vivalapenler

Investment Thesis

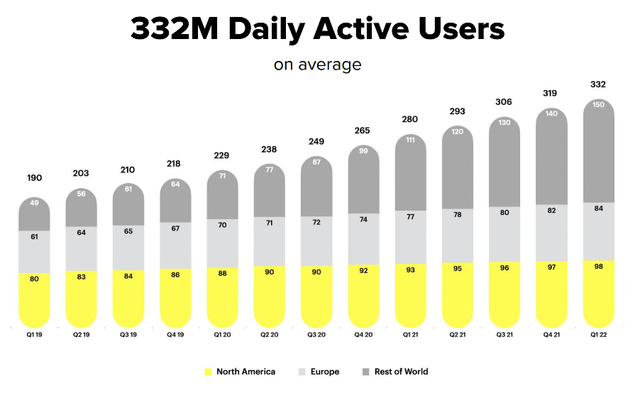

Snap (NYSE:NYSE:SNAP) is a fast-growing social media and communications company with over 330 million daily active users across the globe. It has successfully grown ARPU since its IPO, in part thanks to its ability to integrate augmented reality into advertisements, making them more immersive, engaging, and capable of delivering better results for advertisers.

But does that make Snap a good investment right now? I take it through my framework to find out.

Business Overview

Snap calls itself a camera company; this doesn’t really tell us what the business actually does, but it’s interesting that Snap views itself through that lens. The company’s core mobile app, Snapchat, allows people to chat and send images and short videos to their friends – these are called Snaps.

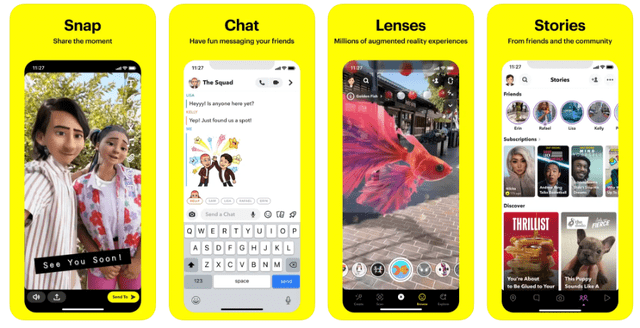

The Snapchat app has expanded continually since its release; it has certainly changed quite a bit from when I used to use it in my teens! The company now has five distinct tabs within the Snapchat app, each offering different communication and content experiences.

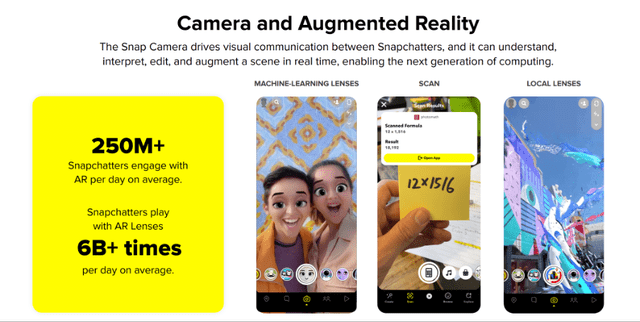

First up is Camera. When a user opens Snapchat, the first thing they will see is the camera (as if you were about to use your smartphone to take a photo), and this can be used to take a Snap and send it to friends. The company offers millions of Lenses as well, created by both Snap and the community, which use AR (augmented reality) among other features to add new dimensions to Snaps.

Snap Q1’22 Investor Presentation

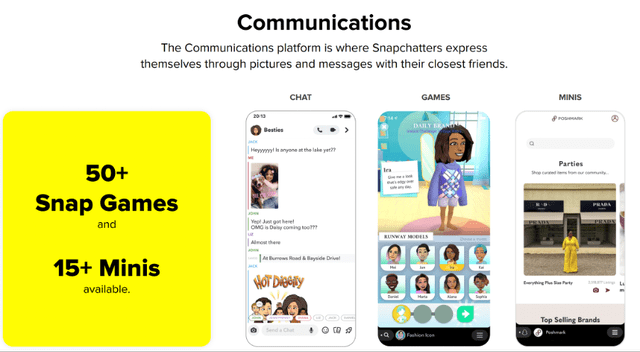

The next tab is Communications. Once a Snap has been taken, it is then sent to friends through Snapchat’s messaging tool. Users can also send written messages, Bitmojis, and even play games through the messaging tool.

Snap Q1’22 Investor Presentation

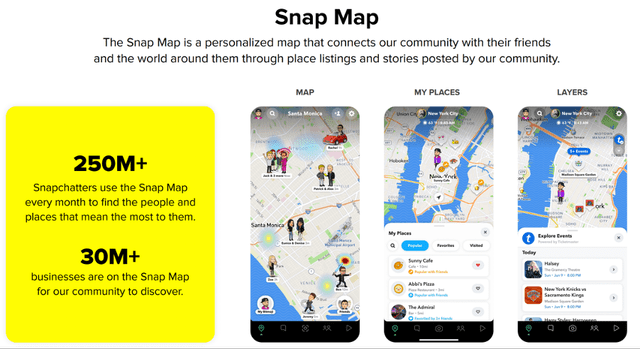

Snap Map is a live map that allows users to explore what’s going on in their local area, or anywhere else in the world. Snapchatters can locate nearby friends who choose to share their location, view a heatmap of recent snaps, and locate local businesses. This also includes Places, which are detailed profiles of businesses with information like Google (GOOG) (GOOGL) Maps, and users can take direct actions from Snap Map such as share a favorite store, order a takeaway, or make a reservation.

Snap Q1’22 Investor Presentation

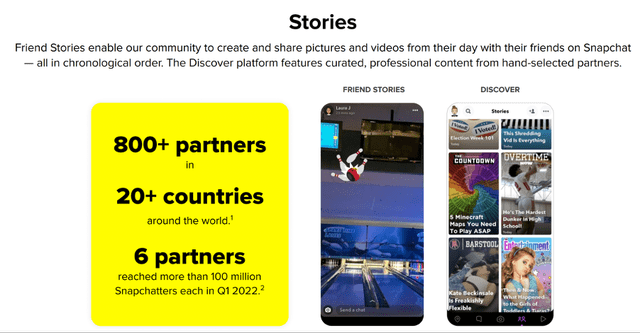

Snapchat also has its own Stories tab. Like most social media platforms, Snaps can be uploaded to stories for all their friends to see. There is also a Discover section, where personalized content is displayed based on a user’s subscriptions and interests from both Snap’s creator community and publisher partners.

Snap Q1’22 Investor Presentation

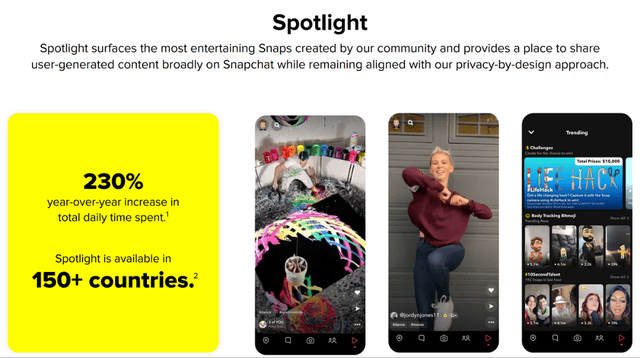

The final tab is Spotlight, which shares user-generated content with the entire Snapchat community – this is very similar to TikTok.

Snap Q1’22 Investor Presentation

Hopefully this gives a good snapshot (2 for 2) of exactly what the Snapchat app has to offer. The company also has a couple of additional offerings, including its partner ecosystem of developers who can integrate their Lenses, Games, and AR experiences into the Snapchat app.

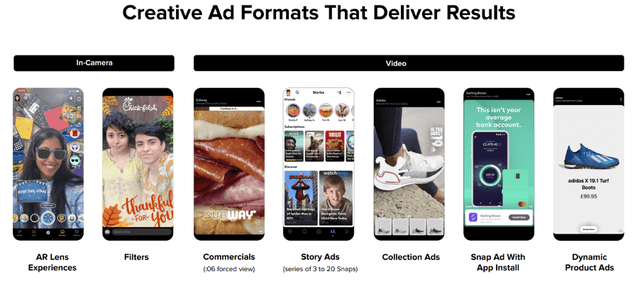

Like the majority of social media platforms, Snap makes most of its money through advertising. It offers a broad range of advertising styles to its partners, such as augmented reality adverts, story ads, non-skippable commercials and more. Snap also provides campaign management and delivery tools to make advertising on Snapchat as easy as possible, and offers first-party and third-party solutions that enable advertisers to measure the effectiveness of their adverts.

Snap Q1’22 Investor Presentation

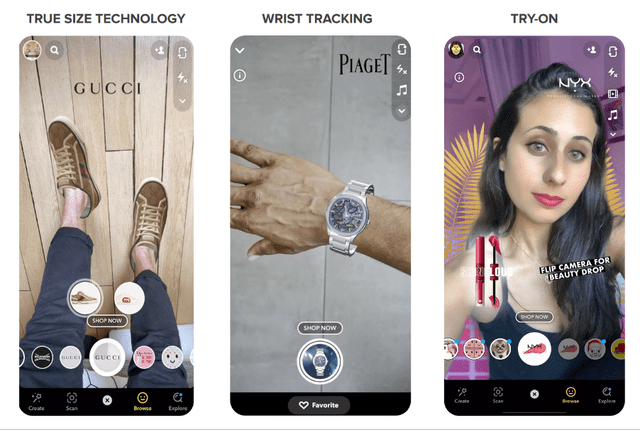

I will highlight the AR possibilities with these adverts. Now, I’ve not used Snapchat for a long time, so I was both surprised and impressed by the progress it has made on augmented reality. As per their Q1’22 Investor Deck, Snap found that over half of the shoppers on Snapchat agree that AR gives them more confidence about product quality. Plus, AR-guided purchases lead to a 25% decrease in returns due to the risk-free try-before-you-buy experience. I find this fascinating, and it could well be the future of advertising.

Snap Q1’22 Investor Presentation

Economic Moats

With every business, I look to see if there are any durable competitive advantages (aka economic moats) that will help the company continue to thrive whilst protecting itself from competition.

The main moat that I see right now for Snap is the network effect, and this is a very common network effect that any communication tools or social media networks benefit from. If I’m on Snapchat, I’ll convince my friends to join so I can communicate with them via Snaps, and they will convince their friends, and so on – it’s a very powerful network effect that can allow companies such as Snap to grow quickly (just look at how TikTok took off).

Snap Q1’22 Investor Presentation

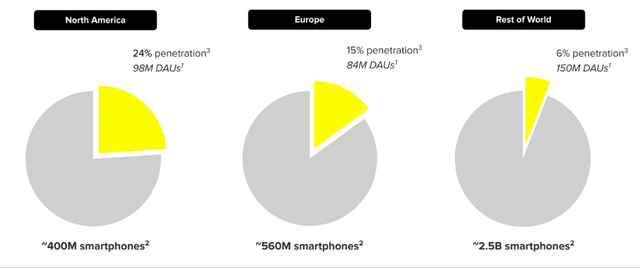

I think this network effect is more impactful in the markets where Snap is expanding, and it’s clear to see the rapid growth in users from the Rest of World segment.

Snap also benefits from network effects through its digital advertising. More users lead to more data, and this enables Snap to make better decisions when targeting adverts, meaning that more advertisers will benefit from using Snap, and so Snap will see higher demand from advertisers, which will lead to more ads and more data, which will lead to better targeted adverts – again, a classic network effect!

I would also give Snap some credit for its brand, since it is an extremely well-known app. Yet a quick look on the app store shows that it isn’t necessarily the most loved, with a below average rating of 3.6 stars out of 5 (for context, Instagram is rated 4.7, WhatsApp is rated 4.7, and TikTok is rated 4.8).

Outlook

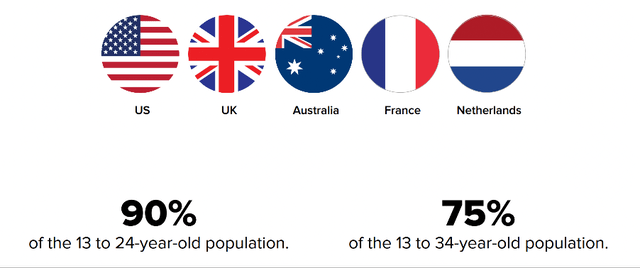

I feel like Snap is making two opposing points in a couple of consecutive slides in its latest investor deck. First, it highlights its high penetration among the 13-24 and 13-34 year old population in its most established markets.

Snap Q1’22 Investor Presentation

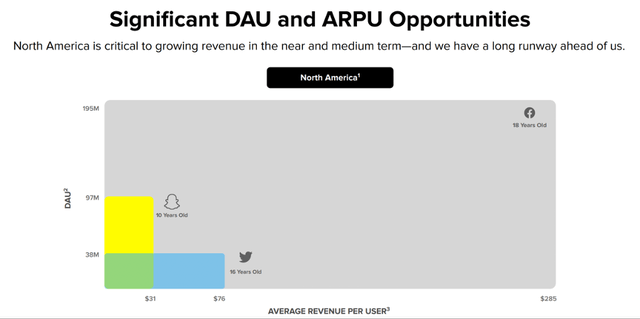

But the company then goes on to talk about how it has only 24% smartphone penetration in North America.

Snap Q1’22 Investor Presentation

So my issue is this; is Snapchat realistically able to expand outside of its target 13-34 year old audience demographic? Because that 24% penetration in North America might look like an opportunity, but only if they’re banking on a bunch of future 50-year-old Snapchatters. Given this, I think it may struggle to achieve meaningful user growth going forward in its established markets.

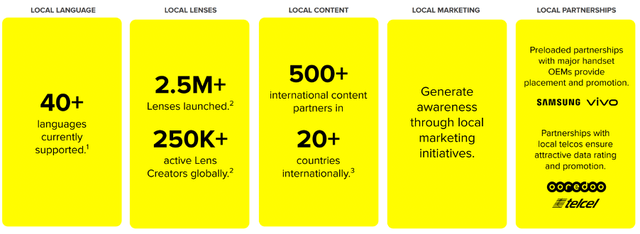

Yet there is certainly room for the company to grow in the Rest of World, and the company is heavily focusing on this with its International Growth Playbook.

Snap Q1’22 Investor Presentation

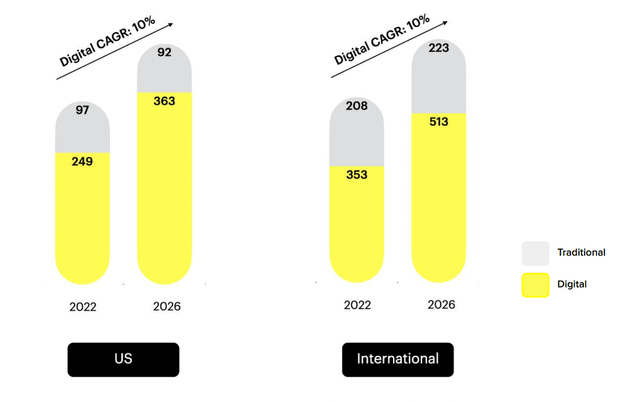

In terms of the overall opportunity, there is certainly a secular shift towards digital advertising. Snap calls out the expected 10% CAGR in the digital advertising industry from 2022 through to 2026 both in the US and Internationally. According to its estimates, this would lead to a market size of ~$876 billion (I’m assuming the below slide is in billions of USD, the company doesn’t actually specify…), which is approximately 200x the size of Snap’s revenue over the past 12 months – clearly, the opportunity is big enough for Snap to continue growing.

Snap Q1’22 Investor Presentation

Management

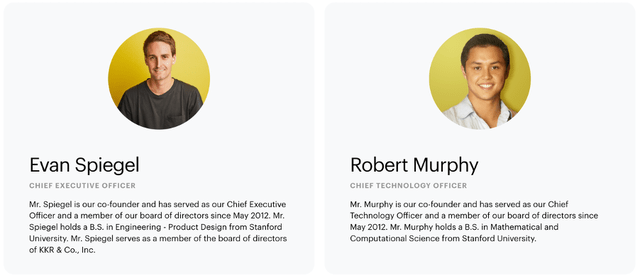

When it comes to fast-paced, innovative companies, I always aim to find founder-led businesses where inside ownership is high. I have a bonus here with Snap, as not only is co-founder Evan Spiegel in the CEO role, but another co-founder Robert Murphy is Snap’s Chief Technology Officer.

CEO Evan Spiegel and CTO Robert Murphy (Snap)

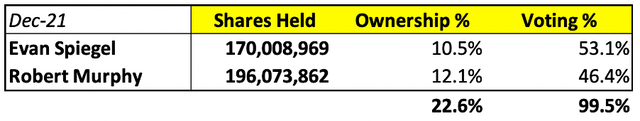

I want to invest in companies where leadership has skin-in-the-game, and insider ownership is extremely high at Snap, with Spiegel and Murphy owning a combined ~22.6% of all shares in the company.

Snap 2021 Annual Report / Excel

Now I normally don’t take issue with founders having a substantial amount of voting power, but I was very surprised to see these two co-founders with a combined 99.5% – and equally surprised to see that Spiegel has over 50% of the voting power. This does concern me; if you invest in Snap, then you are essentially putting complete faith in one person’s ability to lead and execute on their strategy. I don’t normally knock high levels of voting power, but this is so high that it’s worth noting for potential investors.

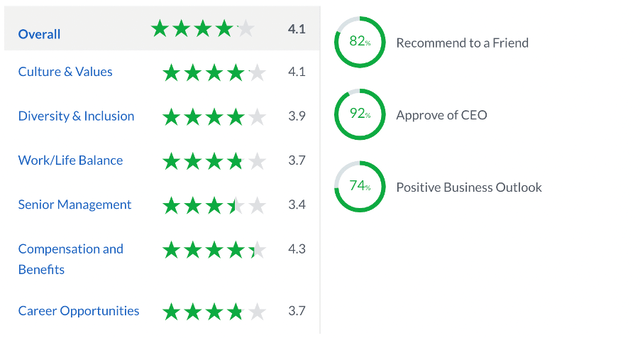

I also like to take a quick look on Glassdoor to get an idea about the culture of a company, and Snap gets some pretty good scores from the 612 reviews left by employees. Any score over 4.0 is impressive, and Snap exceeds this score in Culture & Values and Compensation and Benefits, with high ratings on Recommend to a Friend and a 92% CEO Approval. Yet the company gets a bad score on Senior Management (which is often the weakest category for companies) alongside average scores on Work/Life Balance and Career Opportunities. This seems like a good place to work, just not a great place to work.

Financials

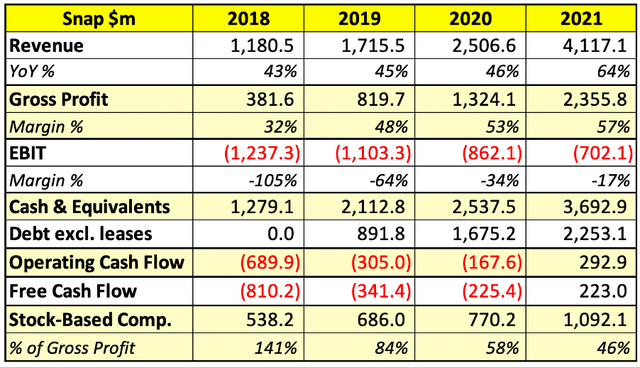

Snap’s financial profile is… interesting. I have a habit of investing in high growth companies that aren’t focused too heavily on profits, but even I was slightly taken aback by some of these figures.

Let’s start with the positives, as revenue growth has been stellar, growing at a ~52% CAGR from 2018 through to 2021. I am surprised by the low gross profit margin, although this has been expanding rapidly. A lot of costs accounted for in gross profit relate to third-party hosting costs, and these should diminish as a percentage of revenue as Snap scales up – we have seen this in action, but a 57% gross profit margin is still pretty poor for a company such as Snap.

I’m not even sure what to say about EBIT; this company is just losing money. As we can see from the bottom line, there is a substantial amount of cost associated to stock-based compensation – but even without the SBC costs, there are poor economics here. The company also only recently turned cash flow positive thanks to a stellar 2021, but with a substantial slowdown expected in 2022, the company may return to its cash-burning past.

The balance sheet of Snap is good, but not good enough to keep up with its historical level of cash burn. If I were a shareholder of Snap, I would be keeping a very close eye on free cash flow throughout the upcoming year, as this company needs to show that it has a business model that can be profitable in the long-term and cash flow positive in the short term (without a pandemic related boost).

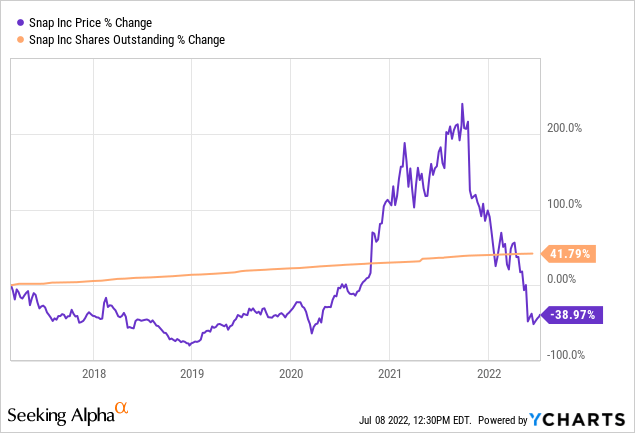

It’s also worth highlighting the impact of this cash burn and high stock-based compensation, as this has resulted in the continual issuance of new shares. From 2017 through to 2022, shares outstanding have increased by ~42% whilst Snap’s shares have fallen by ~39%. It’s been a painful ride for shareholders.

Valuation

As with all high growth, innovative companies, valuation is tough. I believe that my approach will give me an idea about whether Snap is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

CEO Evan Spiegel recently announced that Snap had been hit hard by the current environment, stating that he expected the company to come in below the low end of their Q2 guidance (which was 20% YoY growth), and Spiegel didn’t mince his words:

Well, the macroeconomic environment has definitely deteriorated further and faster than we expected when we issued our guidance for the second quarter. So even though our revenue continues to grow year-over-year in the second quarter, it’s likely that revenue and EBITDA will come in below the low end of our guidance range.

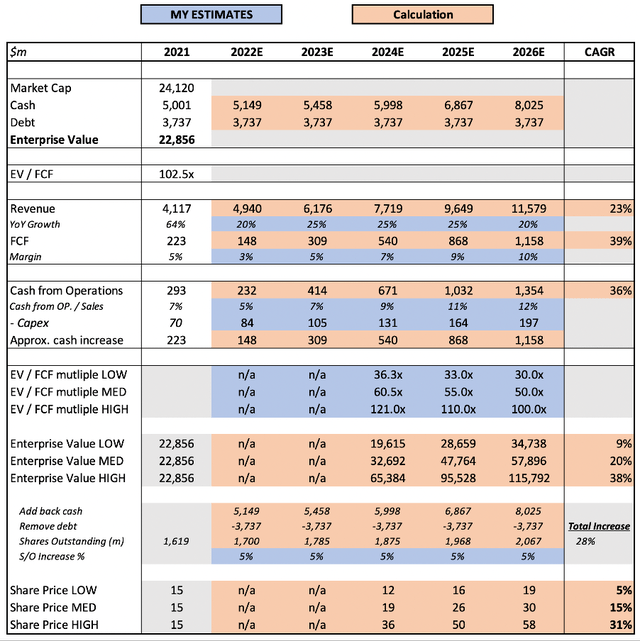

I have assumed a recovery to 25% YoY growth from 2023 onwards. Snap has successfully grown revenues quickly over the past few years, and whilst there is likely a slowdown on the way, I think this company should continue to grow quickly as long as it successfully executes on its strategy.

I have assumed that free cash flows will remain positive and that margins should continue to expand as the company scales up. I have also assumed continued dilution of shareholders in order to fund the company’s growth, with shares outstanding increasing by 28% over my forecast period.

Put it all together, and I can see Snap shares achieving a 15% CAGR through to 2026 in my mid-range scenario.

Risks

This is a pretty good CAGR for shares, but I think the company faces a number of challenges in order to achieve the revenue growth and margin expansion that I have assumed.

One of my first fears would be potential brand erosion, and the possibility that Snapchat goes the way of companies such as Vine. We saw back in 2018 how a tweet from Kylie Jenner sent Snap’s shares plummeting, and although the company has succeeded since, it is a potential hazard. I don’t believe that Snapchat has too many switching costs, but I may be wrong.

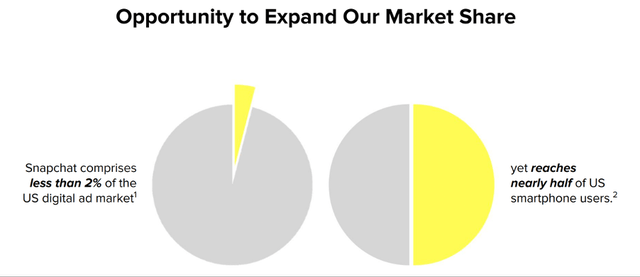

I also think Snapchat highlights another opportunity in its latest investor presentation that I see as a risk: the demographic of its audience. Snapchat proclaims that it has opportunity to expand its market share, since it make up less than 2% of the US digital ad market despite reaching nearly half of US smartphone users.

Snap Q1’22 Investor Presentation

But I don’t see this is an opportunity; I see it as an inherent problem with Snapchat’s audience. The company targets mainly 13-34 year olds, with a good amount of users in the lower half of that age range, and it has substantially lower ARPUs than competitors such as Twitter and Facebook. This could be because younger people with less purchasing power are not as attractive to advertisers.

Snap Q1’22 Investor Presentation

Perhaps I am too being negative: Snap investors may see this as an opportunity to expand ARPU, and believe that young people who use Snapchat will continue to do so as they get older, grow their purchasing power, and therefore become more attractive to advertisers.

I think Snap can expand ARPU, but I also believe that the younger audience demographic will keep Snap behind competitors such as Meta (META). It clearly is capable of creating strong AR-assisted averts, but I think it will remain constrained by the lack of user purchasing power. I also don’t necessarily think that younger Snapchat users will continue to utilize the product as much as they get older. As far as I’m aware, there’s no proof to say that this is or is not the case – it’s just my view, and only time will tell.

Let’s also not forget the risk that is facing pretty much every company, and that is the risk of a recession. Yet as an advertising business, I think Snap could be impacted even more since advertising is an easy cost that other companies can temporarily cut back on during difficult economic times. Snap also doesn’t have the strongest financial profile in the world, so I could see a fall in revenue causing Snap to fall back into its cash-burning ways – yet another yellow flag for investors.

Summary

This is a company with a lot of good aspects, and a lot of bad aspects.

The good: rapid revenue growth, growing user base, international growth, industry-leading AR-driven advertising, founder-led with skin in the game, substantial digital advertising tailwinds, reasonable share price.

The bad: history of burning money, poor margins, could be impacted substantially by a recession, co-founders have virtually 100% of voting rights, consistent shareholder dilution, young audience demographic may be harder to monetize.

I feel like it is personal for each investor when it comes to weighing up the good and the bad in order to come to a decision. For me, there is enough here to avoid Snap as an investment, but there’s also enough for me to see why others believe in the company – only time will tell, and I will watch on with interest from the sidelines.

Be the first to comment