Pavel Vozmischev/iStock via Getty Images

Introduction

I’ve been writing about Energy Transfer (NYSE:ET) for a number of years. In times past, sometimes it felt like hardly any Seeking Alpha authors were writing about the company, whereas now it seems like everyone is writing about ET. Personally, I’m happy for it. Let’s call it the “bandwagon” factor.

Over the past month, I counted 17 Seeking Alpha focus articles about Energy Transfer. In 2019 and 2018, there were ~half the number of articles written about ET over the same time period. In each of those prior years, one of those articles was mine.

Is this important? Well, I’ve found that there seems to be a correlation between the relative volume of S.A. ticker coverage and broad stock sentiment. Stock sentiment is a factor in determining price. It may reveal itself in higher valuation multiples.

In the article, I’ll offer several observations about topics that revolve around the most recent earnings report but were not unpacked. These include:

-

The current debt leverage ratio as determined by the rating agencies

-

The sale of Energy Transfer’s Canadian assets

-

The status of the OG&E sale of ET common units

-

The cash distribution

-

The “KW factor”

-

Common unit performance

-

Unit Valuation

General Energy Transfer Investment Thesis

I remain constructive on Energy Transfer common units. Over the past few years, my investment thesis hasn’t changed much.

Energy Transfer has assembled one of the strongest sets of pipeline transportation assets in the United States. Several years ago, management undertook major construction projects that became lightning rods for pipeline opponents. Doing so cost the company dearly in terms of financial performance. “Pioneers take the arrows.”

However, these projects are now complete. Opponents’ attacks have lost some starch. The company is now running for cash and reducing debt leverage. ET units may be poised to command comparable valuation multiples to peers. If so, ET stock remains discounted and offers strong cash distributions yield to boot.

Let’s break down the bullet points denoted earlier.

Debt Leverage

From time-to-time, I’ve provided readers with my take on Energy Transfer’s debt-to-EBITDA ratio. Rightfully, this metric has dogged the stock for a long time. Some years back, Energy Transfer management over-leveraged itself. Some of it had to do with timing (the 2015 – 2016 energy price collapse), and a lot of it had to do with chasing too many deals with too many hooks and sinkers attached.

Using what I believe is the S&P 500 methodology, I calculate a current 4.3x or 4.4x leverage ratio. That’s within the 4.0x to 4.5x sideboards management (and the rating agencies) have been fixated upon for many years. However, on the 2Q 2022 earnings conference call, co-CEO Tom Long had this to say:

We also expect to reach our leverage target range by the end of this year and going forward, expect our strong coverage and balance sheet strength to allow us to further prioritize growth within our capital allocation strategy.

Are my figures off? Well, that’s possible. In previous articles, I’ve provided the specific inputs utilized. You can check the inputs and my math from the earnings report and filings.

I suspect the apparent disconnect has more to do with differing methodologies used by the three major rating agencies. I’ve pointed this out before. Furthermore, I understand Energy Transfer management is most focused upon Moody’s leverage ratio calculation. Evidently, Moody’s is the most conservatively computed ratio between the credit rating agencies: S&P, Moody’s and Fitch.

Nonetheless, ET is on the doorstep: right here and right now.

Furthermore, using my understanding of the S&P 500 methodology, Energy Transfer may find its year-end 2022 debt leverage ratio near the low end of the target range. Indeed, this presumes $11.3 billion EBITDA (management’s 2022 guidance midpoint) and NO debt reduction from current levels.

Barring unforeseen circumstances, it appears ET leadership has finally got this issue put to bed. It removes an overhang that’s been hindering the stock for years.

Canadian Asset Sale

In August, Energy Transfer announced the completion of the sale of its Canadian assets. The sale raised $270 million cash and reduced consolidated debt by $550 million. All good stuff. These assets were not core to the company and management got a good price for them.

However, I don’t expect the deal to have a significant effect on net debt.

On the conference call, Tom Long offered remarks on another transaction:

This week, Energy Transfer signed an agreement to acquire Woodford Express, LLC, a Mid-Continent gas gathering and processing system for approximately $485 million. This bolt-on opportunity will provide a roughly 450 million cubic foot per day of cryogenic gas processing and treating capacity in Grady County, Oklahoma as well more than 200 miles of low and mid-pressure gathering lines in the heart of the SCOOP play.

The assets are already connected to our inter and intrastate systems as well our gas gathering system. The system is supported by dedicated acreage with long-term predominantly fixed fee contracts with active proven producers. We’re excited to have these strong assets, quality customer contracts and established operations to our footprint in the Mid-Continent, all at an attractive valuation that will be immediately accretive to Energy Transfer unitholders.

The Woodford Express transaction more or less washes out the ET Canada deal. The Canadian assets netted $270 million cash and reduced debt by $550 million. Woodford should suck down ~$485 million. Net/net is $335 million, nothing to sneeze at, but it amounts to less than one percent of Energy Transfer’s current consolidated debt and lease liabilities.

On the other hand, investors should take note of some key wording in the statement: “…immediately accretive to Energy Transfer unitholders.”

The same language was used when the Enable Midstream assets were purchased.

Management sold outlying non-core assets and exchanged these for assets found in the heart of the domestic, unconventional Anadarko Basin; located in South Central Oklahoma. The pipes are connected to Energy Transfer’s existing system and offer immediate cash, presumably better than what was coming in from Energy Transfer Canada.

OG&E Common Unit Sale

Somewhat off the radar screen has been the sale of ET common units by CenterPoint Energy (CNP) and OGE Energy (OGE). Please recall the Enable Midstream acquisition was equity-funded by ET common units. After the sale closed, Enable Midstream unitholders CenterPoint and OGE announced their intent to peddle the ET units.

CenterPoint finished offloading their units earlier this year. They enjoyed ~20 percent uplift on the sale and got a credit agency rating kicker.

Meanwhile, OGE has quietly been selling its units, too. Initially, the company received 95.4 million units. As of June 30, 2022, management announced the business sold 73.3 million units, leaving 22.1 million remaining. This is less than one percent of the total Energy Transfer diluted common units outstanding, and about one days’ average trading volume for ET.

I expect OGE to wind up the process in the third quarter.

The completed OGE sale will remove another overhang on the stock. Immediately after the Enable Midstream acquisition, about 200 million common units were on the block. It’s down to a tenth of that.

Energy Transfer’s Cash Distribution

In 3Q 2020, Energy Transfer slashed its quarterly common unit dividend in half; from 30.5 cents to 15.25 cents.

Investors howled.

Since that time, the payout has been increasing. Here’s the lowdown:

4Q 2021 distribution raised to 17.5 cents (15 percent)

1Q 2022 distribution raised to 20 cents (15 percent)

2Q 2022 distribution raised to 23 cents (15 percent)

On the 2Q 2022 conference call, Tom Long added these remarks:

As a reminder, future increases to distribution level will be evaluated quarterly with the ultimate goal of returning distributions to the previous level of $0.305 per quarter or $1.22 on an annualized basis while balancing our leverage target, growth opportunities and unit buybacks.

Let’s do some arithmetic.

The current distribution is 23 cents. If we add 15%, we have ~26.5 cents. Increase it another 15 percent and we’re back to 30.5 cents per quarter.

I suspect we’ve cracked the code. In another few quarters we should be back to the old cash distribution. On today’s closing bid, that’s a 10 percent distribution yield when the ten-year T-note yields 3 percent.

My rule-of-thumb is a reasonably valued midstream MLP should offer a cash yield about 300 bps above the ten-year.

While we’re not to the valuation section of this article yet, a 6 percent yield on ET common units offering $1.22 a year suggest a $20 stock.

The “KW Factor”

While likely overhyped by ET bears, the “KW Factor” certainly appears to remain a function the stock.

Unquestionably, Executive Chairman Kelcy Warren remains at the center of the Energy Transfer franchise. Energy Transfer LP is not a C-corp. As a Limited Partnership managed by a General Partner, the Executive Chairman and largest individual unitholder is Kelcy Warren; he holds the aces.

We also know sentiment can and does play a role in stock prices; likely an above average role in the case of Energy Transfer.

It’s doesn’t matter that Kelcy Warren took a sleepy intrastate pipeline company and turned it into one of America’s largest and most dynamic midstream / transportation companies in the United States.

Based upon TTM revenues, peers Enterprise Products (EPD), Plains All American (PAA), Kinder Morgan (KMI), Magellan Midstream (MMP) or MPLX (MPLX) are not even close. Check the most recent earnings releases for these companies; it hammers home the point.

On the August earnings conference call, was the KW Factor in play?

Here’s some Q&A commentary from Energy Transfer management. I’ve highlighted certain sections:

Co-CEO Mackie McCrea on Energy Transfer’s interest in purchasing petrochemical assets:

When Kelsey kind of gave us the directive that we need to step in to pet chem [petrochemicals], we certainly are doing that, two perspectives: one, we’re – from an M&A perspective, anything that’s for sale, we’ll take a look at pretty much like anything in the industry; and then on the organic side, we’re excited the project that we’re working on…

[Author observation: maybe better if these comments sounded a little more process-driven / deliberate?]

Co-CEO Tom Long on the Lake Charles LNG project:

Well, the bottom line of that entry is at what point are we going to go to our Board and our Executive Chairman to ask for approval. I think we’ve said publicly that that we can get to that 12% to 14% depending on the customer mix and of course, the infrastructure funds that will be a part of this…but certainly, we’ll make that decision at the right time here towards the end of the year.

[Author observation: maybe better if these remarks ended with a period and without the boldface?]

There wasn’t anything wrong with these statements. No one mis-spoke. However, ET stock fell 5.3 percent during two trading sessions: the day of the earnings conference call and the next day. Meanwhile, the Alerian MLP ETF (AMLP) gave back 2.1 percent and bellwethers Enterpriser Products Partners and Magellan Midstream eased 1.7 percent and 1.3 percent, respectively.

Maybe I’m too jumpy. Maybe it’s just optics. Or coincidence.

Look, the Enable Midstream acquisition / integration has gone well. I am highly confident the Woodford Express deal will pan out just fine. The SemGroup purchase wasn’t so hot, but it wasn’t a terrible move, either. I think the Lake Charles LNG project has legs.

I just think it would be better if we hear about the good projects Energy Transfer management and its board are contemplating instead of referencing a “KW directive.” Perhaps it’s best to highlight seeking approval from the Board and not call out the “Executive Chairman” specifically when speaking about getting a major project FID (Final Investment Decision).

Common Unit Performance

Just for the record, I thought it worthwhile to point out Energy Transfer common units have been doing well. I’ve observed some reader comments on other S.A. articles that might have one believe ET stock hasn’t been performing well.

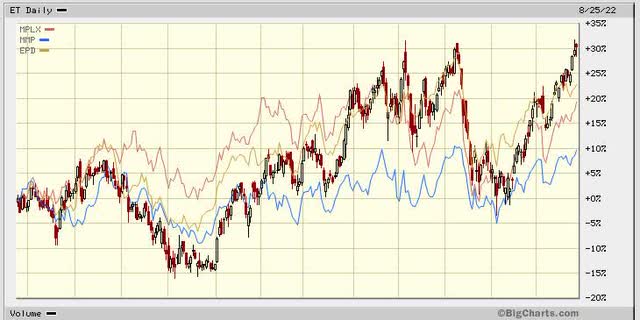

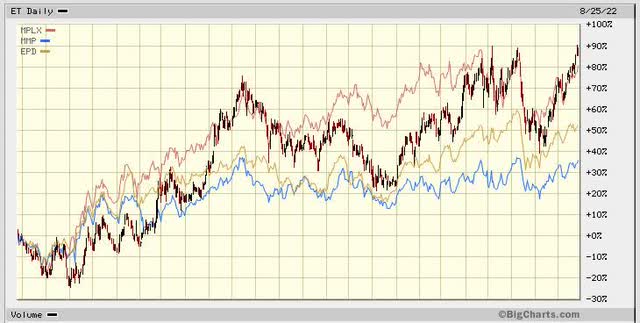

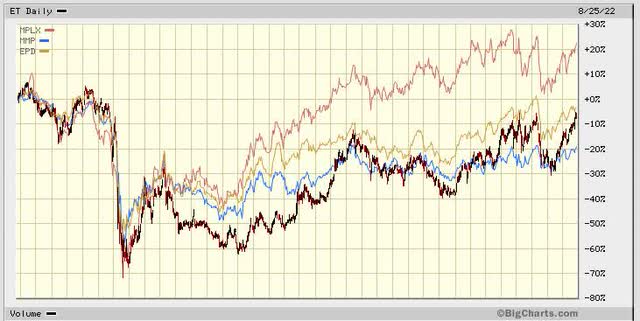

Here are one-year, two-year, and three-year price charts highlighting Energy Transfer (candlesticks line) versus Enterprise Products, Magellan Midstream, and MPLX:

ET One-Year Price versus Peers

ET Two-Year Price versus Peers

ET Three-Year Price versus Peers

We find Energy Transfer stock outperformed peers by a solid margin over the past one-year and two-year periods. It’s middle-of-the-pack on the three-year chart.

Now before anyone skips immediately to the comment section to cry bloody murder, a few observations are in order.

- Such charting is an indicative measure, not absolute. I offered three charts since it’s better than cherry-picking some specific time period. Of course, an individual’s personal returns may vary. For many of us, it varies a lot.

- Frankly, if an investor elects to buy an entire position, all at one time, all on one date, hold it for three years, and refuse to add on weakness or trim on strength, then he / she may not be demonstrating the best portfolio management skills.

- While an article for another day, I’ve never purchased a stock position under the aforementioned parameters. One buys a stock slowly in increments, building a position over time. Within the past three years, we’ve had two chances to buy ET units at ~$5 each and another opportunity to buy when it fell to ~$8. While nearly no one gets the absolute bottom, and absolutely no one gets them consistently. It’s reasonable to build a position on relative weakness so long as there’s a reasonable Fair Value Estimate standing behind it.

- Energy stocks are not buy-and-forget investments. Nor are midstream MLPs bond substitutes.

Bottom line: Of late, Energy Transfer units have done well. The fundamentals have improved greatly since the 2015-2016 energy commodity crash. Riding the back of a bull market in energy, the future of the business looks promising in absolute terms and versus peers.

Unit Valuation

I contend determining a Fair Value Estimate is integral to any investment decision. I define at FVE as an “indifference point,” whereby I would become neutral (“indifferent”) to owning or selling the investment.

Over the past several years, I will be the first to tell you my Energy Transfer FVEs have varied. I’ve found these units more difficult to value than most other securities I cover. Company rollups, political morasses, lawsuits, acquisitions, and affiliated activity made it tough. On the other hand, my recent FVEs indicate ET common units continue to be discounted.

My FVEs seek to look out over a period of 12 to 18 months.

Some recent history:

In 2019, I suggested a FVE $14 or $15, “hold” early in the year, “buy” as the year progressed and the units eased. ET ended the year at $13.

In 2020 I indicated a FVE $20 but identified no catalysts early in the year; then Covid19 destroyed energy stocks; I sought to “buy” as the price dropped throughout the year. ET ended the year a bit above $6 a unit.

In 2021 my FVE was $15 to $16, and I had a “buy” on. The common units ended the year at $8.25.

My current 2022 FVE is $18 to $19, I continue to keep a “buy” the stock. The recent bid is around $12.

Rationale behind my current FVE is found below:

First, let’s examine Energy Transfer’s TTM EV / EBITDA. ET continues to lag peers.

gurufocus.com

I believe this is a function of relatively weak return-on-invested-capital and high debt-leverage. As noted earlier, the debt leverage issue is receding. RoIC remains lower than peers. I’ve covered the latter in several previous articles.

EPD, MMP, and MPLX currently command EV/EBITDA multiples between 9.9x and 12.7x, respectively.

I believe if Energy Transfer management can meet or exceed 2022 forecasts, probabilities are the stock may earn a 9x to 10x multiple: remaining lower-end versus peers due to lower capital returns.

If so, ET common units may have a $18 to $19 Fair Value Estimate.

A comparative, forward-looking P/DCF (Discounted Cash Flow for FY 2022) analysis adds validation to the foregoing. Enterprise Products (8.5x) Magellan Midstream (10x) and MPLX (14x) have materially higher forward P/DCF multiples than Energy Transfer (5.4x).

In 2022, I expect ET to generate about $2.25 DCF. An 8x multiple on $2.25 suggests an $18 stock, aligned with the EV/EBITDA discussion above. The 8x ratio is lower than peers but deserved until 1) the debt leverage issue has fully dissipated and 2) RoIC improves comparably versus peers.

I look forward to your comments below.

Please do your own careful due diligence before making any investment decision. This article is not a recommendation to buy or sell any stock. Good luck with all your 2022 investments.

Be the first to comment