JHVEPhoto/iStock Editorial via Getty Images

Bank of Montreal (NYSE:BMO) missed analysts’ estimates for third quarter earnings as revenue slumped on slowing capital markets activity. BMO Financial Group reported net revenue of C$5.68 billion (~$4.34 billion), significantly lower than the C$6.87 billion (~$5.25 billion) figure expected by analysts. Meanwhile, adjusted earnings per share was C$3.09 (~$2.36) in Q3, against the consensus forecast of C$3.04 (~$2.32).

Bank of Montreal Q3 Earnings Results

Third quarter results were a mixed bag for Canada’s other “Big 5” banks last week. Although TD Bank (TD) and Canadian Imperial Bank of Commerce (CM) delivered better than expected results, Royal Bank of Canada (RY) and Scotiabank (BNS) also missed analysts’ expectations on lower capital markets revenues.

Amid market turmoil and a dearth of new debt and equity issuances during the quarter, reported earnings at BMO’s investment bank dropped sharply, by 53% to C$262 million (~$200 million). This was a bigger decline than most of its peers, except for RBC, which saw earnings in its capital markets division drop by 58% in the same quarter.

BMO’s wealth management business fared better, following underlying revenue growth of 3% in Q3 2022. However, net income fell by 15% to C$324 million (~$248 million) for the quarter, due to the “impact of weaker global markets and a lower benefit from changes in investments to improve asset liability management.”

Against this weakness, BMO saw continued growth in its personal and commercial banking operations in both Canada and the U.S. The performance was particularly robust in Canadian P&C, with reported net income up 17% to C$965 million (~$738 million). This was driven by higher net interest margins following rate hikes and balance sheet growth due to the growth in loan balances, particularly from business customers.

U.S. P&C’s reported net income rose at a slower rate, by 3% to C$568 million (~$434 million), as the deteriorating economic outlook drove a rise in loan loss provisions. The group’s overall provision charge, as a percentage of average net loans and acceptances ratio, increased to 10 basis points – still a low level, although it compared unfavorably to a provision release of 6 basis points in Q3 2021.

BMO’s Housing Market Exposure

Looking ahead, a housing market correction in Canada is a worry for investors in the banking sector. Home prices in Canada have declined by 3.3% from its peak in April 2022, and could fall by another 20% by the end of 2023, according to analysts from Desjardins.

In its favor, Bank of Montreal has the least exposure to the Canadian residential mortgage market of the “Big 5” banks. Canadian residential mortgages account for less than a quarter of its total loan portfolio – far lower than its peer average.

Additionally, 31% of its residential mortgage portfolio is insured through a credited insurer, such as Canada Mortgage and Housing Corporation (CMHC) or Genworth – a higher proportion than most of its Canadian peers. What’s more, BMO’s average loan to value ratio on uninsured mortgages is lower than its peer average, at just 46%.

The state of the Canadian economy will likely have a greater impact on the credit outlook than home valuations. Although the collateral value of mortgages will fall in a housing market correction, the overwhelming majority of mortgages in Canada are recourse loans. This allows lenders to go after the borrower’s other assets to recoup the remainder of the debt, should the collateral be insufficient to repay the loan amount.

Importantly, the resilient macroeconomic backdrop should keep unemployment low and sustain wage growth, which in turn, underpin high levels of mortgage affordability and low default rates. Despite the latest downward revisions to its GDP growth forecasts, Canada’s economy is still expected to hold up well. IMF estimates in July show Canada to be the fastest growing G7 country over the next two years, with real GDP growth of 3.4% and 1.8% in 2022 and 2023, respectively.

Rising Interest Rates

Interest rate hikes will likely pass through to its bottom line more quickly than most of its peers, due to its relatively higher near-term sensitivity to interest rate changes on the asset side of its balance sheet.

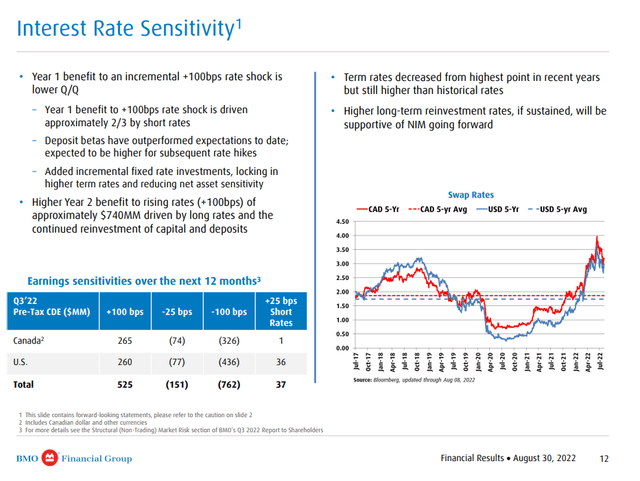

According to the bank’s latest interest rate sensitivity analysis, a 100 basis points increase in interest rates would lift its net interest income by C$525 million (~$401 million) in the first year, with the benefit rising to C$740 million (~$566 million) by the second year.

BMO 2022 Q3 Results Presentation (BMO Investor Relations)

“Net interest income was up 18% and up 22% on an ex trading basis from last year, driven by strong balance growth and margin expansion. Net interest margin ex trading was up 10 basis points from the prior quarter, primarily reflecting higher deposit margins in the P&C businesses.

On a sequential basis, NIM was up six basis points in Canadian P&C and up 20 basis points in US P&C, with wider deposit margins, partially offset by lower loan margins. Looking into the fourth quarter and next year, NIM in both our P&C businesses and at the all bank level is expected to continue to widen, given the rising rate environment.”

Chief Financial Officer Tayfun Tuzun, BMO Q3 Earnings Call

Bank of the West

BMO is in the process of buying Bank of the West, the US retail & commercial banking subsidiary of BNP Paribas (OTCQX:BNPQF, OTCQX:BNPQY), for a consideration of $16.3 billion. The acquisition values Bank of the West at around 1.5 times its tangible book value, with management expecting the deal to boost adjusted earnings per share by over 10% in 2024.

The purchase would put to good use BMO’s excess capital position, which increased significantly when the Canadian regulator restricted capital distributions during the height of the health crisis in 2020. The bank intends to fund the deal primarily from excess capital on its balance sheet, with an equity issuance of just C$2.7 billion ($2.1 billion). As such, it would tackle its lagging profitability, by boosting its return on equity.

BMO currently has a common equity Tier 1 (CET1) ratio of 15.8%, but this is expected to drop to around 11% – a still comfortable level, when the deal is completed.

The purchase of the Bank of the West, which is focused on the Californian market, is seen as highly complementary to BMO’s existing geographical footprint and market capabilities in the U.S. BMO does not plan any branch closures in connection with the transaction, due to the limited geographical overlap between the two businesses. Yet, management expects to eventually generate roughly $670 million in cost synergies from the deal – worth around 35% of the Bank of the West’s non-interest expenses.

Additionally, an expanded footprint and cross-selling opportunities are expected to generate revenue synergy opportunities of between $450-550 million over the next 3 to 5 years, with approximately 60% of that going to its commercial and investment bank and 40% going to its personal and wealth businesses.

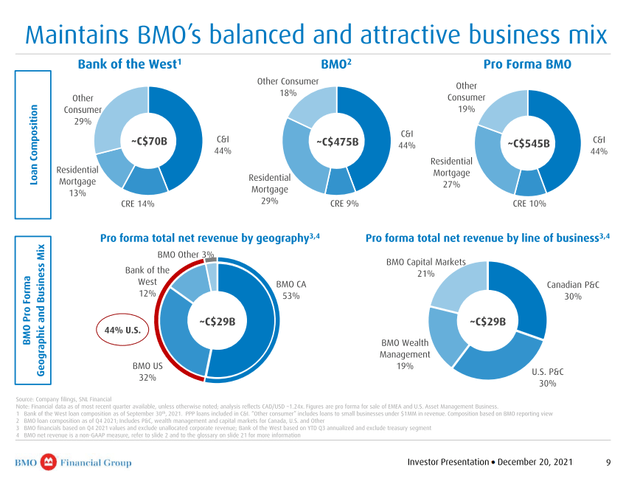

BMO Investor Presentation on the acquisition of Bank of the West (BMO Investor Relations)

The deal will accelerate its expansion in the U.S. market, and catapult the US share of the group’s pre-tax earnings to 44%, with Bank of the West contributing 12% on a pro forma basis. This will give it the largest exposure to the American banking market of the ‘Big 5’ Canadian banks, and further reduce its comparatively low exposure to the Canadian household sector.

Risks

Undoubtedly, there are execution risks to a merger of this scale. Bank mergers are complex procedures, and a lot of time and resources will need to be committed to successfully integrate the two businesses. That said, BMO’s management should have the necessary skills and experience to close the transaction successfully.

The bank has rapidly expanded its presence in the US market through a series of acquisitions, including the purchase of Chicago-based Harris Bank in 1984 and Milwaukee-based Marshall & Ilsley in 2011.

Regulatory uncertainty is another issue though; U.S. Bancorp’s acquisition of MUFG Union Bank has been delayed amid increased scrutiny over systemic risks posed by bank mergers and market consolidation in general. It remains unclear whether there will be any knock-on impact on other mergers in the sector, although BMO remains confident in closing the transaction by the end of the year.

Elsewhere, BMO faces a multibillion dollar claim that its U.S. subsidiary ignored warning signs that former client Tom Petters orchestrated a Ponzi scheme. A bankruptcy trustee is seeking damages of $1.9 billion, plus interest, on grounds that the bank was complicit in the scheme. A jury trial to hear the lawsuit is set to take place on October 7 in Minneapolis.

Final Thoughts

Bank of Montreal’s Q3 earnings was a disappointment, but not necessarily a cause for ongoing concern. Difficult comparables with the previous year were largely to blame and the bank’s relative underperformance appears to be only temporary.

Ultimately, BMO has a business mix that’s well positioned to take advantage of shifting trends in the banking industry. The group has a large presence in investment banking, wealth management, and commercial lending, including in the U.S. market, which should provide some relief against fears of a housing market correction in Canada.

And although the economic outlook has deteriorated in recent months, I remain optimistic on the medium-term earnings outlook due to rising net interest margins, acquisition synergies, and a still resilient macroeconomic backdrop.

Be the first to comment