xavierarnau/E+ via Getty Images

By Paul J. DiGiacomo, CFA

Relief may be in sight for some parts of the supply chain. And we could see things normalize later this year.

Some good news at ports

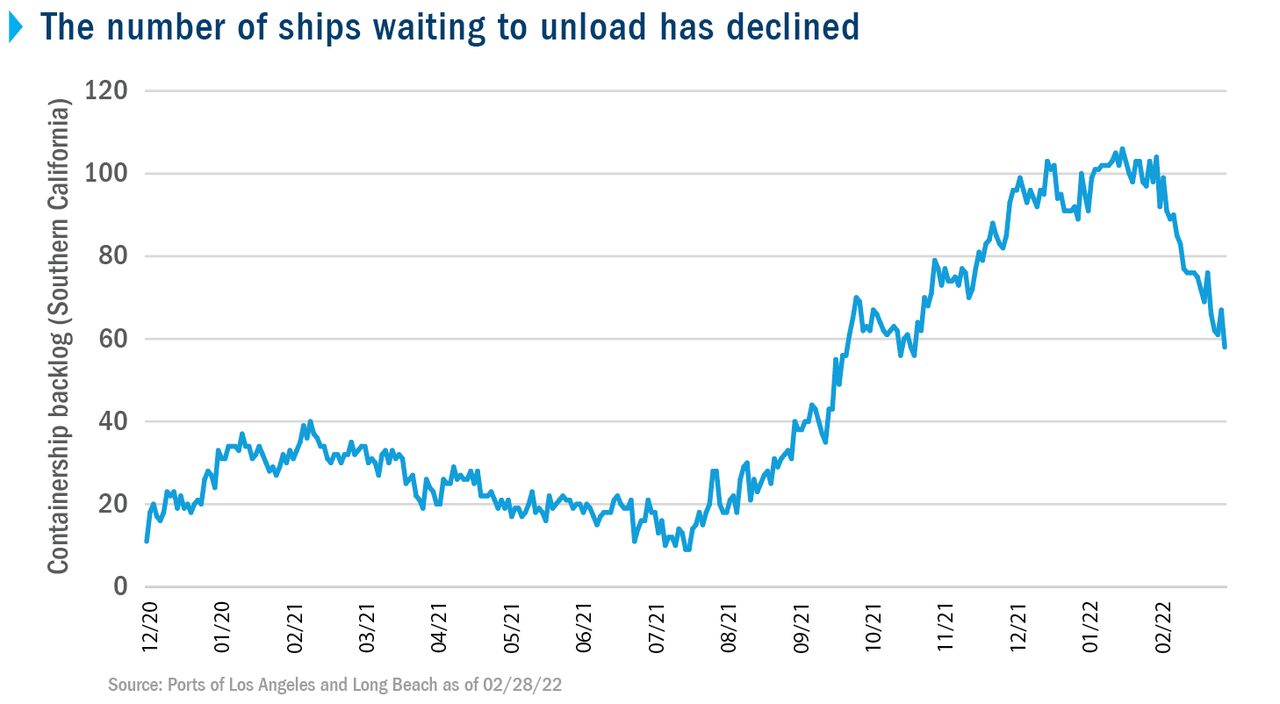

For months, the news has been filled with stories of delays and long wait times for everything from appliances to cars. Recent data from the ports of Los Angeles and Long Beach indicate some relief, as the vessel backlog has declined meaningfully. This is consistent with our view that the ports have started to catch up during the typical seasonal post-holiday slowdown.

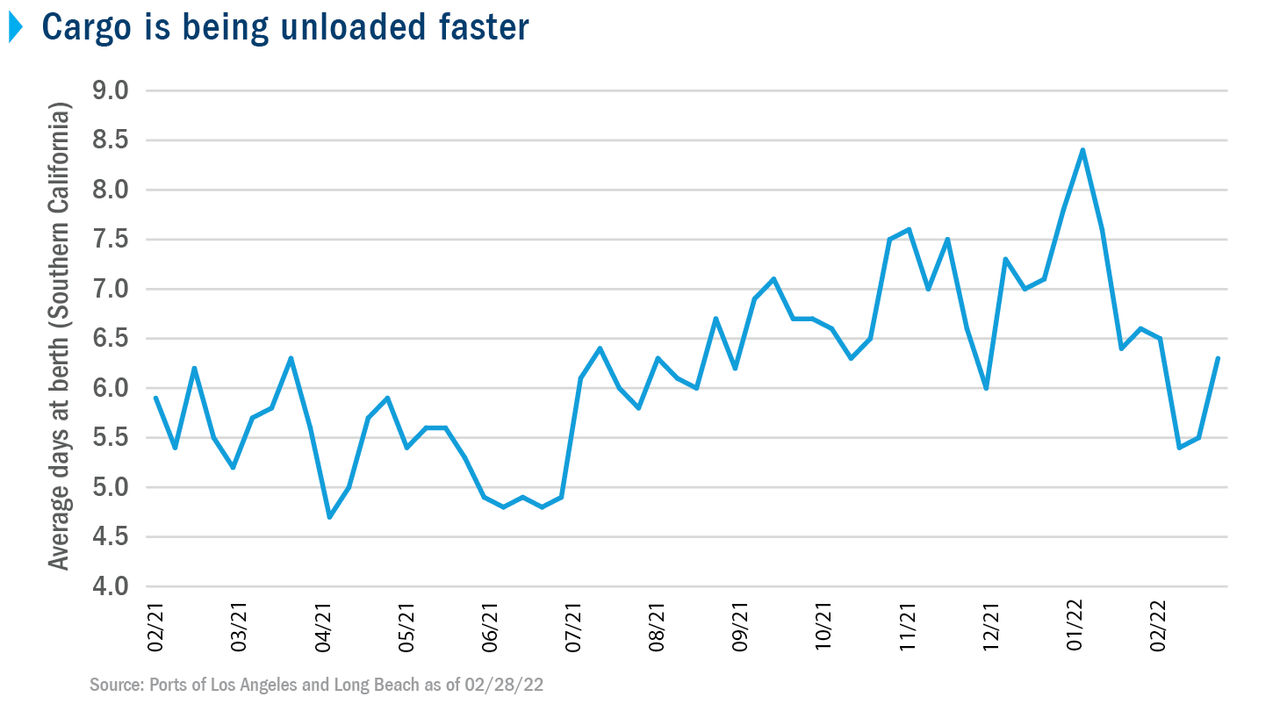

In addition, ships are unloading faster. The average days at berth has declined to near a six-month low. This is significant because the faster ships move through the ports, the faster supply chain congestion unwinds.

Still too early to see impact on prices

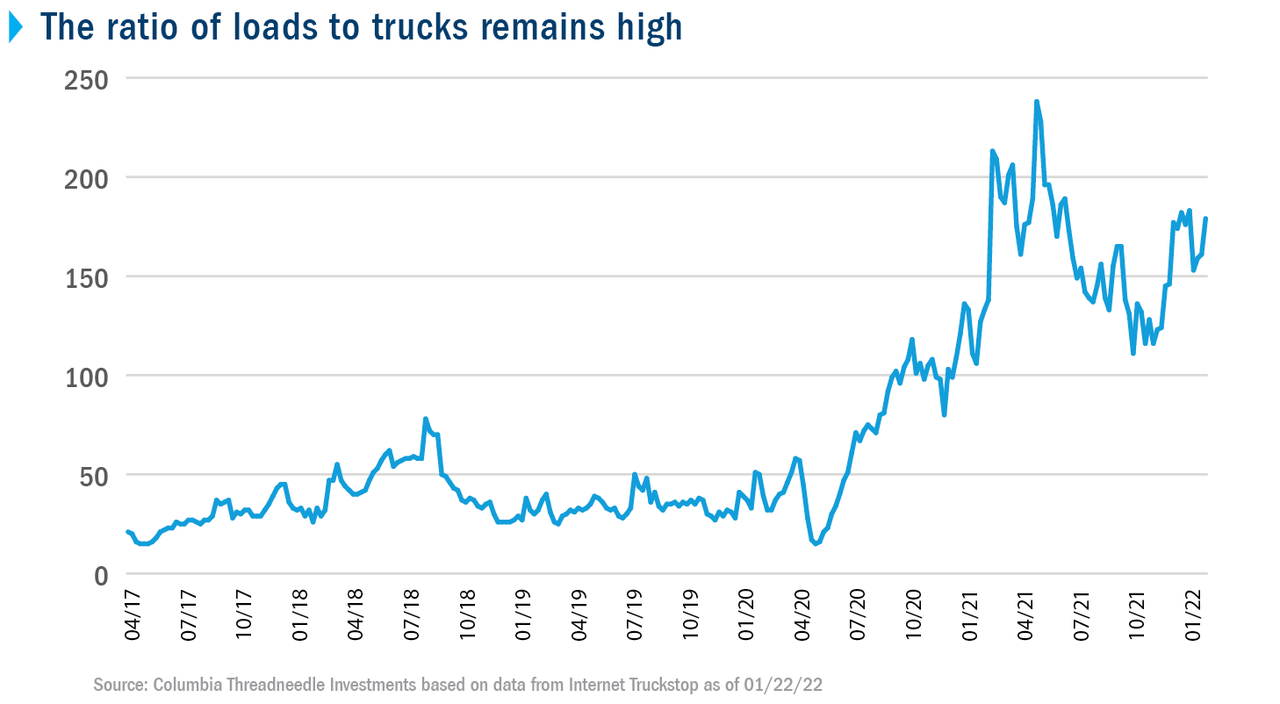

While the ports are less congested, it’s too soon to say that the supply chain delays are over. Once cargo is unloaded, much of it has to go on trucks, and while demand is down from its peak, the ratio of cargo looking for trucks remains quite elevated.

This dynamic is also reflected in prices for containerships and air freight, which also remain high.

Bottom line: Supply chains are turning a corner, slowly

Many expect supply chains to normalize in late 2023. But we are seeing evidence that supply chain constraints are easing sooner. While the war in Ukraine may cloud the global picture, in the U.S., a seasonal lull has alleviated some of the most severe delays.

© 2016-2022 Columbia Management Investment Advisers, LLC. All rights reserved.

Use of products, materials and services available through Columbia Threadneedle Investments may be subject to approval by your home office.

With respect to mutual funds, ETFs and Tri-Continental Corporation, investors should consider the investment objectives, risks, charges and expenses of a fund carefully before investing. To learn more about this and other important information about each fund, download a free prospectus. The prospectus should be read carefully before investing. Investors should consider the investment objectives, risks, charges, and expenses of Columbia Seligman Premium Technology Growth Fund carefully before investing. To obtain the Fund’s most recent periodic reports and other regulatory filings, contact your financial advisor or download reports here. These reports and other filings can also be found on the Securities and Exchange Commission’s EDGAR Database. You should read these reports and other filings carefully before investing.

The views expressed are as of the date given, may change as market or other conditions change and may differ from views expressed by other Columbia Management Investment Advisers, LLC (CMIA) associates or affiliates. Actual investments or investment decisions made by CMIA and its affiliates, whether for its own account or on behalf of clients, may not necessarily reflect the views expressed. This information is not intended to provide investment advice and does not take into consideration individual investor circumstances. Investment decisions should always be made based on an investor’s specific financial needs, objectives, goals, time horizon and risk tolerance. Asset classes described may not be appropriate for all investors. Past performance does not guarantee future results, and no forecast should be considered a guarantee either. Since economic and market conditions change frequently, there can be no assurance that the trends described here will continue or that any forecasts are accurate.

Columbia Funds and Columbia Acorn Funds are distributed by Columbia Management Investment Distributors, Inc., member FINRA. Columbia Funds are managed by Columbia Management Investment Advisers, LLC and Columbia Acorn Funds are managed by Columbia Wanger Asset Management, LLC, a subsidiary of Columbia Management Investment Advisers, LLC. ETFs are distributed by ALPS Distributors, Inc., member FINRA, an unaffiliated entity.

Columbia Threadneedle Investments (Columbia Threadneedle) is the global brand name of the Columbia and Threadneedle group of companies.

NOT FDIC INSURED · No Bank Guarantee · May Lose Value

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment