photoschmidt/iStock via Getty Images

Investment thesis: The Invesco CurrencyShares Euro Currency Trust ETF (NYSEARCA:FXE), is a common way to gain investment exposure to the euro currency. It moves up and down together with the US dollar to the euro exchange rate. It may be one of the most relevant investment assets that are likely to be affected by the currently unfolding historical event, which is set to arguably upend the current fiat-based world order.

The euro is most exposed to the move by Russia to demand ruble payments for its gas exports, because of the heavy reliance of the EU on Russian gas. Russia’s move is a direct attack on the euro’s status as a reserve currency. As I shall explain in this article, it puts the ECB in an impossible situation, where it will have to choose between having to take heavily indebted EU states off of life support or defending the value of the euro.

Regardless of which option the ECB will choose, it will be a negative for the euro currency, therefore FXE is becoming a risky asset. Investors should also consider the implications for a range of other investments, including European stocks, or US stocks that have heavy exposure to the EU economy. With the robust sanctions regime we imposed on Russia, we essentially started an economic war with a country that has an outsized capacity to absorb the hits as well as a capacity to hit back. Russia is now starting to hit back and it will have a significant impact, particularly on the EU, but also on the global economy and on the global financial system. The euro is set to be the first victim.

The era of printing euros in order to purchase goods & services produced around the world is set to come to an end

The undeniable advantage of having a currency that plays a major role as a global FX reserve, as well as a means to facilitate transactions within states and between states is often overlooked when we discuss the economic structure of the Western World. The EU, for instance, has been paying Russia and other countries for imports mostly with freshly-printed Euros.

Even as the ECB increased its balance sheet about seven-fold since the 2008 crisis, the Russian Central Bank, as well as other central banks around the world, have been increasing their FX reserves denominated in euros as well as other major currencies which they earned by exporting tangible goods and services.

Russia, in particular, pursued a policy of switching to euros from dollars, most likely because it thought the euro was less likely to be used the way it was recently to freeze the Russian Central Bank assets. Russia was most likely banking on the Europeans avoiding any moves that will inflict significant pain on their own economy, while the Europeans imposed the recent sanctions while banking on Russia’s own reliance on revenues from its export of energy to the EU, assuming that Russia would not retaliate. The Russians were proven wrong and they are set to retaliate, meaning that the Europeans are also about to be proven wrong in their own calculations.

Classical economic theory says that those FX reserves serve as a claim on the future economic output of the issuer of the currency. The freezing of Russia’s FX reserves is in effect a denial of the right by Russia to redeem the value of those accumulated reserves, which means that many years’ worth of Russian natural gas that was sold to the EU and others around the world who paid in euros were acquired for free since Russia cannot make use of that money. It is an event that other nations around the world will not pass by without drawing conclusions accordingly.

The argument against ditching the euro and USD as FX reserves and as a means of conducting transactions around the world is that the Russian situation is an extraordinary circumstance that most other countries around the world do not have to fear. Yet, the world’s largest holder of FX reserves, namely China, has been the subject of a growing sanctions campaign as well. It now has to wonder about its own FX reserves, given the precedent we just set. At some point, its own FX assets denominated in USD or euros may be frozen as well.

It may be justified over China’s human rights record, a geopolitical situation, or any other excuse, while as much as $3 trillion worth of tangible goods can be declared to have been taken from China for free. It is a calculation that all countries around the world need to account for, and there are signs that there are nations that increasingly do. Saudi Arabia’s heightened interest in China paying for its oil imports in Chinese yuan is perhaps one of the clearest indications of where this thing may be headed. In the meantime, Russia, which is in many ways one of the hardest countries on this planet to coerce economically as well as militarily, is taking concrete steps to remove itself from the current USD-euro-dominated system.

In the particular case of Russia, its decision to have many of its customers pay for their gas imports from Russia in rubles automatically removes a great deal of pressure for the Russian Central Bank to intervene in defending the ruble. It is mostly due to the fact that Russia’s commodities exports are something that the world needs in order to prevent a significant economic downturn that Russia can hope to break away from the dominant Western-dominated global financial system in place. If this measure takes on a more permanent, institutionalized role in the global trade puzzle – and it may even get expanded to other Russian exports – the ruble will increasingly take on a more matured currency role, where it will likely become a more prominent player in the global FX reserve mix.

Eventually, it will be not only countries that absolutely need to import Russian gas, who will start stockpiling enough rubles to meet a few month’s worth of gas, oil, or wheat imports, but central banks around the world, which will see the ruble become increasingly like the petro-dollar equivalent since a ruble will always find a home with anyone who wishes to buy some Russian commodities or other goods. It has some of the same effects that Saudi Arabia’s decision to sell its oil exclusively in USD had on supporting the US dollar in the global market after it went off the gold standard.

The euro will be significantly weakened, just as the ruble is set to gain in prominence as a global FX currency, because now the ECB will issue freshly printed Euros which will have to chase rubles on the market, instead of tangible goods that other countries will sell so they can accumulate those euros. The global FX market will therefore eventually feel oversupplied with euros, leading to a turning point, where selling may commence from all corners, where no one will want to be left holding the bag.

To further gain an understanding of why I see such an event occurring at some point, we should look closely at how this will work, based on the situation at hand. European customers will likely not be able to just offer more euros to Russia directly to buy rubles. Russia has no use for that since it cannot make good use of those euros because of the sanctions. Russia will probably increasingly pay for its own imports in rubles, also because of the sanctions. Europeans will then have to chase those rubles with their freshly-printed euros, backed by nothing in particular on the international market. In other words, they will chase a currency that can always be exchanged for Russian natural gas, with a currency that just gets printed, with no real backing, aside from the already established role of the currency as a prominent medium of exchange.

In the wake of the sanctions against Russia’s Central Bank, where its assets were frozen, there have been some questions raised in regards to what effect it may have on the global FX markets, including on FX reserve policies around the world, as well as the global reliance on the Western financial infrastructure to conduct global trade. Mainstream institutions, including the MSM as well as the IMF and other institutions, came out with an almost unified message. This is that the US dollar cannot easily be replaced as the world’s reserve currency, even if some actors may strive to reduce its use, thus the system is secure.

I do agree, to some extent, with the US dollar’s place in global trade and as an FX reserve currency being very secure, even if it may face a gradual degradation as more and more countries will probably want to diversify. It is not necessarily the case with the euro. Global trade can go on without the use of the euro, uninterrupted. Russia’s latest move is a heavier blow to the euro than most people may realize. On its own, it is not a fatal blow, but within the context of the wider global implications, with many countries around the world looking at those FX reserves with some nervousness, it could become the little snowball that rolls down the hill, growing into a giant snowball that will destroy whatever it hits. There is also the fragile economic state of the EU which does not help in going to economic war with Russia, which is capable of shooting back, as we can see.

ECB is caught between defending the value of the euro and preventing the default of some Eurozone states. Either decision leads to the demise of the euro

War can always get messy and it is often unpredictable. The Russians are finding out just that, as it seems they are having a rather hard time breaking the resistance of Ukraine. This week we may have also found out that going to economic war with a country that is important enough to global trade that any attempts to isolate it will cause a recession for the entire planet can also become a serious mess, with unpredictable outcomes.

On paper, it was thought that the result would be a foregone conclusion. A coalition comprising about half of the global GDP attacked a country that last year comprised perhaps 2% of global output. The coalition is also technologically far superior, which in theory should give it extra weight. And yet, the blow that Russia just landed on perhaps the weakest section of that grand coalition can be enough to incapacitate it, or at least set it on the path of long-term demise.

As I pointed out, the euro currency can easily fall out of grace within the global FX market. Some of Russia’s allies may purposely act to magnify the blow to its standing, by starting to aggressively sell euro assets, just as the euro starts to experience increased instability, as it chases rubles. The pressure can snowball, with a global selloff in euro assets likely to occur. The dollar may actually benefit initially. The euro however faces an existential crisis, and there will be no easy decisions on how to deal with it.

There is the option of accepting a weak euro policy. It would have some advantages, including making European exports more attractive. The obvious disadvantage is that within the context of a global commodities boom, one of the largest net importers of commodities, including energy, can hardly afford to pursue a weak currency policy.

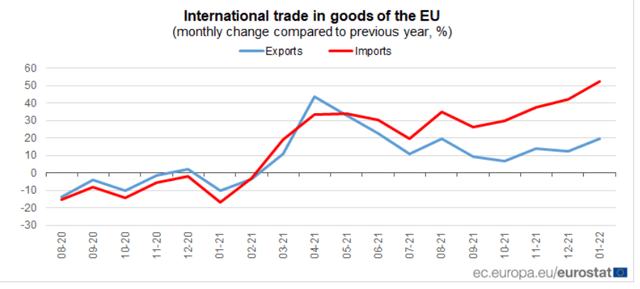

EU YoY export-import growth (Eurostat)

For the month of January, the EU experienced a trade deficit of 36 billion Euros, or about $40 billion. A lot of it has to do with the higher costs of commodities imports, whereas in the past decade, the EU mostly had a trade surplus. Because the EU produces very little oil & gas, while its coal mines have been gradually shut down in the last few decades, energy imports make up a significant portion of its total imports needs. If the ECB were to accept a weak Euro policy within the current context, the inevitable result would be a significant rise in inflationary pressures on the EU economy, as energy prices, which are already dangerously high will just keep rising.

The ECB can opt to defend the value of the euro. The tools at its disposal include a reverse of its balance sheet expansion and raising interest rates. The inevitable outcome of that will be a major blow to the abilities of certain Eurozone member states like Italy and Greece to service their debts. Italy’s current debt/GDP is about 155%, while Greece’s is about 200%. Their 10-year bond yields are about 2% and 2.7% respectively. If the ECB will be forced to remove the support for Euro-denominated debt, those yields could easily skyrocket, pushing those countries and others into a vicious cycle.

I am not sure that there is a great deal of private sector investor appetite for any of that debt, especially if the ECB stops providing support for that debt. Fitch ratings explained in more detail just how important that ECB backing is for Greece’s debt for instance, just at the end of last year. It is not so much an issue of the ECB having to buy up Greece’s debt, but rather one of providing backing in case the market fails to buy it, which gives the market peace of mind, knowing that there is always a buyer of last resort of that debt, making it risk-free. If the ECB is forced to stop being that buyer of last resort in order to defend the euro currency, countries like Greece will probably default.

Economic and financial consequences

It remains to be seen how Russia’s demand for ruble payments for its natural gas will play out this week and beyond. Based on most reactions coming out of the EU, so far we have confusion, shock, and some defiance. Many companies stated that they intend to continue payments in euros. Bulgaria seemingly is thought to have no choice but pay for its gas in rubles, based on Russian expectations. While I have not found any official statements out of Hungary just yet, I think Hungary will abide as well. These are non-euro currency members of the EU, and they are heavily dependent on Russian gas, so it is not such a hard decision for them to take. Previously they used to mostly pay in euros. My guess is that most EU members and companies will react with defiance, refusing to pay, which will lead to Russian gas flows to the EU slowing dramatically.

The first phase will be an EU-wide natural gas price shock, with the global natural gas market feeling the aftershocks. A severe economic slowdown in the EU, with inflation pushing higher, should be expected as a result. The current consensus is that Russia does not have the economic stamina to survive for a prolonged period without its natural gas revenues. We should keep in mind that Russian oil exports are also declining. The latest data suggests that last week there was a 26% decline in Russian oil exports. In theory, Russia’s economy should be on the ropes by now, so one would think that Russia is bluffing in its demand for ruble payments for gas.

I personally think that much like Napoleon and Hitler underestimated Russia’s fighting stamina, to their peril, we are also currently underestimating Russia’s economic stamina. It is self-sufficient in energy & food, while there is a robust suppression system in place to deal with public discontent. That, in the end, is what really counts for the regime’s survival. For those few extra needs it needs to import, some of its energy exports will always find a buyer. It will therefore be the Europeans who will most likely blink first within a few months, in the aftermath of a severe energy price-induced economic shock. Some energy-intensive industries will experience permanent damage, with plant closures and bankruptcies widespread. This phase should last until late spring or early summer.

The next step will involve having to adapt to a new reality, where freshly-printed euros, issued by an already weakened economy, with its industry reeling and hollowed out will chase rubles, so they can make payments on Russian natural gas shipments. This part is difficult to quantify in terms of the likely effects it will have on the euro currency, thus also on the EU economy. The long-term danger I see here is that the EU will see its currency demoted from its privileged status of being sought after by producers and exporters of tangible goods, so they can add to their euro-denominated FX reserves. EU leaders probably see the same danger, which is why they are so reluctant to accept Russia’s demand.

The Euro might become more like the Polish zloty, where there is very little reason to hold it as an FX reserve. India, for instance, will never pay Russia for its LNG in Polish zloty. In the near future, it will most likely also stop paying in USD or in euros and pay in its own currency instead, based on recent reports. Between its diminishing desirability, given the constant threat of asset freezes, and Russia now evidently seeking to shun it as a currency that it might accept for its exports, this is a real possibility. A number of other countries might do the same, for various reasons. The effect this will have on the EU’s economy, if it plays out this way, adds up to total financial and economic devastation.

Investment implications

In the short term, this move is a further escalation of the economic war. Defiance will be the first reaction and a further spike in EU energy prices should be expected. As the EU scrambles to bid on any LNG supplies in the hope that it can divert significant volumes to the EU, global natural gas prices will be pushed higher, leading to higher inflation and a burden on the finances of consumers, businesses, and governments all over the world, especially in Europe. Together with rising motor fuel costs, food costs, and so on, inflation will threaten to get out of control, so central banks around the world will most likely get more aggressive in raising rates. There is very little hope for any upside in stock markets from current levels, between now and the summer. There is simply nothing to be positive about at this point. Stock markets will only gain if we will have one of those rallies that defy fundamentals, which increasingly tends to happen.

Beyond the initial short-term effects, the EU economy is set to experience long-term damage from high energy prices, leading to companies shutting down operations, some permanently and consumers being stretched. Unless Russia relents, which at this point I doubt, EU customers of Russian gas will have to drop their defiance and start paying in rubles. At that moment, the euro currency will begin to drop in its standing as a global reserve currency and as a widespread means of conducting transactions.

Whether one is invested in FXE or any other euro-related investments, this will become a significant risk. It will not by itself completely end its current status, but in conjunction with other factors, it might represent the first major setback that will get things rolling. The euro currency will come under selling pressures, within the context of a raging commodities bull market. The ECB will opt to let the euro weaken because it has to protect some of the weaker members of the monetary union from having their sovereign debt lynched by the markets, pushing them into default.

What this means for investors is that everything denominated and valued in euros will shrink in value. Most companies that have significant exposure to the EU market will see a decline in sales. Renault (OTCPK:RNLSY), for instance, which is more reliant on its car sales within the EU, will suffer more than Daimler (OTCPK:DMLRY), which sells more cars outside the EU. Beyond that, this is yet another heavy blow to the euro project, after many other challenges it faced, especially since the 2008 crisis exposed its fundamental flaws. It remains to be seen how many more such blows it can take before it is abandoned.

Be the first to comment