AlbertPego

Introduction

2022 has been a difficult year for fixed income investors with no place to hide. Investment grade bonds are down 16% (LQD), high yield bonds down 12.5% (HYG) and preferred stock down 14% (PFF). The bear market and of course rising rates and inflation have all combined to create a difficult environment for fixed income. We believe that the “bad news” in fixed income has been essentially priced in and over time fixed income will begin to recover. Current markets present an opportunity for investors to lock in elevated yields for a multi-year period of time, even as it may take more months for Fed moves and inflation to ease.

Closed-end funds (CEFs) provide investors a great way to diversify their fixed income holdings while generating high income yields. On the other hand, CEFs are more volatile due to the leverage they use to boost yields and the wide swings that can occur in the discounts or premiums in which they trade. When the stock market is down, investors have a tendency to dump CEFs, widening discounts, which can put further downside pressure on market prices. These dynamics can be seen this year in PIMCO Dynamic Income Opportunities Fund (NYSE:PDO), one of the PIMCO’s newest funds (inception date of January 2021) and the subject of this article. We would direct readers to check out PIMCO’s website for more information on PDO. (Note: We’re certainly aware of other key PIMCO funds such as PDI, PAXS and PTY; we are assessing PDO alone and will not provide a comparison to other funds in this article).

Fund Overview 2022

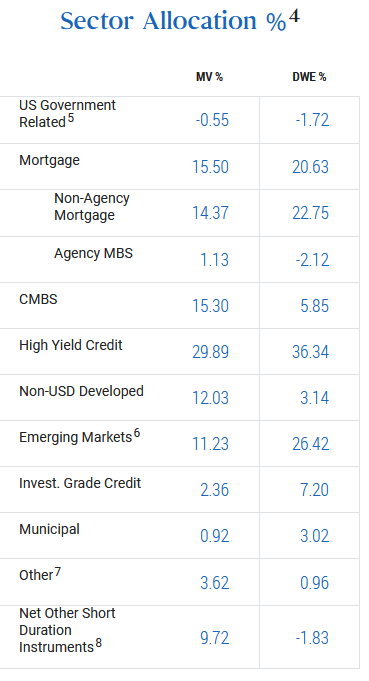

PDO has not been kind to investors in 2022 with about a 23-24% negative return year-to-date. On a net asset value basis (NAV) the performance is better, down about 18%. While it might seem like the PIMCO management team is underperforming, the results are in fact reasonable given the broad market action in fixed income. Importantly, the fund leverage magnifies results both up and down, but also supports the high dividend yield. Current leverage of about 47% means that asset price movement will be magnified by about 150% each way. As the fund allocation shows, PDO has exposure to multiple segments that are down in the mid-teens percentage so far this year; emerging market bonds are down in the 18-20% range.

PDO Fund Composition (PIMCO Website)

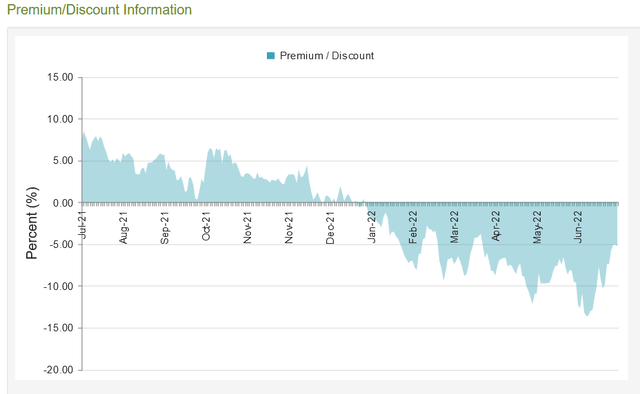

Therefore, 150% exposure would mean an asset price decline of about 22-23% on a gross basis. The decline in NAV of 18% is not surprising and in fact arguably better than might be expected. The lower decline is likely due to the shorter duration of the portfolio, which stands at 3.85 years as of the last reporting. The fact that the market price of PDO has declined even further is due to selling pressure reflective of a bear market. While the fund traded at a premium for most of 2021, it quickly moved to a discount and has remained at discount levels for all of 2022, as seen in the chart below.

PDO Premium/Discount (Source: CEF Connect)

The distribution, which is now at a very attractive 10.8%, appears to be safe based on the coverage numbers issued by PIMCO. In fact on July 1, 2022 management increased the distribution from $0.1184 monthly to $0.1279 or an 8% increase. This is solid evidence for the health and stability of the distribution, as funds don’t increase distributions unless management is highly confident they can comfortably do so for a long term period of time. PDO paid a special distribution at year end 2021 and there is a decent chance this happens in 2022 as well.

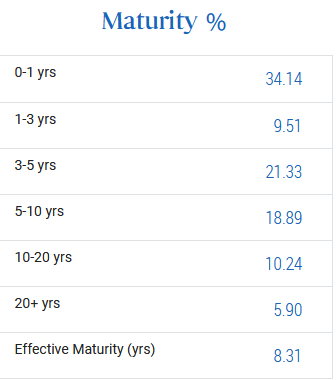

The increase in the distribution should put to rest fears that leverage or higher shorter terms rates will negatively impact the net income of the fund at a level that could impair the distribution. The short duration of the fund is a strong positive. As the chart below shows, 34% of the fund has an under 1 year maturity, which means management can take advantage of the yield spike in all areas of fixed income to position the fund for a better future. Two-thirds of the fund matures in under five years, which means that if rates remain elevated, PDO will be able to continue to roll assets into new, higher yielding investments. It also mitigates further price downside for the fund.

PDO Maturity Profile (PIMCO Website)

Conclusion

So now the key question: Is PDO a buy? We’ve summarized our view on PDO in the following bullet points:

- PDO is a broadly diversified fixed income fund that gives an investor exposure to at least seven varied segments of the fixed income markets. There is no way to expect that the fund will not follow the broad performance of the fixed income markets, which in 2022 have fallen in the mid-teens percentage and in some areas even more. The 18% decline in NAV is thus totally expected given the 150% total exposure with the use of leverage.

- The short duration of the fund is a strong positive, and is likely a reason that unleveraged NAV has not fallen as much as the fixed income indexes. The short duration also allows the fund to take advantage of higher market yields and may already be reflected in the distribution increase announced for August 2022 (the ex-dividend date on this passed on July 8).

- The distribution increase is a major positive for this fund. It was the only PIMCO fund that announced a distribution in the July release. The increase allays fears that rising short term rates or the 50% leverage amount (which is in line with many PIMCO funds) could result in negative outcomes that could potentially lead to reduction in asset holdings or a distribution decrease.

- Investors have to trust in the management skill of the PIMCO team, which has a strong track record of success. Many CEFs, especially those with large exposure to non-publicly traded securities (like CMBS), are a bit of a “black box.” It seems to us that PIMCO has done a decent job in managing PDO, with unleveraged results better than the fixed income indexes and the announcement of a distribution increase.

- Investors have to accept high volatility in CEFs in general, and especially in PDO given the 50% use of leverage. The price movement will simply not be like that of an individual bond. A significant portion of the price decline of PDO in 2022 is the change in the fund trading from a slight premium to today’s 5-6% discount. In mid-2021 the fund had a 7%+ premium.

- When markets are down investors face a “triple whammy” with a fund like PDO: dropping underlying assets values, magnification of such declines due to leverage, and further discounting of the fund price to NAV. The reverse is true when markets recover and rise. The 23% exposure to foreign credit has not helped either this year with the strength of the dollar.

- PDO’s NAV is unlikely to recover until higher yielding credit markets in general recover. The fund has too much general exposure to these broader markets to move in a way that is significantly different from the fixed income indexes. The fund premium, or at least the elimination of the discount, will likely not occur until the stock market recovers. Investors in PDO therefore must be patient and only invest with the belief that higher yielding credit markets recover and that the stock market will eventually bounce back. We believe that both of these things will come true, but of course we cannot predict when. We are more confident that fixed income markets will recover strongly and perhaps sooner than expected as investors realize that the yields available now are quite attractive and present a great opportunity longer term.

In conclusion, our opinion is that PDO presents a compelling opportunity for income investors as part of a diversified portfolio of income investments. Our managed income portfolios incorporate a wide range of income investments: individual high yield bonds, individual exchange traded bonds, individual preferred stock issues both of the $25 and $1,000 face value type (with a heavy bias towards those that have a floating rate feature) and a mixture of closed end funds. We like CEFs for exposure to fixed income segments that are not available except to institutional investors, such as bank loans and mortgage securities. Within this broader construct of income investments, PDO has a solid place.

The two key words in 2022 for high yield income investors and for those in PDO is “frustrating” and “patience.” The lockstep double-digit decline in nearly every segment of fixed income has been tough and has likely tested the resolve of many CEF investors. The “triple whammy” described above has come into full effect to pound down the price of PDO. But “green shoots” can be found in what we considered a surprising distribution increase and what has essentially been stability in the price of PDO in the past four weeks. The 10-year Treasury rate had hovered around the 3% range (with wide day-to-day movements) which tells us that longer term, which means well beyond inflation results in the next few months and Fed rate increases, interest rates will likely remain muted and a 10% distribution yield will be seen as very attractive once again and attract buyers. There could certainly be more downside but we seem to be far closer to the bottom in fixed income and the more likely movement in the next 12 months is up. For income focused investors with many years on the horizon, the 10% yield will help manage through this wait.

Please be aware that Downtown Investment Advisory currently holds PDO in client and personal accounts, and may have added/will add to positions at any time prior to or following the publication of this article.

It is important to note that fixed income investments such as high yield bonds, BB and lower preferred stock, high yield focused closed end funds, and baby bonds are by definition not “investment grade” and are thus only appropriate for investors willing to accept a higher fixed income risk profile. High yield fixed income investments may not be appropriate for all portfolios, so consider these investments only as part of a broader investment portfolio allocation to various assets of all risk profiles.

Please see the Downtown Investment Advisory profile page for important disclaimer language, which is an integral part of this article.

Be the first to comment