imaginima

Introduction

Founded all the way back in 1862, NOV Inc. (NYSE:NOV) is a company that sells products and services to oil and gas (O&G) producers, also called the upstream O&G industry. As the world faces an energy crisis, exacerbated by the Russia – Ukraine war, it needs to rely on interim fossil fuel demand to ensure energy security and reliability amid the broader clean energy transitions. The problem is there has been underinvestment in the O&G producers over many years. Industry forecasts indicate that this overdue investment is necessary to meet global energy needs.

NOV is starting to benefit from initial green shoots in O&G capex and is poised to continue being a beneficiary when more companies ramp up their capex plans. The fundamental case is strong from a long term perspective and the stock. However, the company and its stock may be facing some near-term weakness before the uptrend resumes, perhaps with the renewed vigor of US O&G capex expansions. Therefore, I am keeping it on the watchlist for now, eager to buy again when all the stars align.

Business Brief

O&G producers need to drill wells either in land or offshore (sea) to extract oil and gas. NOV is a LTM $6.7 billion revenue company that provides a suite of products and services that enable these operations. The company has more than 160 years of experience in this domain. Without getting into the very technical details, you can think of NOV’s segments in 3 parts to understand its overall business drivers:

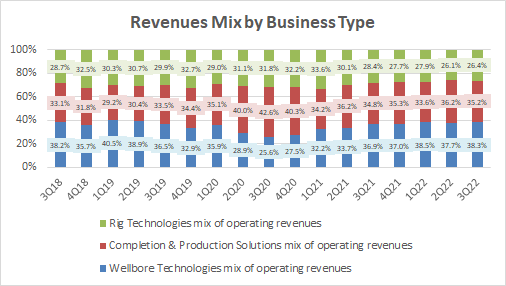

Revenues Mix by Business Type (Company Filings, Own Analysis)

Well-drilling (Wellbore Technologies)

In this segment, NOV sells products and services that help drill wells in an efficient way. This business is exposed to early-cycle, prioritized spends in O&G’s exploration and production (E&P). Overall, the Wellbore segment makes up the majority of NOV’s revenues with a 38% revenues mix as of Q3 FY22.

Well operation and maintenance (Completion and Production (C&P))

The C&P segment comes into play after the initial drilling part is done. Here, the company sells various products and services to help O&G producers operate and extract the resources from the wells, be it land-based or offshore. This business is exposed more to mid to late cycle O&G upstream activity. It is the second-largest segment with a 35% revenues mix in Q3 FY22.

Capital Equipment (Rig Technologies)

The Rig Technologies segment sells manufactures and sells drilling and off-shore rig equipment products and aftermarket services. It also provides solutions to offshore wind installation projects. 70% of the revenues in this business are linked to offshore rig activity, which tends to see late cycle activity pick-up. This segment formed 26% of the overall revenues mix in Q3 FY22.

Reasons for Optimism on NOV

My optimism for NOV is based on one key reason:

NOV can benefit from new, extended wave of O&G investments

O&G market is supply-constrained

Over the years, there has been under-investment in upstream O&G as many stakeholders have discouraged capex spending:

- Politicians have made promises of no new drilling

- Investors have pressured for higher shareholder returns, capital discipline and balance sheet health

- The ESG proponents have discouraged further investments on fossil fuels

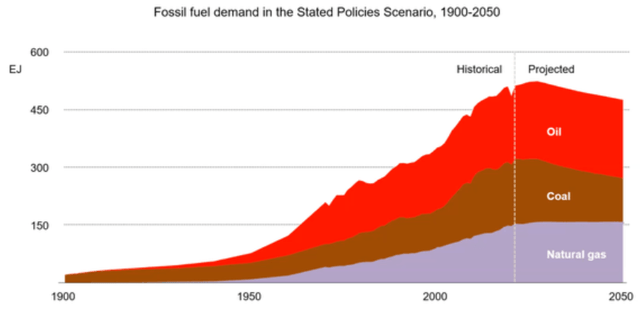

According to the International Energy Agency ((IEA)), the world expects peak fossil fuel demand to occur in this century at the current run-rate of implemented energy policies:

Fossil Fuel Demand Outlook (World Energy Outlook 2022)

However, there is a spanner in the works. Russia is the third-largest producer of crude oil worldwide, accounting for 12% of global production in 2021. It is the second-largest producer of natural gas, making up 18% of global production in 2021. The Russia-Ukraine war has led to short term energy supply deficits and increased the importance of energy security.

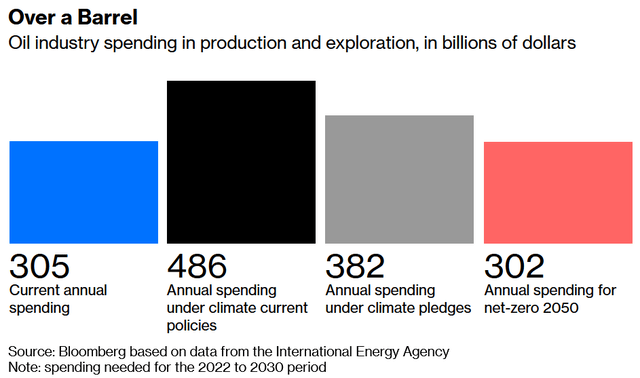

For upstream oil and gas spending in E&P activities, this highlights a global shortfall in spending to meet global energy needs. According to the International Energy Agency, the world’s O&G industry needs to spend nearly 50% more annually ($466 billion) from 2022 to 2030 to meet global oil demand. This is because renewables and clean energy transitions are nowhere near being able to sufficiently take over the critical responsibility of powering the world:

Oil Industry Capex Spend Forecast (Bloomberg)

Indeed, what is striking is that even if governments execute on accelerated clean energy transition paths, investment in upstream O&G would still need to grow by 25% annually until at least 2030.

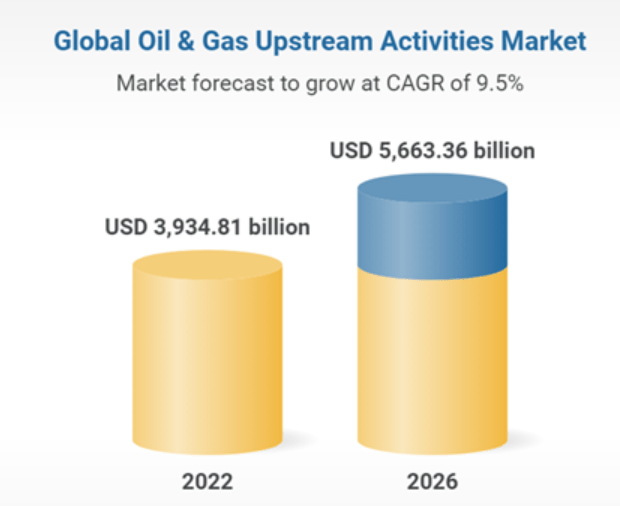

This backdrop yields a positive tailwind for the upstream oil and gas industry. According to Research And Markets, the industry is expected to grow at 9.5% over the next 4 years:

Global O&G Upstream Activity (Research And Markets)

All of this bodes very well for NOV as it is a direct beneficiary of increased investments and drilling by upstream O&G players in the value chain. The CEO of NOV, Clay C. Williams, expressed a similar view in the Q3 FY22 earnings call:

The world faces a significant and scary energy shortfall after years of underinvestment, and our outlook is very constructive as a result.

Return of O&G extraction investments

According to Deloitte 2023 Oil and Gas Industry Outlook, and NOV’s CFO Jose A. Bayardo, upstream O&G companies are currently focused on improving their balance sheets via debt repayments and redistribution of cash back to shareholders. Large upstream investments are yet to pick up across the board. In a Deloitte survey of O&G executives, when asked about capital allocation priorities, nearly 40% responded that debt repayment and shareholder distributions were the top priorities as opposed to new capex spend.

However, some initial green shoots in upstream capex is being seen amongst private companies. As Bayardo noted in the Q3 FY22 earnings call:

…not surprising to see private companies be the first movers to capitalize on the high rate of return investment opportunities associated with newbuild assets.

Deloitte’s industry study corroborates management’s narrative; a 10-15% increase in capex budgets is expected for the 2022-23 capex budgets by private E&P companies.

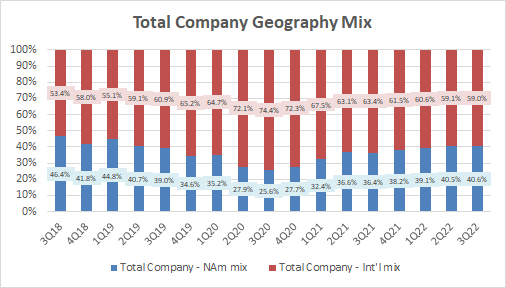

These early shoots are especially prominent in locations outside of North America, specifically in the Middle East, Asia, Africa and Latam America. NOV stands to capture these benefits as it has 59% of its overall revenues coming outside of North America:

Total Company Geography Mix (Company Filings, Own Analysis)

As is typical in capital cycles, the early movers set the way for more conservative players such as publicly listed O&G producers to follow. Overall, we are in the early stages of E&P activity uptick, which implies an extended wave of growth levers ahead for NOV.

Continued momentum for NOV

Well-drilling (Wellbore Technologies)

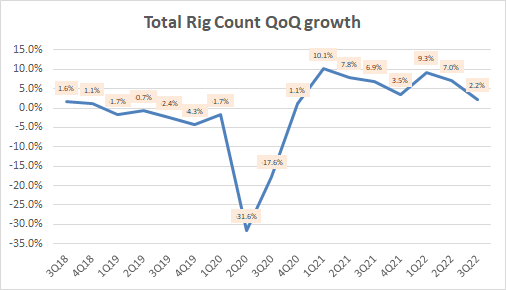

International rig counts have been consistently growing for at an average of 6.7% QoQ since 2021.

Total Rig Count QoQ growth (Company Filings, Own Analysis)

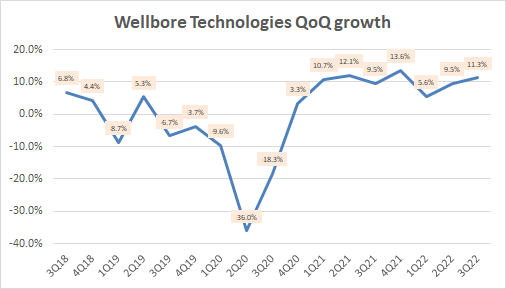

This has translated to similarly consistent revenue growth for the Wellbore Segment, which has grown at an average of 10.7% QoQ over the same period:

Wellbore Technologies QoQ Growth (Company Filings, Own Analysis)

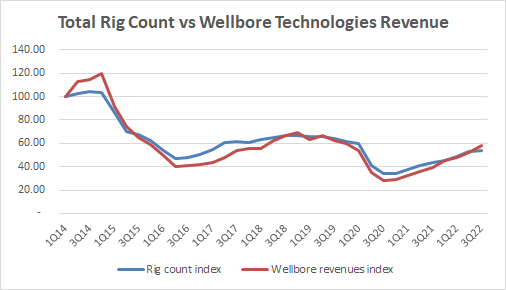

Rig counts are the primary driver of wellbore segment revenues as seen by the extremely high correlation in this indexed chart of global rig counts and Wellbore Technologies revenues:

Total Rig Count vs Wellbore Technologies Revenue (Company Filings, Own Analysis)

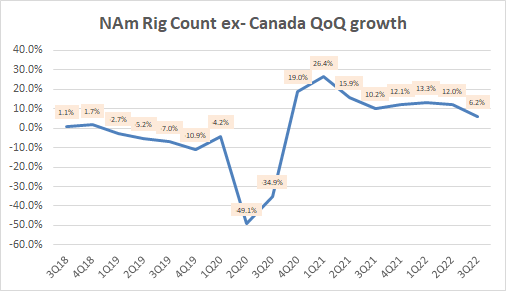

Digging into the geographies, although rig counts in North America had been ticking in >10% QoQ growth rates, in Q3 FY22, this dropped to 6.2% QoQ growth:

US Rig Count QoQ Growth (Company Filings, Own Analysis)

Management commentary indicates a temporary plateau in activity in the US so this is unlikely to be a key growth driver for NOV over the next few quarters.

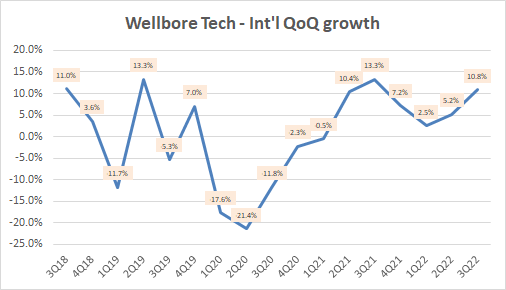

On the other hand, NOV is benefiting from pent-up demand for new drilling tools and new drilling activity in the international segment as the Middle East prepares to ramp up activity in 2023. This is seen in an acceleration of the international split of Wellbore revenues:

Wellbore Technologies – International Growth (Company Filings, Own Analysis)

Overall, I expect Wellbore revenues to see continued growth driven by Middle Eastern activity.

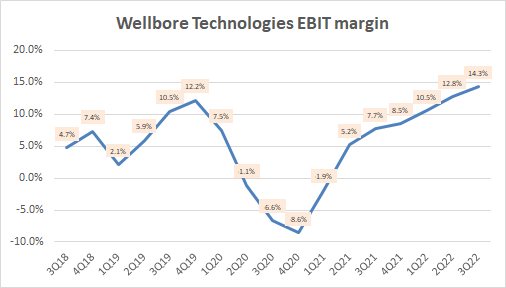

Wellbore margins are also on a consistent increasing trend driven by operating leverage and higher pricing:

Wellbore Technologies EBIT Margin (Company Filings, Own Analysis)

Well operation and maintenance (C&P)

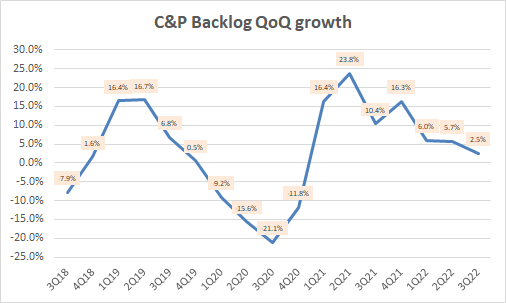

Here, the backlog position is the most important forward-looking driver of the business. Overall C&P backlogs have been seeing a deceleration in recent quarters, suggesting a slowness in the progression of the overall O&G upstream cycle:

C&P Backlog QoQ Growth (Company Filings, Own Analysis)

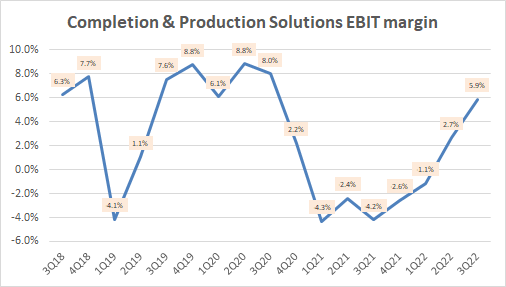

Margins have been increasing back towards pre-pandemic levels as demand recovers:

C&P EBIT Margins (Company Filings, Own Analysis)

Capital equipment (Rig Technologies)

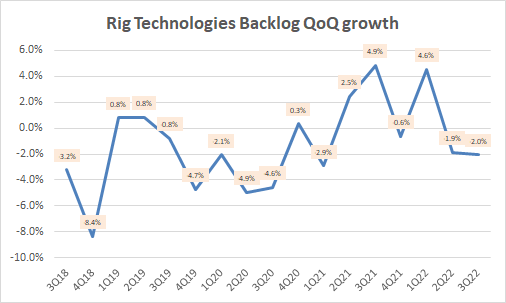

Rig Technologies’ backlog growth has also been decelerating:

Rig Technologies Backlog QoQ Growth (Company Filings, Own Analysis)

The slower recovery in this segment may be due to the fact that 70% of the revenues in this segment comes from offshore operations. Offshore activity is more expensive both in capex and opex. Hence, O&G producers will probably not prioritize offshore spending to meet incremental demand. This may result in a more subdued outlook for NOV’s Rig Technologies segment.

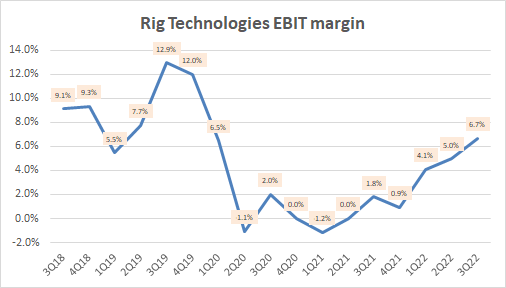

Unsurprisingly, this slower growth has led to slower margin recovery:

Rig Technologies EBIT Margin (Company Filings, Own Analysis)

Overall Assessment

I expect Wellbore Technology revenues to be the focus driver of incremental growth over the next few quarters as that is more tied to early-cycle activity. C&P revenues tend to see a bigger boost later in the cycle as O&G producers don’t have an immediate need for new equipment till later.

As Wellbore Technology margins are much higher than that of the other segments, I anticipate the overall margin profile of the business to improve over upcoming quarters.

Valuation

NOV is currently trading at a PE of 9.1x. This is below its 20-year average PE of 19.0x. This 20-year average includes both the down-cycle of last decade and the up-cycle of the decade prior to that, so the 19.0x PE is a more representative cross-cycle multiple.

NOV PE (Capital IQ)

I believe the stock can re-rate higher and experience up-cycle multiples as it benefits from early cycle drilling related revenues. During the last up-cycle, the stock averaged roughly a 30.0x PE. Assuming an eventual re-rating to this PE multiple later in the cycle, and considering the FY23 consensus EPS estimate of $1.08, the implied valuation results in $32.40. The stock currently trades at $23.22. So this valuation implies a 40% upside to the current price.

Note that this is quite an optimistic upside cycle scenario valuation. For the stock to converge to this target, I believe there are still some checkpoints to clear; US market should increase O&G production and other mid-late parts of the O&G production spend cycle should fire along with early cycle drilling activity.

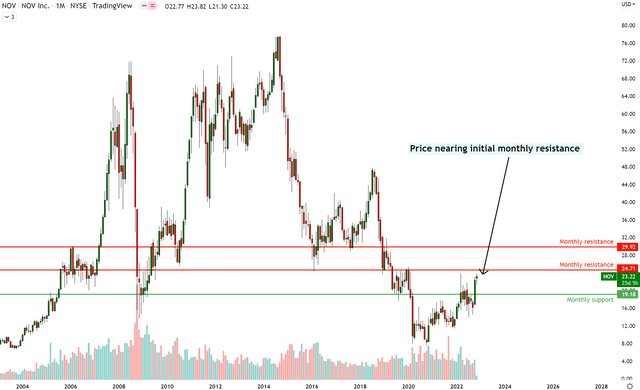

Technical Analysis

NOV Technical Analysis (TradingView, Own Analysis)

NOV has monthly support at $19.18. Currently, it is close to a monthly resistance at $24.71. This makes me a bit more cautious about putting in fresh buys here as the reward to risk ratio is not favorable if the $24.71 resistance holds. In case this is broken, I anticipate price to move towards the next key monthly resistance at close to $29.92.

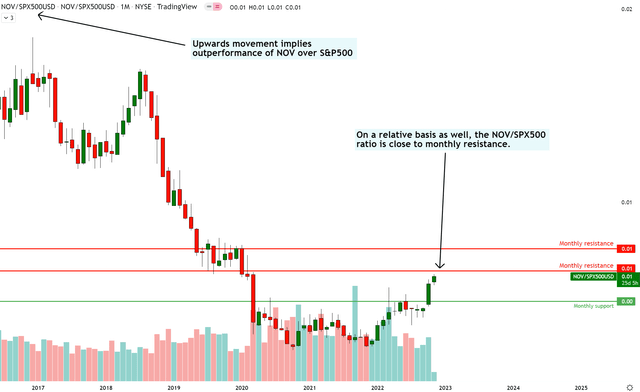

NOV vs S&P 500 Technical Analysis (TradingView, Own Analysis)

On the monthly NOV vs. S&P 500 chart, it is a similar story. Price is close to the monthly resistance. The underlying bullish trend is much more intact here as price has broken out of a sideways accumulation zone that started in April 2020. However, I believe there is a risk of negative alpha over the next few months if there is a temporary correction triggered by a reaction at monthly resistance.

Overall, both the absolute and relative charts of NOV against the S&P 500 flag risks of a correction in the stock’s performance.

Key Monitorables

Rig counts are the number one thing to watch as this is highly correlated to the most important driver of the stock’s performance in the quarters ahead; drilling revenues. Commentary that could give color on the pickup of upstream spend in the Middle East, and signs of revival in North America are other monitorables.

Some re-acceleration in QoQ C&P backlog growth would give me more confidence in an upside break above the monthly resistances ahead.

Conclusion

I think the fundamental drivers for NOV in terms of the upstream capex boost have rich prospects. However, despite the 40% valuation upside, I am wary of relying solely on fundamental analysis for volatile energy stocks. I need the sentiment view of the price action prints to align for me to pull the trigger on a high conviction buy.

Right now, the technicals suggest a bit of caution and patience is warranted to enter at a more attractive reward to risk ratio. Thus, I believe the stock is positioned for inevitable upside but a risky entry now. If I get clarity on the action near the upcoming monthly resistance, I believe the stock would be a buy. This may correspond with fundamental triggers of increased drilling activity, so I am keeping a close eye on that as well.

By the way, I was already invested in NOV and made some alpha vs S&P500. I don’t hold it currently as I am anticipating a correction first. It is currently on my watchlist for future buys.

For more details about my unique albeit successful investment approach, please see my profile description.

Be the first to comment