bjdlzx

(Note: This article appeared in the newsletter on May 11, 2022 and was updated with current information as needed.)

Occidental Petroleum Corporation (NYSE:OXY) made the Anadarko Petroleum acquisition and then had to endure first an OPEC pricing war followed by the coronavirus demand destruction. The next surprise, the Ukrainian war, finally gave this company what it needed to straighten itself out from the acquisition (and that is strong commodity prices).

This company, like so many others, needs to get “back on track.” This industry is notorious for low visibility. Therefore, the challenges will be to get everything done that needs to be done while commodity prices remain strong. The payback for shareholders could be quite a bit from current prices if management succeeds.

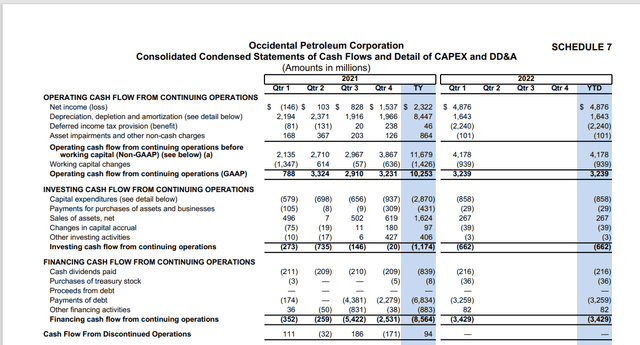

Occidental Petroleum Cash Flow Statement First Quarter 2022. (Occidental Petroleum First Quarter 2022, Earnings Press Release Supplemental Schedules)

The biggest consideration has to be that cash flow before working capital changes took a huge leap past $4 billion in one quarter. The main (if not only significant) reason that working capital changes were negative is the increasing commodity prices made the same sales volumes far more costly. Therefore, accounts receivable would soak up working capital.

Fellow industry competitor ExxonMobil (XOM) has set the stage for earnings expectations by stating that profits are going to take a big jump in the second quarter. Occidental Petroleum is not nearly as diversified. But the upstream operations will report a badly needed great cash flow quarter. It does not take many of those great quarters to make the acquisition look good.

That is not going to be happening every quarter. At some point there will be a cyclical downturn to reverse what just happened. Before that, there should be a point in time where prices level out or reach a slightly lower equilibrium until supplies exceed demand to bring about the next cyclical downturn. That means operating cash flow from continuing operations will increase even if prices do not strengthen anymore. Hopefully this time around, the industry experiences something approaching a normal “good times” that lasts a year or two longer than the last time in 2018.

For a company like Occidental (where management plans got derailed), this is a chance for redemption in the eyes of the market. The market clearly sent the stock to a price level that indicated very little faith in the ability of management to navigate the future. It clearly did not turn out that way, of course. But the market clearly still has its doubts.

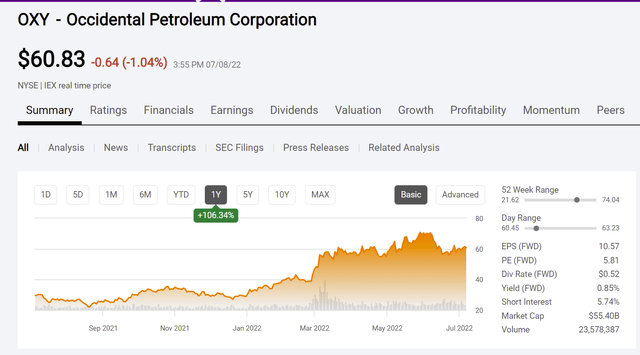

Occidental Petroleum Common Stock Price History And Key Valuation Measures (Seeking Alpha Website July 8, 2022)

This stock is nothing close to the levels achieved before the pandemic. Part of that is due to the unknowns of the pandemic and the effect of delaying the company deleveraging plans. Supposedly, when managements make an acquisition (and plan to deleverage) they include a “cushion” in case the worst happens. However, the market may have feared that fiscal year 2020 was beyond anything management could have planned. That may well be true.

But most managements, including this one, will attempt to fix what they can. The latest pricing environment is a very welcome change from the environment that greeted the acquisition. The risk is that this environment does not last long enough or that very weak prices in the next downturn last too long. Hence the stock price rally may be muted until the market sees lower debt.

On the other hand, management repaid a lot of debt in the first quarter. As a result, management is on track to meet a $20 billion debt goal much sooner than anyone could have imagined 2 years ago. The lower debt allows the dividend restoration to begin far sooner than the market anticipated as well.

Typical Acquisition

Occidental did nothing different than much of the industry.

Cenovus Energy (CVE) acquired the half of the partnership from ConocoPhillips (COP) that it did not own by both using common stock and debt. Management by all accounts fully leveraged the company (probably way more than the stock market wanted because the market proceeded to dump the common).

Even though management had a plan to deleverage the balance sheet and by all accounts executed that plan well, the stock market kept the stock in the doghouse for long past the time after the balance sheet was straightened out.

The market did not care about details like better cash flow from increasing production. Only now after the company acquired additional refining capacity has the market begun to allow the stock out of the doghouse.

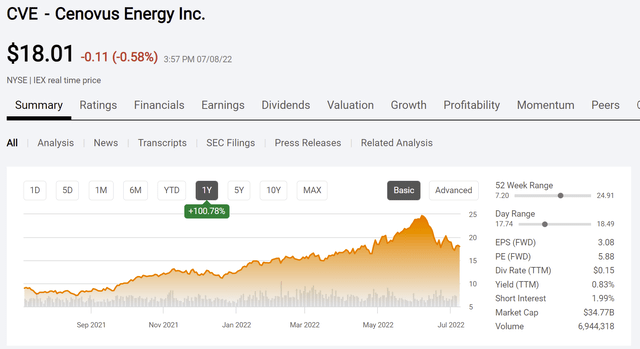

Cenovus Energy Common Stock Price History And Key Valuation Measures (Seeking Alpha Website July 8, 2022.)

Cash flow improved throughout the challenges presented by this industry. But as shown above, the market really has not noticed this stock until relatively recently despite tremendous cash flow improvement since the acquisition.

The point of all of this is that Occidental used a strategy that is actually fairly common throughout the industry. What was not common was the OPEC pricing war followed by the coronavirus demand destruction after that. The sizable cash flow demonstrated by the company is finally showing some demonstration to the market of the benefits of this acquisition.

With Cenovus, the cash flow improvement was far more (as a percentage change) significant. Yet Mr. Market kept the stock in the doghouse for several years as cash flow improved. Occidental will do very well if cash flow doubles at various pricing points from the acquisition.

That means that for Occidental, now is the time to prove to the market that future financial performance per share will exceed the results before the acquisition. It is not unusual for a large acquisition to take a few years to meet the goals of management. The strong commodity sales prices may allow for more cash to be available to speed up the optimization process while repaying debt.

The Future

Clearly Occidental has another quarter of significant debt reduction “in the bag” unless yet another unexpected event happens. After that it is less clear to the market.

On the other hand, the company needs to generate sustained earning power that is superior to the time before the acquisition. This is where a lot of large acquisitions fail to meet management expectations. Therefore, the market doubts about future earnings are reasonable.

Should management meet its goals for the acquisition, then the stock price will likely continue to at least the old highs. Generally, management makes any acquisition to do better in the next business cycle. Whether management has had enough time to optimize operations while assimilating this large acquisition remains an open question to the market.

Warren Buffet keeps buying the stock because the industry is unusually cheap. Price earnings ratios collapsed during the coronavirus demand destruction and really have not yet cyclically recovered. There is a lot of pessimism priced into this history because of what happened in the time period starting in 2015 through 2020.

But this industry is much better prepared for the low visibility than it was back in 2015. The pessimism likely remains overdone because Mr. Market expects the past to continue. Yet the speculative equity and lending money that rushed in (in the past) continues to be absent because of the severe speculative losses that followed. That absence is likely to continue.

At least now, it would appear that this stock has at least a speculative chance to exceed the old high prices of the last cycle. How much more than that depends upon the evaluation of the performance of the acquired properties.

The debt reduction to $20 billion will do a lot to restore the faith of the market in the balance sheet of the company. The next step is probably to get quarterly earnings past $3 per share. Stay tuned to see how well management performs in the future. It appears that the company is now back on track with the original plan.

Be the first to comment