RiverNorthPhotography/iStock Unreleased via Getty Images

Introduction

For investors looking for a high but reliable dividend, with the prospect of single-digit growth going forward, this stock may be for them.

Despite continuing to post decent growth, the share price of Verizon (NYSE:VZ) has collapsed in recent months to a new 6-year low of $40.55.

Verizon is a major American telecommunications company, currently being the second largest in the country just behind AT&T (T). The company currently has 240,000+ employees with operations spanning across thousands of cities.

It’s an already large company in a competitive industry, notorious for its large investment needs, but also known for its high dividend payments. While it may not be what every investor is looking for, it should catch the interest of dividend yield-seeking investors.

Fundamentals

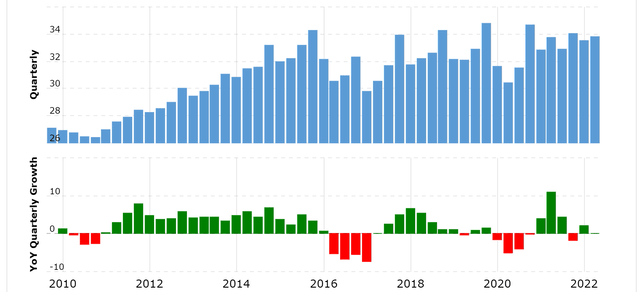

Unfortunately, Verizon’s revenues has been stagnant for the past 6 years, which is a bit worrying to see. It is not uncommon for such companies in the telecommunications industry to have slow growth, but it is definitely something to be aware of.

The stagnant revenue puts extra pressure on the importance of margins being expandable, as in this case it is the only source of growth.

However, management guided towards low single-digit growth going forward, when they held their investor presentation earlier this year.

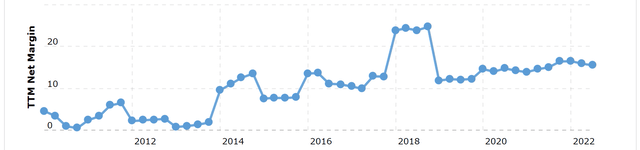

As seen in the image below, the net profit margin has expanded continuously since it bought Vodafone’s 45% stake for $130 billion back in 2014. These annual margin expansions have been the main source of net income growth, but we have to wonder for how long this can be sustained.

Net profit margin (Macrotrends.com)

It has nevertheless produced an impressive amount of net income. The cash has mainly been paid out as dividends, while the rest is reinvested back into the company.

The net income easily covers the dividend with a manageable payout ratio of ~50%. Given its current valuation, this results in a yield of 6.33%.

Capital allocation

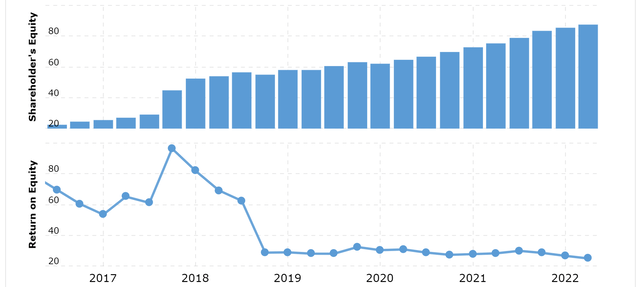

Since the acquisition of the remaining interest of Verizon Wireless in 2014, the management of the company has been fairly good at capital allocation. The company has had a return on equity of 20%+, which is great, when you consider that equity is still growing. Although still above 20% today, it has been declining in recent years, showing signs that the rate is unsustainable.

Although their return on equity has been slightly decreasing, it has still been above 20%. Since the company has paid out ~50% of earnings and no meaningful share buybacks have been made, the remaining 50% has been reinvested. This money has been invested at a return of ~22%, increasing the company’s book value per share by ~11% per year.

Should the company adopt a strategy of share buybacks instead of reinvesting earnings due to lower reinvestment returns, then that would also be sufficient, as the buybacks would yield ~6.3%. The expected annual returns will therefore still be in the double digits.

Equity & ROE (Macrotrends.com)

Valuation

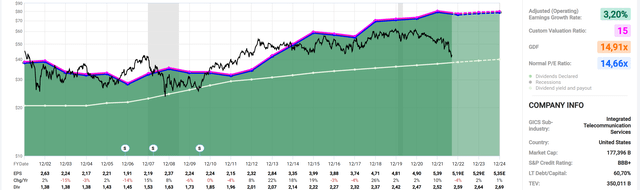

Given the consistent growth you might expect the stock to be valued close to a standard multiple of 15. This would most likely have been true, if it weren’t for the debt that the company has.

The market started assigning a lower multiple after 2014, following the 45% Verizon Wireless purchase. Before the acquisition, when the company was not so leveraged, the average multiple was ~15.4. The average multiple in the last 2 decades has been 14.66.

Verizon as of their most recent quarter carries $175b in debt with only $1.8b in cash, cash equivalents and short term investments. The net debt of $173.8b is a big liability for equity investors and affects the value of the company.

To avoid paying too much for the business, I suggest you add the net debt to the market value. The new $344b company now has an adjusted operating earnings multiple of ~15.5, which still seems attractive.

Earnings per share with multiples (fastgraphs.com)

Stock chart

Quick disclaimer: A technical analysis by itself is not a good enough reason to buy a stock, but combined with the fundamentals of the company, it can greatly narrow your price target range when buying.

Although Verizon’s stock chart is a bit messy due to a decline in earnings per share from 2002-2012, it still shows decent areas of support. I would have assumed that prices below the 50-month moving average would be decent accumulation areas, with the ideal buying area being near the 200-month moving average.

Given that the company now appears to be growing fairly consistently, and is expected to continue to do so in the future as well, and that it has a history of finding support near the 200-month moving average, its current price does appear very tempting.

Final thoughts

Even with low growth, a bloated balance sheet and a declining ROE, Verizon still appears attractive. While it’s certainly not a stock for everyone, it might just be what dividend investors are looking for. The dividend is secure and in no danger.

The company is reinvesting at a rate of ~11%, which seems very attractive, but whether the rate can stabilize remains to be seen. At worst, management instead adopts a strategy of dividend payments + share buybacks, which would currently yield ~12.7% in total. Otherwise, returns of high single digits + the dividend should be doable.

A return to its average multiple of 14.66 would result in capital gains of 75%. While that sounds good, and may not seem unreasonable given the historical average, it’s not something I would expect to happen. To avoid paying too much, I would include the debt when calculating the earnings multiple, which still gives it a fair ~15 multiple.

The dividend payments being done at such a low P/E, combined with the capital reinvestment rate, should make Verizon a fine purchase, even with the debt in mind.

I am therefore giving it a “buy” rating.

Be the first to comment