vice_and_virtue/iStock via Getty Images

Rare earth elements are the fundamental building blocks of both the EV and renewable energy shifts. These both form tenets of the drive to net-zero, a patchwork of pledges around the world to reduce reliance on fossil fuels and cut greenhouse gas emissions to as close to zero as possible. Critically, the rationale for the shift that now aims to change the architecture of whole energy and transport systems is that anthropogenic climate change is real. Hence, all nations have to try and restrict the rise in mean global temperature to well below 3.6 °F above pre-industrial levels.

MP Materials (NYSE:MP) owns the Mountain Pass open-pit mine for rare earth elements situated in Southern California. The company has mainly been focused on mining rare earth oxides at this site with most of the processing completed in China. This is set to change this year with the completion of its stage 2 optimization plan. This will see MP Materials complete the retrofit of its refining capacity for the separation of rare earth oxides, the penultimate part of the company’s mission to restore the full rare earth supply chain to the United States.

Hence, even against the energy crisis, the drive to net-zero will continue to form a critical tenet of government policy. More public funds are being made available for EV grants and renewable energy projects as the range of EV models expands rapidly.

Strong Financials As The Shift Continues At Pace

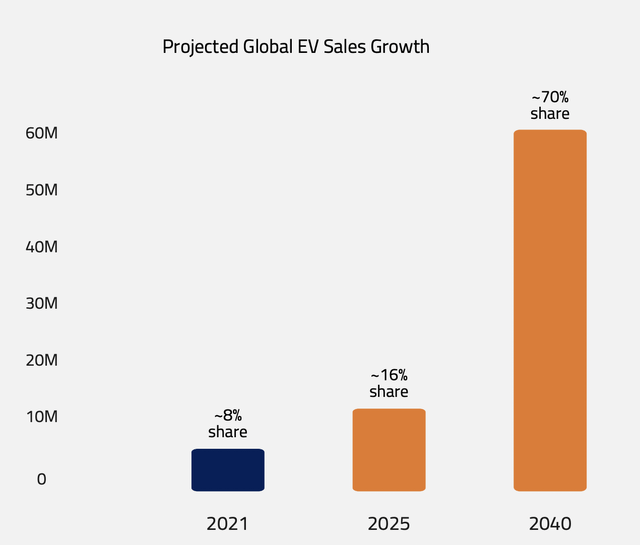

Global EV sales are expected to keep growing strongly in the years ahead. This has been boosted by a good mix of government incentives and changing consumer sentiment. Indeed, the European Union just recently endorsed a framework to end new internal combustion engine vehicle sales by 2035. A move that places the EU on a list that includes the United Kingdom, Norway, South Korea, and California.

By 2025 EVs will have risen to a 16% global market share, more than double its 2021 figure. However, this trend could face an existential bottleneck due to the global reliance on China with the USA currently sourcing about 80% of its supply of rare earth elements from the country. China also has an 87% share of global rare earth processing volume and a 60% share of global rare earth extraction.

This creates an extreme level of reliance for the decarbonisation of the planet on a single source of failure, a risk that can only be mitigated by increased production of rare earths in countries outside China. The US government is starting to recognize this. The Biden administration recently invoked the Defense Production Act to boost domestic production of critical materials for batteries needed to power EVs and renewable energy development projects. The Department of Defense also awarded MP Materials a $35 million contract for the construction of a processing facility for heavy rare earth elements.

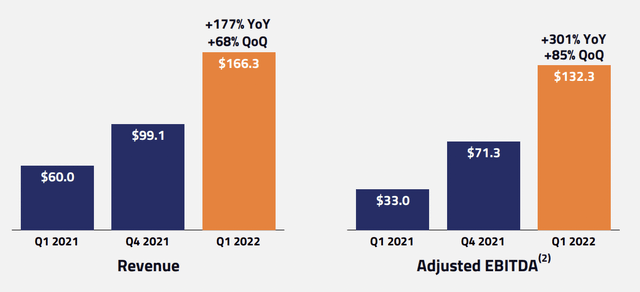

MP Materials last released earnings for its fiscal 2022 first quarter. This saw revenue come in at $166.3 million, a material 177% increase over the year-ago quarter and a $33.1 million beat on consensus estimates.

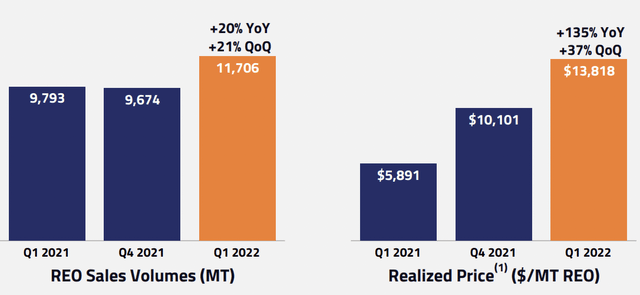

Adjusted EBITDA came in at $132.3 million, a 301% increase from the year-ago quarter and an 85% sequential increase over the previous quarter. These results were extremely strong and mainly driven by a 20% year-over-year increase in REO sales volumes and a 135% increase in realized prices.

This meant the company generated positive cash flows from operations of around $121 million to support capital expenditure during the quarter that grew by 185% over the year-ago quarter to reach $55 million. With its market cap currently at $5.26 billion, the company has been able to escape the extremities of the stock market crash that has reduced deSPAC valuations by an average nearing 80% from all-time highs.

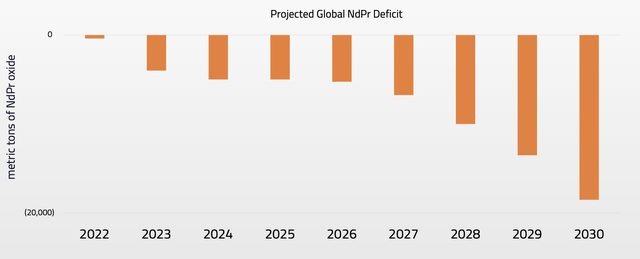

Whilst there will be some variability in earnings that comes with the commodity cycle, the constricted global supply chain for rare earths means there is an expected supply deficit in the years ahead. This will support continued profitability and positive cash flow growth in the years ahead.

The Drive To Net-Zero

The Russian invasion of Ukraine highlighted the shortcoming of the previous EU energy policy. A reliance on barely democratic and somewhat authoritarian states is not a great long-term strategy. This dependency on China for rare earths places the renewable energy transition through a single source of failure.

Increased demands for energy security and independence have come about as a result of the war. This should form a boost for a company that runs one of the only integrated rare earth mining and processing sites in North America. The company’s financials are extremely strong with cash and equivalents of $1.23 billion and a positive free cash flow position. Hence, MP Materials is one to be considered by investors looking for an alternative way to gain exposure to the growth of EVs and renewable energy.

Be the first to comment