gesrey

As we head into the second half of the year, inflation remains one of the primary concerns for consumers and policymakers alike. Financial markets, however, may be looking one step ahead to an economic slowdown or imminent recession. As we look at equities, bonds, commodities, and currencies, it seems that all four may be starting to sniff out slower growth.

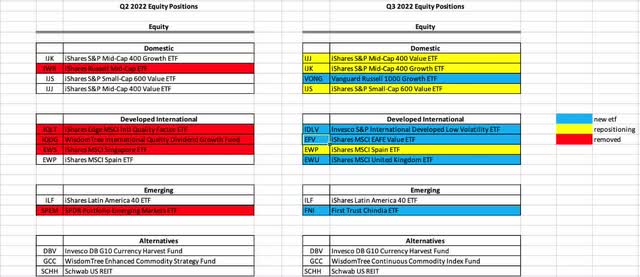

Equity markets have been perhaps the most obvious indicator of a pending downturn among financial markets with the S&P 500 Index ending the first half down about 20%, in bear-market territory. In addition, tighter monetary policy from the Federal Reserve along with persistently high inflation, continued supply chain bottlenecks and the conflict in Ukraine hurt investors across most asset classes. These tumultuous market conditions provide an opportune time to rebalance the ETF Global Dynamic Model Portfolios. Check out the new ETFs being selected in our model portfolio heading into the 3rd quarter.

Model Portfolio Data (ETF Global)

Our domestic equity sleeve has continued to favor Mid-Cap stocks with a tilt towards Value and Growth. While iShares S&P Mid-Cap 400 Growth ETF (IJK), the top-rated domestic equity ETF in the second quarter of 2022, was downgraded to the second position, the rest of the domestic sleeve largely remained the same. Vanguard Russell 1000 Growth ETF (VONG) was a newly selected ETF that followed in 3rd place.

Similar to last quarter, the most notable changes occurred in our developed international sleeve. This was due to several different reasons like the war in Ukraine, persistently high inflation, disrupted supply chains and a weakened EURO. Invesco S&P International Developed Low Volatility ETF (IDLV), iShares MSCI EAFE Value ETF (EFV), and iShares MSCI United Kingdom ETF (EWU) are newly added selections replacing iShares Edge MSCI Intl Quality Factor ETF (IQLT), WisdomTree International Quality Dividend Growth Fund (IQDG), and iShares MSCI Singapore Capped ETF (EWS). iShares MSCI Spain Capped ETF (EWP) remained and was upgraded to the third spot.

Our top-rated emerging market ETF, iShares Latin America 40 ETF (ILF), held on to No. 1 while our second rated fund, SPDR Portfolio Emerging Markets ETF (SPEM), was replaced by First Trust Chindia ETF (FNI). ILF has maintained the top spot as recession fears have investors looking to Latin America. Latin America has benefited from the global market liquidity and as inflation soared and equity markets dried up, investors began looking into opportunities around the globe, especially to countries that are commodity exporters like Brazil, Chile, Peru, and Colombia.

Finishing up our model portfolios is the alternative sleeve which has held constant. The Schwab U.S. REIT (SCHH) was our new addition last quarter which has continued to appear well positioned to benefit from a sustained demand recovery, the inflation-hedging characteristics of real estate, and attractive relative valuations.

Thank you for following the ETF Global Dynamic Model Portfolios. You can find an overview and performance information at ETF Global – About Model Portfolios.

To learn more about our ETFG Model Portfolio strategy, please email us at sales@etfg.com or call us at (212) 223-ETFG (3834).

*****

Assumptions, opinions, and estimates constitute our judgment as of the date of this material and are subject to change without notice. ETF Global LLC (“ETFG”) and its affiliates and any third-party providers, as well as their directors, officers, shareholders, employees or agents (collectively ETFG Parties) do not guarantee the accuracy, completeness, adequacy or timeliness of any information, including ratings and r rankings and are not responsible for errors and omissions or for the results obtained from the use of such information and ETFG Parties shall have no liability for any errors, omissions, or interruptions therein, regardless of the cause, or for the results obtained from the use of such information. ETFG PARTIES DISCLAIM ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO ANY WARRANTIES OF MERCHANTABILITY, SUITABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE. In no event shall ETFG Parties be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs) in connection with any use of the information contained in this document even if advised of the possibility of such damages.

ETFG ratings and rankings are statements of opinion as of the date they are expressed and not statements of fact or recommend actions to purchase, hold, or sell any securities or to make any investment decisions. ETFG ratings and rankings should not be relied on when making any investment or other business decision. ETFG’s opinions and analyses do not address the suitability of any security. ETFG does not act as a fiduciary or an investment advisor. While ETFG has obtained information from sources they believe to be reliable, ETFG does not perform an audit or undertake any duty of due diligence or independent verification of any information it receives.

This material is not intended as an offer or solicitation for the purchase or sale of any security or other financial instrument. Securities, financial instruments, or strategies mentioned herein may not be suitable for all investors. Any opinions expressed herein are given in good faith, are subject to change without notice, and are only correct as of the stated date of their issue. Prices, values, or income from any securities or investments mentioned in this report may fall against the interests of the investor and the investor may get back less than the amount invested. Where an investment is described as being likely to yield income, please note that the amount of income that the investor will receive from such an investment may fluctuate. Where an investment or security is denominated in a different currency to the investor’s currency of reference, changes in rates of exchange may have an adverse effect on the value, price, or income of or from that investment to the investor.

Be the first to comment