adventtr

eVTOL startup Lilium NV (NASDAQ:LILM) has followed in the footsteps of a majority of its peers and de-SPACs, falling over 80% since realizing the business combination as the company faces a volatile and challenging macro environment with real revenues more than six to eight quarters away. Lilium had forecast immense revenue potential from scaling its commercial network and enterprise solutions. Even as Lilium prepares to receive preliminary deposits next year ahead of a full scale launch in 2024 and 2025, setting the stage for rapid revenue generation, the company is likely to need cash to reach such milestones, given its current cash burn rate.

Projecting Massive Growth At Scale

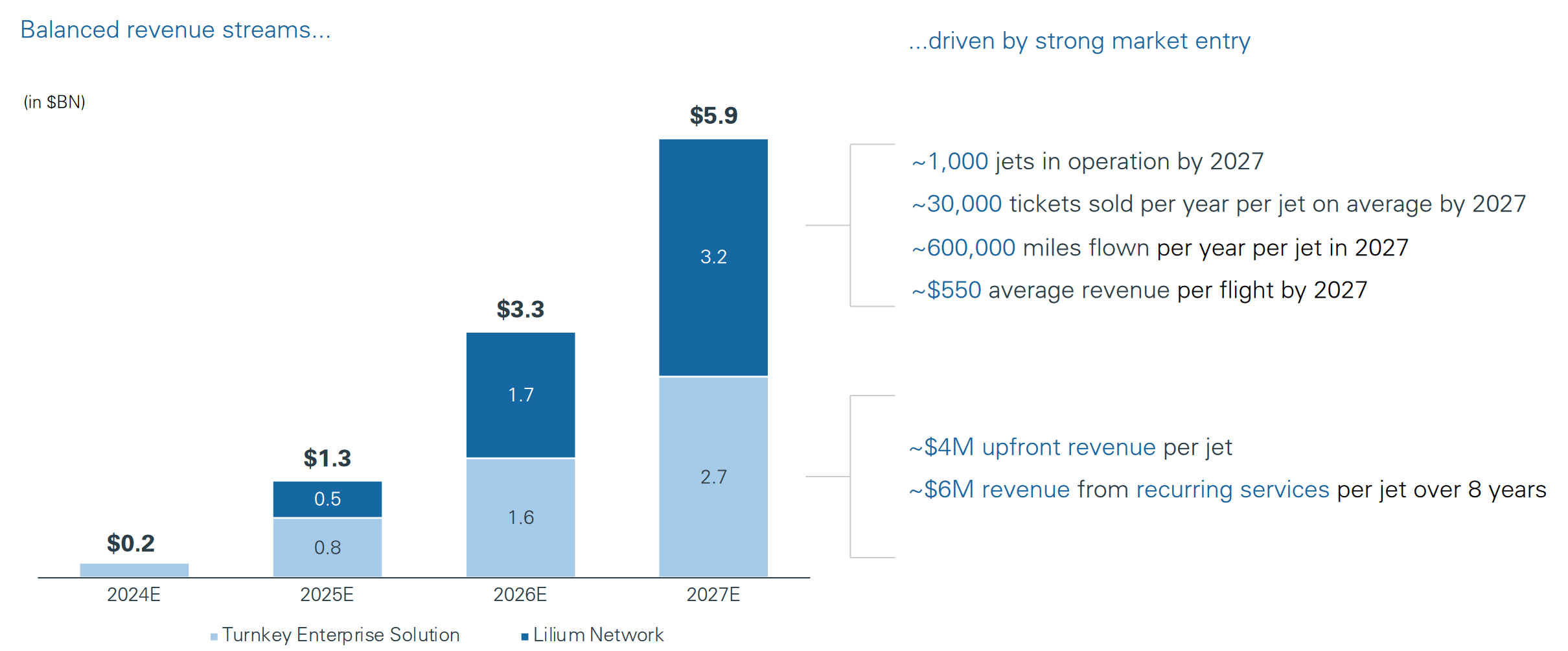

Although it’s still about five to six quarters before Lilium will start generating some meaningful revenue (aside from deposits), Lilium had laid out projections for massive growth in the first few years of commercial operation.

Within its SPAC presentations, Lilium noted that it sees its first revenues in FY24, with commercialization of passenger networks generating revenue in FY25.

Lilium

Management had projected one of the fastest growth rates in the entire market once revenue generation commences — the forecast points to growth at an ~210% CAGR in the initial launch phase from FY24 to FY27. Revenues would begin at ~$200 million in 2024 before scaling to just under $6 billion by 2027.

However, it’s crucial to take these figures with more than a grain of salt — providing such optimistic forecasts for massive amounts of revenue growth allowed a majority of SPACs to command high valuations and thus flush themselves ripe with cash; the qualitative easing and macro/policy conditions at the time also allowed such valuations to run rampant.

eVTOL could be on its path to disrupting the transportation sector as a whole — it can eliminate or replace the need for driving mid-range distances, as well as open a whole realm of possibilities in short term air and cargo travel. The potential is huge — Lilium estimated its TAM at ~$1 trillion.

A More Realistic Forecast

While Lilium’s initial forecast provided some highly optimistic projections for revenues and scale, Lilium is advancing ahead with the early stages of commercialization via jet commitments. Lilium plans to accept deposits during 2023 for the jets, but currently has nearly 500 commitments to date, with some high-profile aviation names such as Brazil’s Azul (AZUL).

Should Lilium move a majority or all of these initial commitments to firm orders, set for delivery in 2024/2025, the firm could be well on its way to generating meaningful revenues by 2025.

At approximately 500 seven-seater jets and an average price between $4 million to $4.5 million per jet (the 16-seat is not expected to be launched until 2028), Lilium has a preliminary order book worth approximately $2 billion. It may take until mid-2026 to fulfill, suggesting revenues may ramp to ~$1.2 billion to $1.5 billion by then.

Attractive Unit Economics At Scale

Lilium’s projected unit economics are relatively attractive as well — average revenue per flight of $550 with 10 to 15 flights per day could generate $5,500 to $8,300 per jet per day — or $2 million to $2.5 million per year. At a scale of 1,000 jets, that’s over $2 billion in revenues. Again, it will take time to reach such a scale, if at all. Lilium’s projected Florida network of 14 vertiports and 125 jets placed annual revenues at $600 million at scale, suggesting revenue potential could be higher with more flights.

Geographic expansion also provides a realm of opportunity for Lilium — if one network in Florida can record over half a billion in revenues annually at scale, the revenue potential from having two to three dozen networks globally, of smaller and larger sizes, significantly increases the revenue Lilium’s passenger network can generate.

Substantial Risks To Launch

Even with Lilium moving along with EASA certification, test flights and demos, and inching towards accepting deposits and turning commitments into firm deliverable orders, the company still faces substantial risks ahead.

Cash Burn Rate

Lilium is not expecting to generate a dime of substantial revenue until at least FY24 (with deposits due in FY23), with full commercialization expected in FY25 and FY26. Given the length of time until revenues begin, it’s inherently risky, and will likely need a substantial injection of cash to scale and develop its commercial network even as it attempts to adhere to a €60 million per quarter cash spend rate.

At the end of Q2, Lilium had approximately €229 million in liquidity, plus a €75 million equity line of credit that it can tap into at the expense of shareholder dilution. At its current cash spend rate, Lilium will have around €170 million in total liquidity, including the ELOC, at the end of 2022.

With this in mind, Lilium is likely to need an extensive capital raise in Q1 2023, at the very latest Q2, in order to fully fund its commercial ramp through the end of 2023 and 2024. Given cash spend rates expected to ramp higher as serial production starts to scale through 2024, Lilium may need to raise upwards of €500 million. Via debt, that will likely be expensive given Lilium’s financial situation, lack of revenues and deliverable product, and risk to launch, as well as the current rate environment. Via shares, likely to incur substantial dilution at the current share price to raise even €150 million, while convertible notes also may incur significant dilution in the future.

Safety Risks

Lilium has noted that its launch timelines are “necessarily inherently uncertain and are subject to a wide variety of significant business, economic, competitive and other risks and uncertainties that could cause actual results to differ materially.” For example, there had been “a negative safety incident involving one of the Lilium Group’s competitors that results in decreased demand for the Lilium Group’s jets or services,” and more possible events in the future in the competitive landscape of for Lilium could impact demand and timelines.

It’s a similar case to autonomous vehicles, which aim to revolutionize ground transportation and ride-hailing, for example, by improving safety – if AVs fail to prove safety, commercialization plans are due to be delayed; for eVTOL, if the jets have adverse safety events or crashes, commercialization plans and timelines could be delayed substantially. Flying involves significant risk to passengers, and if Lilium has some adverse safety incidents, it could damage its safety profile and delay its launch plans.

Other risks include certification taking longer than expected due to the novel type of aircraft involved, building out a vertiport network (and the costs associated with doing so), as well as the broader competitive landscape in the eVTOL sector.

Outlook

Lilium is ripe with potential growth from commercializing and scaling its eVTOL network in Florida and Germany before expanding to other geographies. However, the startup still faces a challenging and long timeline to reach commercialization, with four to six quarters to go until real revenue generation begins from commercialization. Lilium faces multiple risks to commercialization, namely risks related to safety and a major need for cash to fund operations through 2024 and beyond. The stock could face substantial downside from a challenging macro environment and need to raise capital, but upside potential could be significantly large for a risk-taking investor.

Be the first to comment