bjdlzx

Published on the Value Lab 29/7/22

We just published an article on Enel Chile (NYSE:ENIC) trying to divine the quarterly release. We were somewhat right but mostly wrong about EBITDA evolutions with spot prices still weighing heavily on the company and the hydrology situation continuing to trend downwards. At least, ENIC sold its transmission business at what appears to be a great multiple, and this accretion should be very welcome to the stalwart ENIC shareholders.

Quick View On Q2

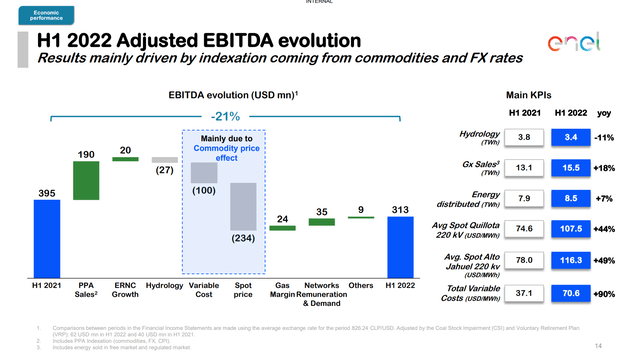

The Q2 situation continues to trend downwards. The contribution from PPA sales was very positive, reflecting the reversal of indexation and margin effects on PPA agreements that we focused on in our prior article. But the benefits end there. Hydrology was already quite weak in 2021, and it continues to weaken in 2022 H1, although reservoirs are apparently refilling a bit in Q2. This is very bad for the company, because it makes them more dependent on supplementing their energy production using coal and gas, where gas is less available and both coal and gas have become vastly more expensive. This massive bloat in spot price headwinds has continued to decimate EBITDA.

EBITDA Evolution (Q2 2022 Pres)

Copper and other prices have reversed as well as the Chilean Peso. PPA margin reversals are happening and this is good. But ultimately given the energy situation, which is buoyed by exogenous geopolitical factors relatively unrelated to economic conditions, ENIC has become very levered to the hydrology situation. This important interaction highlights to investors that the stock is highly speculative on weather effects due to the interaction of its input costs with the commodity environment. With a recovery in hydrology, this would really not be a problem, but ENIC is now a bet on whether it will rain in Chile. Unless you’re a shaman, best to stay away.

Transmission Sale

What should be of consolation to shareholders is the sale of ENIC’s transmission concession. Let us say that more or less this business was annualising $80 million stably in income, and it was sold at an excellent $1.5 billion. Net of depleted tax assets, let’s call it a $1.15 billion which puts it at an effective 14.4x EV/EBITDA multiple, which is fantastic for a regulated utility standard, where we consider a fair multiple is around 10x for a developed market transmission business. Considering political risks to concession based businesses in Chile, this is really a great multiple and brings down the debt meaningfully to about $4.1 billion. With annualised EBITDA being around $600 million, this debt reduction was very welcome as leverage was becoming a concern.

Conclusions

7% of ENIC’s business seems to have been sold for about 14% of the company’s EV, which means a really good deal considering the generation businesses are less exposed to the unclear Chilean political situation. However, ENIC is for the foreseeable future a bet on rain. When energy costs fall someday, if they ever do, ENIC’s situation will entirely normalise. The problem is for every dry season while energy prices are high, value will be meaningfully eroded and net debt will grow. Reservoirs apparently started refilling a bit in Q2, but we don’t like the nature of this investment. At least the transmission sale happened at a good time for the maturity profile and was also a great deal.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment