necati bahadir bermek

The Economy is Paving the Way for a Solid Increase in the Demand for Gold as a Safe Haven to Shelter from Implied Strong Headwinds

The following are the key economic conditions that are increasingly shaping extremely volatile markets that pose a risk to the assets of investors seeking protection in gold as safe-haven assets.

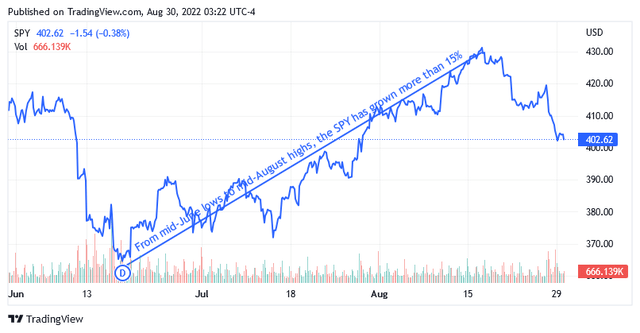

Between mid-June lows and mid-August highs, US-listed equities rose more than 15% on average, leading many market participants to believe that the bottom had already been reached.

Investors found the US economy much less uncertain and were suddenly able to take greater risks and confidently returned to US-listed equities. But it didn’t take long for them to realize they had made a mistake in their assessment, playing recklessly with the factors fueling central bank fears of high inflation, such as global macroeconomic uncertainty and geopolitical tensions between countries, including the aftermath of the war in Ukraine.

The US and European Central Banks Continue to Signal Downside Risk for the Economy

The market certainly had a very original interpretation of the interest rate maneuver, while the US Federal Reserve has always indicated that the economy is headed for recession, which means that consumption [70% of US GDP] must be cut in order to slow down runaway inflation.

And last Friday, in Jackson Hole, Federal Reserve Chairman Jerome Powell reaffirmed the appropriateness of continuing monetary policy with drastic interest rate hikes. Jerome Powell said that even if the consequence of the hawkish stance is that the economy grows below the long-term trend, that risk must be taken as it is necessary to ensure price stability. The latter is fundamental to the economy itself and, along with maximum employment, is the dual objective of the Federal Reserve’s mandate.

Since then, the markets have embarked on a sharp downward movement. The S&P 500 (^GSPC) was down 4%, the NASDAQ Composite (^IXIC) was down 5%, while the Dow Jones Industrial Average (^DJI) was down 3.6% at the close of regular trading on Monday. As the economy heads into recession on historic inflation, the 10-year US Treasury yield rose sharply for the first time in 2 months, topping 3% on Monday. As the future is seen as riskier than it was just a few days ago, the market is unwilling to extend the maturity of loans, which must also be more expensive to offset the risk of default.

In line with the US Federal Reserve, European Central Bank [ECB] Executive Committee members François Villeroy de Galhau and Isabel Schnabel last Friday expected strong interest rate action from September, which will be necessary to keep inflation under control, although it may lead to a recession.

Why Investing in Gold and its Denominated Assets

As uncertainty appears to be increasing as central banks become more determined to fight inflation, the short-term outlook for gold prices promises to be very benign. The precious metal is a strong safe haven for investors against the headwinds of uncertainty.

So if the demand for safe-haven gold rises, the price should adjust to levels above the current $1,737.30 an ounce of gold futures expiring in December 2022, pushing up all gold-backed securities, including publicly traded gold miners.

Because gold stocks typically rise faster than the precious metal itself during a bull market, highly volatile shares could literally skyrocket in the coming weeks.

The Significant Upside Potential of High-Volatility Jaguar Mining Inc. Shares Could Deliver Amazing Return as Gold Moves Up

One gold mining company that appears to have this feature is Jaguar Mining Inc. (OTCQX:JAGGF) (TSX:JAG:CA), a Canadian operator based in Toronto but with mining operations in the Brazilian state of Minas Gerais.

Jaguar Mining Inc. is a junior gold mining company currently operating gold mining properties in a fertile greenstone belt in the state of Minas Gerais, namely the Turmalina Gold Mine Complex and Caeté Mining Complex.

The Canadian mining company owns two other complexes in the Minas Gerais, but these assets have required care and maintenance for several years.

Jaguar Mining’s shares trade on the US over-the-counter market with the symbol (OTCQX:JAGGF) and on the Toronto Stock Exchange with the symbol (JAG:CA).

In both markets, Jaguar Mining Inc. shares have a monthly beta of 1.29 over the past 5-year period, indicating significantly higher volatility than the market as Jaguar Mining tends to outperform any market rally [downturn].

At this point, it seems more than likely that this direct proportionality relationship between Jaguar Mining and the stock market is on track to change its sign as a logical consequence of the mentioned economic developments.

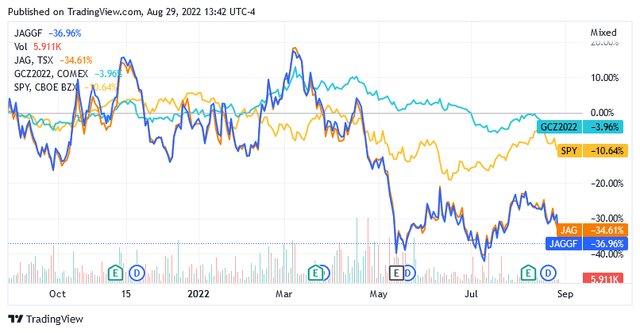

The chart below shows that Jaguar mining, gold futures [the gold price benchmark] and the SPDR S&P 500 Trust ETF (SPY), the market benchmark, have all fallen over the past 12 months.

The answer to the question “Is the fate of Jaguar Mining’s stock price more dependent on gold or the market?” is critical to the success of investing in Jaguar Mining shares. A naked eye comparison between the curves suggests that Jaguar Mining’s stock is more affected by the impact of the change in the gold price than the change in the market price and that the beta gold is likely to be larger than the beta market.

With the economic recession leading to a bearish stance in equity markets due to greater risk aversion to US-listed stocks, Jaguar Mining has the potential to rise in a very short time as it tracks the rising price of gold.

But it won’t be thanks solely to the strong momentum in gold prices that Jaguar Mining’s stock could rise in the coming weeks.

Interesting Trends in the Operations Fuel Optimism that this Company Could Benefit Impressively from a Rise in the Yellow Metal’s Price.

Commenting on Jaguar Mining’s second quarter 2022 results, Vern Baker, the President and Chief Executive Officer, said miners are back on track with the company’s goals of generating critical cash flow after a difficult first quarter.

The second quarter of 2022 delivered what management had hoped for the company’s gold assets, as the project’s economic viability was kept above average despite higher operating costs to increase throughput and fill the market with as many ounces of gold as possible.

|

Items |

Q1 2021 |

Q2 2021 |

Q3 2021 |

Q4 2021 |

Q1 2022 |

Q2 2022 |

AVERAGES |

|

Gold production [ounces] |

18,160 |

20,212 |

22,603 |

22,903 |

16,663 |

22,028 |

»20,428 |

|

Cash operating costs per ounce sold |

$835 |

$858 |

$833 |

$802 |

$1,188 |

$1,029 |

»$924 |

|

All-in sustaining costs per ounce sold |

$1,296 |

$1,281 |

$1,184 |

$1,127 |

$1,680 |

$1,366 |

»$1,322 |

|

Free cash flow per ounce sold |

$11 |

$285 |

$423 |

$348 |

$161 |

$270 |

»$250 |

|

Average realized gold price [per ounce] |

$1,793 |

$1,795 |

$1,753 |

$1,819 |

$1,855 |

$1,852 |

»$1,811 |

As per the table above, costs were higher than the average for the last 6 quarters, but the operation was able to generate higher free cash flow, rewarding the efforts of miners to increase throughput. And the workers are making good progress on that front, as material processed at the mill increased 6.5% year on year to 228,000 tons in the second quarter of 2022, with a steady 87% recovery rate and a 3% improvement in gold concentration to 3.45 grams of the metal per ton of ore.

Inflationary pressures continued to weigh on business as in previous quarters, while a stronger Brazilian real against the US dollar translated into higher costs in USD, as well as higher revenues. While inflationary pressures may ease after monetary tightening and hopefully the end of the war in Ukraine [the main trigger for high energy bills], a stronger Brazilian currency impacts either negative or positive components of the company’s financials.

So the assets were efficient and the price of gold played a big part in producing the result. At the time of writing, gold is trading at $1,737.30, and assuming it moves above $1,850 an ounce and stays that way through the rest of 2022, Jaguar Mining will be poised to capitalize on gold momentum with higher production and lower costs.

Looking forward to the second half of 2022, the company is targeting production of approximately 45,000 ounces, say 22,500 ounces per quarter [or 10% above the average for the last 6 quarters] with an AISC of $1,325 per ounce [in line with the average].

Solid Balance Sheet to Support the Development of the Mines

In the second quarter of 2022, total cash of $30.5 million was about five times total debt of nearly $6 million.

Jaguar Mining’s interest coverage for the 12 months ended June 2022 was 30.58, indicating that the company’s financial position is strong to support the development of mineral activities as follows.

It is calculated by dividing Jaguar Mining’s operating income for the 12 months ended June 2022, which was $36.7 million, by Jaguar Mining’s interest expense for the 12 months ended June 2022, which was $1.2 million.

The Turmalina mining complex, about 80 miles northwest of the town of Belo Horizonte, is developing a corridor and laying a system of horizontal headers to connect drill/blast and ore mines to the overhead portal. The system is provided with an aeration circuit.

At the Pilar mine, which belongs to the Caeté mine complex, about 50 kilometers east of the town of Belo Horizonte, miners are targeting the mine’s southwestern zone in search of additional mineral resources.

Share Price: Low with Significant Potential to Come Back Strong

The stock price has fallen nearly 36% over the past year and is now trading at $2.24 per share on the US over-the-counter market with the symbol JAGGF and CA$3.30 per share on the Toronto Stock Exchange with the symbol JAG:CA.

JAGGF has a market cap of $167.61 million, a forward price-earnings ratio of 14.17 and a 52-week range of $1.96 to $4.41. JAG:CA has a market cap of CA$218.53 million, a forward price-earnings ratio of 13.39 and a 52-week range of CA$2.54 to CA$5.61.

The stock trades below the middle point of the 52-week range in both cases, and stands below the long-term trend of the 200-day moving average values of $3.0477 and of CA$3.8813.

The stock price doesn’t look high compared to recent levels, in addition to the existence of a good chance that it is well below where it could be in a couple of weeks.

Country Risk

Brazil has a friendly environment for foreign operators engaged in mining activities, so the country has low investment risk. The only factor to consider is the meteorological factor that can seriously affect mining activities in the first quarter of the year. Flooding due to inclement weather is not uncommon, particularly in the southeastern state of Minas Gerais. Last January, floods in Minas Gerais forced thousands of people to flee, prompting authorities to place 374 cities under a state of emergency while more than 30,000 people were displaced. There were also several victims.

Conclusion: The Stock is Poised for a Strong Comeback, Supported by Higher Gold Prices and Improved Operations

Macro factors should make gold trading look better going forward as the high level of uncertainty surrounding recession risk is causing investors to flock to the yellow metal as a safe-haven asset.

Among gold miners, Jaguar Mining is well positioned to benefit from rising gold prices with higher production and steady costs.

Be the first to comment