprised the market to the upside and investors are happy enough to send the stock up 35% in light of a below-expectation July CPI increase (8.5% vs. 8.7% consensus) which proved positive for tech valuations. However, shares are again back in a relatively speculative territory with NTM EV/Sales of 20x, a demanding multiple under the new interest rate regime. While the stock could continue to go up, it’s difficult to imagine valuation crossing the 25x mark that markets were so accustomed to seeing last year when money was free and pandemic benefits were in full swing. As excellent as Trade Desk is from a fundamental standpoint, I believe today’s massive price rally represents a great opportunity to take profits and wait for the next train.

Be the first to comment