DNY59/E+ via Getty Images

Hopes over a possible recovery in the second half started fading due to blistering inflation data, aggressive monetary tightening, and concerns over a recession. In other words, the worries that wiped out trillions of dollars in the first half have become even more critical and are beginning to impact the spending power of businesses and consumers. Therefore, it is not prudent to believe that information technology ETFs such as Vanguard Information Technology ETF (NYSEARCA:VGT) have hit bottom. I believe growth investors should wait longer until they see clear signs of economic certainty and improvement in sentiment.

Tech Stocks are Sensitive to Economic and Liquidity Growth

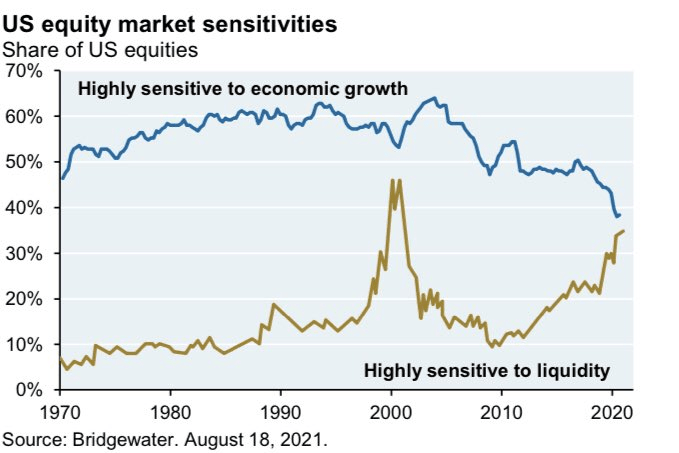

US equities sensitivity to growth and liquidity (Bridgewater Associates)

The chart above shows that U.S. equity markets are highly correlated to economic growth and liquidity. When the economy and liquidity increase, U.S. equities, particularly tech stocks, make significant gains, something we have seen in the past two years. On the other hand, high rates and slower economic growth create a challenging market environment for companies and investors. In the first half of 2022, concerns over economic contraction and tight monetary policies have wiped out trillions of dollars of market value, pushing the tech-heavy NASDAQ index into a bear market with a price drop of around 30%. Despite recent losses, data points that the bearish trend could extend into the second half. For instance, Wall Street firms like Goldman Sachs, JPMorgan Chase & Co., and Barclays have raised their rate hike forecasts to 75 basis points from their earlier projection of 50 basis points. This isn’t good news for tech and other rate-sensitive industries.

“Once the Fed starts moving in 75s it would be hard to stop, and the combination of this and the Fed’s outcome-based approach to inflation feels like it could be a recipe for recession,” Evercore ISI’s Krishna Guha and Peter Williams wrote in a note to clients.

Furthermore, the risk of recession has been amplifying amid a combination of factors like high rates and slowing economic growth. GDP declined by 1.4% in the first quarter of 2022 with a forecast to rise by just 0.9% in the second quarter. Based on a common rule of thumb, two consecutive quarters of contraction trigger a recession. In my view, the intensified volatility in the markets, a record drop in consumer sentiments, and the current bearish trend in stock markets hint that a recession is imminent.

VGT’s Portfolio Composition Carry High Risk

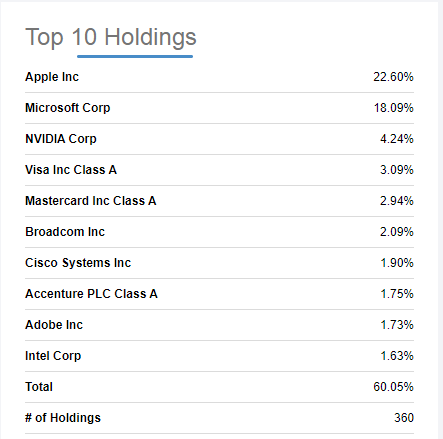

It seems risky to invest in an ETF that tracks the information technology sector since the risk of recession is looming and a monetary tightening will negatively impact tech stocks. VGT investors may also face the risk of under diversification in a volatile environment. Apple (AAPL) and Microsoft (MSFT) account for 40% of the overall portfolio while the top 10 stock picks out of 360 holdings represent 60% of the entire portfolio.

Top 10 stock picks (Seeking Alpha)

All of VGT’s top ten portfolio holdings look like solid businesses with a history of rewarding investors. However, their future fundamentals don’t look promising. High inflation and slow economic growth would limit their revenue growth potential from consumers and businesses alike. For instance, Apple’s growth is reliant on consumers’ spending power. Slow economic growth and higher inflation would definitely make it difficult for the general public to afford luxury items like iPhones and other tech products. Also, the impact of slower consumer spending and high-interest rates on credit card transactions would lower revenue expectations for companies like Visa (V) and Mastercard (MA).

Additionally, information technology companies like NVIDIA (NVDA) and Intel (INTC) that sell their chips directly to companies and organizations would also be heavily impacted amid a drop in technology, communications, and consumer businesses. NVIDIA, for example, has seen its shares plummet almost 48% so far this year as a result of a steep decline in crypto markets and slowing gaming demand. Executives at Intel (INTC) are also cautious about the near-term outlook. In the following quarters, demand for chips could further stall if economic headwinds reduce industrial and automotive growth.

Not in a Buying Zone

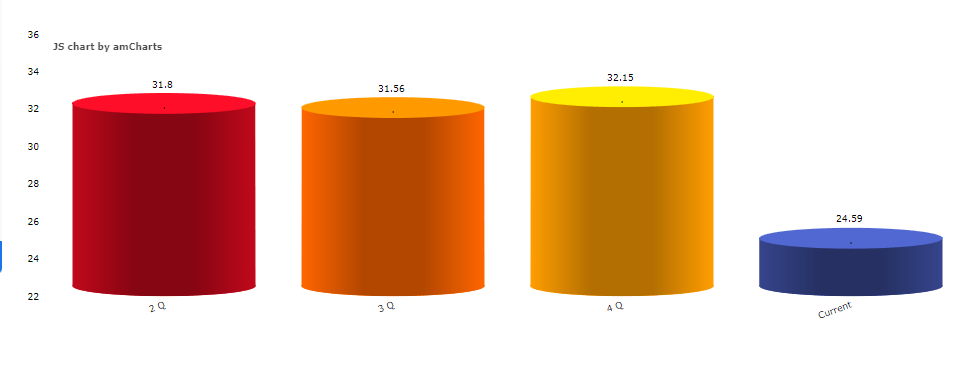

Information technology sector PE ratio (csimarket.com)

While the recent selloff helped to moderate valuations in the past six months, large-cap technology stocks are still trading at a premium, and a potential downgrade in their earnings estimates could negatively impact their valuations. Information technology companies are currently trading at around 24 times earnings, up from 21 times on average over the past five years. Seeking Alpha quant grades also indicates that large-cap technology stocks have poor valuations. Apple, which is trading around 21 times earnings and around 35 times book value, earned an F grade. Similarly, NVIDIA and Microsoft both received an F grade for their valuations, which indicates that their stocks are currently overpriced.

Bear Trend Could Extend into Second Half

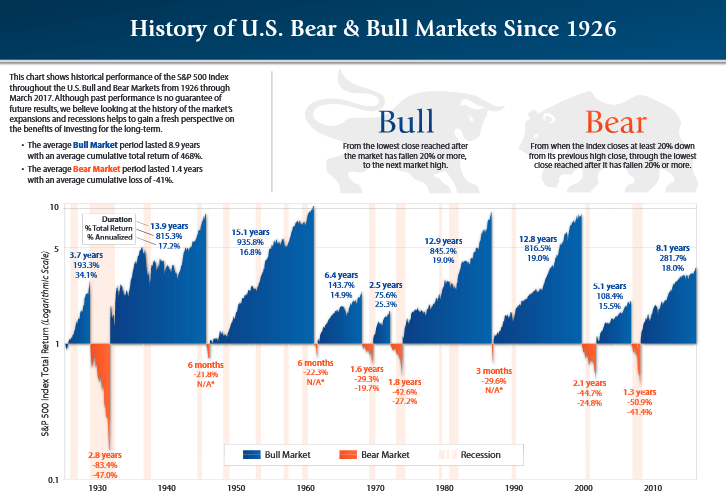

History of US Bull and Bear Market (raymondjames.com)

Equities typically take a longer time to recover and rebound once they fall into a bear market. The S&P 500 fell into the bear market 20 times since 1930, and the average bear market lasted for 1.4 years with a cumulative drop of 41% on average. If history repeats itself, it would take longer for the current bear market cycle to end. In addition to historical trends, economic data and Fed policies also point to further pain for tech-focused ETFs like VGT. Therefore, we might see the current bearish trend continue into the second half of 2022, and equities will suffer significant losses if the economy enters a recessionary period.

Final Notes

Those interested in buying tech-focused ETFs like VGT should wait longer to find a better buying opportunity. A lack of clear direction from the Fed is likely to lead to more uncertainty in the second half. The markets will experience slow GDP growth along with the looming risk of recessions, which is not favorable for tech stocks. Additionally, VGT’s portfolio lacks diversification, which makes it a risky pick in volatile market conditions.

Be the first to comment