lbrix/iStock via Getty Images

Investment Thesis

Despite the apparent rally, Alibaba Group Holding Limited (NYSE:BABA) had fallen recently due to the multitude of negative news, starting with the Chinese government fine, the departure of Jack Ma from ANT, and finally, the delisting fears. However, we believe that the reaction was overblown, since the delisting was old news since March 2022. Even if BABA were eventually delisted from NYSE, investors would still be able to trade the stock in HKSE with no losses.

As for BABA’s latest regulatory fine of $373K from the Chinese government, it was a measly sum compared to its $2.8B fine in 2021 for an antitrust case. In addition, these regulatory fines are not unusual, with Alphabet’s (GOOG) (GOOGL) sum of $2.47B in the recent EU antitrust case in 2022, Meta’s (META) UK fine of $2M in February 2022, and an EU fine of $19M in March 2022. Therefore, these fines should not constitute a fundamental risk, but rather, only temporary headwinds to BABA’s financial performance.

Therefore, this series of declines have resulted in a very attractive entry point for any interested investors at $89.37 at the time of writing. Given BABA’s stellar financial performance thus far, investors should look at the glass as half full with the opportunity to enter at 2017 lows. Nonetheless, it is also evident that the stock is only suitable for those with a higher tolerance for volatility, since the Chinese government’s ongoing Big Tech crackdowns, Zero Covid Policy, and President Xi Jinping’s re-election in November 2022 do represent certain political risks in the short term.

Alibaba Has Been Massively De-Risked By Now, With Jack Ma’s Recent Departure From ANT

While we usually believe in founder-led companies, we think Jack Ma’s departure from ANT (and BABA then) has definitely sent a very positive message to the Chinese government, which will trigger a more stable and sustained stock recovery ahead. The derailed ANT IPO was reportedly caused by Ma’s publicized criticism of the Chinese government for the tightening of financial regulations then. It consequently led to the massive crackdown on Big Tech companies over the next two years, amongst other industries such as education, housing, and gaming.

Therefore, with Jack Ma handing over management control, the regulatory road would likely be smoother ahead, with a toned down but potentially successful ANT IPO by next year in HKSE. Meanwhile, as BABA is increasingly decoupled from ANT’s operations and management, we expect a clearer picture for the former, as the independence of the two companies should appease the Chinese government.

It should be essential to point out that regulatory risk is naturally expected for most companies anywhere, therefore not unique to BABA or the Chinese government alone. For example, Apple (AAPL) and Alphabet had faced scrutiny from lawmakers for their previous monopoly in the App Store and Google Play, leading to Apple and Alphabet opening their platforms and reducing their commission fees, which had been discussed in a separate article we had covered previously.

Beyond the antitrust cases briefly highlighted above, Alphabet and Meta are also facing regulatory issues for their ad-tracking capabilities, which have generated billions in advertising revenue thus far. Amazon (AMZN) was not spared either, with an $865M fine for an EU Data-Protection privacy breach in 2021. Therefore, those who had shunned BABA simply due to the regulatory risks should take a good look at other global Big Tech companies, which are similarly at risk in the US and the EU].

The opinion we hold with respect to BABA remains unchanged, as it remains a hugely undervalued company with over-performing fundamentals. Do not miss this boat, again.

BABA’s Future Performance Remains Broadly Exemplary

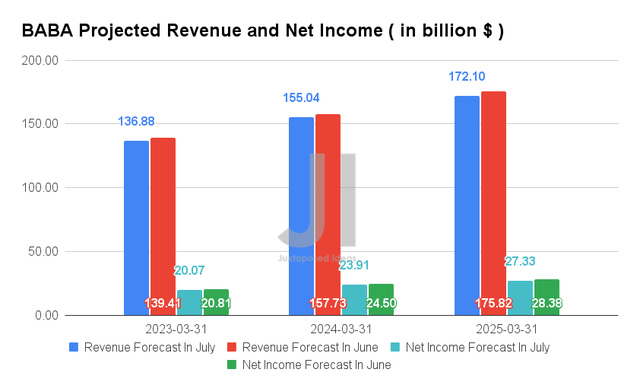

Since our previous analysis in June 2022, BABA’s revenue growth has been moderated by a minimal 1.8% and net income by 3.5% from the latest consensus estimates. These were probably attributed to the recent update from the Chinese government on the reduced GDP target for FY2022. Though initially estimated at 5.5%, analysts are now projecting a 4% GDP growth instead, due to the relentless Zero Covid Policy impacting the country’s recovery.

Nonetheless, it is evident that BABA’s projected FY2022 revenue of $136.88B and net income of $20.07B still represent an impressive normalized CAGR of 24.96% and 11.28% in the past three years, due to the hypergrowth during the pandemic and maturing business model. This event is also not unique to BABA, since Amazon reported a similar slowdown of growth in its latest quarter.

Moving forward, we expect to see a deceleration of revenue and net income growth at a CAGR of 8.56% and 4.43% through FY2025, with its net income margins declining from 23.3% in FY2019 to 15.8% by FY2025. We expect to see BABA’s Free Cash Flow (FCF) generation somewhat impacted simultaneously, though we are not overly concerned given the potential leap in revenue and profitability post-reopening cadence in FY2023.

In the meantime, analysts will be closely watching its FQ1’23 performance, with consensus revenue estimates of $30.21B and EPS of $1.56, representing a YoY decline of -5% and -39.35%, respectively. Given how BABA has been broadly outperforming estimates in the past five quarters, we expect another decent earnings call ahead. We shall see.

Those interested in BABA’s financial performance thus far may refer to our previous article:

- Alibaba: Fear Of Missing Out? Do Not Miss The Boat Again

So, Is BABA Stock A Buy, Sell, or Hold?

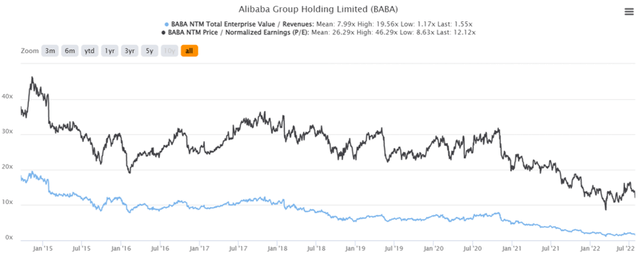

BABA 8Y EV/Revenue and P/E Valuations

BABA is currently trading at an EV/NTM Revenue of 1.55x and NTM P/E of 12.12x, lower than its 8Y mean of 7.99x and 26.29x, respectively. The stock is also trading at $89.37, down 56% from its 52 weeks high of $203.28, nearing its 52 weeks low of $73.28. BABA as a whole, with exemplary financial performance amid extreme fear, has never been cheaper and more attractive in the past eight years.

BABA 8Y Stock Price

Therefore, we are highly convinced of its 81.49% upside with a consensus estimates price target of $162.20. As a result, interested investors with a higher tolerance for risk and volatility may use this opportunity to add more exposure, given the potential recovery post FQ1’23 earnings call. Nonetheless, those who remain concerned about the overall “unreliability” of the Chinese stock market, should obviously avoid this stock like oil to water.

Therefore, we rate BABA stock as a Resounding Buy.

Be the first to comment