NoLiMiT_Bkk

Situation Update

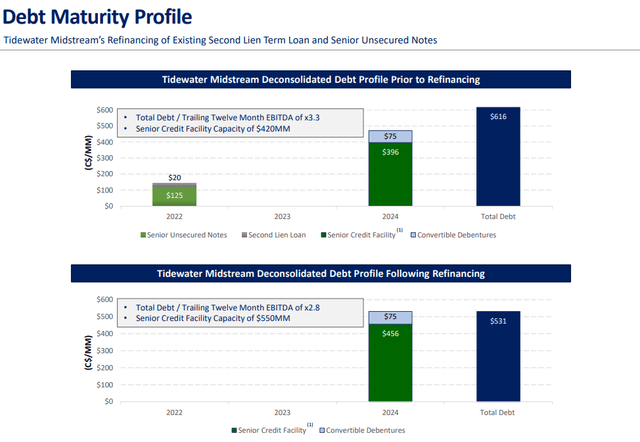

To my surprise, Tidewater Midstream (TSX:TWM:CA) (OTCPK:TWMIF) needed to tap the equity market to take out the 2022 $125 million senior unsecured bond and the remaining $20 million second-lien term loan. The equity issuance was done at $1.20/share that comes with one-half of $1.44-strike 2-year warrant. Share count increased by ~22.5%/30.3% (basic/fully-diluted). On the positive side, this transaction removes the near-term maturity and reduces leveraged.

The quality of the management team is lowered a bit for me as they couldn’t refinance a $125 million maturity at ~3.0x leverage but on the flip side I’m sympathetic as the high yield market hasn’t been open for lower-rated and small issuers like Tidewater.

Operational Update

Tidewater is firing on all cylinders. Prince George Refinery enjoys a >$100/bbl crack spread in Q2-2022. Midstream assets are at or near full capacity. Renewable Diesel Refinery is still on budget and the capital cost is further de-risked via the various renewable energy credit sales at healthy prices. This is why I’m very surprised that Tidewater couldn’t get a regular refinancing done considering all these operational highlights. Overall, there are no negative developments that I could call out on Tidewater’s key assets.

Equity Financing

Being diluted is not fun but there are some insights to be gained. First, it’s clear that people who are willing to put up new equity capital thinks the $1.20/share is attractive. In fact, the original $40.5 million public offering was upsized to $50.5 million, and the greenshoe option was still fully exercised. Second, for all intents and purposes this equity financing was negotiated by the two lead investor Birch Hill and Kicking Horse. They negotiated for a $1.44 strike (20% premium to the $1.20 deal price) 2-year warrant could indicate that they think that some material positive developments could take place in the next two years (e.g. renewable diesel goes in-service). Lastly, the warrants changed hands at $0.15, which means buyers think the upside is north of $1.60/share for Tidewater ($1.44 + $0.15 = $1.59). Obviously this gets a bit circular (i.e. buyers are buying because they think price is going up) but there are strong some bullish indication from this equity financing.

Valuation

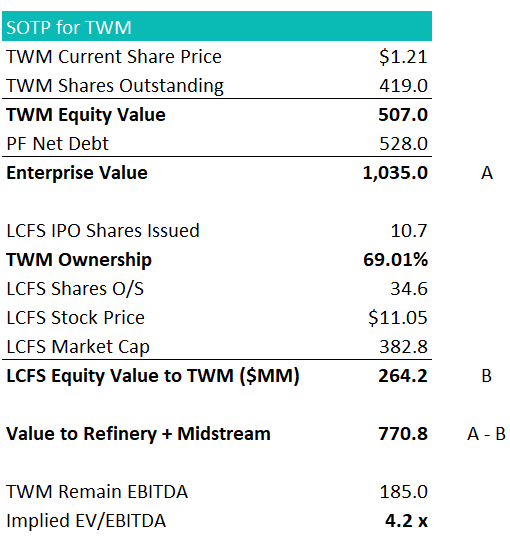

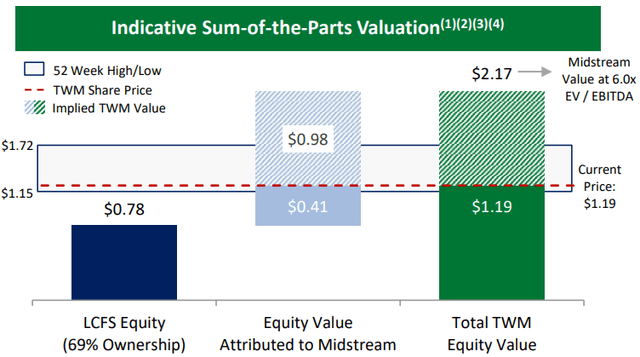

As a reminder Tidewater Midstream owns ~69% of Tidewater Renewables (LCFS:CA). LCFS IPO’ed at $15/share about a year ago and has been trading in the $11-13/share range ever since. The management is guiding $90-100 million EBITDA for the renewable diesel refinery for FY2023, combined with the existing $50 million EBITDA, LCFS should generate ~$140 million EBITDA for FY2023. This means LCFS is trading at 4.0x of FY2023 EBITDA. The single asset risk and the small size (sub $400 million market cap) explain some of the valuation discount but not all.

Subtracting the 69% stake at LCFS current market valuation implies that the midstream and refinery portfolio is trading at 4.2x of the guided $185 million EBITDA.

Author’s Estimate

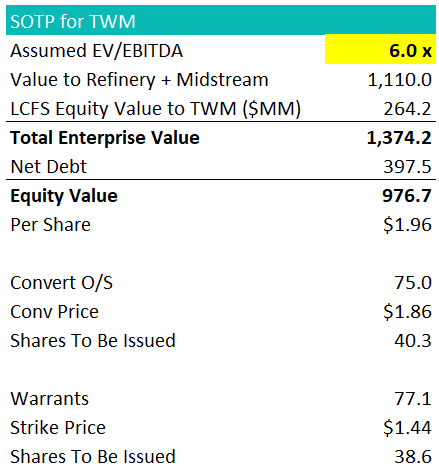

Tidewater has a slide on the sum-of-the-parts valuation but it doesn’t adjust for dilution from the $75 million convertible bond (potentially 40.3 million shares) and the warrants from the recent share issuance (potentially 26.8 million shares). Accounting for the dilution and with the midstream valued at 6.0x, I have the per share SOTP valuation just below $2/share (~60% upside). There is additionally upside from LCFS as the renewable diesel refinery comes online and demonstrate its own earnings power.

Author’s Estimate

Risk and Catalyst

Coming up with a financing plan for the Pipestone Expansion is the next catalyst. Tidewater’s intrinsic value should grow as it captures the building multiple discount (e.g. building at 6.0x EBITDA vs. 8.0x trading multiple). However, it seems like issuing equity is not off the table for the board so I’m a bit concerned that they will issue additional equity to finance growth. On the flip side I think the likelihood is low as Tidewater has just done a large round of equity issuance.

The next catalyst is in Q1-2023 when the renewable diesel is scheduled to be in service. Material cost inflation and labor shortage will challenge the budget but Tidewater seems to be managing the process well and the renewable credit market remains healthy.

Conclusion

Tidewater holds a portfolio of high quality assets and is trading with an excessive margin of safety, but at $1.0 billion EV and ~$400 million market cap it’s too small to get attention and funds flow. The market is probably having a difficult time to classify Tidewater as it holds both an oil refinery and a fleet of gas midstream plants. It’s also very difficult for a midstream company to scale in this FCF-focused environment. I believe the only way to realize the substantial embedded value in Tidewater is to sell itself in pieces to natural holders of these assets. The refinery is probably worth more in the hands of a US refinery company with existing assets on the west coast. The midstream assets are natural fit for Tidewater’s Canadian midstream peers.

In any case, more patience is required. I’m willing to wait especially considering that there are some catalysts in the next 6 months.

Be the first to comment