gremlin/E+ via Getty Images

Investment Thesis: While MakeMyTrip (NASDAQ:MMYT) still needs to see a return to positive earnings, the stock could still see upside if revenue and cash growth continue.

In a previous article back in April, I made the argument that in spite of a challenging macroeconomic environment, MakeMyTrip could be in a good position for further growth given the strong recovery of both the Hotels & Packages and Air Ticketing segments over the past year.

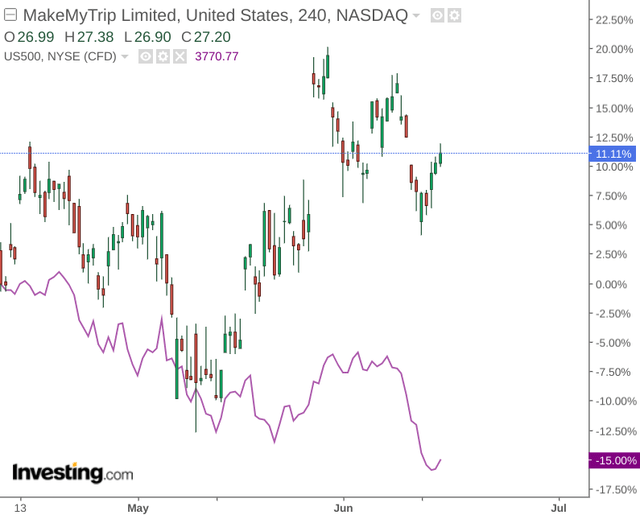

Since April, we can see that the stock is up by over 11%, in contrast to the 15% decline of the S&P 500.

Overall, the recovery in growth for MakeMyTrip has been encouraging. The purpose of this article is to investigate in further detail whether the company can sustain the recovery in growth on the basis of recent results, as well as assess the company’s cash position to determine whether MakeMyTrip could withstand a potentially new downturn in the travel market as a result of concerns with respect to inflation and COVID.

Performance

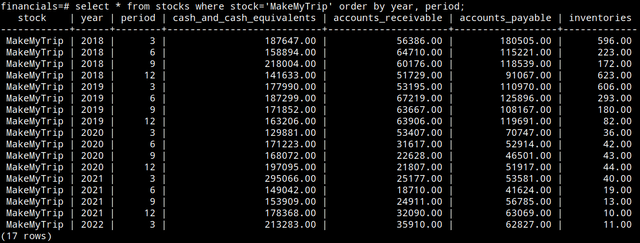

To get a better overview of the financial situation of MakeMyTrip, I decided to gather data from 2018 to 2021 inclusive regarding the company’s cash position from historical financial statements, particularly in relation to that of accounts receivable and accounts payable.

Specifically, I decided to collate this information into a SQL table for further analysis:

Figures sourced from historical financial statements for Lindt & Sprungli. SQL table created by author.

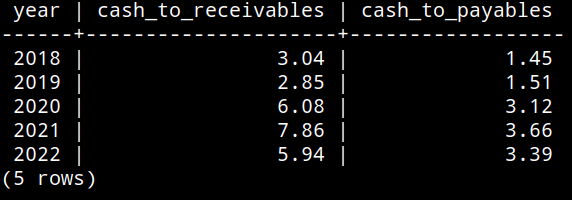

Averaging by year, the ratios for cash to receivables and cash to payables were calculated.

Financial ratios calculated by author using SQL.

We can see that overall (and allowing for the fact that only one quarter of data is included in the analysis for 2022) – the company’s cash position has strengthened over the past five years.

Specifically, we can see that both cash to receivables and cash to payables are higher than in 2018 – which means that MakeMyTrip holds sufficient cash to account for payment delays from debtors, while still being more comfortably able to conserve cash while meeting obligations to its own creditors.

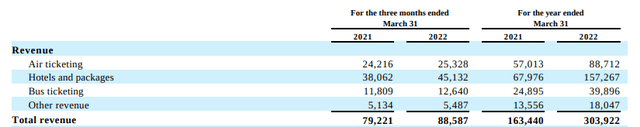

When looking at the most recent quarterly results, we can see that revenue growth across the company’s segments remained strong on both a three month and year end basis.

MakeMyTrip Fiscal 2022 Fourth Quarter and Full Year Results

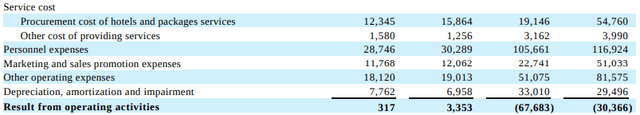

While revenue growth was strong, the company still recorded negative earnings of -$0.42 in the most recent quarter compared to that of -$0.52 in the previous year due to high personnel, marketing and procurement expenses.

MakeMyTrip Fiscal 2022 Fourth Quarter and Full Year Results

While the company still has yet to see positive earnings, I take the view that if MakeMyTrip continues to maintain a healthy cash position to meet its debt obligations, then investors will tolerate higher expenses to a degree if it means that revenue continues to grow robustly.

Looking Forward

As I mentioned in my previous articles on MakeMyTrip, one big advantage this company has is access to the domestic Indian travel market. As such, it is not as dependent on a stable international travel situation to sustain growth.

While the travel industry globally has been opening back up, inflation and higher fuel prices along with travel disruptions have proven to be bottlenecks in terms of overall recovery. Moreover, while disruptions with respect to COVID have started to take a back seat for now – one cannot rule out further disruptions as the Northern Hemisphere heads into the winter season.

In this regard, MakeMyTrip has been continuing to bolster its domestic presence, with homestay listings from Tier II cities having increased by over 70% from pre-COVID levels. In this regard, the company is in a good position to continue bolstering revenue growth across its domestic market as the number of potential hosts looking to list their property on the site continues to rise.

Moreover, while Western travel companies are expected to see a seasonal decline in business activity after the summer months, MakeMyTrip is in a good position to capitalise on the peak season for travel across India, which traditionally runs from October to March.

Conclusion

To conclude, while MakeMyTrip has yet to return to positive earnings, revenue growth seems to be robust and the company appears to have a strong cash position.

While inflationary pressures may hinder the rebound that we have been seeing in international travel – I take the view that MakeMyTrip’s domestic presence in India could allow the company to reasonably withstand such pressures.

Be the first to comment