Bet_Noire

Investment thesis

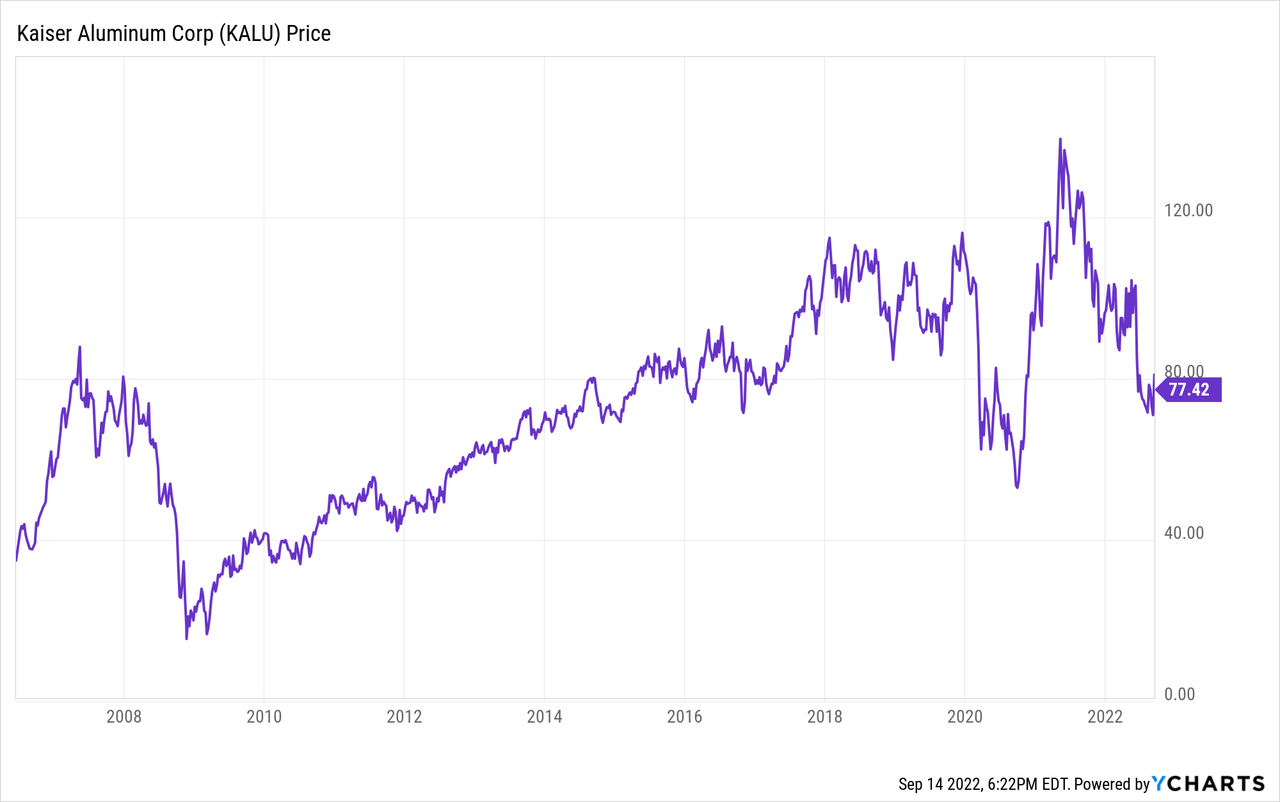

In May 2022, I wrote an article about Kaiser Aluminum (NASDAQ:KALU) as margin contraction caused a ~30% decline in the share price due to inflationary pressures, supply chain issues, labor shortages, and rising transportation costs. Despite that margin contraction, the company was still generating enough cash from operations to cover the dividend payout and interest expenses, and the acquisition of Alcoa Warrick boosted net sales by 73% in 2021 compared to 2019.

During the past four months, the share price continued to decline by another 20% while the S&P500 changed by a positive 0.5%, and the reason for this is that the headwinds that caused the decline in the share price still persist. Furthermore, magnesium shortages caused a force majeure in shipments for the company’s packaging customers due to supply problems in the Warrick Rolling Mill. The company is now getting a limited magnesium supply but is looking for alternative suppliers and other hot metal sources to replace Alcoa’s smelter, which is also having troubles, and this should soon allow for full production rates again.

A brief overview of the company

Kaiser Aluminum is a U.S. manufacturer and seller of semi-fabricated specialty aluminum mill products for aerospace and high-strength products, beverage and food packaging, automotive extrusions, general engineering products, and other industrial products. The company was founded in 1946 and its market cap currently stands at $1.3 billion.

Kaiser Aluminum logo (Kaiseraluminum.com)

The company’s products are mostly sold to third-party manufacturers for the manufacturing process of their own products. As I mentioned in the previous article, one of the strongest points of Kaiser Aluminum is that it has multi-decade relationships with blue-chip companies, which allow for reliable revenue sources.

Currently, the share price stands at $77.42, which represents a 20.09% decline since the last article I wrote, and a 42.25% decline from all-time highs of $134.05 on May 11, 2021. The reason that the price has continued to fall is mainly due to problems related to the supply of the company’s Warrick rolling mill and the lengthening of previous headwinds: supply chain issues, inflationary pressures, increased energy and freight costs, and labor shortages.

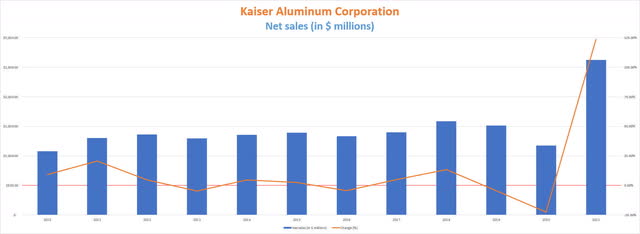

Net sales keep growing

The company’s net sales skyrocketed in 2021 to $2.62 billion thanks to the acquisition of Alcoa Warrick from Alcoa (AA) on April 2021, for which Kaiser Aluminum paid $670 million. Net sales for 2022 are expected to reach $3.45 billion as a consequence, and the increase is expected to continue in 2023 to $3.73 billion.

Kaiser Aluminum net sales (10-K filings)

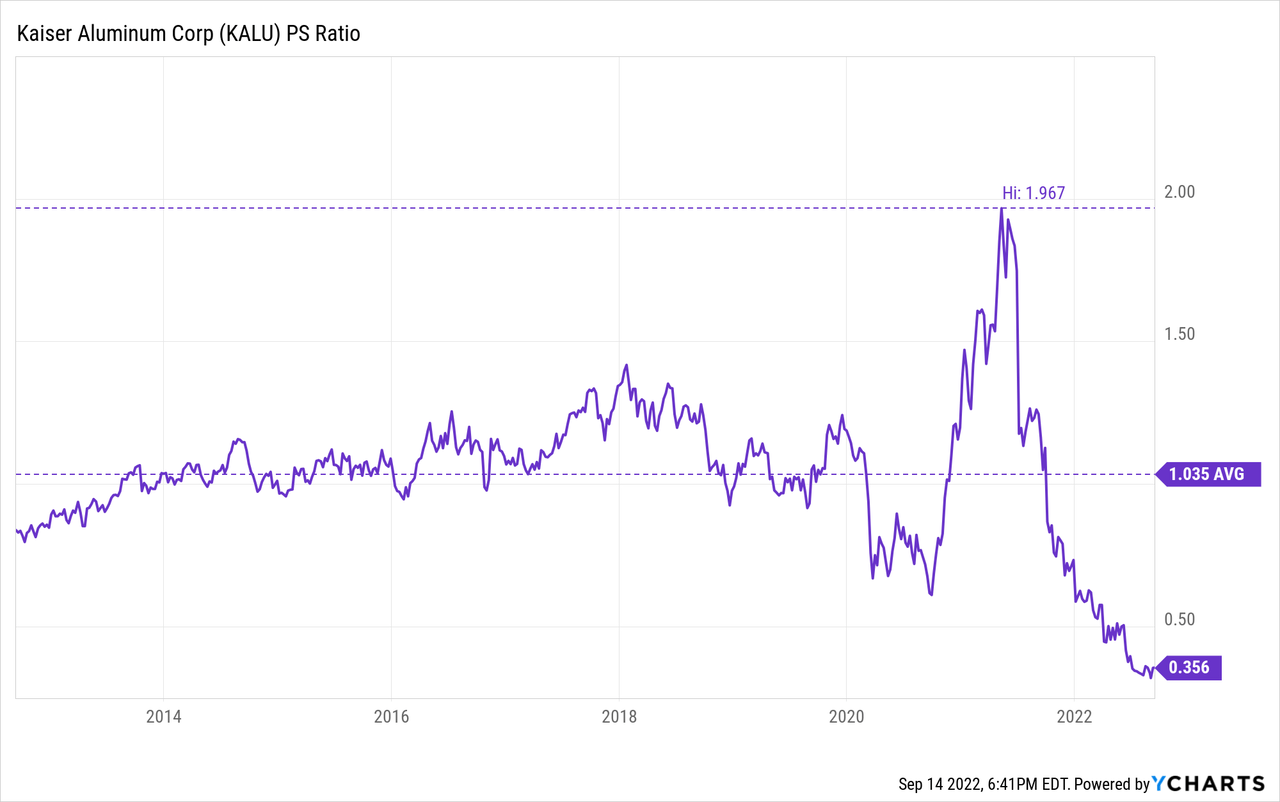

During the second quarter of 2022, net sales increased by 0.57% quarter to quarter and 28.77% year over year, and thanks to this, the current trailing twelve months’ net sales stand at $3.46 billion, in line with the expectations for 2022. In this sense, net sales are not being too influenced by current headwinds, so the PS ratio continues to decline as a result of a continued decline in the share price despite increased sales. In this sense, the PS ratio currently stands at 0.356, which means the company currently generates $2.81 for each dollar held in shares by investors, annually.

This ratio represents an 81.90% decline from the spike of 1.967 reached in 2021 and also a decline of 65.60% compared to the average of 1.035 during the past decade. In this sense, investors are now much less willing than in the past to pay for the company’s sales, and this is so because the contraction of margins has considerably diminished the company’s ability to convert sales into actual cash. In fact, the company is currently using its own cash on hand to cover the interest on the debt and the dividend, but if operations return to normal and Kaiser Aluminum once again enjoys enough surpluses to allow it to deleverage the balance sheet and continue to operate normally over the long term, the upside potential may be considerable for investors as pessimism is very high as such a low PS ratio suggests.

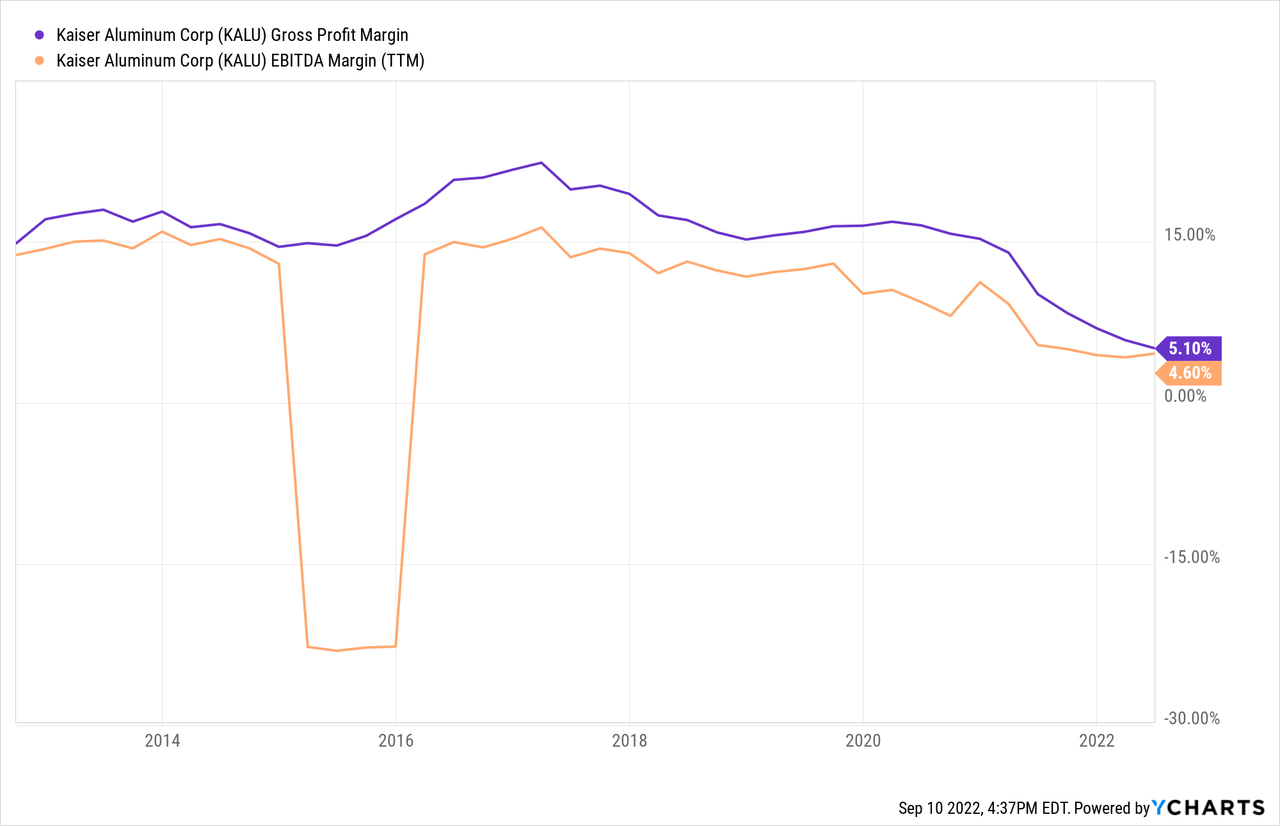

Margins currently don’t allow for cash generation

Margins have continued to deteriorate from 2017 to the present. In this sense, trailing twelve months’ gross profit margins currently stand at 5.10% while EBITDA margins stand at 4.60%. Although they seemed to start recovering before the coronavirus pandemic crisis in 2020, the pandemic, along with subsequent inflationary pressures, supply chain issues, increasing transportation and alloy energy costs, and now the war in Ukraine and magnesium shortages, have deepened the drop in margins to the point of making operations unsustainable. This is the main price investors must pay in exchange for the current decline in the share price.

The company is currently having magnesium availability issues as US Magnesium stopped shipping magnesium in June 2022, which caused a further decline in the EBITDA margin to 2.24% for the second quarter of 2022. This happened after nine months of receiving ~50% less than expected contracted volumes from US Magnesium due to a force majeure declaration in September 2021, so Kaiser Aluminum had to temporarily declare a force majeure in its Warrick rolling mill from July to September 2022. This is a sign that the problems are far from coming to an end. Furthermore, the Alcoa smelter, which provides around 30% of the metal supply needed in the factory, is having issues meeting demand, so performance was also negatively impacted on that front. The war between Russia and Ukraine continues and with it all the macroeconomic problems linked to the conflict. And worst of all, the company now has to face a high interest expense as a result of the debt incurred for the acquisition of Alcoa Warrick.

But still, I consider these headwinds to be temporary since the war in Ukraine will sooner or later end and the inflationary pressures and supply chain issues derived from the post-pandemic era will end up stabilizing. For this reason, and because it is uncertain how long all the macroeconomic headwinds will take to resolve, it is very important to know the resources that the company has since sufficient cash reserves are necessary to continue operating until the margins stabilize and the company returns to generate strong cash from operations as it historically has done.

Net debt keeps rising as operations are (temporarily) unsustainable

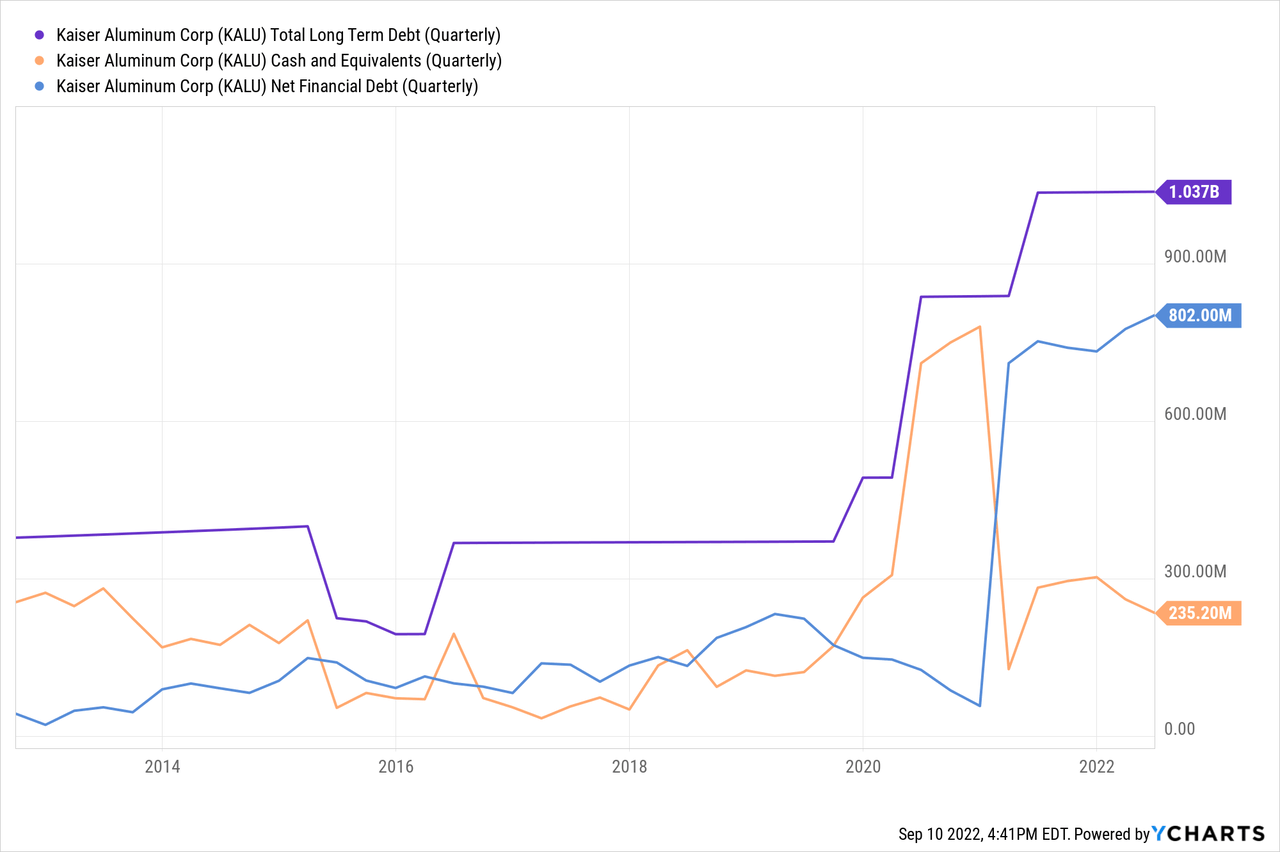

The company’s long-term debt increased significantly in the 2020-2021 period as a consequence of the acquisition of Alcoa Warrick and currently stands at $1 billion. The company kept $300 million of cash on hand, which should allow it to deal with current headwinds for quite some time, and still holds $235 million as net debt increased by $50 million because the cash payout ratio surpassed the 100% mark in the third quarter of 2021.

That cash on hand should be enough to cover the current cash outflows for about 2 years if we consider trailing twelve months’ cash from operations currently stands at $81.5 million but capital expenditures at $85.5 million, dividends paid at $48.4 million, and interest expense at $49.2 million. Still, accounts receivable increased by $9.2 million year over year in the last quarter, inventory by $84.8 million, and accounts payable by $74.7 million.

But if operations continue to deteriorate or the recovery takes longer than expected, the company may need to go back into more debt to continue operating or cut the dividend, or both.

The cash payout ratio is too high and the dividend is not safe

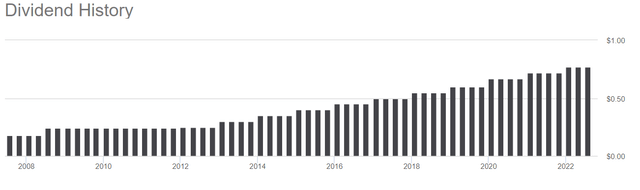

The company’s dividend has been increasing steadily since 2007, and it has almost tripled in the last decade.

Kaiser Aluminum Dividend history (Seeking Alpha)

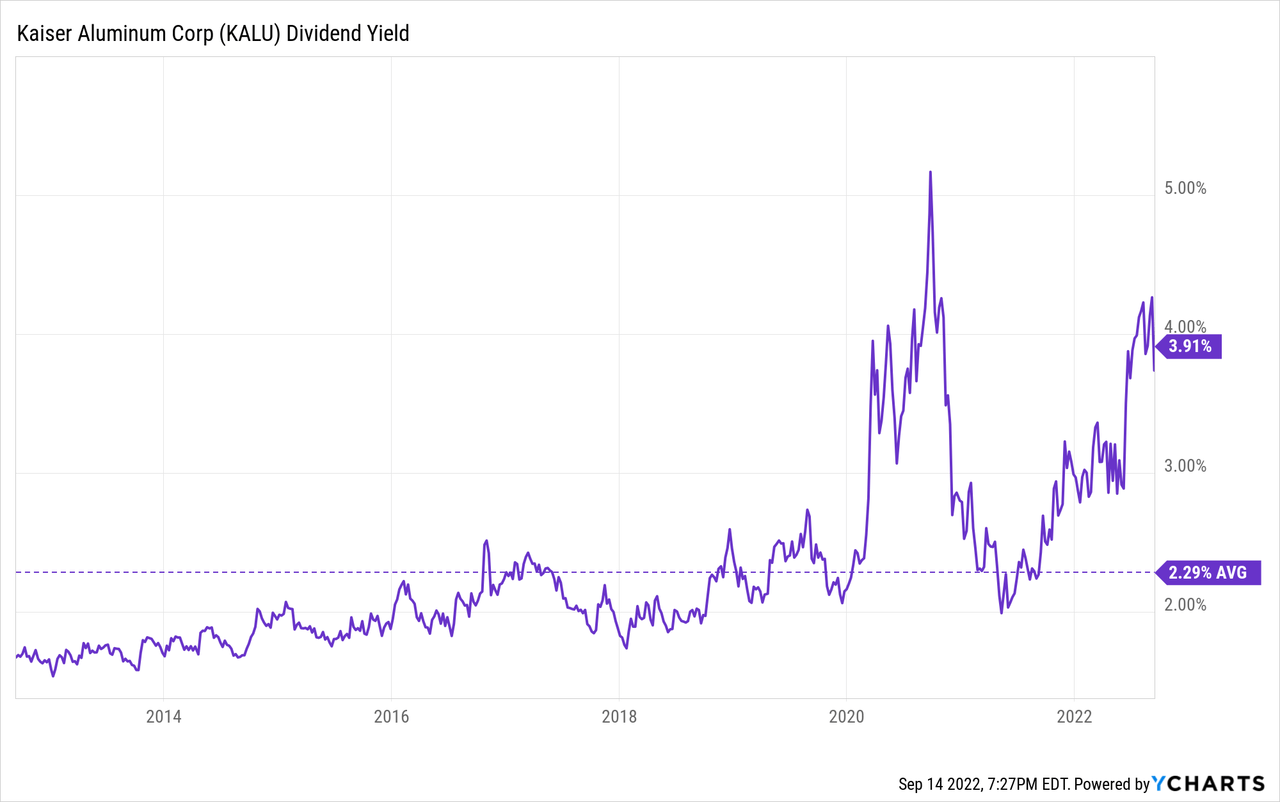

These raises along with the recent decline in the share price caused the dividend yield to skyrocket to 3.91%, which is 71% higher than the average of 2.29% during the past decade. Nevertheless, the increased dividend yield comes with an increased risk of being cut as the current cash payout ratio has exceeded the 100% line without counting the capital expenditure. And if the dividend is finally not cut, its growth will be significantly limited in the coming years due to the current need to deleverage the balance sheet.

In the past article, I calculated the historical capacity of the company to cover the dividend and the interest expenses by calculating what percentage of the cash from operations was used each year to pay both, but below I will focus on the last quarter’s cash payout ratio, always using the trailing twelve months’ data.

| Quarter | Q2 2020 | Q3 2020 | Q4 2020 | Q1 2021 | Q2 2021 | Q3 2021 | Q4 2021 | Q1 2022 | Q2 2022 |

| Trailing twelve months’ cash from operations (in millions) | $256.7 | $229.1 | $206.9 | $143.1 | $116.9 | $61.1 | $79.4 | $92.2 | $81.5 |

| Trailing twelve months’ dividends paid (in millions) | $41.2 | $42.3 | $43.4 | $43.8 | $44.9 | $34.1 | $46.7 | $47.5 | $48.4 |

| Trailing twelve months’ interest expenses (in millions) | $29.7 | $36.0 | $40.9 | $47.1 | $49.0 | $49.4 | $49.5 | $49.4 | 49.2 |

| Cash payout ratio | 27.62% | 34.18% | 40.74% | 63.52% | 80.33% | 136.66% | 121.16% | 105.10% | 119.75% |

As we can see in the table, both dividend and interest expenses have increased significantly in the past few quarters while cash from operations has deteriorated heavily. With $225 million of cash on hand, the company still has wide margins to continue paying the dividend and interest expenses, but it is necessary that the profit margins improve soon if the management wants to avoid cutting the dividend or having to take more debt as the company now needs to make use of its cash reserves in order to keep going.

Risks worth mentioning

In general, almost all the significant risks revolve around the deterioration of profit margins, which has accelerated in recent quarters. The company needs to find new suppliers of magnesium at good prices if it wants to turn around profit margins and generate again the vast amounts of cash from operations it used to, and it is still not certain whether the conditions will be as good as they were with US Magnesium. Also, energy and freight costs will remain a headwind until they stabilize. Time is against Kaiser Aluminum, but the company luckily has enough cash reserves to weather the storm for quite some time.

In 2021, the five top customers accounted for ~49% of Kaiser Aluminum’s net sales, and therefore, a significant reduction in demand by any of these five customers would have a very significant impact on the demand for the company’s products.

The dividend is not safe. Taking into account the interest and dividend expenses, the cash payout ratio exceeds 100%. But if we also add capital expenditures to the equation, we can conclude that the company currently has an outflow of ~$100 million per year. Investors who venture to invest in this turnaround should do so because of the high dividend yield on cost they will receive in the long term, and not counting on the current dividend, since a cut is possible.

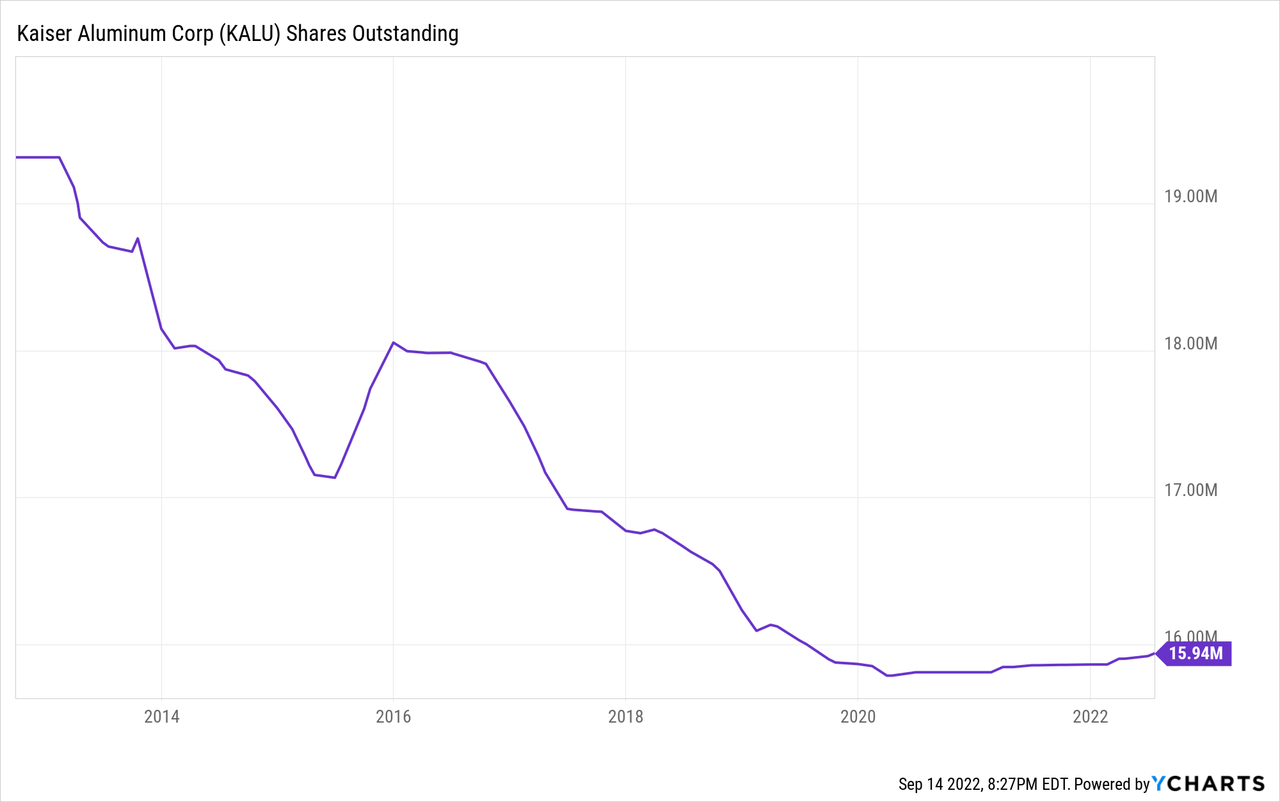

Also, share repurchases may take a long time to resume due to the increased debt.

The company has historically reduced the total amount of shares outstanding via share buybacks and has effectively reduced the number of shares outstanding by 17.50% during the last decade, thus increasing the size of the company that each remaining share represents. But despite this, I believe that it is likely that management will opt to reduce the debt pile once the current headwinds calm down before declaring any share repurchase program again.

Conclusion

Time plays against Kaiser Aluminum as the company is using its own cash reserves to cover the dividend, interest expenses, and CAPEX. Investors who are interested in acquiring shares should do so with the knowledge that operations are currently unsustainable, but that the headwinds that have brought the company to this situation are of a macroeconomic scale and will be likely temporary as they are linked to real global problems (supply chain issues due to the reopening of the economies of the world after the pandemic, inflationary pressures, and the war between Ukraine and Russia).

In exchange for patience and risk tolerance, the current PS ratio is 81.90% lower compared to the spike of 1.967 reached in 2021 and also 65.60% lower compared to the average of 1.035 during the past decade. Also, the current dividend yield of 3.91% is 71% higher than the average of 2.29% for the past decade, which will leave a juicy dividend yield on cost to investors with a high risk tolerance even if the dividend is temporarily cut.

Be the first to comment