krisanapong detraphiphat/iStock via Getty Images

For faithful investors, Progressive has delivered enormous returns in line with Big Tech

A year ago, I invested in auto insurer The Progressive Corporation (NYSE:PGR) and posted on the company (“the previous post“). My total return has been ~16% vs ~12% for the S&P 500. While satisfactory so far, we have to treat the results with caution as PGR remains the most expensive stock among big US Property & Casualty insurers. At the end of 2021, it was trading at 3.5 of its book value per share (BVPS) and has advanced 11% since. Are these valuations justified and under what conditions?

I will try to answer this question with a caveat. The auto insurance industry is facing risks related to uncertainties in insuring autonomous vehicles and possible disruption from new entrants like Tesla (TSLA). In the previous post, I spent significant space analyzing these risks and concluded they should be manageable for big and sophisticated insurers like PGR or Geico (BRK.B). My opinion has not changed since and I will not revisit these topics. For the same reason, I will also avoid a description of the company and its unique multi-faceted strategy – please see my previous post for it. What follows presumes certain familiarity with Progressive. All numbers are in millions of USD except per share.

Why PGR is so expensive?

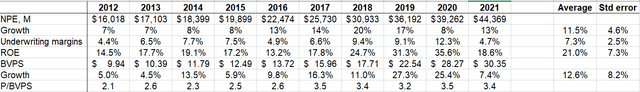

In short, it is due to high and profitable growth over many years. I put together a simple table displaying this growth (NPE stands for net premiums earned).

Company’s filings, author’s calculations

The combination of 11.5% NPE growth and 21% average ROE over 10 years is something extraordinary for a massive insurer (PGR currently employs ~50,000 people!).

Enviable ROE is directly related to relatively high underwriting margins – the correlation between them is 90%. This is not surprising at all. What is surprising is the correlation between NPE growth and underwriting margins – it is a positive 15%. On average, PGR achieves its high growth in NPE simultaneously with gains in profitability. It leaves no doubt that the company is executing incredibly well. It is not by accident that Warren Buffett compared PGR with a well-functioning machine.

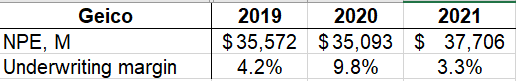

PGR has been beating Geico over the last several years. Here are some figures from Berkshire’s 10-K filings:

Berkshire’s 10-K filings

You can see that both NPE growth and underwriting margins of PGR are superior to those of Geico. While there are certain differences between the companies’ product lines, the numbers are comparable: the lion’s share of PGR’s business and all of Geico’s business consist of personal auto policies. The fact that Progressive is beating Warren Buffett in his own game tells something about the company.

Does PGR’s performance justify its valuations?

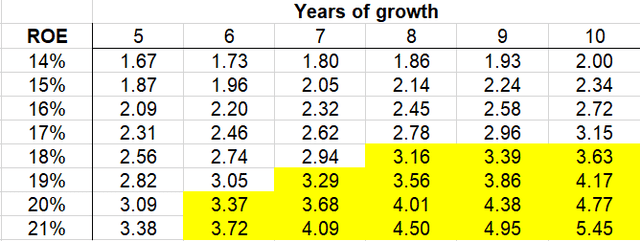

We know that PGR’s ROE is 21 ± 7.3% over the last 10 years. Let us build a model around this fact based on several assumptions:

- Over the next 5-10 years, PGR’s ROE will stay between 14 and 21% on average. To be cautious, we will not consider scenarios with higher ROE, even though they are realistic as you will see in the next section.

- The first table shows that BVPS grows only at 12.6%, much lower than ROE. The discrepancy is caused primarily by dividends. PGR pays tiny quarterly dividends of $0.10 and a sizable year-end dividend based on the past year’s performance and PGR’s ability to profitably reinvest retained earnings. Payout ratios vary from year to year but hover around 50%. To avoid dealing with dividends, we will assume that PGR reinvests all of its retained earnings. While not true, this model can be easily reproduced by retail investors in a tax-free environment (like IRA) by reinvesting all dividends back into PGR. Otherwise, taxation or non-reinvesting will lead to divergence between our model and reality.

- At the end of each period, we can estimate PGR’s stock price using the well-known rule of thumb that an insurance company with an ROE of 10% is trading at its BVPS. Consequently, an ROE of 14% produces a stock price of 1.4xBVPS and so on. Thus, we introduce a significant shrinking of multiples in the future since currently, PGR is trading at more than 3.5 BVPS vs 2.1 BVPS as follows from this rule.

- The stock price at the end of the period is discounted back by a regular 10% to determine the present value in the units of BVPS.

Hopefully, the table below will the model easier to understand:

The interpretation of the results is straightforward. For example, if we assume that PGR will be growing at 21% ROE for 6 years its value today should be about 3.72xBVPS.

During the last 4 years, PGR has been trading at 3.2-3.5 BVPS. The area in yellow corresponds to this range and shows the market’s predictions about PGR’s growth. Only 6 years of growth at the 21% ROE is sufficient to justify the current valuation.

Can PGR continue this performance?

Now we know what the market expects but we still do not know if PGR is likely to meet these expectations. Please note, however, that the market does not expect anything that PGR has not already achieved. In other words, if the next 10 years are similar to the previous 10 years, the investor’s returns will be outstanding. As a reminder: over the last 10 years, the stock delivered positive returns every year, and only twice returns were less than 10%. The stock’s IRR was about 23% (with dividends reinvested) easily beating the index.

Are there any specific circumstances that may negatively affect either growth or profitability? We do not think so. On the contrary, the current conditions may be particularly favorable for the stock. Let us address rising interest rates first.

In 2021, PGR’s investment income was $1,082 (vs. $2,085 of underwriting income) at a 2.1% yield for the investment portfolio with a 3.0 average bonds duration. Two years ago, in 2019, the yield was 3.1% and it may easily reach the same level again in a couple of years. Then investment income will jump ~50% for the same size portfolio (in reality, the portfolio will grow in line with NPE growth). It is well-known that insurance companies are major beneficiaries of growing interest rates and PGR, with its $52B portfolio mostly in bonds, is not an exception.

Due to existing cost, marketing, underwriting, and technological advantages (I explained them in my previous post), NPE growth should continue unabated because the markets in which PGR operates are highly fragmented. Here is how PGR describes its main market of personal auto insurance (2021 10-K):

We ranked third in market share in the U.S. private passenger auto market for 2020, based on premiums written, and we believe we continued to hold that position for 2021. There are approximately 280 competitors in this market. Progressive and the other leading 15 private passenger auto insurers, each of which writes over $2.5 billion of premiums annually, comprise about 83% of this market.

Geico estimates its 2021 market share at 14.2% and Progressive should be close to this number. Both companies are gradually growing their market shares at expense of both #1 insurer State Farm and smaller insurers. Plenty of room for growth for both companies remains.

However, per its CEO, PGR’s biggest growth opportunity is in Commercial Auto. Here is the market description from the 2021 10-K

There are approximately 340 competitors in the total U.S. commercial auto market. We primarily compete with about 50 other large companies/groups, each with over $200 million of commercial auto premiums written annually. These leading commercial auto insurers comprise about 82% of this market. Our Commercial Lines business ranked number one in the commercial auto insurance market for 2020 based on premiums written, and we believe that we continued to hold that position for 2021.

PGR’s market share for Commercial Auto is estimated at ~13%. But different from Personal Auto, it does not face Geico. The second biggest company in the segment – Travelers (TRV) – is twice smaller. For the first two months of 2022, Commercial Auto NPE grew 49% vs 13% growth companywide (partially due to the recent acquisition in the segment) and the underwriting margins for the business are better than for Personal Auto. In 2021, more profitable Commercial Auto represented 17% of total premium written vs 13% in 2020. Currently, Progressive is expanding this segment to adjacent lines beyond auto and it is now called Commercial Lines in filings. The segment is becoming big enough to positively affect the consolidated results.

Progressive’s Property business (mostly homeowners’ insurance) is relatively new, represents only 5% of the total premiums, but grows faster than Personal Auto. So far, however, it has generated underwriting losses. Different from auto insurance, PGR is a relatively small player in this segment. With growing scale and expertise, Property is expected to start turning underwriting profits and improve overall profitability.

Conclusion

Progressive is an outstanding company that appears to trade close to its fair value. As we know from Mr. Buffett, buying a good business at a fair price is a viable approach. Investing in PGR at P/BV~3.5 is likely to beat the index. But it is not a value investment and does not possess a margin of safety. I intend to hold my existing investment for a long time but will not add to my position unless the price drops.

Be the first to comment