jetcityimage

Surging U.S. inflation has been detrimental to most assets since the start of the year. The Series I Savings Bond has been an exception.

I bonds are a U.S. savings bond issued through TreasuryDirect.gov. The bonds earn taxable interest for 30 years with a composite yield that includes a fixed rate and an inflation indexed rate that is adjusted semiannually. These bonds offer the same risk protections as U.S. Treasuries.

The current rate on new issuance I bonds is 9.62% and is effective until October 31, 2022. That yield is attractive to me and with inflation cooling down I’m buying my I bonds now before the rate declines significantly.

Fixed Rate

The first component of the I bond composite rate is the fixed rate that is good for the life of the bond. These fixed rates have been very low for the last two decades. Since 2020 I bonds have offered 0% fixed rates, meaning that the composite rate is entirely contingent on inflation for yield.

I expect that since yields across the entire curve have been rising this year that there is a chance that the fixed rate could rise above 0% in November at the next semiannual adjustment. If so, I would imagine that the fixed rate would be 0.3% or less, which is minuscule compared to the yields offered by Treasury Bills or Bonds.

This table of previous fixed rates is from the TreasuryDirect website:

| Date the fixed rate was set | Fixed rate for bonds issued in the six months after that date |

|---|---|

| May 1, 2022 | 0.00% |

| November 1, 2021 | 0.00% |

| May 1, 2021 | 0.00% |

| November 1, 2020 | 0.00% |

| May 1, 2020 | 0.00% |

| November 1, 2019 | 0.20% |

| May 1, 2019 | 0.50% |

| November 1, 2018 | 0.50% |

| May 1, 2018 | 0.30% |

| November 1, 2017 | 0.10% |

| May 1, 2017 | 0.00% |

| November 1, 2016 | 0.00% |

| May 1, 2016 | 0.10% |

| November 1, 2015 | 0.10% |

| May 1, 2015 | 0.00% |

| November 1, 2014 | 0.00% |

| May 1, 2014 | 0.10% |

| November 1, 2013 | 0.20% |

| May 1, 2013 | 0.00% |

| November 1, 2012 | 0.00% |

| May 1, 2012 | 0.00% |

| November 1, 2011 | 0.00% |

| May 1, 2011 | 0.00% |

| November 1, 2010 | 0.00% |

| May 1, 2010 | 0.20% |

| November 1, 2009 | 0.30% |

| May 1, 2009 | 0.10% |

| November 1, 2008 | 0.70% |

| May 1, 2008 | 0.00% |

| November 1, 2007 | 1.20% |

| May 1, 2007 | 1.30% |

| November 1, 2006 | 1.40% |

| May 1, 2006 | 1.40% |

| November 1, 2005 | 1.00% |

| May 1, 2005 | 1.20% |

| November 1, 2004 | 1.00% |

Inflation Adjusted Rate

Because the fixed rate component is so minor, the inflation rate component is exclusively responsible for the attractiveness of the bond. The inflation rate component is determined every six months in May and November and is set by annualizing the change in the non-seasonally adjusted Consumer Price Index for all Urban Consumers (CPI-U) for all items over the past six-month period.

The current inflation for the previous six-month period is 4.81%. Therefore, the current I bonds rate is 9.62% which is the annualized inflation rate (4.81% x 2) plus the fixed rate (0%). The advantage is that this rate is effective for the next six months of any newly issued bond between now and October 31, 2022. So if the new inflation adjusted rate released in November is lower than 4.81%, I bonds issued today will keep this rate until March.

The advantage of I bonds over TIPS is that I bonds do not ever yield less than zero. If inflation falls below zero the bond will yield nothing for the inflation rate component but the bond’s redemption value will not decline.

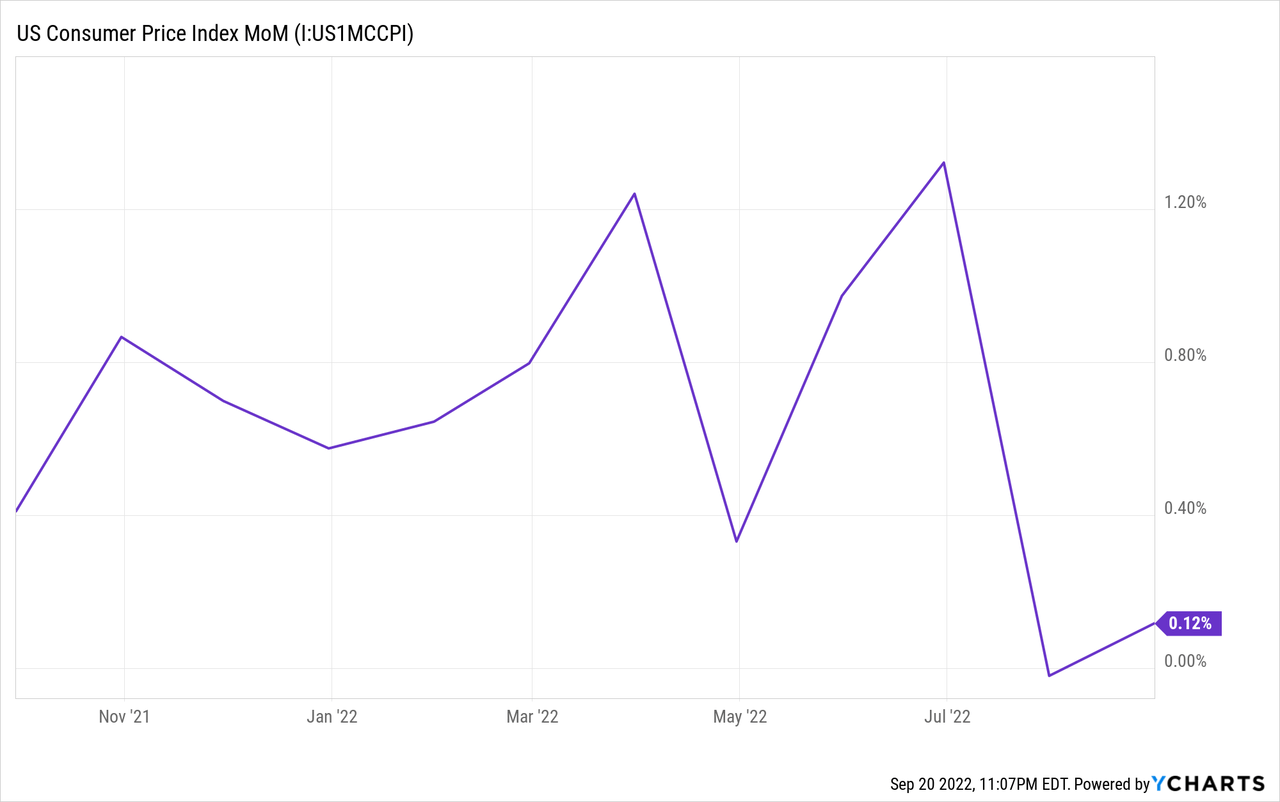

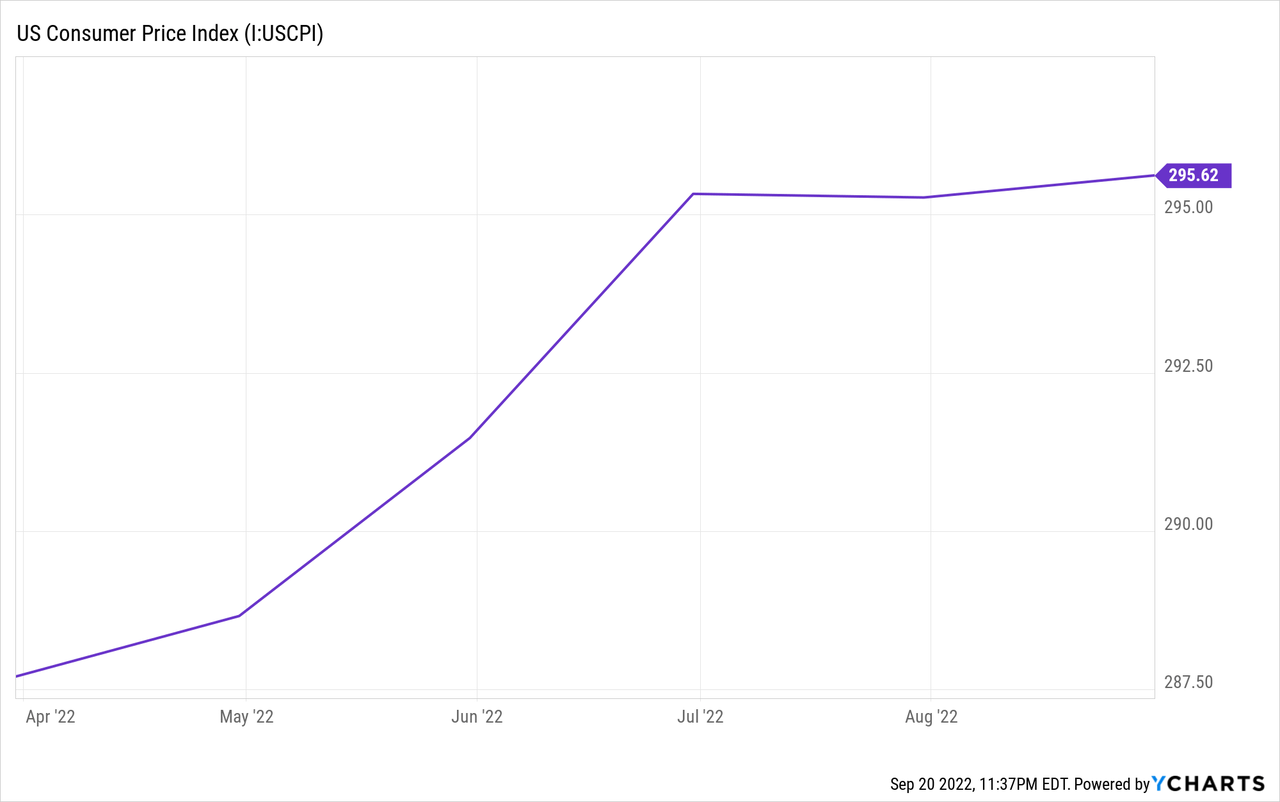

This rate structure offers investors a unique opportunity when inflation is falling because the yield of I bonds lag by as much as 6 months resulting in positive real yields. This is exactly what I think is going to happen. The chart below shows the MoM CPI change for the past 12 months followed by a chart of the CPI over the last 6 months.

After June, the CPI has averaged an annualized rate of 0.6%. Additionally, since the last I bond inflation rate adjustment, the CPI has only gained 3.01%. We will know what the inflation rate component for November will be when the September CPI data is released but there is a significant probability that September MoM inflation will be at or near 0.0%. This means that the I bond composite rate could fall from 9.62% to 6% for new issuance after October 31.

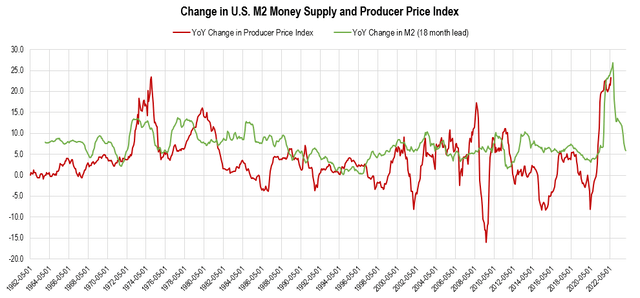

The reason I expect inflation to continue to flatten is because the growth of M2 money stock has preceded this decline in inflation by 18 months and forecasts lower inflation next year. Below is a chart of M2 growth and the Producer Price Index which tracks the CPI but I think the PPI is a more accurate gauge of price inflation. In addition to lower money stock, energy prices continue to decline which is significantly impacting CPI growth.

Chart by author (data from Federal Reserve Economic Data | FRED | St. Louis Fed)

Bond Redemption

Despite the rate for the next six-month period decreasing by 30-40% I bonds still make sense for this issuance. If I’m wrong and inflation begins to rise again, I bond holders can expect higher yields in 12 months from now. If not, I plan to redeem my I bonds after 12 months because disinflation or deflation will likely decrease I bond interest below the rate of Treasury Bonds by then.

I bonds cannot be redeemed before 12 months. After 12 months there is a redemption penalty until the bond reaches 5 years old. The penalty is a forfeiture of the last three months of interest. I expect that this will pencil out for me when the time comes. Below is a table that breaks down the expected yield at 1 year redemption, including the forfeited interest, based on what the November composite rate is:

| November 2022 rate | 6.0% | 6.1% | 6.2% | 6.3% | 6.4% | 6.5% | 6.6% |

| Effective yield at 1 year redemption | 6.3% | 6.3% | 6.4% | 6.4% | 6.4% | 6.4% | 6.5% |

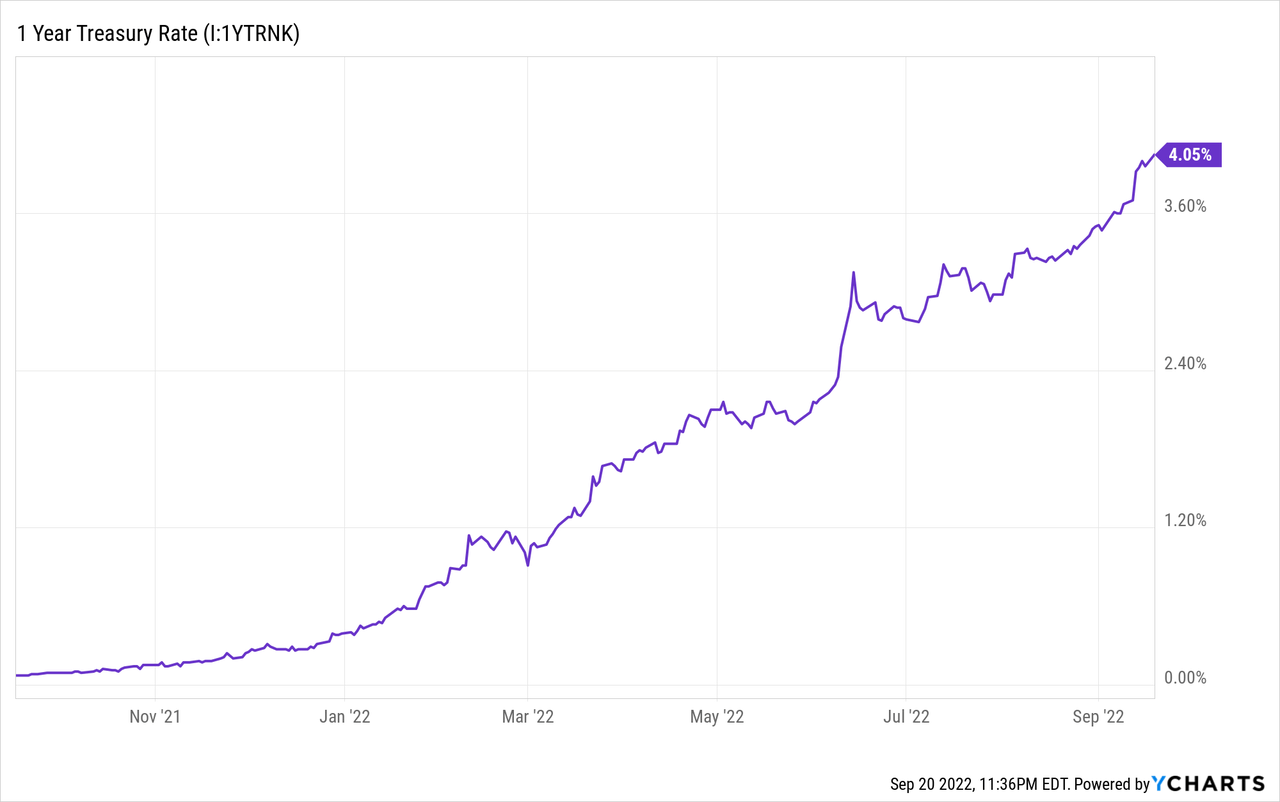

Based on this information I am expecting a realized yield of 6.3-6.4% after the first 12 months with the penalty included. This rate is better than the 1-year Treasury rate which is 4.05% and it comes with inflation protection and no interest rate risk.

Summary

I bonds are an excellent asset to keep up with CPI. Because I don’t think the CPI is an accurate measure of inflation, I do not prefer instruments that are CPI linked. Nonetheless, the structure of I bonds make them attractive in particular environments of disinflation which I expect to occur going forward.

Buying the current issuance of I bonds makes sense, even with an early redemption penalty. However, it won’t make sense with the November issuance because I bonds will barely yield more than the 1 Year Treasury Bond based on my inflation expectations. Therefore, I’m buying my I bonds now before “last call!”

Be the first to comment