spooh

Buying energy companies that produce reliable distribution growth may be the best thing investors can do to hedge against the slow and pernicious devaluation of their incomes. Enterprise Products Partners (NYSE:EPD) just increased its distribution to unitholders to $0.475 which raises the yield to 7.6%. Units have fallen to an attractive valuation level in July and the midstream firm has great recession value!

Enterprise Products Partners: Midstream business represents deep free cash flow value

In “Enterprise Products Partners: Recession-Resistant Midstream With A 6.6% Yield” I explained in June what I believed was the best reason to buy units of EPD: The company has a fee-based business model that protects the midstream firm against price movements in the markets for its raw materials, thereby generating predictable free cash flow available for distribution. Since about 82% of Enterprise Products Partner’s gross operating margin last year was driven by fees, the midstream firm is an excellent way to bet on continual distribution growth even during recession times.

I am re-posting a shortened version of the free cash flow table I used in my last work on Enterprise Products Partners to demonstrate the firm’s free cash flow trend. This table shows EPD’s adjusted EBITDAs, cash flows from operating activities and free cash flows.

|

$m |

FY 2017 |

FY 2018 |

FY 2019 |

FY 2020 |

FY 2021 |

|

Adjusted EBITDA (non-GAAP) |

$5,615.30 |

$7,222.90 |

$8,117.30 |

$8,057.00 |

$8,381.00 |

|

Net cash flows provided by operating activities (GAAP) |

$4,666.30 |

$6,126.30 |

$6,520.50 |

$5,891.50 |

$8,513.00 |

|

Cash used in investing activities |

($3,286.10) |

($4,281.60) |

($4,575.50) |

($3,120.70) |

($2,135.00) |

|

Other |

($48.80) |

$156.50 |

$526.60 |

($100.40) |

($82.00) |

|

Free Cash Flow (non-GAAP) |

$1,331.40 |

$2,001.20 |

$2,471.60 |

$2,670.40 |

$6,296.00 |

(Source: Author)

Before the pandemic — in FY 2018 and FY 2019 — Enterprise Products Partners generated between $2.0-2.5B in free cash flow annually. Even during the pandemic, which resulted in a drop-off in energy demand initially, free cash flows grew to $2.7B. In FY 2021, severe weather conditions and a strong economic recovery post-pandemic led to 136% increase in free cash flow to $6.3B.

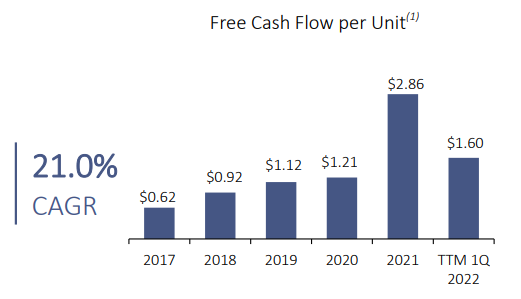

Winter storms resulted in windfall profits for the entire midstream industry in FY 2021, largely because of a record Q1’21. Going forward, however, investors in the company’s units must expect a normalization in free cash flow that is not affected by extreme weather events. I believe Enterprise Products Partners will generate between $1.50-$1.60 per-unit in free cash flow this year which represents a drop-off compared to FY 2021. However, this reset level of free cash flow will still be significantly above the FY 2017-2020 average FCF of $0.97 in per-unit.

Enterprise Products Partners

Raised distribution translates to a 7.6% yield

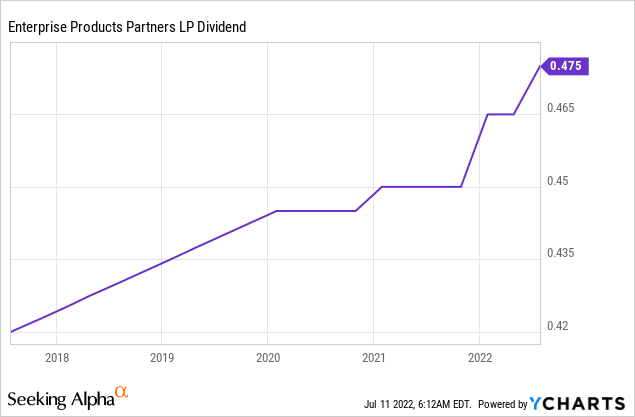

Enterprise Products Partners increased its distribution to the limited partners of the business to $0.475 per-unit on July 7, 2022, which shows 2.2% quarter over quarter growth. The new quarterly distribution of $0.475 per-unit will be paid on August 12, 2022 to unitholders of record as of the close of business on July 29, 2022. The annualized payment of $1.90 per-unit, at a unit price of $24.98, calculates to a yield of 7.6%.

Enterprise Products Partner’s long term distribution growth is impressive and since the midstream firm grew its dividend even during the pandemic, EPD has deep recession value for investors despite a normalization in free cash flow prospects.

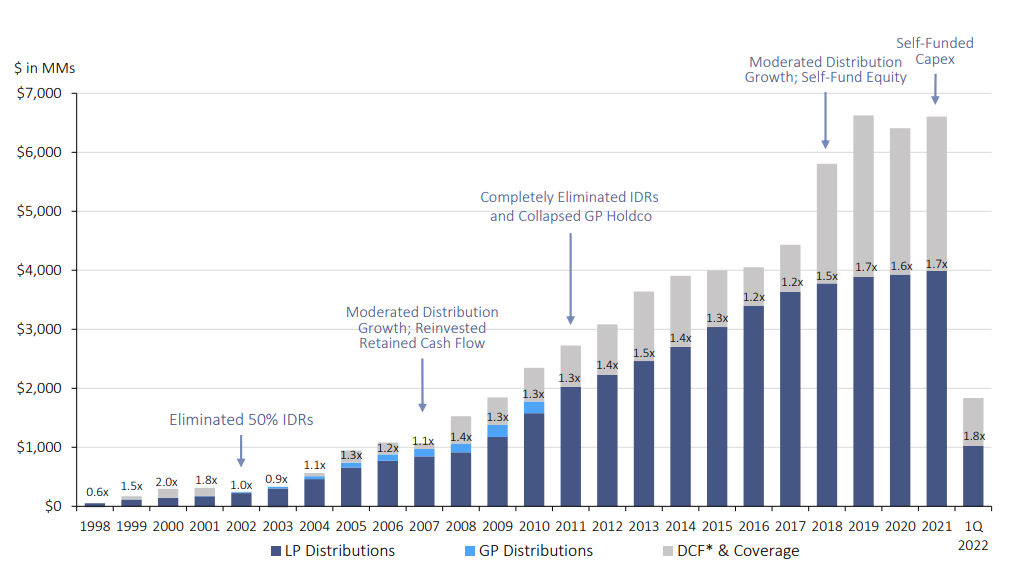

Since 1998, Enterprise Products Partners has now raised its unit distribution 74 times, implying that EPD’s unit distribution will likely continue to grow, especially since the firm’s coverage ratios have improved in recent years as a result of strong execution and strict capital discipline. The distribution coverage ratio, based off of distributable cash flow, was 1.8x in Q1’22 and averaged 1.6x between FY 2018 and FY 2021. Enterprise Products Partners has a very safe distribution as well as a very safe coverage ratio which gives the firm attractive distribution upside during a recession.

Enterprise Products Partners

Enterprise Products Partners’ units are now undervalued

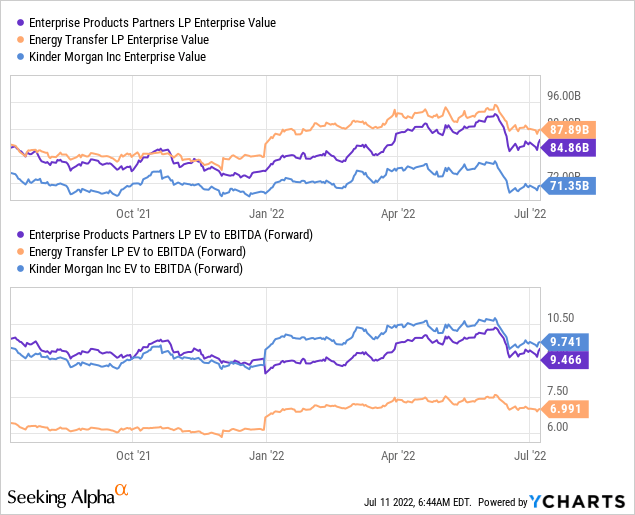

The midstream firm’s units were fairly valued at the start of June, but now they are undervalued. Because of the 12% decline in pricing since last month, units of Enterprise Products Partners represent better value than before. EPD’s units have an EV/EBITDA ratio of 9.5 X, based off of an enterprise value of $84.9B, compared to a ratio above 10.0 X last month. I believe EPD could trade at ratios of 10-11 X to represent its long term distribution potential. Energy Transfer (ET) has an EV/EBITDA ratio of 7.0 X — which also represents great value — while Kinder Morgan (KMI) has an EV/EBITDA ratio of 9.7 X.

Risks with Enterprise Products Partners

With an understanding of how the midstream firm’s business works — transporting raw materials for a fee to customers — is becomes clear that market price risk is not a big risk for the industry or Enterprise Products Partners. I don’t see a recession as a big risk for Enterprise Products Partners either because the firm generated sufficient free cash flow in the past to support its distribution growth.

What is a big risk factor for the industry, however, is adverse government regulation that could stifle output in the fossil fuel industry. If new pipelines or other energy infrastructure can’t be built due to lack of regulatory support, the growth potential of the entire industry could be severely limited.

Final thoughts

The units of Enterprise Products Partners are in a buy-the-drop situation which allows investors to collect a covered yield of 7.6%. Enterprise Products Partners just raised its distribution, adding to its record as a reliable dividend grower. Additionally, because of the decline in pricing in June, units of EPD now represent deeper value from a yield and valuation perspective!

Be the first to comment