Bastar

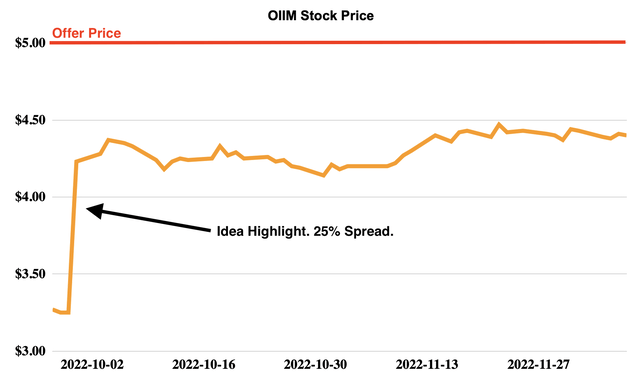

I covered O2Micro International (NASDAQ:OIIM) to the members of my marketplace service Special Situation Investing back in September, immediately after the definitive privatization agreement at $5/share was announced. At the time the spread stood at 25%, which seemed way too wide and the market was clearly asleep at the wheel in front of this intriguing setup. Although then the spread has narrowed to 12%, I think this arbitrage is still attractive.

Yahoo Finance, Author’s Calculations

O2Micro International is being taken private at $5/ADS by a consortium consisting of Chinese PE firm FNOF Precious Honour Limited and OIIM’s CEO/chair. Note that the $5/ADS consideration needs to be adjusted for the $0.05/ADS cancellation and $0.02/ADS distribution fee. The adjusted offer price is thus $4.93/ADS.

The primary remaining condition is shareholder approval. The meeting date hasn’t been announced yet and I think this might be the first small catalyst here for the spread to narrow. Share prices of recent similar going-private transactions, namely BLCT and GSMG, reacted positively to the announcements of shareholder meetings. During the recent Q3 earnings call Q&A session, management noted they continue to target Q1’23 as the closing date.

Shareholder approval looks very likely as 2/3 of the votes cast are needed and the buyers own just over 17%. The deal comes amidst the semiconductor market downturn and is also at a material 50%+ premium to pre-announcement prices. I expect shareholders will happily cash out here – I have not witnessed any similar Chinese privatizations being downvoted by shareholders.

The buyer consortium’s intentions seem serious. The consortium includes a reputable Chinese PE firm FNOF Precious Honour Limited – a vehicle of Forebright Capital Management, which is a spin-off from a prominent and public-listed Chinese investment firm China Everbright ($1bn market cap, $25bn AUM). Forebright Capital notes that it has successfully completed several going private transactions involving China-based US-listed issuers in recent years, and the market valuation of these privatized companies exceeded, in aggregate, $850m. OIIM management including Chairman/CEO and CFO have also eventually joined the buyers’ consortium – I take this as a strong positive and think this increases the chance of a successful outcome.

There is a decent chance that OIIM is getting privatized just to be re-listed on the local Chinese stock exchange later. Overall, the sentiment towards Chinese stocks in the US markets has been extremely negative for a while now. It seems that OIIM could fetch a significantly higher multiple if relisted on a domestic exchange in China. OIIM’s Shanghai-listed peer Amlogic ($4bn market cap) trades at 33x 2021 earnings vs 11x for OIIM. Amlogic also looks more expensive on pre-COVID earnings.

Another example of the benefits of re-listing on Shanghai is one of Forebright Capital’s previous investments, Jinpan International, currently called Jinpan Smart Technology. The company was taken private in 2016 and relisted on the Shanghai stock exchange last year. Jinpan now trades at $2.3bn market cap vs $100m privatization price.

US-listed Chinese privatizations with definitive agreements in place, tend to close successfully. My research shows that only 2 such transactions have failed over the last 5 years. In OIIM’s case, the pro-longed review/negotiations till the signing of the definitive agreement and management later joining the buyer’s consortium add confidence that buyers will not walk away. The downward offer price adjustment from the initial non-binding $5.5/share, should not be viewed as a negative sign – it seems to be a rather rational adjustment given the recent industry headwinds as well as confirmation of buyers’ continued interest in the transaction.

In the unlikely scenario that the merger breaks, the downside to pre-announcement prices is just below 30%.

Conclusion

Despite the market’s skepticism toward anything China-related, OIIM’s privatization is likely to close successfully in the coming months and offers 12% arbitrage gains or c. 50% IRR.

Highest conviction ideas for Premium subscribers first

Thanks for reading my article. Make sure to also check out my premium service – Special Situation Investing. Now is a perfect time to join – with today’s high equity market volatility, there is an abundance of lucrative event-driven opportunities to capitalize on. So far our strategy has generated 30-50% returns annually. We expect the same going forward.

SIGN UP NOW and receive instant access to my highest conviction investment ideas + premium weekly newsletter.

Be the first to comment