Leila Melhado/iStock via Getty Images

Investment thesis

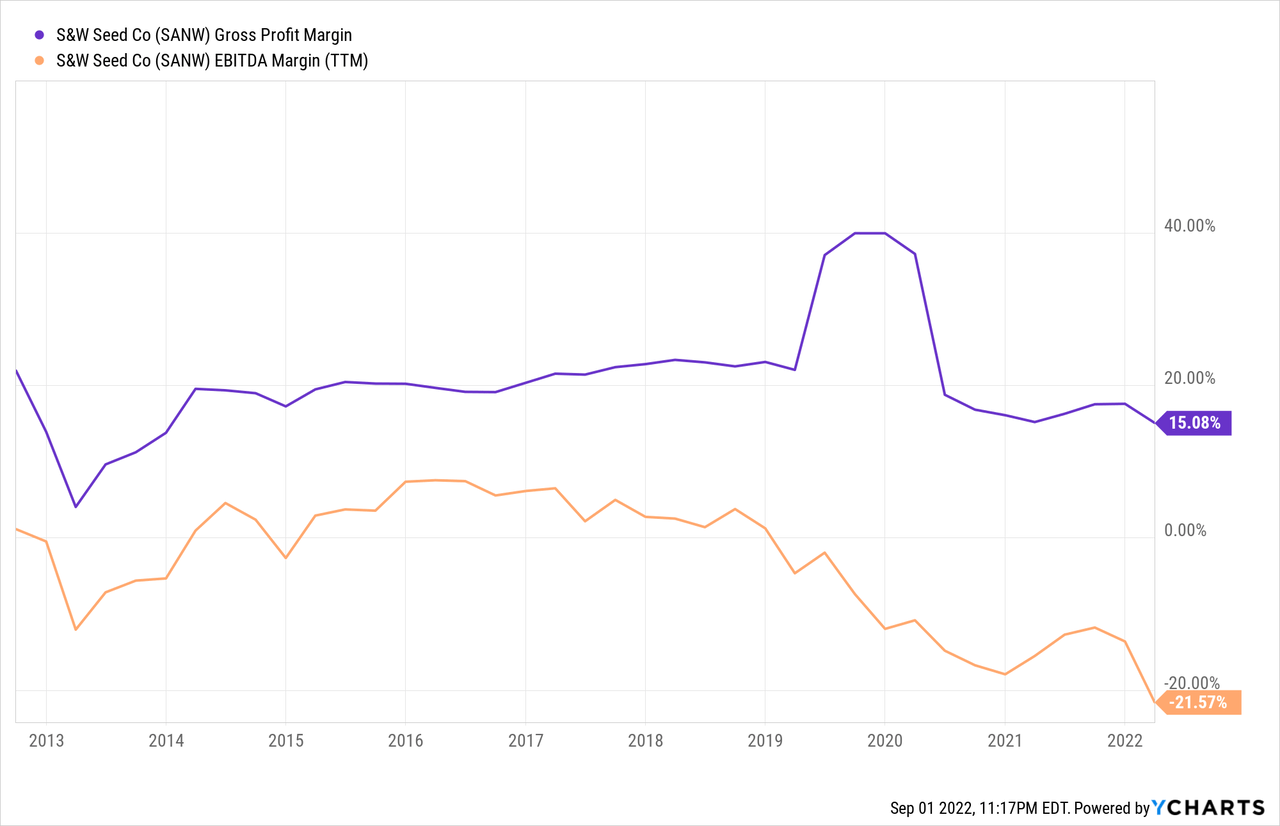

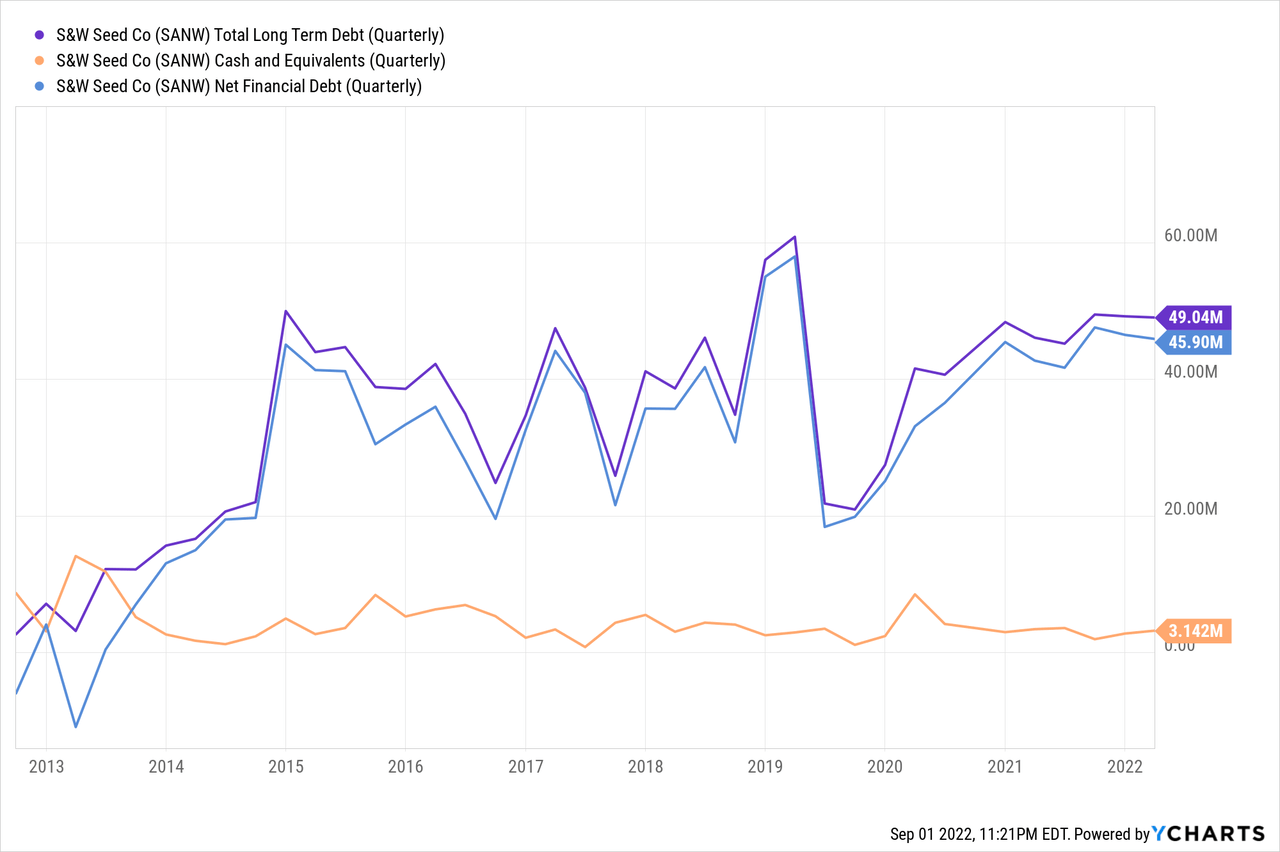

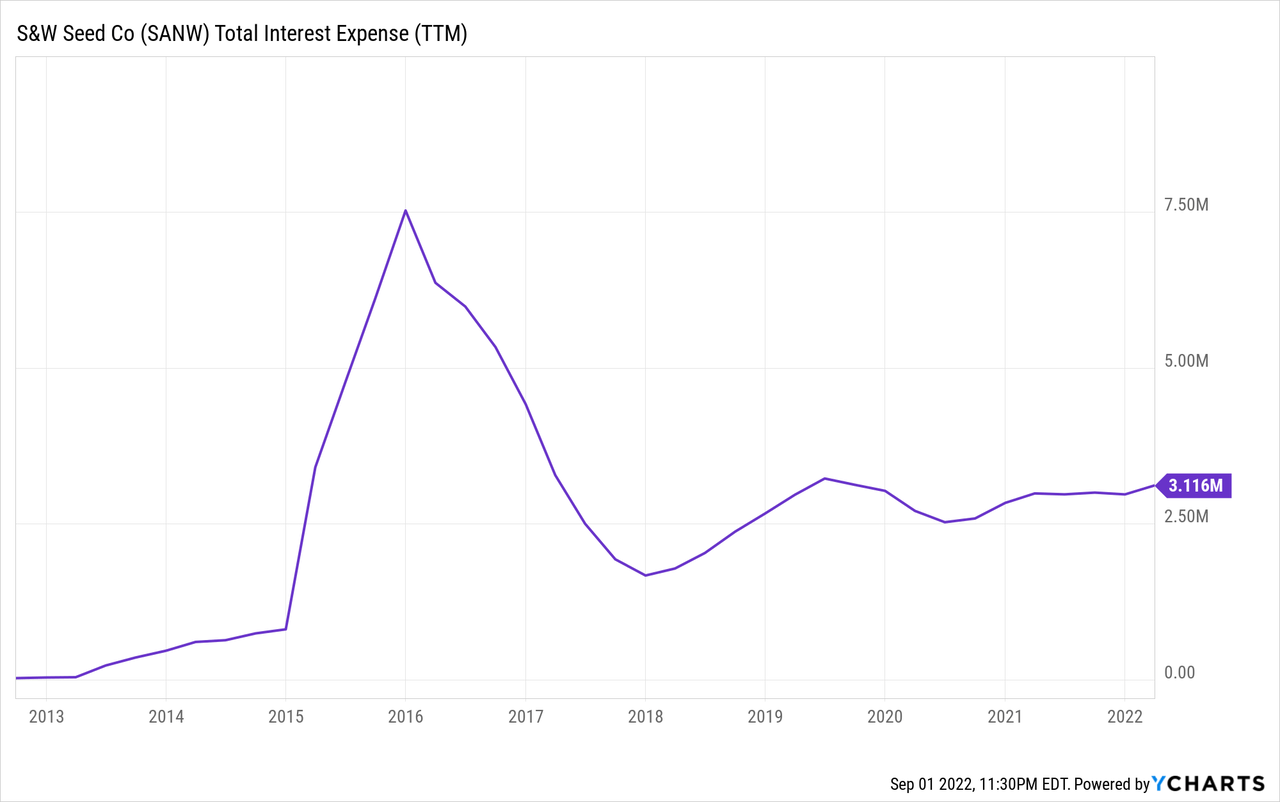

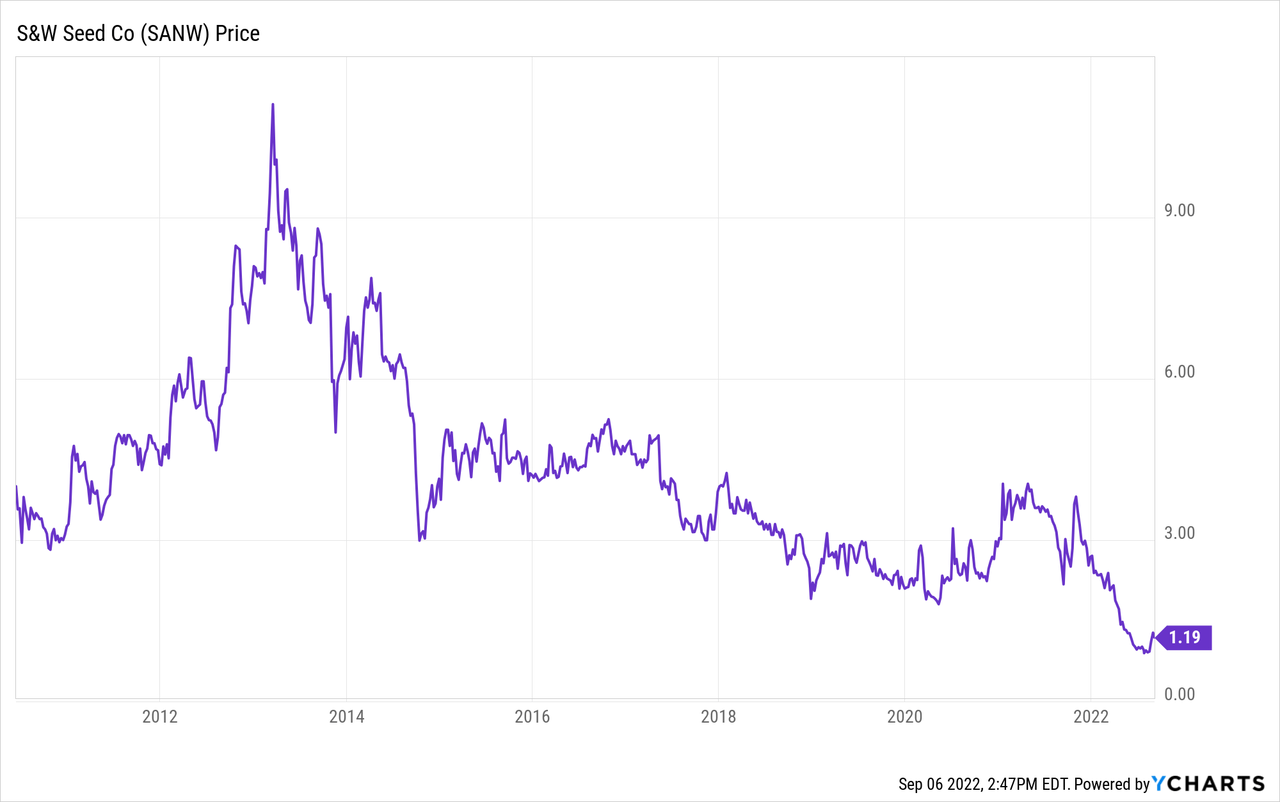

S&W Seed (NASDAQ:SANW) has not been profitable in the past several years, and this has taken its toll on the share price, which has continued to fall. Share dilution and increased long-term debt have introduced the company into a wheel from which I believe will be very difficult to get out: current interest expenses of $3 million add to the operating losses the company reports quarter after quarter, and share dilution has destroyed shareholder value permanently. Even more, current inflationary pressures are generating even more losses in the company’s operations, so the company’s deterioration process is accelerating even more. Therefore, in this article, I am going to explain why I believe that it is better to stay away from S&W Seed despite the recent decline in the share price.

A brief overview of the company

S&W Seed is a global multi-crop, middle-market agricultural company. The company was founded in 1980 and its market cap currently stands at $52 million, employing almost 200 full-time workers. Insiders only own 3.95% of the shares outstanding despite its very low market cap. In this sense, it is a micro-cap company heading straight for nano-cap status, which usually carries very high risks due to limited access to financing and strong competition.

The company operates in the breeding, production, and sale of alfalfa, sorghum, and wheat seeds, and maintains an active stevia development program.

S&W Seeds Company (Swseedco.com)

Until now, the company has not managed to be profitable and has depended on the issuance of shares and access to debt to finance itself. Now, its CEO Mark Wong has plans to enter the camelina market in order to operate as a seed and technology provider for the biofuel industry, and also plans to capitalize on the US growing demand for stevia through operations within the United States as an alternative to imports in order to find a profitable way to exploit the market.

Currently, shares are trading at $1.19, which represents an 89.28% decline from all-time highs of $11.10 on March 18, 2013, and a 74.13% decline from its recent high of $4.60 on October 29, 2021. While it is true that such a deep drop in the share price is often seen as a great opportunity for contrarians, I believe this is not the case for S&W Seeds as I think there is too much risk of the company heading straight for bankruptcy due to its profound profitability issues. Furthermore, even if the company manages to achieve enough profitability that allows it to continue operating in the long term, share dilution has destroyed, and will likely continue to destroy, shareholders’ value permanently. For this reason, my opinion is that even an eventual turnaround would not translate into a certain return for shareholders willing to take the risk.

Net sales have skyrocketed in recent years

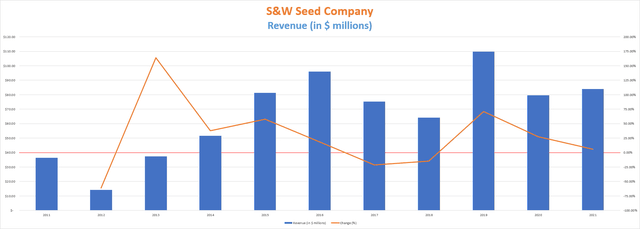

The company receives revenue from four different sources: the sale of seed, milling and packaging services, research and development services, and product licensing agreements. In recent years, sales have increased very rapidly.

S&W Seed Company Revenue (10-K filings)

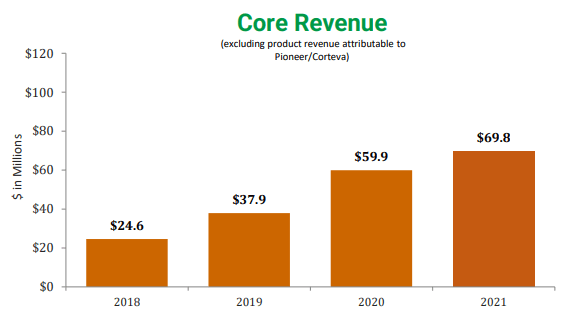

Looking at the chart, it may appear that sales are too volatile. Still, it is very important to note that the company’s revenue is very influenced by licensing agreements. For example, the company entered into a licensing agreement with Corteva (CTVA) in fiscal 2019 and received a fully pre-paid, exclusive license to produce and distribute certain of the company’s alfalfa seed varieties worldwide (except in South America). If we focus on core revenue, it is actually increasing more steadily.

S&W Seed Company Core Revenue (November 2021 Investor Presentation)

Total revenue is expected to decline by ~3.75% from $84.05 million in fiscal 2021 to $81.35 million in fiscal 2022, and then increase by ~13% to $92 million in fiscal 2023. During the third fiscal quarter of 2022, core revenue declined by 2.9% year over year due to non-recurring discounted stock sales that occurred in Q3 of 2021, and also as a result of timing changes in the Australian domestic sales due to the unseasonable heavy rainfall.

The company has been making strong efforts to achieve supply agreements and acquisitions in order to increase revenues. In February 2020, the company acquired Pasture Genetics Pty Ltd., the third largest pasture seed company in Australia generating $20 million in annual revenue, for $13.5 million. More than a year later, in September 2021, the company entered into an exclusive U.S. stevia pilot production supply agreement with Ingredion Incorporated (INGR), a global provider of ingredient solutions to the food and beverage manufacturing industry. And finally, in May 2022, the company entered preliminary, nonbinding discussions to potentially combine wheat operations with Trigall Genetics by setting up Trigall Australia. Thanks to this partnership, the company is planning to sell wheat seeds with a gene for drought tolerance called HB4 in Australia.

Using fiscal 2021 as a reference, 44% of the company’s revenue is provided by operations within the United States, whereas 26% comes from Australia, 7% from Saudi Arabia, 3% from South Africa, 2% from China, 2% from Pakistan, 2% from Mexico, 2% from Argentina, 1% from Libya, 1% from Sudan, and the other 8% comes from the rest of the world.

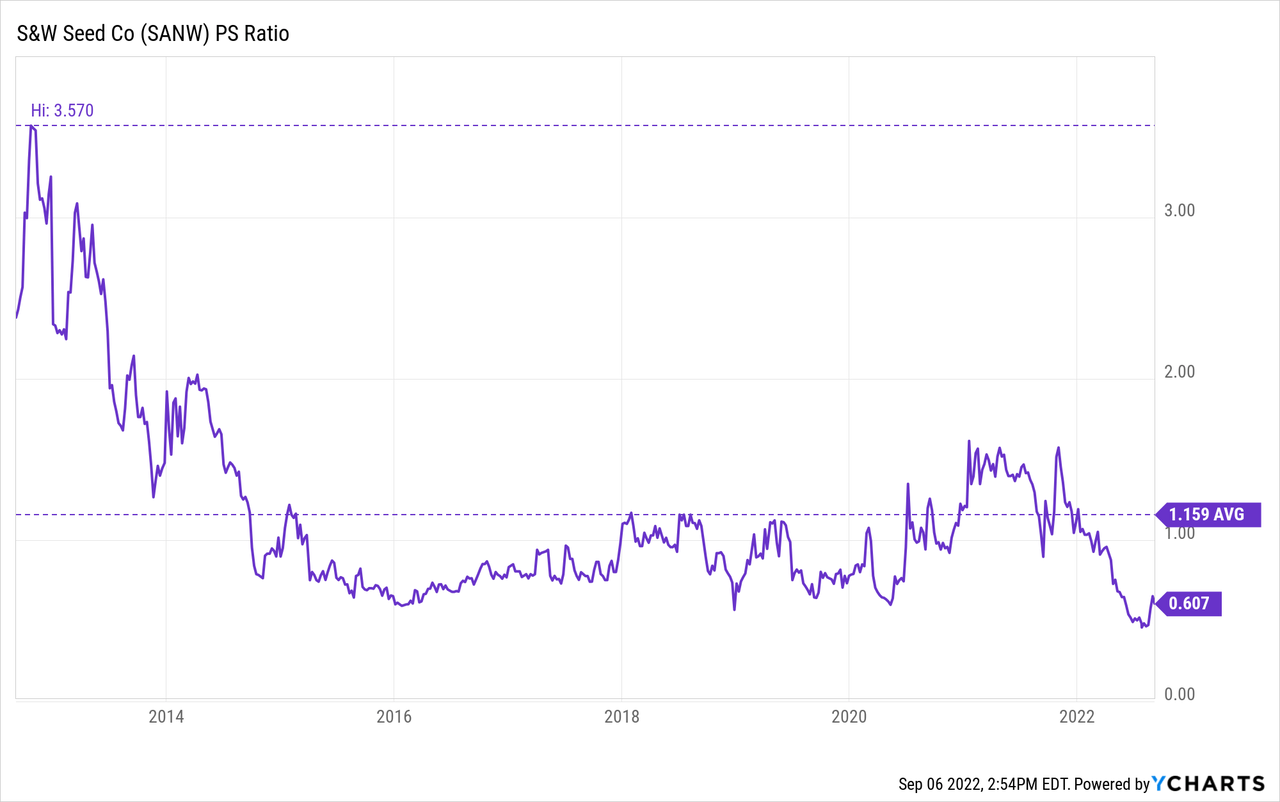

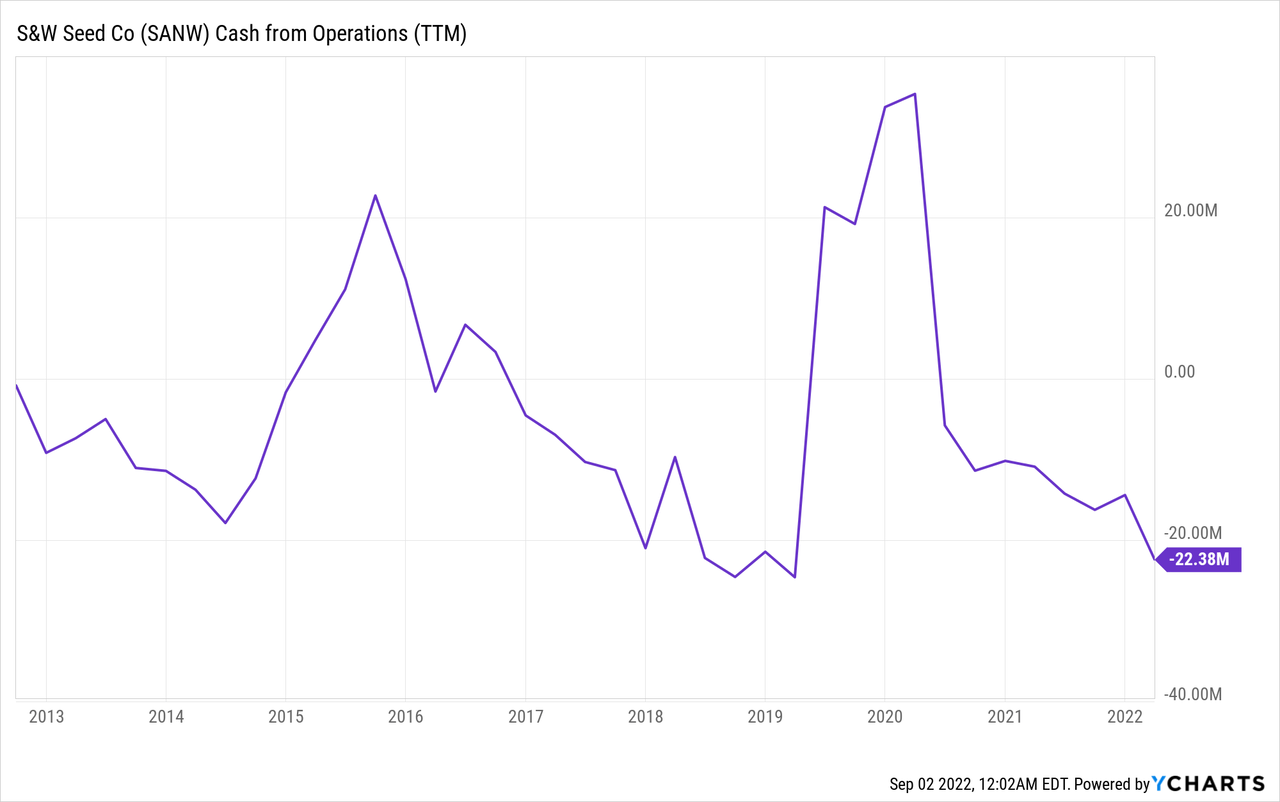

Currently, the PS ratio stands at 0.607, which means the company generates $1.65 for each dollar held in shares by investors, annually. This ratio is 48% lower than the average of 1.159 during the past decade and 83% lower than the high of 3.570 a decade ago, and this shows the current pessimism among investors as they are willing to pay much less for the company’s sales because of the disappointing margins it has had lately. And the fact is that for S&W Seeds, more sales actually mean more losses as such low margins do not allow to transform them into positive cash from operations.

The company is not profitable

The company’s margins have declined after the coronavirus pandemic crisis, which has negatively affected its ability to convert sales into actual cash. Furthermore, the decline in margins continues to deepen due to current supply chain issues, inflationary pressures, and labor shortages. But profitability problems are not something of the present since during the last decade the company has reported negative cash from operations in 2013, 2014, 2017, 2018, 2020, and 2021, and is poised to generate negative cash from operations also in 2022. It should be said that the years in which the cash from operations has been positive have not even remotely offset the losses of other years, as I will show below.

Both gross profit and EBITDA margins have suffered a very deep deterioration, to the point where the EBITDA margin has reached levels below 20% due to lower than anticipated volume, high inflation, and increased logistical costs, which I strongly believe will cause permanent damage to shareholder value as I believe the company will need to issue shares in the coming quarters to keep raising cash. In fact, gross profit margins of 11.7% (GAAP) during the third quarter of fiscal 2022 represent a major decline compared to 19.1% during the same quarter of fiscal 2021.

Management’s efforts to reduce costs are not having the expected effect because the macroeconomic outlook is getting increasingly complicated. In March 2021, the company sold its Five Points, California seed processing facility for $2.25 million in order to compress its U.S. alfalfa seed production operations in the two remaining mechanized facilities located in Nampa, Idaho, and New Deal, Texas, and thus achieve an improvement in efficiencies. The company used the cash to pay down some debt. Now, the management plans to bring new genes to the seed market, bring stevia seed production to the United States in order to increase profitability in the American market, and enter the camelina seeds market to supply biodiesel producers. Furthermore, CEO Mark Wong plans to reduce operating expenses by ~$5 million per year.

Despite all the efforts carried out so far, the company’s trailing twelve months’ cash from operations currently stands at -$22.4 million, and inventory only increased by $5.9 million in the same period. During that period, accounts receivable decreased by $0.4 million, and accounts payable increased by $2.4 million. So the company is losing money, and at the moment, I don’t see any reasonable reason to believe that profitability will improve anytime soon. In my opinion, they are basically buying a promise.

The company’s net income has been negative for five years in a row, and fiscal 2022 is poised to deliver negative net income again. And what is worse, the balance sheet is in a critical situation due to the very low cash on hand and the $3 million in interest expenses derived from the debt.

The debt pile is generating over $3 million in annual interest expenses

As you can see in the graph below, debt is also at relatively high levels. Current long-term debt currently stands at $49 million while the company only has $3.14 million of cash on hand, leaving a net debt of $45.90 million.

This cash on hand will only allow the company to cover one year of interest on the debt while everything else will have to be refinanced by taking on more debt, which would only make the situation worse in the long run, or by issuing more shares, which would dilute existing shares, thus decreasing the portion of the company that each existing share represents. But this would be in the event that the company stopped losing money in its operations. If we add the losses of the operations, the catastrophe is served.

Therefore, as long as profit margins are not high enough to generate enough cash to cover interest expenses and produce surpluses, the management will continue to resort to two modes of financing that are equally negative for the overall stock performance: increasing debt exposure or diluting shares.

Share dilution keeps destroying shareholder value

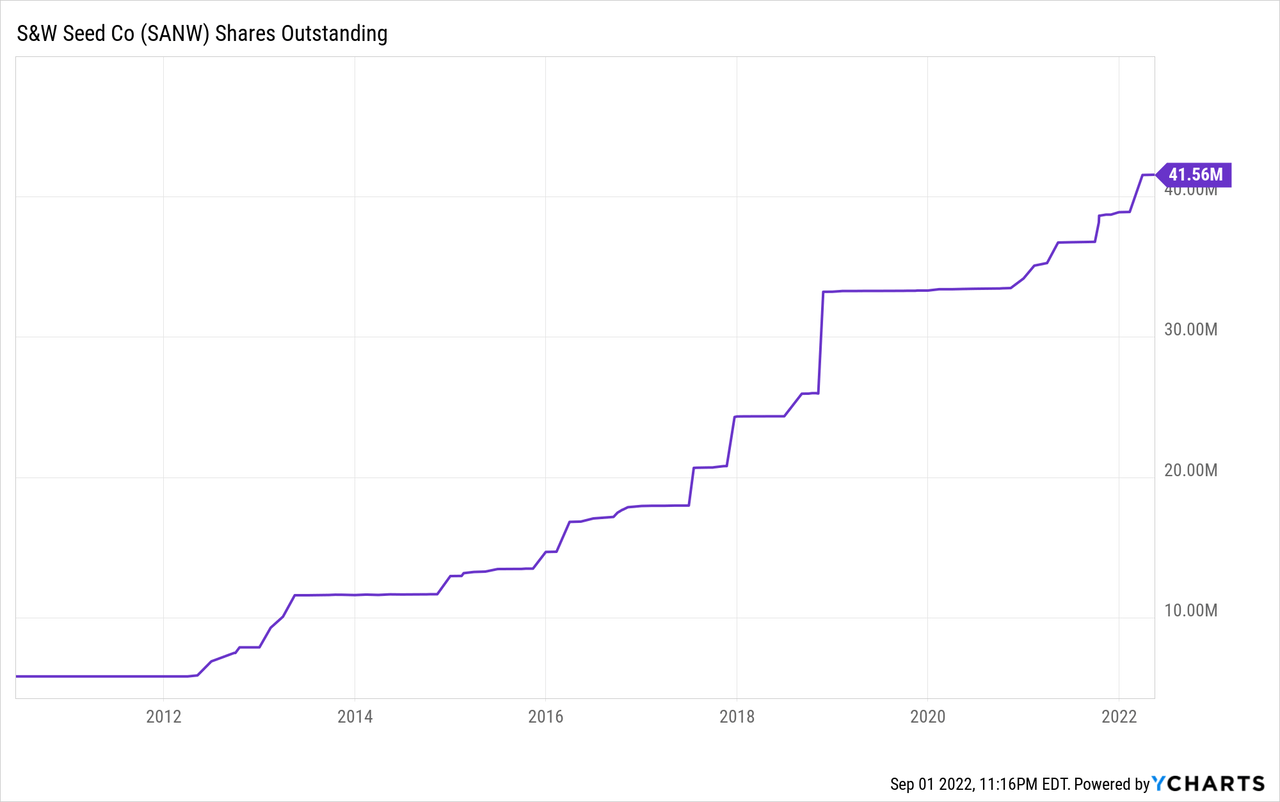

It is true that the company’s sales have skyrocketed in the last decade. But this hasn’t translated into any returns for shareholders, and for good reason. The number of shares outstanding as of September 25, 2012, was 7,473,000. Now, as of May 16, 2022, the total number of shares outstanding is 41,559,732. This represents an increase of 456.13%.

This means that each share of the stock is a smaller and smaller portion of the company as time passes, with which the size of the position of investors always tends to shrink. Share dilution is not a bad thing per se. If the cash raised from share issuance is used to expand a company’s operations, it can be very positive in the long run. And although it is true that the operations have expanded very quickly as revenue increased at very high rates during the past decade, my opinion is that the difficulties in generating cash will mean that the company will have to continue issuing shares to survive as it is the company’s only alternative to avoid going into more debt to cover losses, which would inevitably lead to bankruptcy sooner rather than later.

Risks of investing in S&W Seed

Companies operating in the commodity markets often have very volatile margins as the products offered rarely have any added value. The company is trying to bring new genes to its offerings, but that does not mean that it will achieve it in a satisfactory and/or profitable way. Any change in the price of seeds would have a direct impact on the company’s sales and margins, and increasing costs of growing seeds could impact the company’s margins even further. Furthermore, the company depends on the U.S. dairy industry as a big portion of sales comes from the alfalfa hay market, and therefore, changes in this industry could have negative changes on the company’s operations.

Annual interest expenses of $3 million are something that the company can hardly reduce as the company does not generate cash that can be used to pay off its debt pile. In addition to operating losses, these interest expenses will be a burden that will continue to pierce the balance sheet until, in my opinion, the company’s operations are no longer sustainable. The only solution to prevent this from happening is for the company to generate enough positive cash from operations to pay interest on the debt and reduce debt exposure over a long period of time, which is very complicated at this point if we consider how damaged profit margins have been in recent years. The only way at this point seems to be to succeed in launching a gene that successfully enters the agricultural market and adds some added value.

Share dilution will most likely keep intensifying as time goes by. In fact, the recent drop in margins will inevitably speed up the process as I believe the management can’t afford to increase the debt pile any further. If the company can’t successfully raise capital in the coming quarters or years, it may effectively go bankrupt.

And lastly, I would like to mention that the company’s revenue is concentrated in a few clients, which leads to a high risk of losing volume as a result of some significant change in their operations or in the number of seeds purchased from S&W Seed.

Upside risks worth mentioning

All of the above is based on my opinion and my way of taking risks. It is very important to keep in mind that there is also a significant upside risk if the company finally manages to bring to market a type of seed with a useful gene modification in a niche market. In such a scenario, the share price could increase significantly, which would lead to potential losses for investors who go short. The company will be co-owner of Trigall Genetics along with Bioceres Crop Solutions (BIOX) and Florimond Desprez, and S&W Seeds will be responsible for offering transgenic wheat seeds with an HB4 gene, which is drought-tolerant, on the Australian market. If this gene is well received in the Australian market, the company could achieve large revenue streams and improved margins.

We should also keep in mind that if good margins are achieved through sales of camelina seeds in the biofuel industry, the company may choose to focus its expansion efforts on this market niche. The camelina oil market is expected to grow at a CAGR of over 5% until 2025 and does not compete with food crops as it is planted as a second crop, and CEO Mark Wong is keen to expand in this market. Currently, the company is looking for the right partner to jump into the industry and has been talking for a year with potential partners, and at the moment nothing else is known.

Also, stevia is a very fast-growing market as it is a non-caloric sweetener that is poised to replace sugar in some products. Currently, stevia has to be imported from other countries, largely China and Paraguay. If S&W Seed manages to introduce stevia seeds into the United States in order to avoid having to import them from China, especially now that transportation costs have increased so significantly, it could find extensive expansion opportunities throughout the United States.

Conclusion

I don’t think it’s a good idea to invest in S&W Seed hoping for a successful turnaround. First, profit margins are deeply depressed and cash from operations is very negative and has been for a very long time. Second, the company carries debt that already generates $3 million in annual expenses, which will limit the margin of maneuver of the management. And third, for this situation to be reversed, profound changes are required in the company’s operations, either by launching new products that replace the current ones or by accessing a new market such as camelina or U.S. stevia, which are markets that the CEO assures will bring great profits to the company.

Investing in hopes during a critical time can bring big surprises, but in the case of S&W Seed, I don’t think it’s worth taking the risk given how weak the balance sheet already is. The company has been generating negative cash from operations during the past decade. As time passes without anything changing things, the company will have to continue diluting the shares, which means that time clearly plays against the shareholders hoping for a turnaround to take place.

Be the first to comment