SolStock

The entire world economy rests on the consumer; if he ever stops spending money he doesn’t have, on things he doesn’t need, we’re done for. – Bill Bonner

Introduction

Twitter

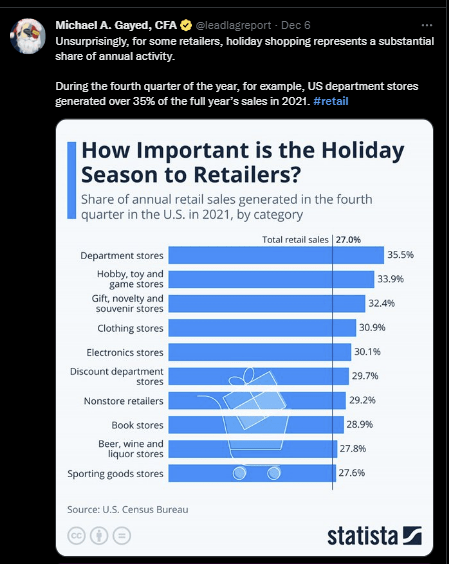

The other day I put out some content for the Super Followers of The Lead-Lag Report highlighting how crucial the holiday season could be for certain retailers. Given that the Q4 period typically accounts for over a third of total retail sales, I suppose this pocket may pique the interests of certain investors.

One of the products whose holdings may attract the attention of investors during the holiday season is the Vanguard Consumer Discretionary ETF (NYSEARCA:VCR). This exchange-traded fund (“ETF”) offers investors exposure to the stocks of over 300 companies that manufacture products or provide services that consumers purchase on a discretionary basis. Should you get on board? Here are some things to note.

The Case for VCR

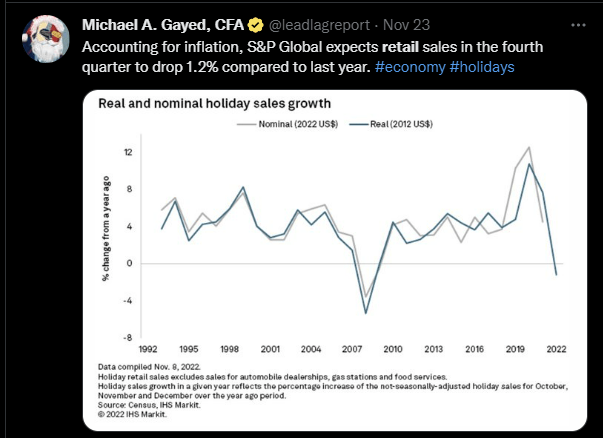

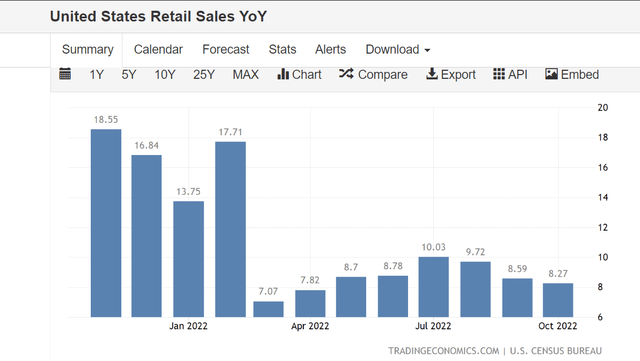

It’s alright to feel sanguine about retail sales in nominal terms, which should grow at a decent mid-single-digit pace in Q4, but as noted in The Lead-Lag Report, if one accounts for inflation, you’re actually staring at a decline of 1.2%. That certainly doesn’t make for a great sell.

Twitter

The recent inflation report may have thrown off some indications that things could be pivoting from here, but I would urge investors not to jump the gun as yet.

In fact in a recent interview on Lead-Lag Live, Lyn Alden posited that while you could have transitory overlays of disinflation, the structural problems surrounding inflation will likely make it a long-standing phenomenon. This comes back to a leadership crisis where the Fed has been too short-sighted in controlling demand-side conditions, while nothing of substance has been done to alleviate some of the supply-side gaps, particularly in something like the natural resources arena, where the level of CAPEX initiatives are nothing to shout home about. Unless something concrete is done here, it would be difficult to see sustained level of disinflationary growth in various industries including retail.

Lest one forget, don’t dismiss the impact of inflation on household earnings where the ILO now believes that we could see a decline in real terms for the first time this century.

Twitter

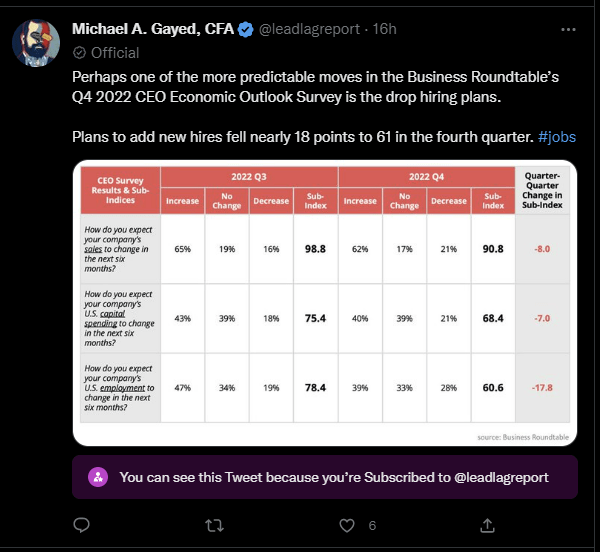

Compounding the issue, you also have fairly underwhelming data points coming out from the recent CEO Economic Outlook Survey, which I shared with my followers.

Twitter

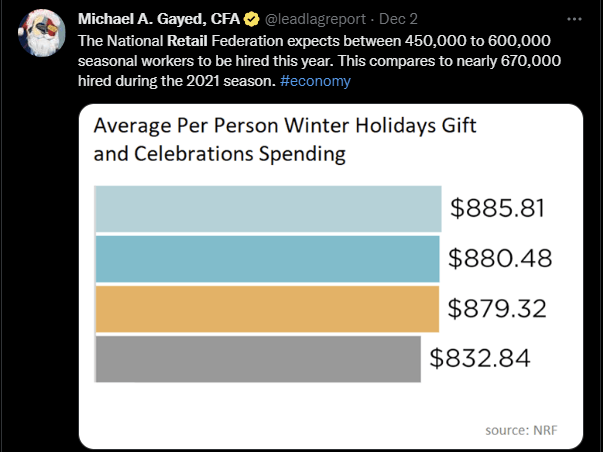

According to that survey, hiring intentions of fresh employees have taken a turn for the worse, which doesn’t bode well for the business of discretionary stocks. In keeping with those subdued employment trends, it also looks like retailers are going slow with their own hiring plans. As noted in The Lead-Lag Report, the number of seasonal workers that could be hired could drop off by anything from 10-33% YoY.

Twitter

Looking beyond the seasonal season, Fitch Ratings does not believe that the retailers will have a great 2023 either. While certain staple categories could remain stable, retail volumes next year will likely be modestly negative. Investors should also note that the high double-digit base effect will likely continue until Feb at the very least, so don’t expect any fireworks here.

If there’s one encouraging sub-plot to VCR investment’s case is that the valuation picture of its large holdings looks a lot more palatable than what they did around a year ago. The table below shows that most of VCR’s top 10 names are currently trading at forward P/E valuation discounts of 4-50% relative to their long-term averages. Overall, the top-10 names are currently trading at an average P/E of 25.1x, a 23% discount to the 5-year average of 33x.

|

Forward P/E |

5 Year Average |

Difference |

|

|

Amazon (AMZN) |

53.19 |

74.24 |

-28% |

|

Tesla (TSLA) |

28.2 |

54.99 |

-49% |

|

Home Depot (HD) |

19.58 |

19 |

3% |

|

McDonald’s (MCD) |

26.03 |

23.83 |

9% |

|

Lowe’s (LOW) |

14.93 |

14.61 |

2% |

|

Nike (NKE) |

30.13 |

42.54 |

-29% |

|

Starbucks (SBUX) |

25.37 |

26.5 |

-4% |

|

TJX (TJX) |

22.37 |

20.36 |

10% |

|

Target (TGT) |

15.37 |

30.5 |

-50% |

|

Booking (BKNG) |

16.59 |

20.29 |

-18% |

Source: YCharts

Conclusion

Twitter

As noted in The Lead-Lag Report, given the festive cheer around, it appears as though investors may have taken their eyes off the ball, making them vulnerable to the impact of a potential tail event in the equity markets. Subscribers who’ve followed the “Leaders-Laggards” section of my paywalled research would note that a ratio measuring discretionary stocks and the S&P 500 highlights a lingering lack of interest in this sector. At a time when all four of my signals have switched to risk-off mode, it’s difficult to beat the drum for a high-beta play such as VCR.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you’ll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Be the first to comment