Andrew Burton

Introduction

Alibaba (NYSE:BABA) stock has been an unwelcome source of wealth destruction for over two years now. After a prolonged downtrend, I feel there’s potential for this narrative to change, as a few fundamental and technical developments have recently coalesced to lend support to a Bull thesis. Here’s why I’m optimistic about BABA stock.

Improving EBITA dynamics driving cash generation

Alibaba’s cash-generating qualities have picked up in recent quarters (in Q2, FCF grew by 61% YoY), and there’s reason to believe this improvement may well persist. Granted, the FCF yield isn’t as attractive as the double-digit levels seen in October/November (down mainly to the appreciation in the share price), but at this juncture, you’d still be locking in a fairly noteworthy FCF yield of close to 9.6%, which is almost 400bps higher than what this stock has typically yielded over the last 5 years (5-year avg of 5.7%)!

FCF improvements have been largely driven by better EBITA dynamics in BABA’s largest division – China commerce division. In the June quarter, the EBITA of this division was down by 14% YoY, but in the recently concluded quarter, there was a sharp 6% YoY improvement. Within China commerce, there’s one business that I’d like to expand on- Taocaicai, whose operating efficiency has recently picked up with some benefits attributed to better sourcing.

For the uninitiated, this business focuses on next-day grocery and fresh food pick-up services at various neighborhood pick-up points. Taocaicai had seen a surge in gross merchandise value (up by 40% YoY in the Sep quarter) and this popularity could be a function of the company’s impetus in ‘community group buying’ which enables BABA to engage in bulk purchases from primary food providers, thus bypassing the traditional middlemen (BABA was a late entrant to this market, relative to some of its peers). Negating the middlemen enables BABA to save on costs, which can then be passed on via greater discounts, attracting more user engagement and loyalty.

Another business worth noting is Ele.me, which was instrumental in reducing the pressure on the EBITA of the local consumer services division. In the Q3 report, management highlighted the trend of higher average order values and better unit economics per order with Ele.me. Now, with China making a sudden policy shift away from zero-Covid, some Chinese commentators have expressed concerns over the vulnerability of the health system there, given the low vaccination rates of the country’s elderly class (reportedly only 40% of those aged above 80 have had a booster shot). However, as perverse as this sounds, it looks like Ele.me may be well-poised to benefit from additional business momentum linked to the elderly class in this sort of precarious environment. This week, an elderly-assistance section was introduced on Ele.me, even as online consultancies regarding this have doubled on a weekly basis.

Besides ongoing EBITA improvement, we’ve also seen a slowdown in cash purchases of property and equipment, which was down by over 6% in H1 and 14% in Q2 alone.

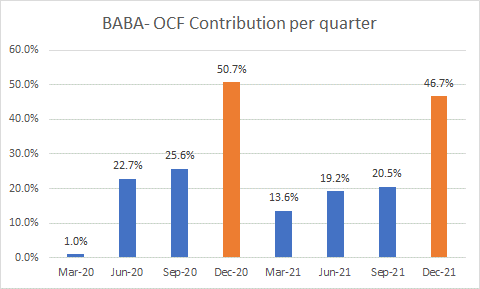

All in all, I believe there’s a good chance that investors could see a further uptick in the FCF yield, as typically the December quarter has proven to be a very solid period for operating cash generation. To expand on this, consider the last two fiscals, where operating cash flow (OCF) generation in Q4 alone had accounted for roughly 49% of the company’s total OCF for the whole year!

Seeking Alpha

Apt proxy for the China re-opening trade

After a difficult 2022, it appears as though 2023 could be a lot more promising for the Chinese economy, backed by useful policy support. Reports coming out from China suggest that the Politburo will now focus on economic recovery and employment stabilization in 2023, even as health-related objectives take a backseat. Whilst many expected a gradual exit from the Zero-Covid universe, restrictions have been lifted with greater alacrity, so much so that Bloomberg Economics expects all restrictions to be off by the end of the March quarter. Incidentally, this is three months ahead of Bloomberg Economics’ original estimated schedule.

If China is to get to the 5% GDP level, expect consumer spending to play a key role, as this accounted for close to two-thirds of GDP last year (Source: NBS). Some suggest that the central government could pay out cash vouchers worth 5000 Yuan to the Chinese populace to help spur spending. It is believed that some municipal governments within the Guangdong and Hainan provinces are likely to roll out shopping vouchers soon enough. Alibaba’s omnipresence in the consumer ecosystem makes it an ideal bet for any macro recovery next year. Just for some context, this is a company that recently served 1 billion active consumers in China alone, which would represent close to 70% of China’s total population!

Attractive forward valuations

Besides the attractive FCF yield, earnings-related valuations too look very appealing. As per YCharts estimates, BABA looks poised to deliver a March 2024 annual EPS of $8.65. At the current share price, that translates to a forward P/E of just 10.51. That works out to a steep discount of roughly 40% versus the stock’s long-term forward P/E average of 17.6x. Lest you forgot, this was a stock that was trading at forward P/E multiples of well over 30x less than 18 months ago! Also, think about the level of earnings growth you’re getting at that 10.5x multiple. The EPS of $8.65 would imply annual earnings growth of 16%, translating to a low PEG ratio of just 0.67x. That PEG multiple feels criminally low for a company that is already a monster in the Chinese consumer landscape and is also quietly building scale in the Chinese public cloud market (a market poised to triple and hit $90bn by 2025!).

The technical landscape looks promising

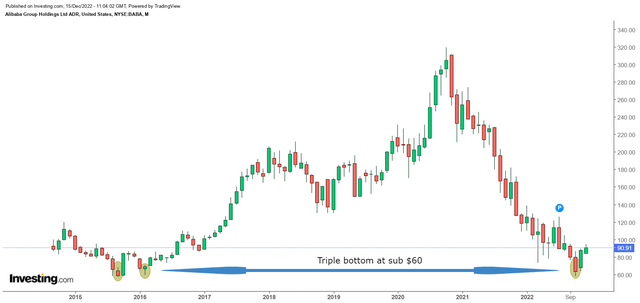

If we look at BABA’s long-term chart on the large time frame, we can see that after a prolonged downtrend it recently formed a triple bottom pattern around the sub $60 levels, a zone that had previously served as pivot points in 2015 and 2016; this likely increases the probability of a further move higher.

If we narrow the lens to the smaller time frame weekly chart, we can see that the price action had been moving in the shape of a pretty consistent descending channel since October 2020. In November, we finally saw a breakout from that descending channel, with the stock attempting to stabilize around the $90 level, before making another move higher. It does not look like there are any major hindrances until the $125-$130 levels, where it could run into an old congestion zone, and a potential pivot point. All in all, the risk-reward on the standalone charts looks good.

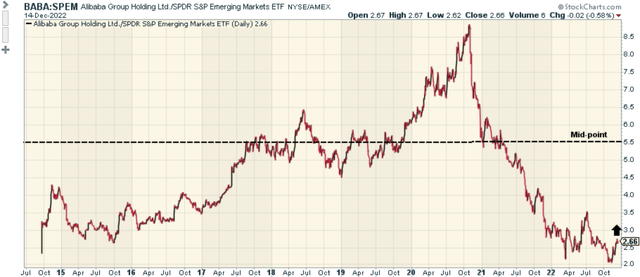

The long position is also augmented by the notion that BABA could be one of the prime candidates for those looking for mean-reversion opportunities within China or within the broader emerging market landscape. The first chart highlights how oversold BABA looks relative to a portfolio of stocks that are domiciled in China but available to foreign investors. That ratio is still 52% lower than the mid-point of its long-term range.

The second chart juxtaposes BABA against a portfolio of over 3000 EM stocks; despite a recent improvement in the relative strength ratio, even here, it is still a long way off the mid-point, implying higher potential for a catch-up.

Be the first to comment