SimonSkafar

Welcome to the October 2022 cobalt miners news.

The past month saw the U.S. DoE award $2.8 billion in grants to supercharge U.S. manufacturing of batteries for electric vehicles and the electric grid. For some reason cobalt related companies missed out while lithium, graphite and nickel companies were some of the winners. Maybe next round for U.S. cobalt projects? One positive at least was the start of the American Battery Material Initiative to fast track permitting for both domestic and international critical minerals projects.

Cobalt price news

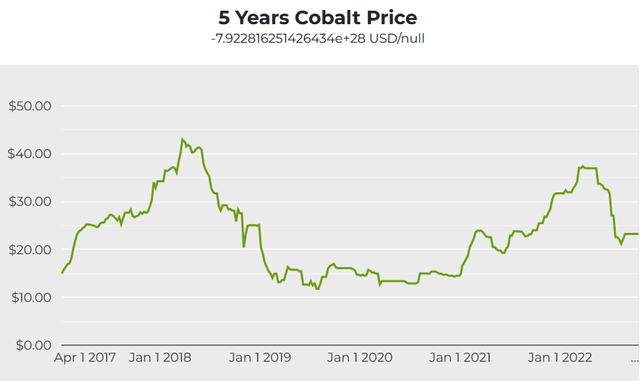

As of October 21, the cobalt spot price was flat at US$23.25/lb, from US$23.25/lb last month. The LME cobalt price is US$51,015/tonne. LME Cobalt inventory is 168 tonnes, lower than 178 last month. More details on cobalt pricing (in particular the more relevant cobalt sulphate), can be found here at Benchmark Mineral Intelligence or Fast Markets MB.

Cobalt spot prices – 5-year chart – USD 23.25 (source)

Cobalt demand v supply forecasts

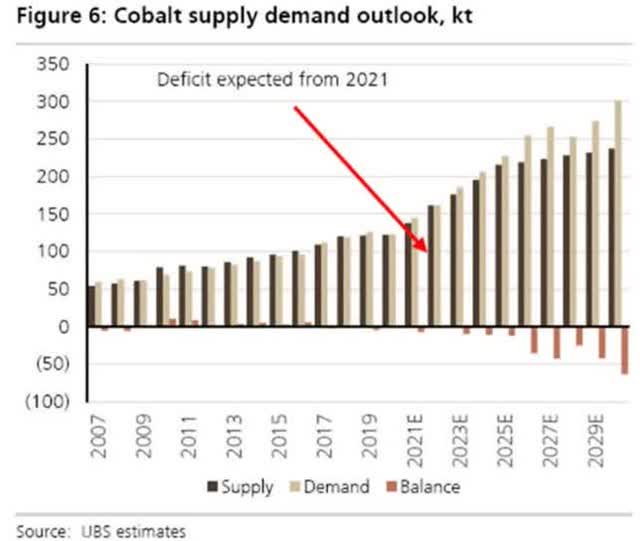

UBS cobalt supply and demand forecast (as of 2021) – Growing deficits from 2023

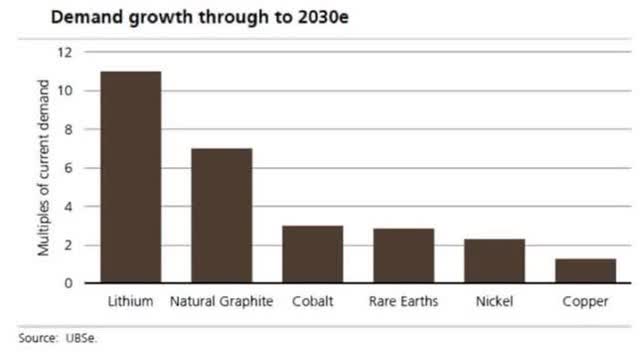

UBS’s EV metals demand forecast (from Nov. 2020)

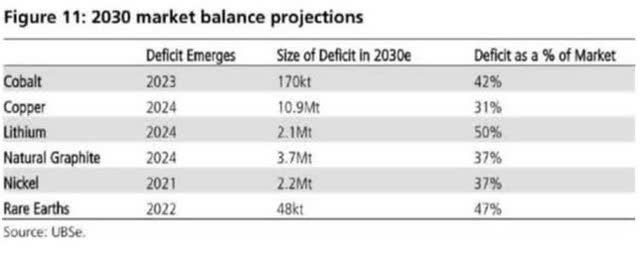

UBS forecasts Year battery metals go into deficit – Source: UBS courtesy Carlos Vicens LinkedIn

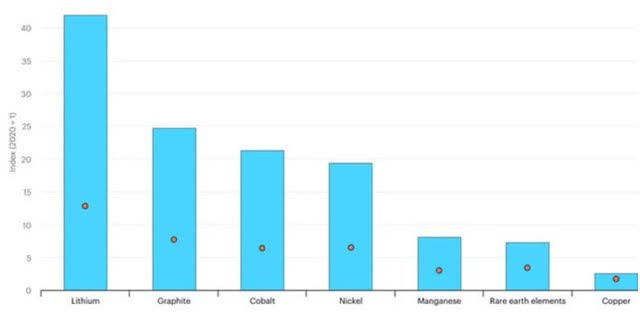

2021 IEA forecast growth in demand for selected minerals from clean energy technologies by scenario, 2040 relative to 2020 – Increases Of Lithium 13x to 42x, Graphite 8x to 25x, Cobalt 6x to 21x, Nickel 7x to 19x, Manganese 3x to 8x, Rare Earths 3x to 7x, And Copper 2x to 3x

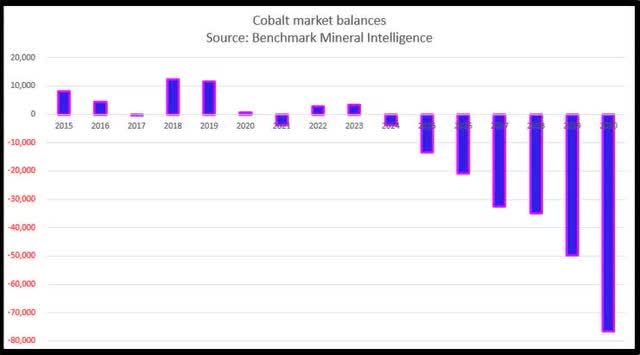

BMI 2022 forecast for cobalt – Deficits building starting from 2024

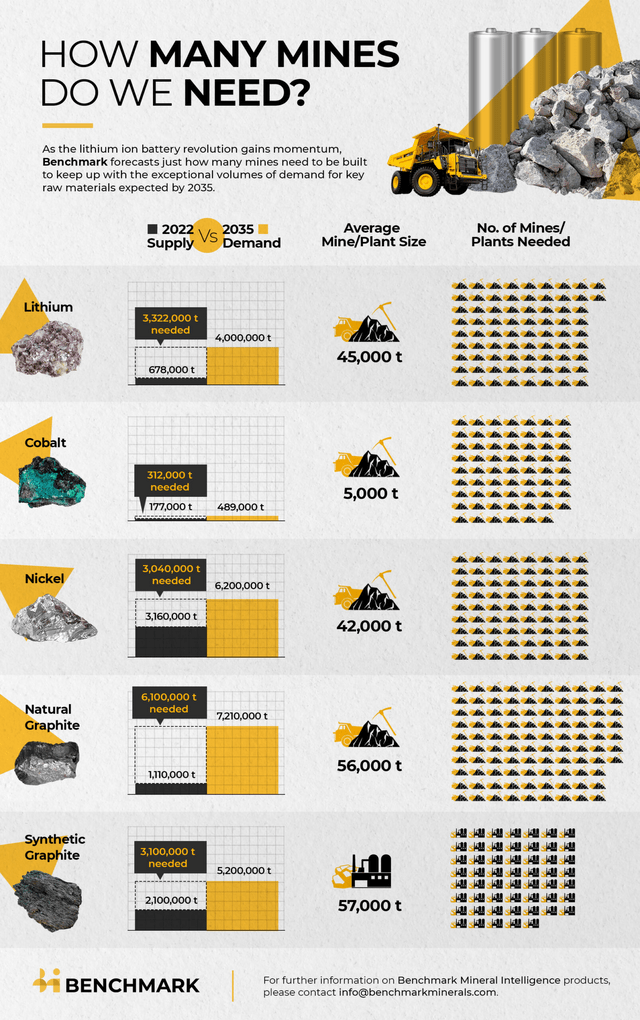

2022 – BMI forecasts we need 330+ new EV metal mines from 2022 to 2035 to meet surging demand – 62 new 5,000tpa cobalt mines (drops to 38 if include recycling)

Cobalt market news

On October 14 The Financial Post reported:

Canada will fast-track energy and mining projects important to allies: Freeland…Canada will have to fast-track energy and mining projects if it is to help its democratic allies and achieve its own net-zero ambitions, Deputy Prime Minister Chrystia Freeland said in a speech this week in Washington…Freeland also addressed calls for the federal government to create incentives to decarbonize on par with those in the U.S. Inflation Reduction Act – legislation that could prompt a surge in investment in emissions reduction and renewables south of the border over the next decade.

On October 17 Investing News reported:

Cobalt market update: Q3 2022 in review…In Q3, macroeconomic headwinds continued to hit the cobalt sector, limiting demand from several industries…EV demand in China is also likely to pick up as Q4 is a traditionally robust period for automakers…The consumer electronics sector is unlikely to improve…Looking at supply, cobalt mine output rose 12 percent year-on-year in 2021 to 160,000 metric tons after falling in 2020…”There will be limited risk to supply-side fundamentals in Q4 as (throughout 2022) strong cobalt production, especially in the DRC, along with limited demand, has pushed the cobalt market into a significant surplus this year,” Hughes said.

On October 18 Yahoo Finance reported (on Straits Research):

The global cobalt market size was valued at USD 8712 million in 2021 and is projected to reach USD 19,470 million by 2030 at a CAGR of 9.3% from 2022 to 2030. China is expected to dominate the global cobalt market.

On October 19 CNBC reported:

“Elon Musk addresses Twitter takeover, possible recession on Tesla earnings call. “Tesla wrote, in its shareholder deck, “We continue to believe that battery supply chain constraints will be the main limiting factor to EV market growth in the medium and long terms.”

Note: Bold emphasis by the author.

On October 19 Energy.Gov announced:

Biden-Harris administration awards $2.8 Billion to supercharge U.S. manufacturing of batteries for electric vehicles and electric grid. The 20 companies will receive a combined $2.8 billion to build and expand commercial-scale facilities in 12 states to extract and process lithium, graphite and other battery materials, manufacture components, and demonstrate new approaches, including manufacturing components from recycled materials. The Federal investment will be matched by recipients to leverage a total of more than $9 billion to boost American production of clean energy technology, create good-paying jobs, and support President Biden’s national goals for electric vehicles to make up half of all new vehicle sales by 2030 and to transition to a net-zero emissions economy by 2050…DOE anticipates moving quickly on additional funding opportunities to continue to fill gaps in and strengthen the domestic battery supply chain…The President also announced the launch of the American Battery Material Initiative…The Initiative will coordinate domestic and international efforts to accelerate permitting for critical minerals projects, ensuring that the United States develops the resources the country needs in an efficient and timely manner, while strengthening Tribal consultation, community engagement, and environmental standards to build smarter, faster, and fairer.

Cobalt company news

Glencore [HK:805] [LSE:GLEN] (OTCPK:GLCNF)

No cobalt related news for the month.

CMOC Group Limited [HKSE:3993] [SHE:603993] (OTCPK:CMCLF) (formerly China Molybdenum)

No news for the month.

Zhejiang Huayou Cobalt [SHA:603799]

On September 22, Zhejiang Huayou Cobalt reported:

[Media coverage of Huayou] Huayou Cobalt joins hands with Tesla to consolidate its leading position in lithium battery material integration… The agreement stipulates that the companies plan to supply the battery material ternary precursor products to Tesla from July 1, 2022 to December 31, 2025…The company will confirm its revenue in the relevant years according to the performance of the agreement, which is expected to have a positive impact on the company’s operating performance from 2022 to 2025…Based on its performance in the first half of 2022, Huayou Cobalt is expected to make a profit of over 2.2 billion yuan in the first half of this year, a year-on-year increase of over 49.86%.

On October 20, Zhejiang Huayou Cobalt announced:

Huayou Cobalt and Vale Indonesia sign the Project Framework Agreement of Sorowako high pressure acid leaching…

Jinchuan Group International Resources [HK:2362]

On October 17, Jinchuan Group announced:

Jinchuan Group seals position as key metals manufacturer…The group is home to the world’s third-largest sulfide nickel and copper deposit, and has built facilities including the first nickel flash smelting furnace of its kind in Asia and the fifth in the world.

Chemaf (subsidiary of Shalina Resources)

No news for the month.

GEM Co Ltd [SHE:002340]

No significant news for the month.

Investors can read more about GEM Co in the Trend Investing article: “A Look At GEM Co Ltd – The World’s Largest Battery Recycling Company” when GEM Co was trading at CNY 5.08.

Eurasian Resources Group (“ERG”) – private

ERG own the Metalkol facility in the DRC where ERG processes cobalt and copper tailings with a capacity of up to 24,000 tonnes of cobalt pa.

No news for the month.

Umicore SA [Brussels:UMI] (OTCPK:UMICY)

On September 26, Umicore SA announced: “Umicore and PowerCo establish joint venture for European battery materials production.” Highlights include:

- “Unique cooperation in European automotive industry: Umicore and Volkswagen Group battery company PowerCo to establish large-scale supply chain for sustainable batteries.

- Joint venture invests € 3 billion and aims to produce battery materials for 2.2 million fully electric cars per year by the end of the decade.

- Headquartered in Brussels, JV will provide Umicore secured access to important part of European demand for EV cathode materials and cover large part of supply for PowerCo’s gigafactories in Europe.

- Major milestone to help European Union achieve its Green Deal ambitions.”

Sumitomo Metal Mining Co. (TYO:5713) (OTCPK:STMNF)

No cobalt related news for the month.

MMC Norilsk Nickel [LSX:MNOD] [GR:NNIC] (OTC:NILSY) (ADRs to remain in circulation until April 28, 2023)

On October 4, MMC Norilsk Nickel announced:

Nornickel cancels treasury shares. Nornickel, the world’s largest producer of palladium and high-grade nickel and a major producer of platinum and copper, announcesthatthe791,227ordinary shares, which had been bought back from shareholders in June 2021,werecancelled yesterday.

On October 17, MMC Norilsk Nickel announced: ‘Nornickel reports successful placement of rub 25 bn exchange-traded bonds…”

OZ Minerals [ASX:OZL] (OTCPK:OZMLF)

On September 23, OZ Minerals announced: “Green Light for West Musgrave Project.” Highlights include:

- “OZ Minerals makes Final Investment Decision on West Musgrave.

- West Musgrave to be one of the world’s largest, lowest cost, lowest emissions copper-nickel projects…

- Capacity to fully fund West Musgrave. New $1.2 billion syndicated facility supported by key relationship banks, subject to final binding agreements. Potential strategic partnership via a minority interest being explored.

- Feasibility Study finalised…”

Sherritt International [TSX:S] (OTCPK:SHERF)

On October 5, Sherritt International announced: “Sherritt releases its 2021 sustainability reports.”

On October 13, Sherritt International announced:

Sherritt finalizes transformative five-year payment agreements with its Cuban partners to settle $362 million of outstanding receivables…Under the agreements, the Moa Joint Venture (Moa JV) will prioritize payment of dividends in the form of finished cobalt to each partner, up to an annual maximum volume of cobalt, with any additional dividends in a given year to be distributed in cash. All of the Cuban partner’s share of these cobalt dividends, and potentially additional cash dividends, will be redirected to Sherritt as payment to settle the receivables until an annual dollar limit, including the collection of any prior year shortfalls, has been reached. All amounts are in Canadian currency unless otherwise noted.

Nickel 28 [TSXV:NKL] [GR:3JC] (OTCPK:CONXF)

On September 29, Nickel 28 announced: “Nickel 28 files fiscal Q2 financial statements.” Highlights include:

The Company’s principal asset, an 8.56% joint-venture interest in the Ramu Nickel-Cobalt (“Ramu“) integrated operation in Papua New Guinea, had another outstanding quarter. Highlights from Ramu and the Company during the quarter include:

- “Strong quarter end cash balance of US$4.6 million, providing ample liquidity for the Company.

- Production of 8,128 tonnes of contained nickel and 695 tonnes of contained cobalt in mixed hydroxide (MHP) during the second calendar quarter, placing Ramu as the number one producer of MHP globally.

- Actual cash costs for the second calendar quarter, net of by-product sales, of US$3.03/lb. of contained nickel.

- Total net and comprehensive income of $3.0 million ($0.03/share) and $0.2 million ($0.00/share) for the three and six months ended July 31, 2022, respectively, largely as a result of lower sales and higher input and labour costs.”

Investors can view the company presentations here.

Possible mid-term producers (after 2022)

Jervois Global Limited [ASX:JRV] [TSXV: JRV] (OTCQX:JRVMF) [FRA: IHS] (formerly Jervois Mining)

On September 23, Jervois Global Limited announced:

Jervois receives environmental approval for SMP Stage 1 construction… This license from the State environmental regulator, Companhia Ambiental do Estado de São Paulo (“CETESB”), represents São Paulo State approval for construction of the Stage 1 SMP restart, another important milestone as Jervois continues detailed engineering on the restart prior to final investment decision. Jervois forecasts to produce 10,000 metric tonnes per annum (“mtpa”) and 2,000 mtpa of refined nickel and cobalt metal cathode respectively in Stage 1.

On October 10, Jervois Global Limited announced: “Jervois commences commissioning at Idaho Cobalt Operations in the U.S.” Highlights include:

- “Jervois celebrated the official opening of Idaho Cobalt Operations mine site (“ICO”) mine site near Salmon, Idaho on Friday 7 October with United States (“U.S.”) Federal and State government representatives and the Australian Ambassador to the U.S. in attendance.

- Jervois has commenced initial commissioning activities at ICO, with an expectation of nameplate capacity to be sustained by the end of Q1 2023.

- Once commissioned, ICO will be the only cobalt mine in the U.S.

- Jervois is evaluating ways to optimise near term operating plans, including to address costs pressures resulting from U.S. inflationary headwinds.”

On October 20, Jervois Global Limited announced: “Jervois secures long term renewable energy at its Finland operations.”

On October 21 Jervois Global Limited announced: “Jervois Quarterly Activities Report to 30 September 2022.”

Upcoming catalysts include:

- Sept. 2022 – Idaho Cobalt Operations commissioning, with full production in February 2023.

- 2023 – First production targeted from the São Miguel Paulista Refinery.

Electra Battery Materials [TSXV:ELBM] (ELBM)

On October 5, Electra Battery Materials reported: “Electra confirms cobalt mineralization at new target in Idaho.”

On October 13, Electra Battery Materials reported:

Electra starts commissioning of Battery Materials Recycling Demonstration Plant at its Ontario Refinery Complex…

Upcoming catalysts include:

Early 2023 – Target to have their Ontario cobalt refinery operational with ore feed from Glencore.

Investors can view the company presentations here and a recent Trend Investing article on Electra here.

Sunrise Energy Metals Limited [ASX:SRL](OTCQX:SREMF)(formerly Clean TeQ)

Sunrise Energy Metals has 132kt contained cobalt at their Sunrise project.

No significant news for the month.

Upcoming catalysts include:

2022 – Possible off-take agreements and project funding/partnering.

Investors can also read the latest company presentation here.

Fortune Minerals [TSX:FT] (OTCQB:FTMDF)

On October 3, Fortune Minerals announced:

Fortune Minerals extends Option to acquire the Alberta Refinery Site for the NICO Critical Minerals Project.

Upcoming catalysts include:

- 2022 – Possible off-take or equity/strategic partners, project financing.

Investors can read the latest company presentation here, or a company pitch video here.

Australian Mines [ASX:AUZ] (OTCPK:AMSLF)

No cobalt news for the month.

Investors can read the latest company presentation here.

Upcoming catalysts include:

- 2022 – PFS on alternative nickel-cobalt laterite ore processing.

Ardea Resources [ASX:ARL] (OTCPK:ARRRF)

In total, Ardea has 5.9mt of contained nickel and 380kt of contained cobalt at their KNP Project near Kalgoorlie in Western Australia. Ardea is also exploring for gold and nickel sulphide on their >5,100 km2 of 100% controlled tenements in the Eastern Goldfields region of Western Australia.

On September 27, Ardea Resources announced: “2022 annual report.”

On October 14, Ardea Resources announced: “Emu Lake nickel sulphide exploration update.” Highlights include:

- “…Six of the diamond holes and all four extension holes were drilled at the Binti prospect to test DHEM (down-hole electromagnetic) and geological targets, where high-grade nickel sulphide mineralisation was recently discovered at Binti South (i.e. AELD0003: 2.72m at 5.42% Ni and 0.85% Cu from 391.04m – ASX release 14 January 2022).

- Drilling from the first program resulted in the discovery of the Binti Central prospect 300m northwest of Binti South, with drill holes intersecting massive nickel sulphide mineralisation in both the Central and Western Ultramafics (i.e. AELD0006: 0.3m at 5% Ni from 409.74m) and disseminated/blebby mineralisation in the Western Ultramafic (i.e. ELD023: 10.44m at 0.52% Ni from 423.56m)…

Upcoming catalysts include:

- 2022 – Possible off-take partner and funding for the GNCP Project. Further exploration results.

Investors can read the latest company presentation here.

Cobalt Blue Holdings [ASX:COB] (OTCPK:CBBHF)

Cobalt Blue has 81.1kt of contained cobalt at their 100% owned Broken Hill Cobalt Project [BHCP] (formerly Thackaringa Cobalt Project) in NSW, Australia. LG International is an equity strategic partner.

On October 6, Cobalt Blue Holdings announced: “Demonstration Plant -Ore processing update.” Highlights include:

- “As previously reported, underground mining has been completed with 4,500 t of ore extracted.

- Concentrator circuit has subsequently completed phase one of testwork on 500 t of ore. We expect a further 2,500 – 3,000 t of ore to be concentrated over the next 4 weeks.

- Gravity circuit upgraded cobalt in ore to ~4,300 ppm in concentrate (with 75% mass rejection). Cobalt in ore varied from low grade ~500 ppm to >1,000 ppm with consistency of upgrade confirmed.

- Kiln circuit commissioned, with leach and MHP production circuits to follow shortly.”

Upcoming catalysts include:

- 2022 – Possible off-take agreements. Feasibility Study & project approvals. Final Investment decision. Project Funding.

Investors can watch a CEO interview here and a recent presentation here.

Havilah Resources [ASX:HAV] [GR:FWL]

Havilah 100% own the Mutooroo copper-cobalt project about 60km west of Broken Hill in South Australia. They also have the nearby Kalkaroo copper-gold-cobalt project (optioned to Oz Minerals), as well as a potentially large iron ore project at Grants. Havilah’s 100% owned Kalkaroo copper-gold-cobalt deposit contains JORC Mineral Resources of 1.1 million tonnes of copper, 3.1 million ounces of gold and 23,200 tonnes of cobalt.

On September 29, Havilah Resources announced: “Mutooroo copper-cobalt-gold deposit drilling results.” Highlights include:

- “Confirmation of continuity of copper-cobalt-gold sulphide lode (sulphide lode) at shallow depth in recent Mutooroo pre-feasibility study open pit resource expansion drilling.

- Significant intervals of copper-cobalt-gold mineralisation intersected in several holes, including: 4 metres of 1.31% copper, 0.11% cobalt and 0.16 g/t gold and 5 metres of 0.77% copper, 0.09% cobalt and 0.22 g/t gold.

- Multiple sulphide lodes on several sections is encouraging for depth continuity and resource expansion potential.

- Mutooroo and the surrounding highly prospective Mutooroo Project Area are a high priority for drilling over the next few months.

- Heritage surveys have cleared planned drilling sites on several key copper-cobalt-gold prospects.”

On October 4, Havilah Resources announced: “OZ Minerals strategic alliance first $3m payment.” Highlights include:

- “…Extensive planning and preparatory work for commencement of field activities, including establishment of a 30 person accommodation camp.”

Upcoming catalysts include:

- 2023 – Progress towards the OZ Minerals option to buy Kalkaroo.

Investors can learn more by reading the Trend Investing article “Havilah Resources Has Huge Potential and/or the update article. You can also view a CEO interview here, and the company presentation here.

Aeon Metals [ASX:AML](OTC:AEOMF)

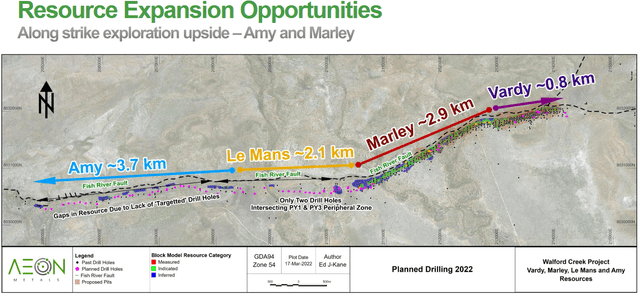

Aeon Metals 100% own their Walford Creek copper-cobalt project in Queensland Australia.

On September 23, Aeon Metals announced: “Drilling success at Walford Creek extends mineralisation at Le Mans.” Highlights include:

- “Assay results received from a further 4 holes of the 2022 drilling campaign at Walford Creek.

- Significant new results include: WFDH537 intersected: 65.0m at 1.01% CuEq* in PY1 from 276.0m. WFDH541 intersected: 12m at 2.28% CuEq in PY1 from 398.0m. WFDH533 intersected: 26.0m at 0.47% CuEq in PY1 from 298.0m and 12.0m at 1.14% CuEq in PY1 from 371.0m. WFDH534 intersected: 2.0m at 0.27% CuEq in PY1 from 401.0m and 34.0m at 0.52% CuEq in PY3 from 616.0m, incl. 10m at 0.99% CuEq from 640.0m.

- Walford Creek drill program remains on track with 21 drillholes completed year-to-date; 17 at the Le Mans zone and 4 at the Amy zone.

- Of the 21 holes, 16 are believed to have intersected their targets based on assay results to date combined with visual estimates (remaining holes were terminated due to localised drilling conditions).

- Demonstrates robust geological model for targeting and framework for cost-effective exploration.

- Maiden Mineral Resource Estimate targeted for emerging Le Mans zone later this year.

- Confidence around the high grades at Amy West hole WFDH378 (46m at 2.93% CuEq; first reported 16 October 2018) continue to grow, with wide zones of Cu-Pb-Zn sulphides noted in adjacent hole WFDH548 (assays pending).

- These results reaffirm confidence in the thick intervals of high-grade mineralisation and impressive 10 km of strike extent to the Walford Creek system.”

On September 30, Aeon Metals announced: “30 June 2022 annual report.”

Investors can view the latest company presentation here.

Schematic showing the Walford Creek strike zones (source)

GME Resources [ASX:GME][GR:GM9] (OTC:GMRSF)

GME Resources own the NiWest Nickel-Cobalt Project located adjacent to Glencore’s Murrin Nickel operations in the North Eastern Goldfields of Western Australia. The NiWest Project which has an estimated 830,000 tonnes of nickel metal and 52,000 tonnes of cobalt.

On October 10 GME Resources reported: “GME and Stellantis sign non-binding MOU for future offtake of battery grade nickel and cobalt sulphate.”

On October 12 GME Resources announced:

Successful placement to advance NiWest Nickel Cobalt Project. Firm commitments received for a Placement of approximately 42.1 million shares at a price of A$0.095 to raise A$4.0 million. Proceeds from the Placement will be applied towards the Definitive Feasibility Study for the NiWest Nickel-Cobalt Project and general working capital.

Investors can read a company investor presentation here.

Global Energy Metals Corp. [TSXV:GEMC][GR:5GE1] (OTCQB:GBLEF)

On October 17, Global Energy Metals Corp. announced: “Global Energy Metals announces results of partner funded exploration at the Millennium Project including confirmation of high cobalt and copper grades.” Highlights include:

- “Assay results continue to return high cobalt grades.

- First diamond drilling assays received including: 12m @ 0.62% Cu, 0.14% Co and 0.34g/t Au from 51m (MI22DD01).

- Additional RC results received including: 3m @ 0.22% Co from 61m (MI22RC04). 12m @ 0.53% Cu and 0.14% Co from 39m (MI22RC08 – outside current resource).

- Scope of the Central Resource area extended approximately 120m north of existing Resource.

- Electrical (IP/resistivity) geophysics survey completed.

- Resource upgrade work to commence upon receipt of final outstanding assay results.”

Note: “The exploration program is being fully funded by Metal Bank Ltd. (“MBK”) as it earns up to an 80% interest in the project through staged exploration and milestone share equity payments. Global Energy Metals currently holds 100% of the Project through its wholly-owned subsidiary Element Minerals Australia Pty Ltd and has a 31,250,000 share equity position in MBK.”

Giga Metals Corp. [TSXV:GIGA][FSE: BRR2] (OTCQX:HNCKF) (Turnagain Nickel Deposit now held via Hard Creek Nickel Corporation [TSXV:HNC] (OTCQX:HNCKF)

No news for the month.

The Metals Company (TMC)

On September 30, The Metals Company announced:

Innovative agreement will have union workers processing critical minerals from seafloor nodules for production of electric car batteries…

On October 5, The Metals Company announced:

TMC Subsidiary NORI commences monitoring of the Environmental Impacts of Pilot Nodule Collection System Trials in the Clarion-Clipperton Zone…

On October 12, The Metals Company announced:

TMC and Allseas achieve historic milestone: Nodules collected from the seafloor and lifted to the production vessel using 4 km riser during pilot trials in the Clarion Clipperton Zone for first time since the 1970s…

Other juniors and miners with cobalt

Happy to hear any news updates from commentators. Tickers of cobalt juniors we will also be following include:

21st Century Metals (CSE: BULL) (OTCQB:DCNNF), African Battery Metals [AIM:ABM], Alloy Resources [ASX:AYR], Artemis Resources Ltd [ASX:ARV] (OTCQB:ARTTF), Aston Minerals [ASX:ASO] (formerly European Cobalt), Auroch [ASX:AOU] [GR:T59], Azure Minerals [ASX:AZS] (OTCPK:AZRMF), Bankers Cobalt [TSXV:BANC] [GR:BC2] (NDENF), Battery Mineral Resources [TSXV:BMR], BHP Group Limited (BHP), Blackstone Minerals [ASX:BSX], Brixton Metals Corporation [TSXV:BBB], (OTCQB:BBBXF), Canada Nickel [TSXV:CNC], Canada Silver Cobalt Works Inc [TSXV:CCW] (OTCQB:CCWOF), Canadian International Minerals [TSXV:CIN], Carnaby Resources [ASX:CNB], Castillo Copper [ASX:CCZ], Celsius Resources [ASX:CLA] [GR:FX8], Centaurus Metals [ASX:CTM], CBLT Inc. [TSXV:KBLT] (OTCPK:CBBLF), Cobalt Power Group [TSX:CPO], Cohiba Minerals [ASX:CHK], Corazon Mining Ltd [ASX:CZN], Cruz Battery Metals Corp. [CSE:CRUZ][FSE: A2DMG8] (OTCPK:BKTPF), Cudeco Ltd [ASX:CDU] [GR:AMR], DLE Resources [TSXV:DLP], Dragon Energy [ASX:DLE], Edison Battery Metals [TSXV:EDDY], Electric Royalties [TSXV:ELEC], First Quantum Minerals Ltd. (OTCPK:FQVLF), Fuse Cobalt Inc [CVE:FUSE] (WCTXF), Galileo [ASX:GAL], GME Resources [ASX:GME] (OTC:GMRSF), Stillwater Critical Minerals Corp. [TSXV:PGE] (OTCQB:PGEZF), Hinterland Metals Inc. (OTCPK:HNLMF), Hylea Metals [ASX:HCO], IGO Limited [ASX:IGO] (OTCPK:IIDDY), King’s Bay Res (OTCPK:KBGCF) [TSXV:KBG], Latin American Resources, M2 Cobalt Corp. (TSXV: MC) (OTCPK:MCCBF), MetalsTech [ASE:MTC], Meteoric Resources [ASX:MEI], Mincor Resources (OTCPK:MCRZF) [ASX:MCR], Namibia Critical Metals [TSXV:NMI] (OTCPK:NMREF), Pacific Rim Cobalt [BOLT:CSE], PolyMet Mining [TSXV:POM] (PLM), OreCorp [ASX:ORR], Power Americas Minerals [TSXV:PAM], Panoramic Resources (OTCPK:PANRF) [ASX:PAN], Pioneer Resources Limited [ASX:PIO], Platina Resources (OTCPK:PTNUF) [ASX:PGM], Quantum Cobalt Corp [CSE:QBOT] GR:23BA] (OTCPK:BRVVF), Queensland Pacific Metals [ASX:QPM] (OTCPK:QPMLF), Regal Resources (OTC:RGARF), Resolution Minerals Ltd [ASX:RML], Sienna Resources [TSXV:SIE], (OTCPK:SNNAF), and Victory Mines [ASX:VIC].

Conclusion

October saw cobalt spot prices flat and LME inventory was slightly lower.

Highlights for the month were:

- Canada will fast-track energy and mining projects important to allies: Freeland.

- BMI: “There will be limited risk to supply-side fundamentals in Q4 as (throughout 2022) strong cobalt production, especially in the DRC, along with limited demand, has pushed the cobalt market into a significant surplus this year.”

- Tesla: “We continue to believe that battery supply chain constraints will be the main limiting factor to EV market growth in the medium and long terms.”

- Biden-Harris administration awards $2.8 Billion of grants to supercharge U.S. manufacturing of batteries for electric vehicles and electric grid…The American Battery Material Initiative will coordinate domestic and international efforts to accelerate permitting for critical minerals projects.

- Umicore and PowerCo (Volkswagen Group’s battery company) establish joint venture for European battery materials production. JV invests €3b and aims to produce battery materials for 2.2m fully electric cars per year by the end of the decade.

- OZ Minerals gives the green light for the West Musgrave Project.

- Nickel 28 reports another outstanding quarter with Ramu production of 8,128 tonnes of contained nickel and 695 tonnes of contained cobalt.

- Jervois Global commences commissioning at Idaho Cobalt Operations in the U.S. Once commissioned, ICO will be the only cobalt mine in the U.S.

- Electra starts commissioning of Battery Materials Recycling Demonstration Plant at its Ontario Refinery Complex.

- Havilah Resources drills at Mutooroo 4 metres of 1.31% copper, 0.11% cobalt & 0.16 g/t gold and 5 metres of 0.77% copper, 0.09% cobalt & 0.22 g/t gold.

- Aeon Metals drilling success at Walford Creek extends mineralisation at Le Mans. WFDH537 intersected: 65.0m at 1.01% CuEq* in PY1 from 276.0m.

- Global Energy Metals announces results of partner (Metal Bank Ltd.) funded exploration at the Millennium Project – 12m @ 0.62% Cu, 0.14% Co and 0.34g/t Au from 51m (MI22DD01).

- GME Resources and Stellantis sign non-binding MOU for future offtake of battery grade nickel and cobalt sulphate.

- TMC and Allseas achieve historic milestone: Nodules collected from the seafloor and lifted to the production vessel using 4 km riser during pilot trials in the Clarion Clipperton Zone for first time since the 1970s.

As usual all comments are welcome.

Be the first to comment