Kevin Dietsch/Getty Images News

The story of how the then $900 billion worth social media empire lost more than $200 billion during a couple of hours of after-hours trading after a disastrous earnings release will be remembered as one of the largest historically witnessed value destruction in stock-market history. The sheer magnitude of the shareholder’s value destruction that has taken place at Meta (NASDAQ:META) is both tragic and historic but has opened up what might become one of the best investment opportunities of this bear market.

After the disappointing earnings release and the subsequent crash, we have already had a chance to cover the company in our February article under the title: “Meta: Crash Is An Overreaction”. In the article, we have expressed our dissatisfaction with the manner in which the market priced in the guidance downgrade, but have also pointed out that this development had created a significant spread between price and value. Since then, the company has been experiencing further selling pressure and lost another 31.14%, with shares of the social media giant currently trading at $163.73 per share. This has only served to reinforce our belief that Meta represents a great value proposition and carries significant upside potential.

Facing Multiple Headwinds

The difficulties that the least liked social media company experiences are in fact three-fold. First, the company seems to have hit what can be considered a high ceiling in terms of the maximum reach of its main social platforms such as Facebook or Instagram. The social media giant is finding it very difficult to continue to grow the reach of its product base, with some of the more stagnant ones like Facebook experiencing their first declines in users since their inception. This somewhat serves to damage the reputation of Meta as a “high-growth” company, with the first indications that the company entering into a “mature phase”.

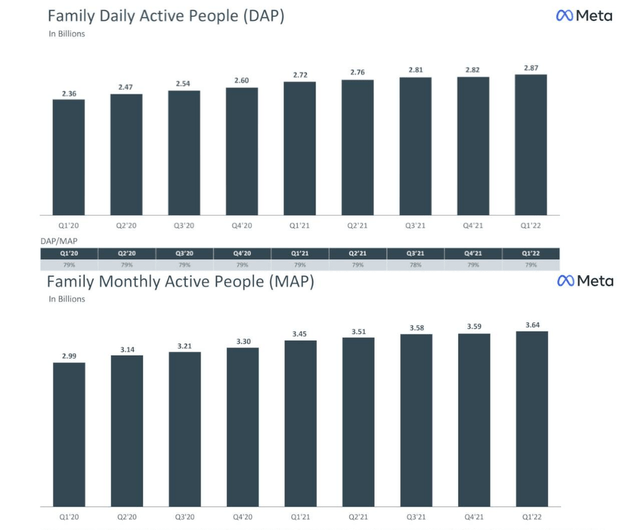

DAP and MAP Growth (Q1 2022 Earnings)

In the new world reality where generations remain completely obsessed with social media, Meta remains the undisputed king of social media. The company has reached 3.64 billion monthly active users across its platforms and has generated 2.87 billion family daily active people. That is a level of consumer penetration that is unprecedented. With an estimated world population of close to 8 billion people, where three billion people still do not have access to the internet and almost a billion lack access to clean water, achieving 45% penetration is a tremendous achievement.

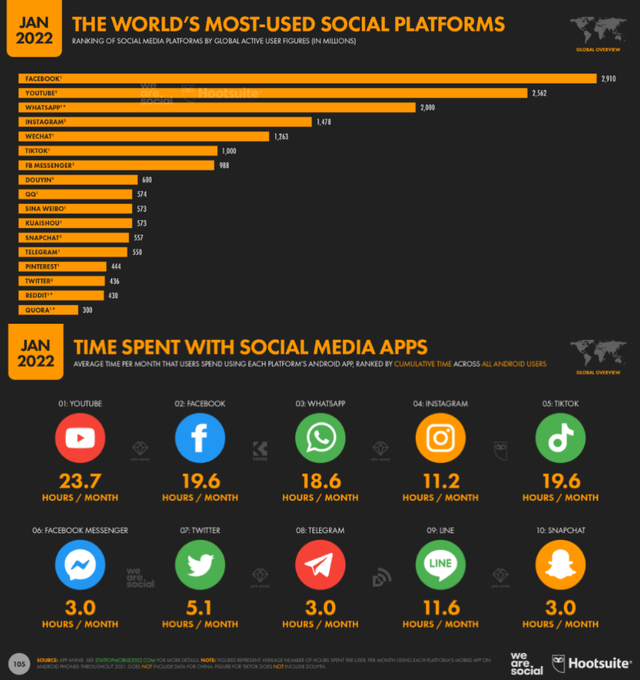

Social Media Statistics (We Are Social)

The company still reigns supreme across all tracked parameters, having both a broader reach and more users than the competition. According to the research from We Are Social, Meta owns three out of five of the most popular social media sites in terms of global monthly active users. Also, the company apps take three out of the top five list in terms of average time spent per month. Even with newly established rivals such as Snap (SNAP) or ByteDance (BDNCE), Meta remains the undisputed king of social media.

The second part of the issue is the increasingly negative relationship between the social media powerhouse and companies such as Apple (AAPL) or Alphabet (GOOG) (GOOGL) who are actively seeking to implement new privacy and security features on their iOS and Android OS platforms. The relationship which has been deteriorating over the course of the past couple of years has only taken a turn for worse. The latest in the growing rivalry was the decision from the former to implement major privacy changes to its iOS 14 operating system which had the result of limiting Meta’s ability to generate targeted ads for its clients.

I talked last quarter about some of the near-term challenges facing our business. Some are specific to Meta, like our transition to short-form video, which doesn’t monetize as well for now but which we’re quite optimistic about over the long term. Some are specific to our industry, like signal loss resulting from Apple’s iOS changes, which is a meaningful headwind, but we also expect that with the right technology investments we’ll navigate okay over time.

Mark Zuckerberg, CEO – Q1 2022 Earnings

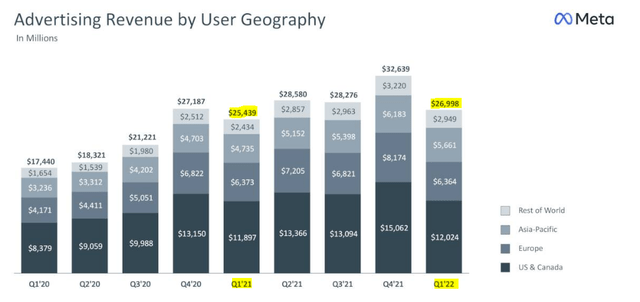

Not only impacting the company’s ability to generate top and bottom-line growth over the course of the next couple of years, but the actions by Apple also shook the market’s perception of the depth of Meta’s moat. The company’s business model proved somewhat vulnerable to the actions of other seemingly unrelated tech companies, which the market strongly dislikes. The push towards privacy-friendly environments set many tech companies on a collision course with Meta. However, from the latest quarterly reports, we can see that advertising revenues are still up 6.13%. However, when compared to the last year’s quarterly growth for the same period of 45.81%, we can already see the first impact of the limitations.

Advertising Revenue (Meta Q1 2022 Earnings)

The third issue is the question of how well will Meta execute its transition over to the “Metaverse”, and will the project prove as a significant growth factor or a giant flop.

The Metaverse Dilemma

The strong pivot to Zuckerberg’s brainchild project took place during an increasingly negative PR and political landscape for the FAANG stock, with the company even deciding to completely rebrand from “Facebook” to the new and more in line with the current goals “Meta Platforms” earlier this year. The transition has been finalized last month as the company no longer trades under its old stock ticker “FB”, but is instead using the new “META” ticker.

Meta has been on the received end of the stick for some time now in regards to their attempt to shift everyone’s focus to their new metaverse project. The social media giant even went as far as to pledge a $10 billion investment in these areas over the course of the next twelve months. The entire move to “the metaverse” received an almost completely negative reception by both investors and analysts, with none seemingly taking a particular liking to the project.

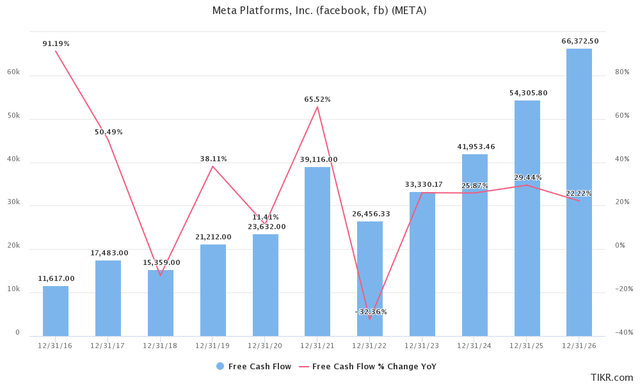

Free Cash Flow Estimates (TIKR Terminal)

While the initial investment does seem to be tremendously expensive, we should keep in mind how much cash the company manages to generate and weigh the expenses accordingly. In order to fully understand the shift to the metaverse, I believe we should take a step back and consider the possibilities for the company:

- Introducing a dividend – This company could decide to return value to the shareholders by introducing a dividend, which would make the company the second FAANG stock that has decided to go down that road. As analyst projections for FCF remain strong, the company is expected to generate $33-41 billion per year in free cash flow in the upcoming period. Assuming that Meta would be willing to distribute a quarter of its FCF, we would be discussing a potential 3-4% dividend yield given current prices.

- More buy-back programs – Meta could divert more cash flow towards its newly introduced share buy-back programs. Current buy-back initiatives already saw the number of shares outstanding being lowered to 2.70 billion shares from the 2.82 billion shares at the same time last year, according to the latest quarterly report. Ironically, this has only drawn further criticism related mostly to the price at which the buy-backs were executed knowing the “weaker” earnings are down the road. This is definitely something that we would like to see more of, especially so at these depressed prices. Another round of buy-backs with the same $40-50 billion the company had authorized could see close to 300 million of shares bought back given the current prices depressed prices.

- M&A Activity – The possibly greatest success story of the company was the 2012 purchase of Instagram for merely a billion dollars, which later went on to become one of the most popular social media platforms in the world and remains the driving force of growth for the company. The social media giant most definitely does have the pocketbook that would allow them to attempt to find further acquisition targets, both inside and outside of the social media space. But given the developing situation surrounding Meta’s relationship with Washington and the general reputational impact the company has suffered throughout the past couple of years, it is safe to conclude that acquisitions remain unrealistic at this point.

In the end, what is left is diverting more funds into R&D, and henceforth we arrive at the inception of the Metaverse project and the expenses associated with it which attracted so much critique. While I am not the greatest fan of the project, I can certainly understand the logic of pursuing new revenue streams, especially if capital cannot be efficiently deployed elsewhere.

Further to the point, the project is self in my view is not as far-fetched as it seems to have been. While many have this borderline dystopian view of the metaverse, we can see multiple down-to-earth and realistic uses for the project that can end up being immensely profitable, and that are feasible during the next decade.

- Business Related Use – Blending the reality of remote work in the modern corporate environment through virtual meetings and virtual offices; Virtual tours use in property markets and tourism; Brilliant tool for healthcare accessibility, etc.

- Entertainment Related Use – Extreme Sports; Social interaction; Virtual concerts and meetings; The almost unlimited erotic potential, etc.

- Gaming Use – With VR gaining more traction by the day in the gaming phase, only technical limitations seem to stand between now and full-time adoption.

Valuations and competitors

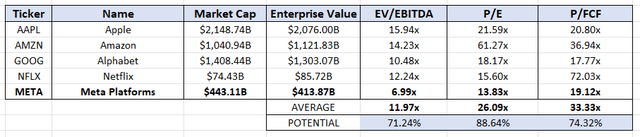

Attempting to approach the question of valuation when it comes to Meta is immensely difficult. As we have already discussed, the company is in a category of its own, almost finding itself as the king of the hill. However, as it is mostly recognized as a member of the FAANG group, historically its valuations were often compared to the rest of the stocks within the group. This is how Meta’s valuations look today when compared directly to other FAANG stocks.

FAANG Comparative Valuation (Author Spreadsheet)

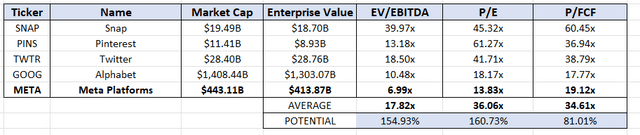

Such a comparison would make the company look significantly undervalued. It would place the price in the $278-306 range on comparable companies alone. Still, considering that its business is almost solely based on advertising, it would be much more beneficial to compare it to similar social media companies with a strong reliance on advertising revenue generation, such as Pinterest (PINS), Twitter (TWTR), or Snap.

Peer Comparative Valuation (Author Spreadsheet)

When comparing the company to its direct social media peers, we can conclude that it is making Meta look even more undervalued than before, with the potential upside indicating a target price between $298-423.

It would seem that there are two schools of thought when discussing the range of competitors Meta is facing. The first would indicate that the only real competition Meta has to face are rivals in the social media space that have a strong reliance on advertising. The second school of thought would expand that range of rivals with the idea that in today’s world Meta is going to have to compete with any and all companies that fight for consumer attention. That would include, first and foremost, Alphabet with its YouTube platform, but also a myriad of various streaming companies such as Netflix (NFLX), Warner Bros Discovery (WBD), Amazon (AMZN) or Disney (DIS), but also modern gaming companies including the likes of Electronic Arts (EA) or Activision (ATVI). In other words, all the companies with significant consumer bases are slowly shifting their business models to include various degrees of advertising.

Final thoughts and conclusions

The question of Meta is first and foremost a 3-point question of execution. First, the social media giant stands at a test of how well it will circumnavigate the rise of the popularity of online privacy. Second, the company will have to find new ways of monetizing its platforms in order to generate additional sources of revenue, considering it will no longer be able to “sell the growth” story for much longer. And third, it is an open question as to how lucrative the pivot towards the “metaverse” will ultimately prove to be, with the leadership being more willing than ever to make high-stakes gambits on the yet unproven model.

It remains a fact that the company will continue to suffer in terms of both top and bottom lines growth from the reinvigorated focus on personal privacy that can only get much worse before it can get any better. With companies such as Apple doubling down on their privacy crackdown, and companies like Alphabet looking for possibilities to implement similar solutions on their android OS, consumers are seemingly more aware of privacy matters than ever. Furthermore, the recession-like macroeconomic environment means that Meta is going to have to face and endure a slowdown in demand for advertising services, which is another blow for the social media giant.

If the venture into the metaverse proves a giant flop for Meta, it is simply another good idea that failed to materialize. Sometimes it is okay if things simply do not work out, because, at other times, we get something like Amazon Web Services. Companies with extraordinary cash-generating potential such as Meta should utilize what Monish Pabrai would define as the “spawner framework” to continuously pursue growth. If the company is on a road to generating more than $200 billion in free cash flow over the next five years, a $20-30 billion investment into a project such as a Metaverse does not seem that much of a waste, especially considering the new revenue streams such an endeavor could unlock. In the end, we remain confident that the social media giant will find a way to leverage its 3.6 billion strong user base to weather the almost perfect storm of negativity that is surrounding it and ultimately prove one of the best investment opportunities of the year.

Be the first to comment