IURII BUKHTA

One of the biggest things weighing on the economy in 2022 has been the incredibly high rate of inflation. This inflation has led many people to begin seeking out second jobs simply to pay their escalating food and energy costs. After all, these increasing expenses have basically made all of us start feeling poorer and poorer. This has been devastating to retirees, and most sectors of the S&P 500 index (SPY) have declined precipitously. The cost of living adjustment to Social Security payments was well below the actual level of inflation that most people are dealing with in their daily lives.

Fortunately, there are some ways for investors to generate additional income that does not involve taking on another job or coming out of retirement. One of the best ways is to invest in a closed-end fund (“CEF”) that specializes in the generation of income. These assets have the advantage of professional management as well as the ability to use various strategies that allow them to pay out higher yields than pretty much anything else in the market.

In this article, we will discuss one of the better funds in this category, the Eaton Vance Enhanced Equity Income Fund (NYSE:EOI), which yields 8.33% as of the time of writing. I have discussed this fund before, but more than a year has passed since that time, so obviously a great deal has changed. This article will therefore focus specifically on those changes as well as provide an updated analysis of the fund’s finances in an effort to determine if it still makes sense to add this fund to a portfolio.

About The Fund

According to the fund’s webpage, the Eaton Vance Enhanced Equity Income Fund has the stated objective of providing investors with a high level of current income. The fund states that capital appreciation is secondary to this objective. This is admittedly a bit unusual for an equity closed-end fund, as many of them opt to focus their efforts on providing investors with a high total return since equities are, at their core, a total return instrument. After all, most people that invest in equities do so in order to earn both capital gains and dividend income.

We can assume that this fund likely uses a rather unusual strategy, particularly considering that the current yield on the S&P 500 index is not especially high and has been at very low levels over most of the past decade. This is indeed the case, as this fund basically uses a covered call strategy. In short, the fund purchases common equities and writes call options against them. The hope is that the fund can collect the option premiums and have the options expire worthless so that it can write another option and do the same thing over and over again.

The fact that the fund uses an options strategy might worry some risk-averse investors, since many of us have heard consistently in the media about the risks of options. However, the covered call technique that this fund uses is generally considered to be a safe options strategy. This is because of the way that the strategy works. The fund buys the stock and then it writes a call option against that stock. This ensures that the worst-case scenario is that the fund has to deliver the stock that it already owns to the option buyer. Thus, the strategy will cap the potential gains that the fund can get from a given position, but it will never have to go out and potentially buy the stock at any price should the option be exercised.

This strategy works very well when the market is flat to declining slightly, such as in today’s market. This is because any option that the fund writes is likely to expire out of the money and nobody will ever exercise an out-of-the-money option. Meanwhile, the fund still gets to keep the premium that it received from the sale of the option. Thus, it effectively turns a non-dividend-paying stock into a dividend-paying one or increases the yield of a dividend-paying stock. This is exactly the thing that we like to see from an equity fund that is promising investors to deliver a high level of current income.

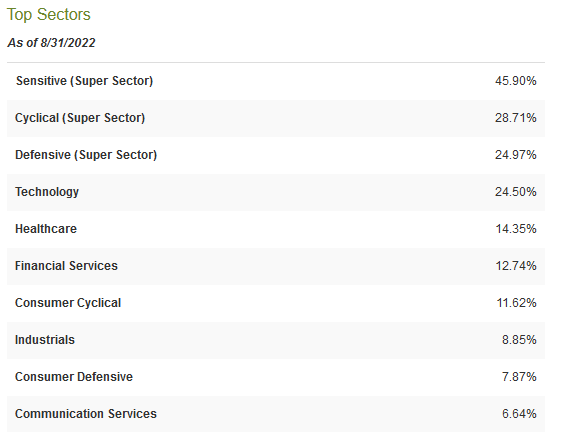

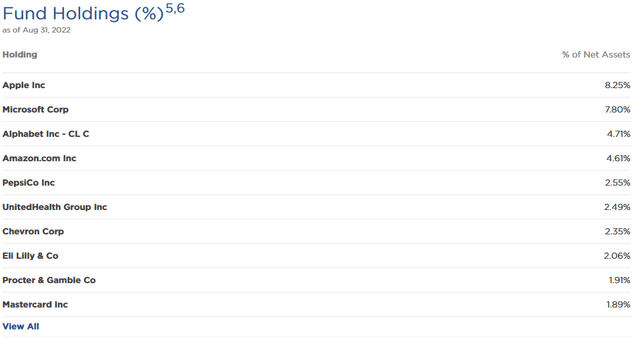

The fund’s portfolio is not exactly what we would normally think of when thinking about an equity-focused income portfolio. Here are the largest positions in the portfolio:

The first thing that I notice here is that the four largest holdings in the portfolio are four of the mega-cap technology stocks. These make no sense to include in an income portfolio. After all, Alphabet (GOOG, GOOGL) and Amazon (AMZN) do not pay a dividend. Although Apple (AAPL) and Microsoft (MSFT) do, their yields are so low that the dividend is basically irrelevant. We would not expect to see these companies in a portfolio focused on income because one could replace these with pretty much any dividend-paying stock and generate substantially more income.

However, the fund’s options strategy does make a bit a difference here, as these stocks tend to experience somewhat higher daily moves than many dividend stocks. This results in higher option premiums than the fund would receive by investing the same amount of money into utilities or other high-yielding stocks. This may offset the lack of any impressive dividends from these positions.

We do see a number of changes to the portfolio since the last time that we looked at the fund. In fact, the only positions that have remained the same over the past year are the four mega-cap technology companies and UnitedHealth Group (UNH). The weightings of these positions have all changed fairly significantly over the time period, but this could be caused by one stock outperforming another in the market. The changes are fairly telling, though, about management’s current outlook on the broader market. These changes were JPMorgan Chase (JPM), Visa (V), Eaton Corp. (ETN), Bank of America (BAC), and Danaher (DHR) being replaced with PepsiCo (PEP), Chevron (CVX), Eli Lilly (LLY), Procter & Gamble (PG), and Mastercard (MA).

Basically then, we see a few financials being replaced with consumer staples, healthcare, and energy. This is exactly what you’d expect to see if management believes that the economy is about to enter into a recession accompanied by a tighter Federal Reserve policy than we saw during the last two recessions. I cannot fault management for this viewpoint, as it is exactly what I am expecting to see in the near term as well.

The heavy weighting to Apple does not make sense in that viewpoint, though, since Apple will likely be hit pretty hard by declines in consumer spending. After all, most consumers will prefer to spend their declining discretionary income on food than the latest iPhone. This is especially true because the higher interest rates have begun to drive down both home values and the stock markets, so people cannot depend on constant increases in these things to buy luxuries either.

The fact that so many of the largest positions in the market have changed over the past year may make us believe that the Eaton Vance Enhanced Equity Income Fund has a relatively high turnover rate. This is something that can be an issue because it costs the fund money to trade stocks at other assets, which get passed through to the fund’s investors. This creates a drag on the fund’s performance that management needs to work hard to overcome.

Although a high turnover rate does not necessarily mean that a fund will underperform the index, it does create a hurdle for management that most funds tend to fail to jump over consistently. This is one of the reasons why index funds have become popular, as their relatively minimal amount of trading results in them having very low expenses. This fund, in fact, only has a 35.00% annual turnover rate, though, which is not particularly high for an equity fund. It is certainly much higher than an index fund, though.

As my long-time readers on the topic of closed-end funds are likely well aware, I do not generally like to see any individual position account for more than 5% of a fund’s portfolio. This is because this is approximately the point at which a position begins to expose the fund to idiosyncratic risk. Idiosyncratic, or company-specific, risk is that risk that any asset possesses that is independent of the market as a whole. This is the risk that we aim to eliminate through diversification but if the asset accounts for too much of the portfolio then this risk will not be completely diversified away.

Thus, the concern is that some event will occur that causes the price of a given asset to decline when the market does not. If the asset accounts for too much of the portfolio then such a situation may result in it dragging the entire fund down with it.

As we can see above, there are two positions that account for more than 5% of the portfolio. These are Apple and Microsoft, although both Alphabet and Amazon are fairly close to this threshold. Any potential investors in the fund should ensure that they are willing to be exposed to the risks of these companies individually before taking a position in the fund.

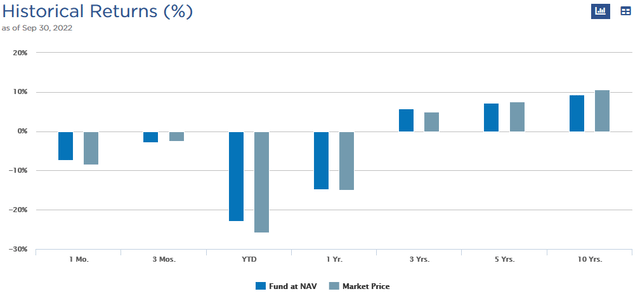

The fund’s heavy weighting to the mega-cap technology names may be one reason why it has underperformed the S&P 500 index year-to-date.

The fund’s net asset value is down 22.85% year-to-date versus 18.90% for the S&P 500 index. One thing that we have seen is that the big technology names are generally substantially underperforming. In fact, only Apple has outperformed the S&P 500 but it is still down 15.74% year-to-date. Microsoft is down 30.27%, Alphabet is down 34.16%, and Amazon is down 40.36% year-to-date. This clearly shows the danger of having such a high weighting to these companies, especially considering that many of them are still dramatically overvalued on quite a few metrics. The energy sector has generally outperformed substantially, but the fund has almost no exposure to that:

CEF Connect

Overall, then, while we did see some signs that management is moving in the right direction with some of the changes that were made to the portfolio over the past year, there is still room for significant improvements. Fortunately, the covered call strategy that the fund uses should allow it to begin to outperform if the technology sector does not experience any more significant trouble. This is because the fund will still collect the premiums from the option sales, which does reduce somewhat its losses when a stock declines. The fund is not as diversified, though, as the S&P index, which caused the problems that we see in its performance year-to-date.

Distribution Analysis

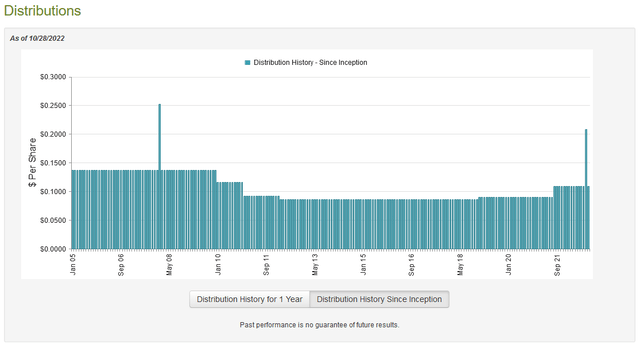

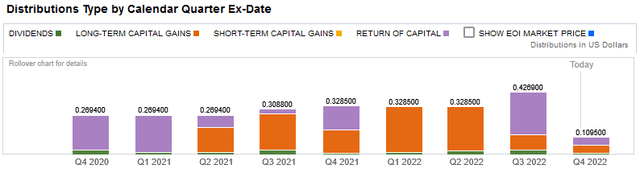

As stated earlier in the article, the primary objective of the Eaton Vance Enhanced Equity Income Fund is to generate a high level of current income for its investors. In addition, the fact that the fund steadily sells covered call options provides it with a significant source of income. As such, we could expect that the fund will boast a fairly high distribution yield. This is indeed the case as the fund pays a monthly distribution of $0.1095 per share ($1.314 per share annually), which gives it an 8.33% yield at the current price. The fund has been remarkably consistent about this distribution over time. In fact, it has not only managed to maintain it for more than ten years but has grown it over the period:

This will undoubtedly appeal to any investor that is seeking a steady and secure source of income with which to pay their bills. However, the fact that some of the fund’s distributions are classified as a return of capital may prove to be a bit of a put-off:

The reason why this may be concerning is that a return of capital distribution can be a sign that the fund is returning the investors’ own money back to them. This is obviously not sustainable over any sort of extended period. However, there are other things that can cause a distribution to be classified as a return of capital for tax purposes. Among the most common of these scenarios is the distribution of unrealized capital gains. In addition, distributing the money that was obtained through the use of certain options strategies can result in the distribution being considered a return of capital. This fund obviously might be doing either of these things, so it is important for us to investigate further and determine exactly how the fund is financing the distributions and how sustainable it is likely to be.

Unfortunately, we do not have a particularly current report to consult for that task. As of the time of writing, the fund’s most recent financial report corresponds to the six-month period ending March 31, 2022. As such, this report will not provide us with any insight into how the fund performed over the past several months. This is very unfortunate, because the past few months were the ones that saw the biggest losses in the stock market. It is still a much newer report than the one that we had available to us the last time that we reviewed the fund, though.

During this six-month period, the Eaton Vance Enhanced Equity Income Fund brought in a total of $5,298,000 in dividends from the assets in its portfolio. It paid its expenses out of this amount, leaving it with $1,264,234 available for investors. This was obviously nowhere close to enough to cover the $26,030,866 that it actually paid out to the shareholders. The fund does have other ways to get the money that it needs to cover the distribution, though, such as through capital gains.

The fund enjoyed some success in this area, as it realized a net gain of $39,004,722 during the period, but this was partially offset by a total of $17,968,447 net unrealized losses. Overall, the fund did fail to generate the money that it needed, as it got a total of $22,300,509 in net investment income plus net capital gains, which was not enough to cover the distributions. The fund did manage to get another $13,857,751 through the sale of its own stock, and overall its assets under management increased by $10,127,394 after accounting for all inflows and outflows.

I will admit that I do not particularly like the fact that the fund only covered its distribution by bringing in new money, as this may not be sustainable over the long term. With that said, it did easily generate enough cash through net investment and realized capital gains to cover it. The distribution is probably okay and reasonably safe, but we will still want to keep an eye on it and ensure that it does not suffer significantly more losses, especially given that huge position in the mega-cap technology stocks that have generally not been performing very well.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund, the most common way to value it is by looking at its net asset value. A fund’s net asset value is the total current market value of all the fund’s assets minus any outstanding debt. It is, therefore, the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund at a price that is less than the net asset value. That is because such a situation implies that we are acquiring the fund’s assets for less than they are actually worth. That is not the case with this fund. As of October 28, 2022 (the most current date for which data is available as of the time of writing), the Eaton Vance Enhanced Equity Income Fund had a net asset value of $15.41, but the shares currently trade for $15.99 per share. That gives it a 3.76% premium to net asset value at the current price. This is substantially more expensive than the 1.81% discount that the shares have traded at on average over the past month.

It rarely makes any sense to buy a closed-end fund at a premium to net asset value, and that is especially true in the case of a fund that typically trades at a discount. It, therefore, would make sense to wait and see if the fund begins trading for a more attractive price in the near future.

Conclusion

In conclusion, investors today need to increase their incomes to maintain their expected standard of living in the current inflationary environment. The Eaton Vance Enhanced Equity Income Fund has an excellent track record of performance in this area that could be added to a portfolio to help accomplish this. Unfortunately, the fund is very heavily weighted to a handful of large technology companies which may be a drag on its performance should the current market conditions continue for the next few months.

It does appear that the 8.33% yield is sustainable for the time being, though. The fund is currently incredibly expensive relative to its historical average, so it may make sense to wait until the price becomes more attractive. Overall though, there are worse funds out there than EOI.

Be the first to comment