CatEyePerspective

General Introduction

Market tumult this year has perhaps exemplified the utility of inverse leveraged ETFs. These synthetic wrappers are not generally geared towards entry-level money managers but are designed to offset adverse market volatility.

Useful to punctually hedge out a basket of risky assets without completely having to unwind it, these exotic exchange traded funds have gained increasing popularity. The beauty of ETFs and derivatives is that security replication can be achieved, allowing for portfolio risk profile customization.

Finding a perfectly negatively correlated security is tricky – correlation rises among asset classes as volatility increases. Traditionally it has been fixed income, consumer staples, commodities, alternative investments and in some instances currency. Yet it has never been easy to find that Holy Grail: the one asset which rockets to the upside as markets crumble.

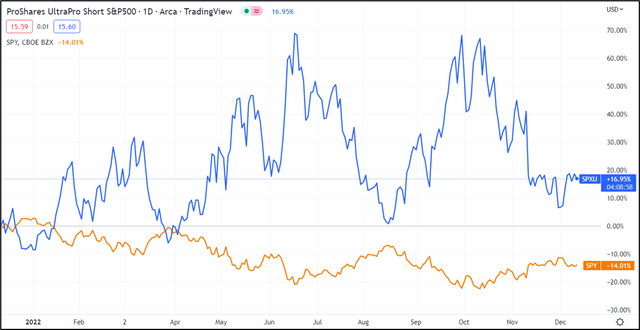

A one-year comparison between SPXY (+16.95%) and SPY (-14.01%) highlights how the ETF does not perfectly replicate a negative 3x correlation

Thankfully ETFs married with derivatives offer a solution, by synthetically marrying all the attributes of an inversely correlated security heavily sought after by risk managers.

Security customization has become a growing trend in the packaged securities marketplace, with fund houses such as Pro Shares, and Direxion Daily, among others concocting handcrafted instruments for hedging.

Yet if there is any key thing to take away from the family of inverse leveraged ETFs, it pertains to risk involved around holding synthetic securities. This family of ETFs is used for punctual speculation on the direction of the market or rough-cut hedging of a basket of risky assets.

Alternatively, as I have mentioned in previous posts, inverse leveraged ETFs allow certain money managers constrained by a given portfolio mandate to get around it by having recourse to an ETF. The perfect example is long-only money managers.

By definition, they cannot short the market during price action jitters. Previously, they could seek refuge in assets with low correlation. Now they can immediately take on a leveraged inverse position such as the one proposed ProShares UltraPro Short S&P 500 ETF (NYSEARCA:SPXU)

My outlook is neutral on the package. Not specifically based on a directional assumption on market price action but rather because these tools are near-term synthetic securities unlike regular equities. For capital allocators looking to develop deeper portfolio management skills, understanding leveraged synthetic ETFs is invaluable.

Product Overview

ProShares UltraPro Short S&P 500 ETF provides traders a 3x inversely correlated ETF used to speculate on market price action or hedge out a long portfolio of equities. Note that I use the word “trader” here. This term is purposefully used to underline the short-term philosophy behind the ETF.

Negative 3x returns on the S&P 500 are a target (not a guarantee) for a single day. Daily re-setting means there will be some drift between returns on the S&P 500 and negative 3x returns during the same time. This is an important aspect to be mindful of and a key risk factor.

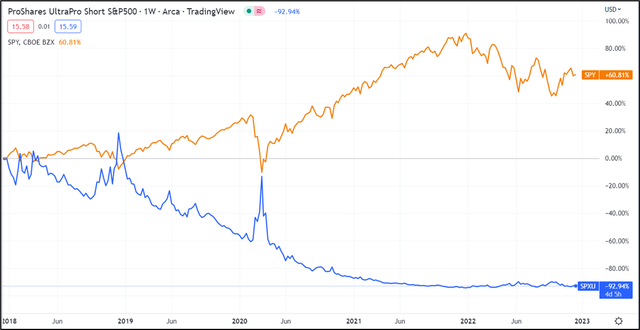

Compounding of daily returns implies holding the ETF for greater than one day can create distortions between target returns and reality. The effects of daily resetting and compounding are often more accentuated in funds with larger inverse multiples or with higher exposure to volatility.

Over much longer periods, it can be witnessed how SPXU naturally implodes. Only reverse splits ever stop the ETF from reaching terminal zero.

Practical Uses

A long holding in the ETF provides broadly -300 deltas punctually that you can use to offset a long portfolio. For example, consider you are holding 1000 SPY shares ~$395K and you are about to navigate a period of volatility such as a rates announcement by the Federal Reserve, a jobs report or even CPI print.

You could lower risk exposure simply by selling 600 shares. But there are many other ways you could achieve a similar result, perhaps avoid capital gains taxes or even qualifying for a dividend. Long put options, short call options or even short futures contract holdings could be used to hedge out risk.

Alternatively, you could buy 200 x SPXU providing overall portfolio exposure of 1000 SPY deltas long + (-600 deltas) giving a new net exposure of +400 deltas. Note that delta describe directional risk, mainly used in derivatives markets but can be handily put to work here to determine how to hedge.

In this scenario, you maintain your holding in SPY (1000 shares @ $395K) while lowering your risk exposure by purchasing 200 shares of SPXU. If the S&P 500 capitulates, your long position in SPXU will provide gains offsetting losses incurred on the SPY holding. The example is very simple but demonstrates practical usage of SPXU.

Another use is to take a speculative long/ short, levered position against SPY. You could achieve this with options, futures contracts or even our namesake negative 3x levered ETF, SPXU.

ETF Structure

It is worth noting that the composition of SPXU is heavily underpinned by OTC derivative contracts between the fund manager and different banks. Over-the-counter derivative contracts are not managed by a clearing house, as would be the case with standard market options contracts.

This lack of clearing house implies counterparty risk – the risk that during extreme bouts of market volatility, the counterparty is capable of making good on its promise to honour its contractual obligations. This is not always the case, notably when systemic risk results in market contagion, not unlike what we witnessed during the great financial crisis.

OTC Derivative Risk

Over-the-counter derivative use is another critical risk factor that needs to be understood before holding the ETF. For the most part, these derivatives include swap contracts, index swaps, cash and even futures contracts on treasuries. Whereas looking at the innards of any normal ETF provides a good idea of the investment goals, it is very hard to identify them with synthetically leveraged products due to their manmade nature.

Risks of Leverage

Leverage kills. Just ask Sam Bankman-Fried. Leverage newbies often misunderstand that leverage cuts both ways. While it can deliver staggering returns, it can just as easily issue a wave of destruction. Understanding risk exposure related to this is critical to managing SPXU. Handily enough, the ETF does also provide liquid options contracts, ideal for selling off or buying a part of the distribution. In summary, it makes risk management easier.

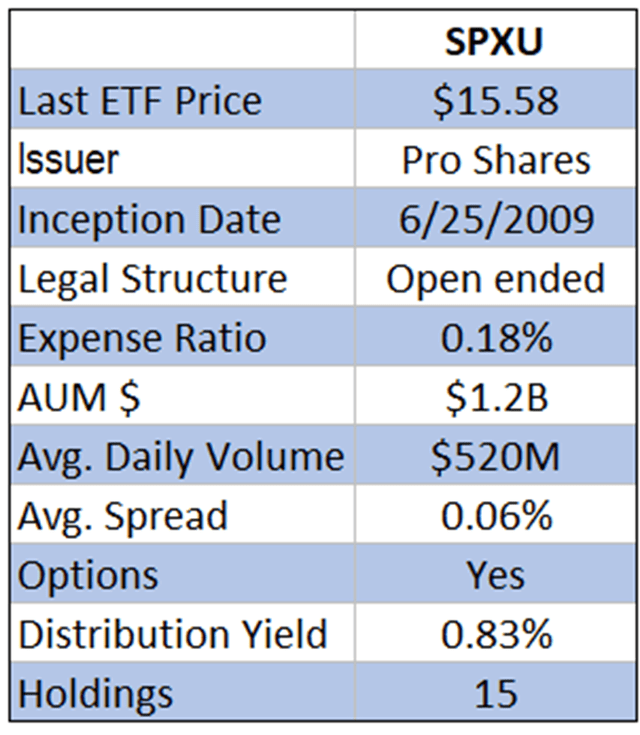

Spreadsheet developed by author

ETF Analysis – SPXU: Note the huge average daily volume reflective of high turnover of the fund and short duration holdings.

Key Takeaways

SPXU – Ultra Pro Short S&P 500 is Pro Shares negative 3x inverse leveraged ETF. It occupies a growing niche of exotic ETFs generally used for a purpose beyond simply delivering positive risk adjusted returns.

In this instance, it is a tool for portfolio hedging or a leveraged directional wager over a very short time frame. The product is not for hodlers but rather tactical traders. It is heaped with risks related to compounding, path dependency, daily resetting, and use of OTC derivates.

Accordingly, money managers should handle with great care.

Be the first to comment