Tim Boyle

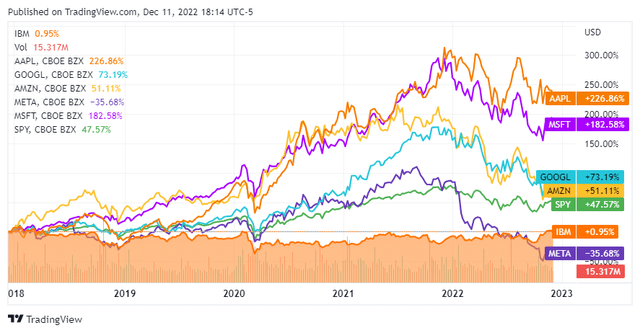

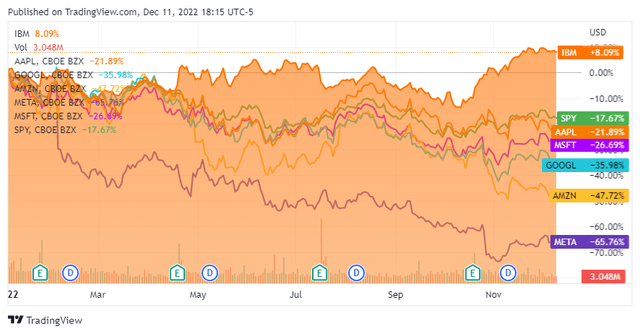

Over the previous 5 years, International Business Machines (NYSE:IBM) has underperformed the overall market in addition to big tech. Over the years, IBM has seen Berkshire Hathaway (BRK.A) exit its position, and investors question IBM’s relevance in cutting-edge technology going forward. With Amazon’s (AMZN) AWS and Microsoft’s (MSFT) Azure dominating the cloud, questions around the $34 billion acquisition of RedHat and IBM’s future continued to put downward pressure on shares. Through it all, IBM remained a cash cow, delivering billions in net income and free cash flow (FCF) annually. IBM had declined so low that the bear market in 2022 didn’t make shares decline further, and IBM was so beaten up that their ability to generate positive FCF started to be rewarded. IBM has appreciated 8.09% YTD, while the S&P has declined by -17.67% and I think a bottom could be forming. This unloved tech company is still relevant even if it’s not a leader in the cloud, produces billions in FCF, and has provided 26 years of annual dividend increases. Since the October lows, IBM has rallied significantly.

Why I think IBM can continue generating billions in profits and substantial growth

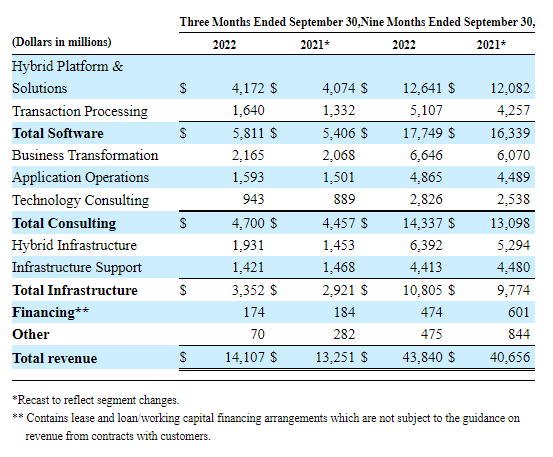

Last November, IBM spun off Kyndryl (KD), which was comprised of IBM’s managed infrastructure services segment of its global technology services segment. Arvind Krishna was IBM’s former Cloud Chief who succeeded Ginni Rometty as CEO in 2020. Mr. Krishna has been laying the groundwork for a digital future as he was a driving force behind the RedHat acquisition to serve as the foundation of IBM’s hybrid cloud and AI business. IBM’s vision is to leverage RedHat open-source software to provide cross-compatible AI-powered hybrid cloud services with AWS, Azure, and other cloud platforms. The plan is coming together as IBM beat Q3 top and bottom line estimates by generating $14.1 billion in revenue and producing $1.81 in EPS. Mr. Krishna stated that IBM expects its 2022 revenue growth to come in above its mid-single-digit model. What was so impressive was that IBM’s Q3 results were led by its software segment, as it generated $5.8 billion, an increase of 7.5% YoY. Over the first 9 months of 2022, IBM’s total revenue is up 8.92% or $3.55 billion YoY in its remaining businesses.

IBM

IBM is sitting on $9.57 billion in cash and short-term investments on its balance sheet, with another $1.6 billion in long-term investments. IBM announced it would acquire Octo, which is a U.S.-based IT modernization and digital transformation services provider exclusively serving the U.S. federal government, including defense, health, and civilian agencies. It’s been a busy 2022 as IBM has acquired 8 companies in 2022 and more than 25 companies since Mr. Krishna started his reign as CEO. On the Q3 conference call, Jim Kavanaugh (IBM’s CFO) stated that IBM expects to generate $10 billion in FCF in 2022, which would be an increase of $3 billion YoY. He also stated that IBM is working to drive capital efficiencies and improve its operating profit profile.

Today’s IBM isn’t the IBM of yesterday, and its digital transformation is succeeding. At some point, I believe the street will have to change its tune as IBM continues to grow its business segments, which are the future of computing, not legacy infrastructure. IBM is utilizing its war chest to acquire companies and accelerate its growth. The Octo acquisition could pay off in spades down the road as it makes IBM more attractive for government contracts. IBM already looks cheap from a valuation methodology, and if it keeps this pace of revenue growth up and optimizes its profit profile, investors could see continued share price appreciation in 2023.

From a valuation standpoint, IBM looks inexpensive

In many cases, the market isn’t rational, as companies appreciate to unthinkable levels while others decline to levels investors would have never anticipated. Putting market and investor sentiment aside, the numbers are the numbers, as $1 of revenue and $1 of free cash flow [FCF] equals $1 of revenue and $1 of FCF regardless of the company’s name or sector it does business in. Every investment is the present value of all future cash flow. Therefore, as an investor, I factor into my investment thesis a company’s FCF valuation. I have discussed FCF for years because I feel one of the most important valuation metrics is the FCF to Market Cap multiple a company trades at. Coincidently, this hasn’t been a widely discussed valuation metric. FCF represents a company’s cash after accounting for cash outflows to support operations. I like to use this metric rather than net income because FCF is a measure of profitability that excludes the non-cash expenses and includes spending on equipment and assets. It’s also a harder number to distort or manipulate due to how companies account for taxes, and other interest expenses. This is also the pool of capital companies utilize to pay back debt, reinvest in the business, pay dividends, buy back shares, and make acquisitions.

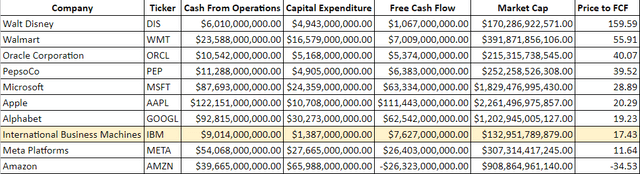

I compared IBM to Apple (AAPL), AMZN, MSFT, Meta Platforms (META), Alphabet (GOOGL), Walt Disney (DIS), Walmart (WMT), Oracle Corporation (ORCL), and PepsiCo (PEP) to see how IBM was valued. I wanted to incorporate companies outside of big tech because IBM is considered an old-world company to some, so I wanted to see how it compared to boring companies such as PEP and WMT also. The results are a bit surprising.

Today, IBM trades at a price to FCF of 17.43x. ORCL, which generates less FCF than IBM, trades at 40.07x its FCF, while MSFT trades at a price to FCF of 28.89x. AAPL and GOOGL trade at slightly larger valuations, 20.29x and 19.23x FCF. PEP trades at a price-to-FCF valuation of 39.52x, and WMT is trading at 55.91x.

Steven Fiorillo, Seeking Alpha

If you were going to acquire a company, would you want to pay a large premium for its FCF or the lowest possible price? Too many investors don’t consider this in their investment thesis. At the end of the day, companies are in the business of turning a profit regardless of the sector they operate in. As an investor, I want to invest in great companies and the lowest valuation possible to increase my chances of generating capital appreciation. IBM is very interesting here. Its market cap is $132.95 billion, and they are generating $7.63 billion in FCF, placing its price to FCF at 17.43x. Why would you pay a 40.07x price to FCF valuation for ORCL when they are generating less FCF than IBM with a higher market cap? Another interesting aspect is that big tech has fallen so much out of favor that companies such as PEP and WMT trade at larger valuations than AAPL and MSFT. When the market rebounds, we could see a significant rotation into big tech due to the disparity of valuations. I think there is a good chance that the shares of IBM have bottomed, considering they are positive in a year where most of tech has seen their shares decline in value. From a valuation standpoint, I think IBM is very attractive, as its price to FCF valuation is one of the lowest across big tech.

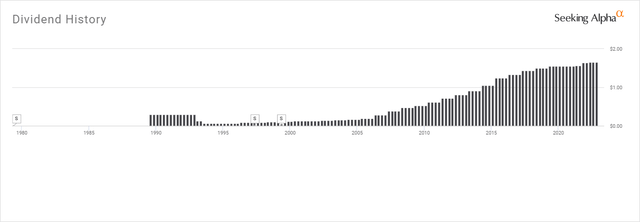

IBM continues to be a dividend powerhouse

IBM is one of 65 companies part of the illustrious Dividend Aristocrat club. IBM also has one of the largest dividend yields in big tech, as its $6.60 annual dividend is a 4.49% yield. IBM has provided investors with a 3.18% 5-year average annual dividend growth rate and has increased its annual dividend for the past 26 years. IBM is expected to deliver $9.04 of EPS in 2022 and grow this number to $9.62 in 2023. There is more than enough room in the current EPS projection to provide future dividend increases, and with the future EPS growth, I would speculate that there are many more annualized dividend increases to come.

There aren’t many companies with large dividend yields in the tech space. IBM offers an above-average yield that investors have been able to rely on. It’s fair to say IBM is a dividend powerhouse considering its track record, yield, and payout ratio. IBM hasn’t been a great investment over the years, but for new investors, IBM trades at an attractive valuation, and they will receive a lucrative dividend while waiting for shares to appreciate. I think IBM is an interesting stock for both income investors, and investors looking for capital appreciation.

Conclusion

I am intrigued by IBM and believe it can be both an income and capital appreciation play. IBM isn’t fading into the night, and it looks as if Mr. Krishna is making all the right moves to advance IBM down a digital path. While it’s unlikely, I wouldn’t be surprised if a larger tech company tried to acquire IBM. The two candidates I think would benefit the most would be GOOGL or ORCL. Acquiring IBM would instantly increase its FCF while advancing its cloud infrastructure offerings. This could also help close the gap between Google Cloud and AWS or Azure. Acquisition or no acquisition, I think IBM is a different company and is undervalued. Today you’re able to get shares for less than 20x its FCF with a 4.49% dividend yield. I am not a shareholder yet, but I plan on starting a position in 2023.

Be the first to comment