JHVEPhoto/iStock Editorial via Getty Images

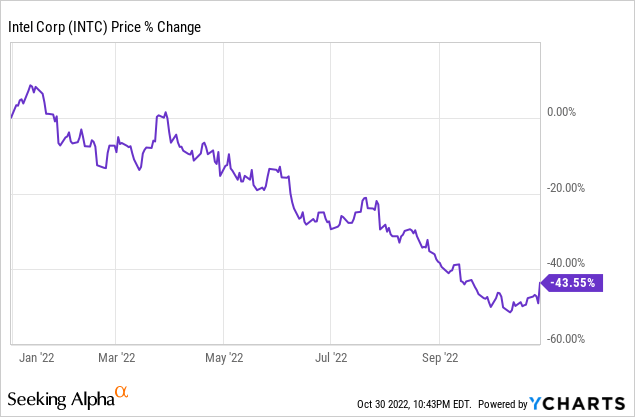

In mid-October, I warned that Intel (NASDAQ:INTC) was at risk of having to lower its guidance for FY 2022 a second time due to a stronger-than-expected deceleration in PC shipments throughout the third quarter. According to consulting firm Gartner, global PC shipments declined almost 20% year over year in the third quarter due to slowing customer demand. Last week, Intel indeed was forced to lower its forecast for FY 2022 a second time and reported a high, double-digit revenue drop for Q3’22. Although shares of Intel soared almost 11% on Friday, I believe the rebound is undeserved and investors are taking a big risk here if they buy Intel’s shares!

Intel reports earnings beat despite plunging revenues

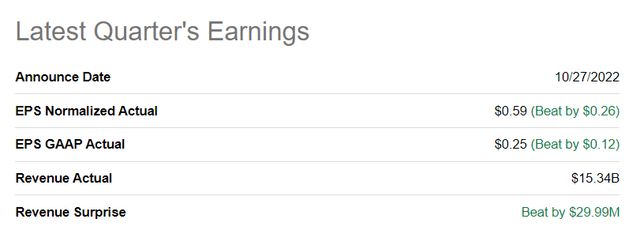

Intel reported $0.59 per share in adjusted earnings for the third quarter compared to a prediction of $0.33 per share. Revenues for the third quarter were $15.34B compared to a prediction of $15.25B, so Intel delivered a beat on both the top and the bottom line.

Seeking Alpha: Intel’s Q3’22 Results

Accelerating decline in PC shipments

As I indicated in my work “Intel: Brace For Impact“, the chipmaker was set to reduce its guidance a second time because of a sharper-than-anticipated decline in the PC market between July and September. All major PC vendors ranging from Apple (AAPL) to Dell (DELL) to Lenovo (with the exception of Asus) have seen double-digit declines in PC shipments in the third quarter, according to preliminary shipment data revealed by consulting firm Gartner. PC shipments declined an estimated 19.5% in Q3’22, showing an acceleration in the decline over Q2’22 which saw a decline of 12.6% year over year.

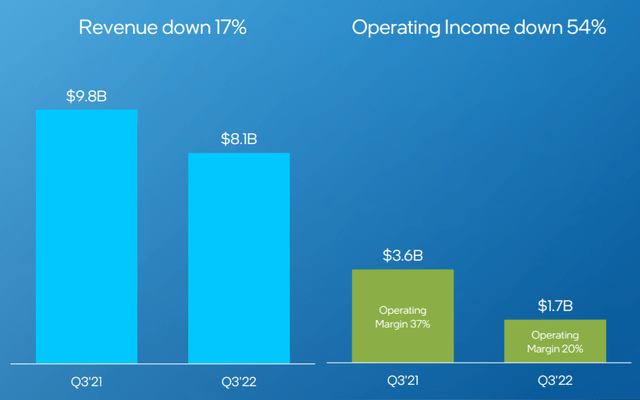

Because of a deteriorating PC market and slowing customer demand, Intel reported a 17% year-over-year drop in revenues in its important Client Computing Group/CCG to $8.1B while the group’s operating income dropped by more than half (54%) year-over-year. In the third quarter, Intel’s CCG revenues accounted for about 53% of total revenues. Intel’s notebook sales were hit especially hard from the downturn in the device market in Q3’22 with product-specific revenues dropping 26% year over year to $4.4B.

Mobileye IPO

Intel has listed Mobileye, which represents its self-driving car technology business, on the stock market last week, which was widely considered to be a big success for the company as shares of Mobileye soared 37% on their first day of trading. The spin-off may allow Intel, which retains a controlling stake in the company, to create a higher valuation for Mobileye and concentrate on the restructuring of its semiconductor business.

New guidance for FY 2022

Intel, expectedly, was forced to lower its full-year guidance a second time last week. In Q2’22, Intel lowered its revenue outlook by $8-11B and its EPS forecast by $1.30 per share. The “old” outlook before Q3’22 earnings called for $65-68B in revenues and $2.30 per share in earnings. The “new” outlook, which considers Intel’s expectations of continued weakness in PC shipments, assumes $63-64B in revenue and $1.95 per-share, meaning top line and EPS guidance have been revised downwards by 5% and 15%.

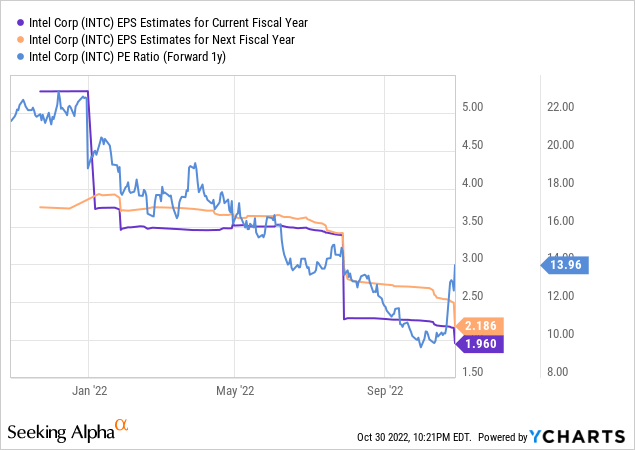

Earnings estimate risks and Intel’s valuation

Intel’s shares currently have a P-E ratio of 14.0 X. However, pressure on Intel’s FY 2023 estimates is likely going to build now that the company downgraded its FY 2022 forecast twice. I believe, given the risks in Intel’s business right now, especially uncertainty about volume shipments, the company’s valuation is still too high. Even before Intel cut its outlook for FY 2022, earnings estimates have already started to drop sharply…

Risks with Intel

The biggest commercial risk for Intel is that the PC market keeps decelerating. Although prospects of a continual decline in the fourth quarter are likely now fully reflected in Intel’s updated outlook for FY 2022, that doesn’t mean things won’t get worse in FY 2023. Heading into the next year, there is a considerable risk that Intel will continue to suffer from weak product demand, especially in PCs and notebooks, which could have a negative pricing and volume effect on Intel’s important Client Computing Group going forward. For this reason, I expect that pressure on Intel’s estimates will continue to grow, which could result in a new down-leg for Intel’s shares.

Final thoughts

A fool and his money are soon parted, largely because Intel’s outlook change was a disaster and the price surge on Friday was totally undeserved. Although shares of Intel have already revalued 44% lower year to date, it is hard to see what could drive a revaluation to the upside, especially after the chipmaker reduced its guidance for the second time in three months. I believe chances are that the PC market will continue to deteriorate in Q4’22, especially because the shipment decline accelerated in the third quarter. Intel’s valuation is not yet attractive enough to entice me to buy, which is why I am waiting for the stock to find a bottom first!

Be the first to comment