Avi Rozen

The biggest narrative trade in cryptocurrency over the last few weeks has been on the possible implications of the Ethereum (ETH-USD) merge from a proof-of-work to a proof-of-stake consensus mechanism. I’ve talked about it quite a bit both publicly and for my BlockChain Reaction subscribers:

For Ethereum miners, this is particularly problematic because ETH mining is still done with GPUs rather than with the ASIC machines required by most other PoW networks. Ethereum miners can’t simply switch to securing Bitcoin (BTC-USD) because their machines aren’t capable of profitably mining it.

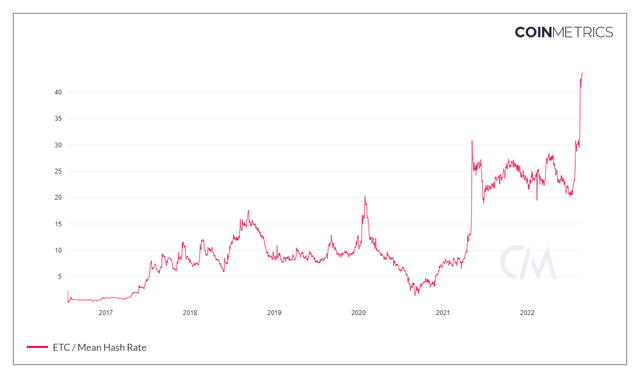

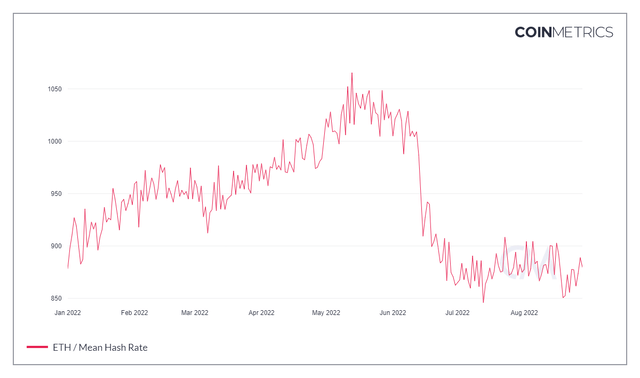

While there has been speculation that ETH miners can simply move to Ethereum Classic (ETC-USD), the reality is Ethereum Classic has very little economic activity happening on the network and I’ve detailed some of those shortcomings in BlockChain Reaction. Still, that hasn’t stopped some miners from switching over to Ethereum Classic already if mean hash rate is any indication:

We’ve seen a massive spike in hash rate over the last month or so and the hash rate of the network is now at an all-time high. This is only explainable by GPU miners coming online to secure the network and the decline in hash rate on Ethereum over the same time period seems to indicate at least a small migration has already started:

I think betting on Ethereum Classic is a pretty large gamble. But if that’s a gamble that you want to take, Grayscale Ethereum Classic Trust (ETCG) is an interesting way to do it.

The Discount Rate is Insane

While I think it’s now widely understood that Grayscale’s cryptocurrency trusts trade at varying discounts or premiums to the net asset value of the trust shares, ETCG is a clear outlier in its discount rate compared to the other funds in the top 5 by holdings:

| Asset | Ticker | Total Holdings | Total Holdings($) | Holdings Per Share | Marker Price Per Share | Premium Rate |

|---|---|---|---|---|---|---|

| Bitcoin | (OTC:GBTC) | 636.45K BTC | $12.48B | $18.98 | $12.66 | -33.3% |

| Ethereum | (OTCQX:ETHE) | 3.06M ETH | $4.39B | $15.41 | $11.59 | -24.8% |

| Ethereum Classic | (ETCG) | 11.94M ETC | $368.01M | $29.92 | $11.95 | -60.1% |

| Litecoin (LTC-USD) | (OTCQX:LTCN) | 1.54M LTC | $82.55M | $4.84 | $3.16 | -34.7% |

| Bitcoin Cash (BCH-USD) | (OTCQX:BCHG) | 311.16K BCH | $35.43M | $1.07 | $0.85 | -20.6% |

| Zcash (ZEC-USD) | (OTCQX:ZCSH) | 334.71K ZEC | $20.51M | $5.58 | $5.65 | 1.3% |

| Decentraland (MANA-USD) | (OTCQX:MANA) | 18.28M MANA | $13.72M | $7.90 | $17.25 | 118.4% |

| Horizen (ZEN-USD) | (OTCQX:HZEN) | 617.84K ZEN | $9.19M | $1.48 | $1.36 | -8.1% |

| Stellar (XLM-USD) | (OTCQX:GXLM) | 75.13M XLM | $7.73M | $9.59 | $10.10 | 5.3% |

| Livepeer (LPT-USD) | (OTCQB:GLIV) | 592.72K LPT | $5.65M | $11.01 | $10 | -9.2% |

| Basic Attention Token (BAT-USD) | (OTCQB:GBAT) | 5.98M BAT | $1.96M | $3.37 | $3.45 | 2.4% |

| Chainlink (LINK-USD) | (OTCQB:GLNK) | 309.23K LINK | $1.94M | $6.42 | $17 | 164.8% |

| Filecoin (FIL-USD) | (OTCQB:FILG) | 107.44K FIL | $604.33K | $5.90 | $36.10 | 511.9% |

Source: CoinGlass

While it’s typical for Grayscale’s funds to trade at large discounts, 60% is very extreme. The Ethereum Classic Trust is Grayscale’s third largest fund by assets under management. The average discount rate of the other 4 funds in Grayscale’s top 5 by AUM is 28%. There is clearly something about the Ethereum Classic fund that the market doesn’t like. While many often point to Grayscale’s management fee as the justification for the fund share discounts, the take rate from ETCG is 2.5%. That’s identical to every other Grayscale single asset fund with the exception of GBTC which is 2.0%.

Grayscale is the ETC Market

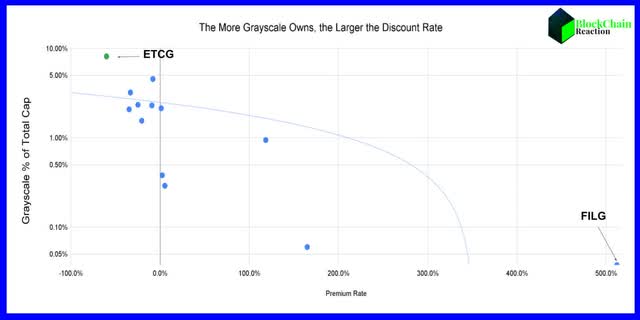

The most glaring difference between ETCG and the rest of Grayscale’s funds is the amount of the circulating supply that Grayscale is managing. If we compare the holdings figures from each of Grayscale’s single asset funds with the market cap of the circulating supply of the underlying assets, we get Grayscale’s ownership % of the market for that asset.

We can see there is a general correlation between how much of the assets circulating supply Grayscale owns and how large the discount rate is. This correlation is expressed clearly through each of the outlier assets. At 0.04% of the circulating supply, Grayscale owns very little Filecoin. As a result, FILG now trades at a preposterous premium over 500% because liquidity in the fund shares is so low. On the other end of the spectrum, Grayscale owns 8.2% of the ETC in circulation, far and away the largest instance of Grayscale ownership by percentage of an underlying asset.

Risks

It is my belief that the only way to truly alleviate these pricing arbs in Grayscale’s funds is to offer a redemption of the assets – even if such a program has a high minimum. If redemption were to be offered, the discount rates would likely close very quickly. The problem with doing that from Grayscale’s perspective is the management fee is the business. Thus, potentially forfeiting AUM through redemption would be detrimental to Grayscale long term.

But I think a redemption program might be a risk worth taking if Grayscale can determine the right minimum threshold. The biggest problem I see is a lack of confidence in the trust products and I’m surprised we’re not seeing Grayscale do more to remedy that. Since Grayscale trust shares are a derivative of the underlying assets that they represent, there is an added element of risk associated with holding the shares.

Summary

Of course, there is a reason for choosing Grayscale funds over holding assets directly and that’s the potential tax-advantaged exposure to crypto that comes with buying Grayscale shares through a retirement account. We’re already seeing hash rate increase in the Ethereum Classic network. What we have yet to see begin to develop is a legitimate economic reason to buy ETC. Ethereum Classic doesn’t have a footprint in decentralized finance or in non-fungible token trading.

What gives these assets value is the demand from economic participants for the tokens. Right now, Ethereum Classic doesn’t have that. Furthermore, one of the token’s largest holders, if not the largest holder, is Grayscale. Because of the management fee mechanism, Grayscale is actually a net seller of ETC when it is collecting its management fee. Without further private placements, there is no fresh ETC coming into Grayscale’s holdings. And at the moment, private placements are closed.

All that said, there is an interesting setup for Ethereum Classic. Some in the ETH community are frustrated with the move from PoW to PoS. For miners, proof-of-stake means the block reward is over. They are essentially out of business. For any in the development community who value censorship resistance, there is a growing case that Ethereum is going to have centralization challenges post-merge. Those challenges could push developers to leave Ethereum and instead look for something comparable. Since Ethereum Classic is actually the original chain, ETC might offer some familiarity for displaced developers and miners. While I don’t personally hold ETC or ETCG, if we return to a risk-on environment in the broad market, I think there are worse bets to make than taking a flier on ETCG.

Be the first to comment