10’000 Hours

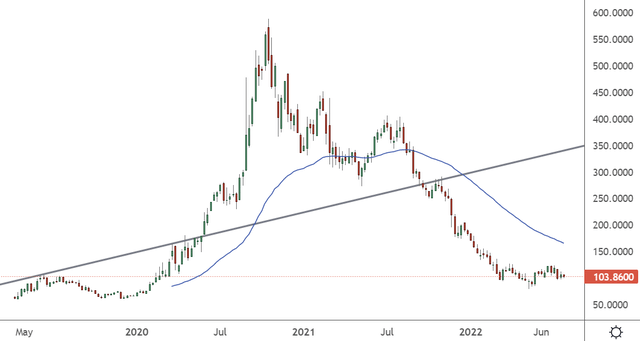

In May of 2020, I warned that Zoom Video Communications (NASDAQ:ZM) was overvalued and would not sustain its lofty valuation. The stock went a lot higher before it eventually crashed to my bearish target near $70. Although I was right about the valuation I will explain my mistake in a Phase Transition and also discuss a wildly bullish projection by ARK Invest analysts (ARKK).

What happened in Zoom Video Communications?

Zoom Communications timed its launch perfectly and some early adoption saw the company enter the market as a video meeting competitor. That led to the market storming into this name and giving it an eventual P/E ratio of 400x.

During that first article I said:

“If Zoom were to match the revenues of Skype and be valued at a more realistic, but still favorable, valuation of around 6x sales, they could be worth $10 billion. The current market cap is $34 billion.”

Fast forward two years later and Zoom is still worth 7x sales with a valuation of $30bn. The price at publication was $140 and I said that the stock could go to $70. The stock is actually 30% lower from my first call and trading near $100 after lows at $79.03 and there is still downside risk with the post-pandemic reopenings.

The only thing that I lost in this stock was pride, but many were sucked into the false promises of Wall Street and are likely still long. What I missed in this name was a Phase Transition in buying that was driven by a longer-than-expected pandemic and driven by an unrealistic growth tangent that unfortunately still exists to this day.

What is a phase transition?

I recently wrote a book called The Stock Market is Easy and in one of the chapters I talk about the phase transition.

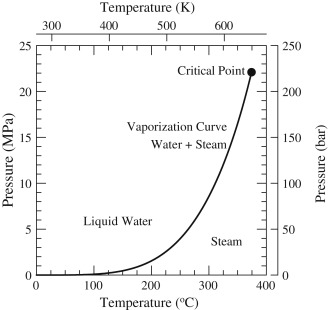

A phase transition is a qualitative change in the state of a system under a continuous change in an external parameter (Li, 2002).

In science, a phase transition is a ‘change in state from one phase to another.’ The defining characteristic of a phase transition is an abrupt change in physical properties.

Phase Transition (Science Direct)

The changing of state from water to steam is an example and once we cross the boiling point of water, the transition picks up speed and leads to a rapid pressure increase. In financial markets, this can be seen when there is a transition from bearish to heavily bullish or vice versa.

Many investors can be turned off from a stock due to a previous period of bearishness or inactivity – think GameStop (GME) and AMC Entertainment (AMC). When the transition comes, many will miss out because they may have an inherent bias against the name, or against the sector.

The transition does not have to come after a bearish period but can come from a change in external circumstances. Trying to be smart with technical analysis and standard valuation metrics failed in Zoom because the water was already boiling and a break above the resistance at $180 led to a sharp move higher.

The shift was more from bullish or neutral to ultra-bullish and caused market participants to become exuberant and overvalue the price and prospects for Zoom.

The phase transition is an important aspect to remember in financial markets because bulls and bears can be caught in a tug of war that makes observers complacent.

Ironically, I called the breakout in Peloton (PTON) at the same time and it too saw a phase transition where the bears were bulldozed. However, in both cases, I didn’t expect the pandemic to run as long as it did. It is always important for investors to update their outlook and consider what has changed.

The conflict in Ukraine and the recent aggressiveness of the Federal Reserve are prime examples. Investors can be caught up in previously held assumptions and correlations but should be looking more closely at investment flows and consider what has changed. Many investors tried to buy the dip on this tech wreck many times on the way down but were doing so based on yesterday’s environment.

Cathie Wood’s ARK is in stormy waters with Zoom

ARK Invest, the ETF empire of Cathie Wood, has released a ridiculously bullish case for Zoom recently with a price target of $1,500 in Zoom by 2026. That would be a 13x surge in the name and it seems like a marketing gimmick to capture new investors after a year of outflows.

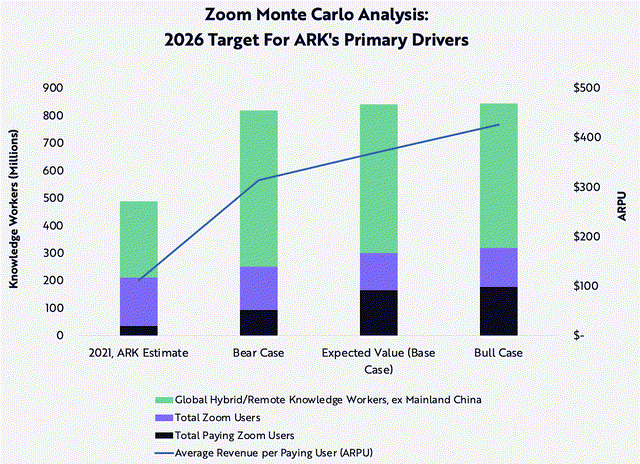

Based on the Monte Carlo model, the company has a bull and bear case of $2,000 and $700.

ARK importantly notes in the footer, that “Forecasts are inherently limited and cannot be relied upon as a basis for making an investment decision and are built on our modeling that reflects our biases and long-term positive view of the company.”

Being gloomy about stocks is not a good marketing approach for selling ETFs and that really underlines the purpose of the company’s open source research model.

Author Nicholas Nassim Taleb said in his book, Fooled By Randomness, that the Monte Carlo tool was the closest thing he had ever seen to a toy in his adult life. Although he admitted to liking the model, analysts should be realistic about future scenarios and ARK Invest seem to be detached from reality with theirs.

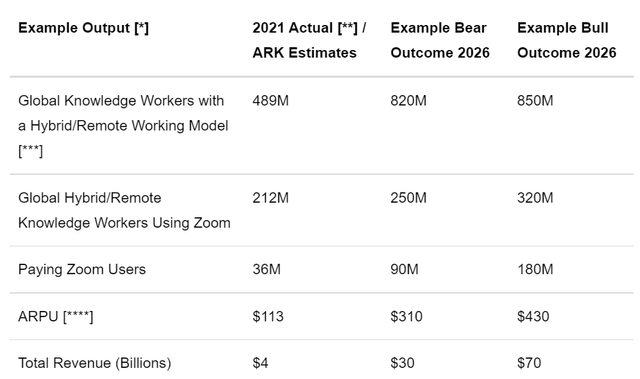

ZM Metric Predictions (Ark Investment)

In the bullish and bearish predictions for Zoom, the company only sees a difference of 30M global workers but a 90M difference in paying users. They also see the number of workers using the platform increasing by 18-50% but they expect that paying users will increase by 150-400%.

That is the real flaw in ARK’s modeling, where they believe that there will be an overnight shift of digital workers embracing the platform. Businesses are streamlining their expenses as the world lurches towards a recession so there is potential for the company to lose some paying customers and drift further from the ARK targets in the near term.

On the revenue side, we are also given a projected 650% increase on the bear case 150% increase in subscribers. ARK obviously believes that there is a dormant waterfall of cash just waiting to erupt into Zoom products.

The world has embraced the work-from-home and hybrid models but after offices reopened, that has seen growth going into reverse at Zoom.

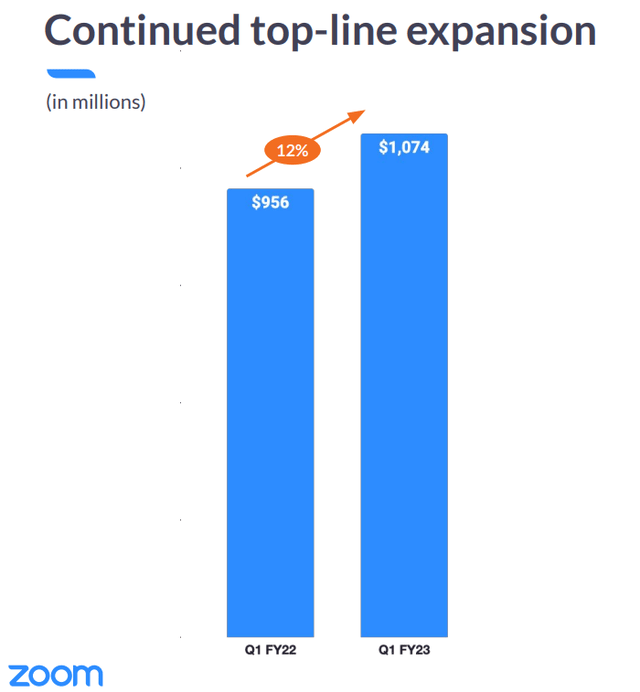

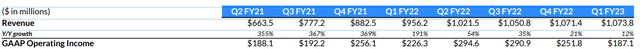

In the latest Zoom earnings presentation, the company shared that it had increased revenues by 12% in Q1 Y-o-Y. They forgot to add that revenue growth is on a severe downward trend over that year from 355% and a high of 369%. The last three quarters have seen revenues of $1,050 million, $1,071, and $1,073, and this highlights that the company is stagnating.

We are back in the same trend as before where analysts cannot make realistic projections for the future. The difference this time around is that liquidity has disappeared and investors are no longer giving a pass to fantasy valuations.

ARK knows this only too well because they have continued plunging into Zoom after believing that prices above $400 marked the dip and are now down around 80% on the stock. In the company’s flagship ARK Innovation ETF (ARKK), ZM is the largest weighting at 9.49%, while the Next Generation Internet ETF (ARKW) is made up of 8.14% in ZM.

These are numbers that no hedge fund would dare replicate and the 13x price projection looks like an attempt to explain the investment mistake and attract new capital to keep buying the dip.

The world in 2021 was still grappling with lockdowns which only changed at the turn of the new year and it is no coincidence that revenue growth has slumped at Zoom. ARK and other analysts are now looking ahead to a shift in companies to remote working but they cannot grasp that the last two years had that trend on fast forward. Companies that were forced to work from home had to grasp new working ideas and as soon as they were allowed to go back into the office, the revenues are drying up for Zoom.

We’ve already been shown what will happen over ARK’s five-year timeframe, but the company believes that new users will stampede onto the ARK and power a 13X stock move.

What to expect in the Zoom Q2 earnings?

Earnings are due at the end of August and the same stagnating trend is expected with Q2 predictions of $1.12 billion in revenue, up 9.28% from a year ago.

Bernstein analyst has a $122 price target on Zoom and said recently: “Zoom was a COVID tailwind poster child,” but as restrictions eased he noted in an investment report that sales slowed and operating costs rose “twice as fast as sales”. Weed believes that Zoom can now expand at 17% per year, but he is not bullish on profitability.

One problem could be in cash flow where net cash was $526.2 million for the first quarter, compared to $533.3 million in the first quarter of their fiscal year 2022. There was also a $ 30 million adjustment lower due to property purchases and litigation. We have to look at the fact that the lockdown reopenings really came into effect at the beginning of this year and Zoom had captured a weak net cash improvement year-over-year. We could see the real effects of the return to offices and the recession fears start to bite into the company’s bottom line.

Operating expenses increased from $464M to $624M, although this was really down to R&D costs and Sales & Marketing. That should be a closely-watched number in the upcoming report because some cutbacks in those areas could boost income without showing real growth. There will also be US dollar headwinds that have been hitting all stocks in their Q2 reports.

On a valuation basis, Zoom is still not undervalued at this current price. The company trades at 7x sales with a P/E ratio of 25x. Those numbers come with the 12% Q-o-Q growth and -50% growth in EPS and I have seen better growth figures and valuations in this technology selloff.

The upcoming earnings will really be a marker for Zoom Communications in order to see how the post-pandemic return to office work is affecting the company’s enterprise outlook.

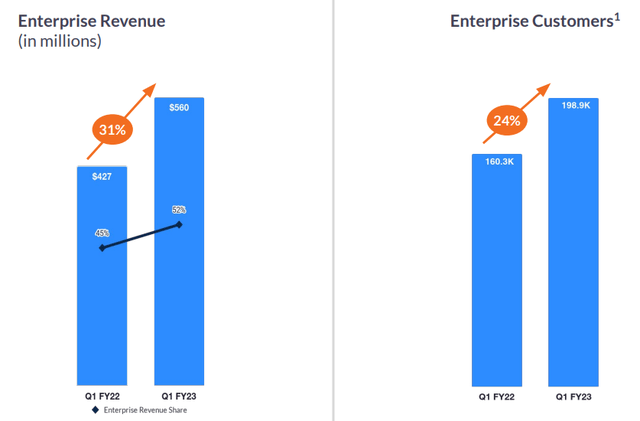

Enterprise customers and revenues increased by 24 and 31% respectively in the year from April 2021 to April 2022. My gut feeling is that the full reopening, a stronger US dollar, and the threat of recession could hurt the Q2 and Q3 numbers for Zoom and could see further downside in the stock.

Conclusion

I shared the example of my mistake in Zoom Communications for others to learn from. Even when we are fully confident of an investment decision, there really needs to be a final assessment of macro conditions to consider what has changed. In the example of the pandemic lockdowns, I tried to predict a short-term change in the landscape, which eventually ran another 18 months. Investors have been hurt this year by clinging to the zero percent interest rate era with low expectations for inflation and interest rates. The action in Zoom taught me an important lesson, but in the end, valuations always win. Although the company provided a valuable service during the work-from-home period, workers are happy to be back at the office and we may see the recent downward trend in Zoom revenues get worse before they get better. The world only fully reopened in the first quarter of 2022 and alongside a higher US dollar and corporate cutbacks, we could see headwinds for Zoom in the near term. In my opinion, the Monte Carlo predictions from ARK Invest seem like a headline-grabbing exercise and investors can count themselves lucky if they see the bear case of $700. This stock is still not undervalued and could see Q2 headwinds.

Be the first to comment