zorazhuang

EnLink (NYSE:ENLC) reported another strong quarter. Their Q3 adjusted EBITDA net to EnLink was $343.4MM, a new record. They have plenty of projects in the works for 2023 and beyond to sustain the growth outlook. Their full-year guide was revised to the upper end of their guidance range of $1250MM to $1290MM, so it should come in around $1280MM to $1290MM, up 22% over 2021 and a new record. Given the strong performance, EnLink is a buy on any pullbacks of $1.50 to $3.00.

Segment Profit Highlights

Every segment of EnLink’s business grew sequentially, QoQ.

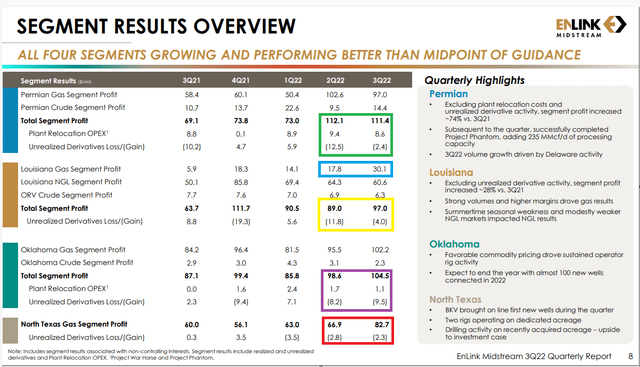

EnLink Q3 2022 Segment Profit (EnLink’s Quarterly Report)

Oklahoma and North Texas

In Oklahoma, the segment profit grew 4% QoQ (net of plant relocation costs and unrealized derivative gains – purple box in figure 1). During the Q3 earnings call, Ben Lamb (who recently moved into the CFO role) said he now expects Oklahoma to grow between 12-16% in 2023 which will add roughly $50MM in net EBITDA in 2023. This is driven by robust drilling activity in the STACK region by various producers including Devon Energy (DVN), Ovintiv (OVV), Marathon Oil (MRO), Citizens Energy and others. As commodity prices have risen this year, especially natural gas and natural gas liquids, the economics of the STACK region have improved, driving additional activity in the region. Even with the pullback in NGL prices later in the year, Ben expects robust activity in Oklahoma.

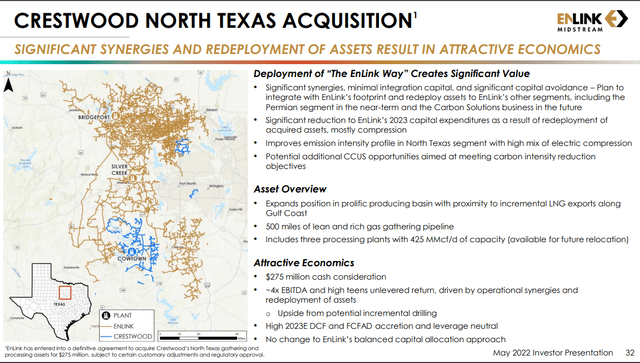

In their Barnett (North Texas Gas segment), you can see the segment profit jump due to their recent Crestwood Equity (CEQP) acquisition (red box in figure 1). They paid $275MM plus $14.5MM in working capital to acquire the Crestwood system at the southern end of their footprint in that basin. The acquisition earned an estimated $17.3MM in EBITDA in Q3 ($12.6MM in net income plus an estimated $4.7MM in depreciation) which gives that project a 4x EBITDA multiple, meaning they paid four times the EBITDA (earnings before interest, taxes, depreciation and amortization) that the asset is currently yielding.

The system has $50MM in surplus compression and other equipment that can be redeployed to other areas of the business (or potentially sold). Removing the $50MM from the cost of the acquisition, drives the EBITDA multiple down to 3.25x ($275MM minus $50MM, then divide by $69.2MM – the annualized EBITDA of Q3 2022). The larger southwest portion of the Crestwood system sits in an area of the Barnett that hasn’t been drilled in years. It is a declining system and if you work out the math, you need a 3x EBITDA multiple to justify the purchase.

There are a couple of upsides to the deal that will drive better economics. To EnLink’s surprise, a 4-well pad was drilled on the system in the quarter. I suspect the drilling took place in the active Tarrant county portion of the acquisition (Lake Arlington), an area that isn’t connected to their overall system and produces dry natural gas. The drilling will by no means remove the decline in this asset, but it will help improve the economics of the deal slightly.

The overall system also came with 425 MMcf/d of natural gas processing plants. These plants have already been shut down or will be shut down when EnLink integrates Crestwood’s gathering assets into their existing Barnett system. Ben Lamb said on the earnings call that one or more of the natural gas plants tied to the system may be suitable to transport to their Permian footprint. Every 200 MMcf/d of processing transplanted from the Barnett to the Permian offsets $70MM+ in capital costs versus a new build. Should they be able to utilize these plants in the Permian, the economics of the Crestwood deal would improve substantially. However, some of these plants are getting old and may not be suitable – the 100 MMcf/d plant in Johnson county was built in 2006 by Devon Energy. The 125 MMcf/d Corvette plant in Hood county was placed into service in 2009, and the 200 MMcf/d Cowtown processing plant in Hood county was built in 2005.

In contrast, the two plants they’ve moved to date are much newer – the BattleRidge plant in EnLink’s Oklahoma system was originally built in 2014 and their Thunderbird plant (also originally built for Oklahoma) was built in 2018 and became operational in early 2019. For additional comparison, Targa Resources (TRGP) moved their Longhorn plant from the Barnett to the Permian – that plant was originally built in 2012. The older the plant, the less suitable it becomes for relocation. It doesn’t make sense to move a plant if it runs inefficiently and allows valuable molecules to escape into the natural gas stream. We’ll have to wait to see if any of the Crestwood plants make the grade.

I expect the Barnett region to contribute about $25MM+ in additional EBITDA in 2023 versus 2022, due to the Crestwood acquisition which closed on July 1st, 2022. In 2023, EnLink will benefit from a full year’s output from that asset. Outside of that acquisition, EnLink expects volume and EBITDA to be stable in 2023.

Crestwood Acquisition (Enlink’s Q2 2022 Quarterly Report)

The mighty Permian

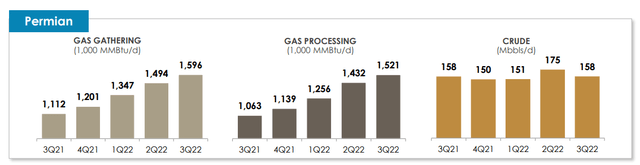

Their Permian segment profit grew 8% QoQ, net of plant relocation costs and unrealized derivative gains (see green box in figure 1). Most of the growth occurred on the Delaware side of the basin as the natural gas processing capacity on the Midland side was full. They have now completed the move of their 200 MMcf/d Thunderbird plant from their STACK region in Oklahoma to the Midland basin in the Permian. As part of that process, they upgraded the plant to now run 235 MMcf/d and renamed the plant Phantom. That move will give them enough running room to last around 5 quarters (perhaps more), at which time, they may need to invest in another plant if the Midland keeps growing.

Although EnLink hasn’t provided guidance for 2023, I think it is safe to assume that their Permian business will continue to grow volumetrically, albeit at a slower pace. Their volume in the Permian grew 44% YoY in Q3 2022 but their segment profit (excluding plant relocation costs and unrealized derivative gains) grew 74%. Since EnLink recently commissioned the Phantom plant in their Midland footprint to meet producer growth plans, we can infer that volume on the Midland side of the basin is scheduled to grow into next year. Even with the addition of Phantom, EnLink is already at nameplate capacity of natural gas processing in the Permian (currently 1,533 MMcf/d).

EnLink’s Permian Volumes (EnLink’s Q3 2022 Quarterly Report)

They had been offloading some natural gas processing volumes to their competing neighbors on the Midland side of the basin until they fully commissioned Phantom. Now that this plant upgrade and relocation is complete, the offloaded volumes have returned to EnLink’s plants. As volumes continue to ramp in 2023, they will most likely run their plants above nameplate and may even offload additional volumes. I suspect they will also announce a new natural gas plant in 2023 to manage the new growth.

Permian 2023 segment profit

There are a lot of factors affecting the segment profit in their Permian segment starting with the price of natural gas. Natural gas prices peaked in Q3 2022 at an average spot price of $7.99/MMbtu Henry Hub. They have since moderated in Q4 with a weekly range of $4.34 to $6.80/MMbtu. Although the Delaware side of the basin for EnLink is primarily fee based, the Midland side of the basin is exposed to commodity prices. As the price of natural gas moderates, so too will their Permian segment profit because much of the gas received by producers on the Midland side is marketed by EnLink.

Another factor affecting segment profit growth in the Permian is pipeline takeaway capacity. As we turn the corner on 2022, Permian takeaway capacity is getting tight (too much gas, too little pipe). To combat the constraints, EnLink entered into a short-term firm transportation agreement on the Whistler Pipeline which will move some of the gas out of Midland into Agua Dulce near Corpus Christi (about 90MMcf/d or 25% of their commodity price exposure). This is critical. If EnLink were to continue marketing all the gas locally (Waha hub), both their customers and EnLink would realize lower profits. Waha natural gas spot prices have already gone negative in Q4 of 2022 due to maintenance on takeaway pipelines. Once the new Matterhorn Pipeline is built in 2024, EnLink will move their firm transport to the new pipeline. More on this below.

EnLink also hedges some of their natural gas volumes exposed to commodity price fluctuations. Hedging in a rising commodity price environment reduces their segment profit. In a falling commodity price environment, like we are seeing now, the hedges offset the decline. Over the next 4 quarters, they have hedged an average of 120MMcf/d of natural gas at an average price of $6.45/MMbtu – up from 82MMcf/d hedged at the end of Q2. According to Pablo Mercado, their previous CFO, they’ve now hedged a 1/3 of their Permian commodity price exposure.

A final component to determining how well EnLink will do in their Permian segment is the new and growing LNG (liquid natural gas) export terminals along the gulf coast and potentially Mexico’s coast. As LNG export capacity grows in the coming years, exporters will source a significant amount of it from the Permian. Also, we just got word that the Freeport LNG terminal located in Texas, which has been offline since June 8th due to a fire, is not scheduled to return to service until Q1 of 2023. The date for this terminal’s return has been pushed out several times. Once the terminal is fully operational, an additional 2 Bcf/d of feedgas demand will hit the US market and natural gas prices might head higher.

As you can see, there are a lot of moving parts in their Permian segment making it difficult to make accurate predictions for 2023. Volumetrically, I expect their Permian segment to grow 20% from Q3 2022 to Q3 2023. I expect their segment profit to moderate to 15-17% growth. This is purely an educated guess. We’ll get a better view in mid-February when they discuss their 2023 forecast.

Matterhorn Express

We got greater clarity on the economics of their 15% equity investment in Matterhorn Express. Recall that Matterhorn Express (once it is built) will be a long-haul, 580-mile pipeline running from the Permian basin to the Katy area near Houston and will go into service in late 2024. EnLink will contribute $70MM in CAPEX this year and $30MM next year. According to Pablo Mercado’s comments during the Q3 earnings call, the project has a “75% loan to value” ratio. From that we can estimate the total cost of the project ($2.7 billion). We can also infer that the levered return on the project for EnLink might be mid-single digits (5-6x EBITDA or roughly $20-25MM per year). EnLink plans to be a shipper on that pipeline which means that much of that cash flow will get recycled back to Matterhorn in form of firm transportation fees.

Louisiana

Moving on to Louisiana, their segment profit net of unrealized hedging gains grew 20% QoQ (yellow box in figure 1) led by their natural gas sub-segment. Their Louisiana segment is unlike any other segment in their portfolio. About 72% of their segment profit comes from their NGL (natural gas liquids) fractionation business, 21% from natural gas gathering, processing and transportation and the rest comes from their oil gathering and marketing business in their Ohio River Valley (ORV) operations in the Northeast.

Most of their natural gas processing plants in Louisiana have been shut down over the years due to a lack of throughput, and now they only operate two of them: their Gibson plant located in Gibson, LA processing up to 110MMcf/d and their 600 MMcf/d Pelican plant in Patterson which can also pull gas from the Louisiana Intrastate Gas (LIG) system if markets are favorable – if the gas has enough ethane in it, and if ethane prices are high relative to the heating value of leaving the ethane in the natural gas stream. In 2021, they only processed an average of 200MMcf/d in Louisiana and the segment profit from it was modest. I suspect that 2022 was more favorable but we won’t get the volume numbers until EnLink post their 2022 annual report in Feb 2023.

Despite the lack of natural gas processing revenue, Louisiana generated $30.1MM in segment profit from natural gas in Q3 which is a record even going back to the Crosstex Energy days. As a reminder, Crosstex Energy (which owned their entire Louisiana segment as well as other segments) merged with Devon’s midstream division to form EnLink in early 2014. So why the big jump in their natural gas business in Louisiana? The note on the side of the slide of their Q3 Quarterly Report (see figure 1) says higher volumes and higher margins. Part of the jump in Q3 segment profit relates to their marketing business and the price of natural gas.

Natural gas prices hit a peak in Q2 and Q3 of this year averaging $7.48 per MMbtu in Q2 and rising to $7.99 in Q3 (Henry Hub spot prices). The higher prices drove higher margins. Part of the reason the higher numbers didn’t show up in Q2 is because EnLink’s volume of marketed natural gas dropped in Q2. In Q2 they got higher margins, but lower volumes of natural gas sold. In Q3, everything aligned, and they got higher volumes of natural gas sold coupled with higher margins.

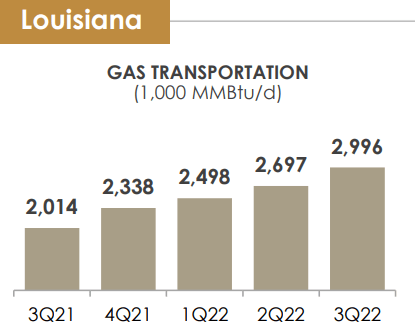

Digging into the numbers a bit, we also got a jump in the gathering and transportation fixed fees of $6.4MM offset by higher operating costs which subtracted $3.1MM. You can see that Louisiana has been driving higher natural gas transportation all year. The total volume across all their Louisiana pipelines grew from 2 million MMbtu/d in Q3 2021 to 3 million MMbtu/d in Q3 2022, a 50% rise.

EnLink’s Louisiana Volumes (EnLink’s Q3 Quarterly Report)

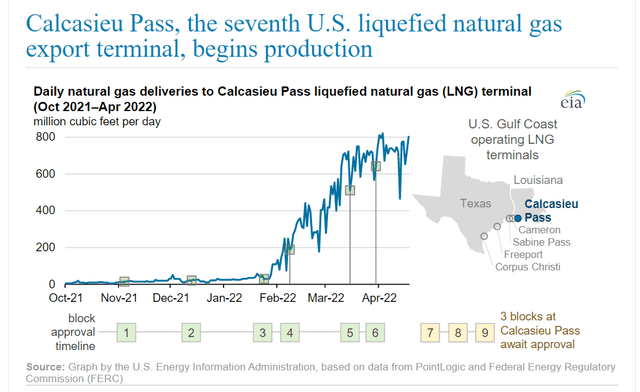

The new LNG capacity that came online starting in the 4th quarter of last year continued to ramp through the third quarter helping to drive higher natural gas prices and higher volumes in Louisiana. Those volumes came from Venture Global’s new Calcasieu Pass LNG (up to 1.6 Bcf/d at peak operating capacity) and Sabine LNG, train 6, which added about 0.8 Bcf/d of demand. Still, those increased volumes on EnLink’s system could come under fire from larger competitors ramping up pipeline capacity. For example, TC Energy (TRP) recently commissioned their Louisiana Xpress upgrade project (3 new compression stations plus 1 upgraded compression station) which added 1 Bcf/d of capacity on their Columbia Gulf Transmission, helping to feed Sabine’s Pass train 6 and other end points on the Louisiana gas system.

Venture Global Calcasieu Pass LNG

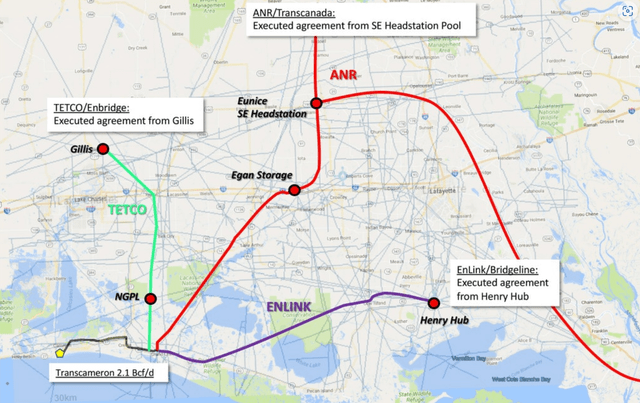

In 2019, EnLink signed a 20-year firm transport agreement with Venture Global LNG to transport up to 303,030 MMbtu/d (about 285MMcf/d) from Henry Hub down through a portion of EnLink’s Bridgeline Pipeline to an interconnect with VG’s TransCameron pipeline, a 42” header system that feeds their Calcasieu Pass LNG terminal. According to FERC’s published documents, EnLink receives a reservation rate of $14.65MM per year, a small commodity charge (up to $1MM per year depending on throughput) and a 1% fuel charge. Although their agreement commenced on February of 2021, Venture Global’s feedgas didn’t start ramping until February of 2022.

Venture Global’s Calcasieu Feedgas Volumes [EIA]

Venture Global (VG) also signed firm transport agreements with Tetco (owned by Enbridge) and ANR (owned by TC Energy). This gives VG exposure to Gillis hub, the Eunice SE Headstation Pool, Henry Hub and several connections along these pathways.

Venture Global LNG Firm Transport Agreements (Venture Global)

On the Q3 earnings call, EnLink announced an expansion of their firm transport agreement with Venture Global that would grow the throughput from Henry Hub to VG’s TransCameron Pipeline by another 200,000 MMbtu/d. Venture Global’s TransCameron Pipeline can accept 500,000 MMbtu/d from Bridgeline, so I suspect the expansion was in the works for several years. EnLink will invest another $20MM in 2023 to upgrade their compression and throughput and this will generate another $9.7MM per year in segment profit (estimated). They spent $20MM on the original project, so a total of $40MM in CAPEX will be spent, and EnLink will earn an EBITDA return of roughly $25MM/year total. These capital light projects that earn a 1.6x EBITDA multiple create value from underused pipelines.

They also announced a CO2 transportation agreement in Louisiana with Exxon Mobil (XOM) but the yield on that project likely won’t be seen until 2025 so we’ll save the details of that project and other future projects in Louisiana for a future article.

2023

EnLink has given us enough clues about how 2023 will unfold that we can make some educated guesses about the returns in 2023 and the potential dividends. Take the following analysis with a grain of salt because EnLink has a lot of flexibility in their use of free cash flow.

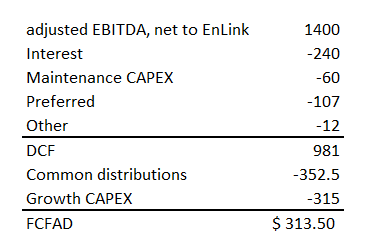

They have reiterated that growth in the Permian will be “robust”. Let’s call that 20% volumetric growth and 15% segment profit growth. If the Permian does $432MM in segment profit in 2022 and grows by 15% YoY, then the Permian will grow by an additional $65MM. Some of that growth will occur on the Delaware side which is a 50/50 joint venture so let’s remove $15MM and call it $50MM net to EnLink YoY. Ben Lamb guided growth in Oklahoma to between 12-16%. At 14% growth, that’s another $50MM YoY. If the Barnett remains relatively stable, it will earn an additional $25MM in 2023 vs. 2022 because the Crestwood acquisition closed on July 1, 2022 and in 2023, EnLink will benefit from a full year’s worth of segment profit. Let’s say Louisiana is flat YoY. If EnLink achieves $125MM growth in 2023 relative to 2022, and we add a bit of conservatism, their numbers might look something like this:

EnLink’s 2023 estimated EBITDA and FCFAD (Author)

Figures are in millions of dollars. Adjusted EBITDA net to EnLink grows to $1.4 billion. Interest charges rise to $240 million from $217 because they’ve taken on a bit more debt and at higher rates. Maintenance CAPEX rises to $60MM from $45MM in 2023. Preferred unit distributions rise to $107 from an estimated $91MM in 2022 because their Series C preferred equity payouts rise to 8.76% (estimated based on current LIBOR rates) from 6% starting Dec 15, 2022. The common distribution rises to $0.75 from $0.45 per unit and growth capex remains the same at $315MM. This level of growth will still give EnLink $313.5MM in FCFAD (free cash flow after distribution). Earning $300+ in FCFAD is a key metric for them, so I expect them to aim for at least this amount in 2023.

Jumping from a distribution of $0.45 to $0.75/unit might be too much. They could dial this back to $0.55 and earn $407MM in FCFAD from which they could buy back $100MM in preferred stock and $200MM in common stock. They could pay down some debt and/or fund a new acquisition. They might low-ball the guide in February and dial all this back until they get greater visibility. Whatever direction they choose, I suspect they will take a balanced approach as they have done all year.

Conclusion

It is easy to get skittish on a stock that has reached a pricing level last seen in April of 2019, but the numbers tell us a different story. By the end of 2023, EnLink is projected to earn 40% more in distributable cash flow per share over 2019. Fundamentally, EnLink is a much stronger company than they were in 2019. Sure, there will be sellers at $13 and especially at $15 but the bulls are still in control. I recommend buying EnLink on pullbacks in the $1.50-$3.00 range. You can also sell out of the money March puts at $0.50+. Short-term targets are at $13 (recent high) & $15 (long-term resistance). Those with a longer-term horizon (1-2 years) could look for $18 (fundamental value). In the next article on EnLink, we will take a deeper dive on future Louisiana projects and discuss 13F data and a summary of EnLink’s buyback program, showing why EnLink’s stock continues to be supported.

Be the first to comment