CHENG FENG CHIANG/iStock via Getty Images

Enbridge Inc (NYSE:ENB) is a superstar among high yield stocks. Not only does it sport a high 5.9% yield, it‘s also delivering strong returns in 2022. Up 18% year-to-date as of this writing, ENB is absolutely crushing the S&P 500, which is currently negative for the year.

Thanks to the bullishness in energy stocks this year, ENB‘s yield has fallen considerably. At the start of the year, the yield was above 6%. For most of the last five years, it was above 7%. This year, ENB stock is rising, and the yield is coming down with it. Still, a 5.9% yield is much higher than what you‘ll get with the average stock.

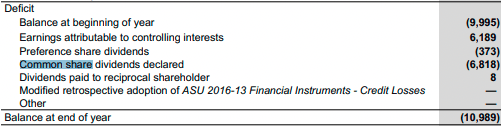

The question many investors have on their minds is, “is this 5.9% yield sustainable?” There‘s no doubt that Enbridge pays out rivers of income based on its declared dividends for 2022, but there are some signs that ENB‘s payout isn‘t the most sustainable. If you look in Seeking Alpha Quant, you will see that ENB has a 119% payout ratio. Based on earnings, this ratio is just about accurate. Enbridge had $2.27 GAAP in earnings in the most recent 12 month period, and paid a $2.64 dividend on those earnings. That gives us a payout ratio of 116.2%.

If GAAP earnings were all there was to the picture, then Enbridge‘s dividend would not be very safe. However, the company‘s cash flows paint a different picture. If you look at operating cash flow or distributable cash flow (“DCF“), you see that ENB is in fact quite able to continue paying, and raising its dividend. And when you consider that alongside the fact that Enbridge is situated in one of this year‘s most strategically important industries, you‘ve got a recipe for continued success.

Competitive Landscape

Before diving into ENB‘s financials, we need to take a look at the competitive landscape it operates in. That is, the quality of the industry itself, and ENB‘s position compared to its competitors.

First, the industry itself:

Enbridge is a midstream energy company whose main activity is transporting crude oil via pipeline. It also has a smaller business as a natural gas utility. ENB‘s pipelines transport oil all over North America. Its utilities business supplies about 75% of the natural gas consumed by Ontarians.

Both of Enbridge‘s main industries are showing strength in 2022.

First, the pipeline business. Crude oil is selling for historically high prices in 2022. A lot of the price increase is due to supply shocks like the situation in Ukraine, but demand is strong too. Pipelines make money transporting oil in exchange for tolls. The greater the demand for oil, the more likely it is that their pipelines will be filled to capacity. Some pipeline contracts even have clauses that say the toll goes higher when oil prices are higher. So there are many ways in which pipeline companies profit in a period of rising oil prices.

Next up, we have the natural gas business. Natural gas prices are rising and Enbridge‘s rates are rising right along with them. Enbridge‘s competitive position in Ontario is rock solid, as it supplies the overwhelming majority of the province‘s natural gas. So it has plenty of room to raise natural gas rates further provided that regulators allow it.

The competition in the pipeline segment is more keen–at least as measured by number of competitors. Among North American pipelines, there are many major companies, including:

Competition is not really a concern for these companies on a day to day basis. Clients are more than willing to pay double pipeline rates for crude-by-rail, suggesting there is enough demand to keep all the pipelines booked solid. Competition is keen in the sense of building new projects. If one company tries to build a pipeline in a given State and is denied by regulators, that creates an opening for other companies to position themselves as the alternative. It‘s for this reason that the cancellation of Keystone XL was cited as a tailwind for Enbridge.

Enbridge‘s Financials

Having looked at Enbridge‘s competitive position, we can now turn to its financials. When we take a good look at ENB‘s income statement, balance sheet and cash flows, we see that its dividend is well covered. We should look at the income statement first, because it is this statement that most strongly argues against my thesis.

Some of the key income statement metrics from Enbridge‘s most recent fiscal year were:

-

$47 billion in revenue.

-

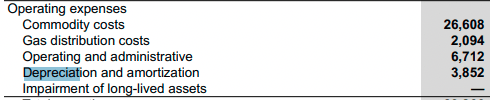

39.2 billion in expenses.

-

$7.8 billion in EBIT.

-

$5.8 billion in GAAP net income.

-

$6.8 billion in common share dividends.

Enbridge

It is from GAAP net income that we get the dreaded 116% payout ratio that most data platforms report. This is indeed Enbridge‘s GAAP payout ratio. However, we need to consider that GAAP net income includes:

-

Depreciation.

-

Amortization.

-

Unrealized gains/losses on stocks and derivatives.

-

Impairment.

None of these have any influence on dividend paying ability whatsoever. And if we look at Enbridge‘s income statement in more detail, we see that at least one of them had a huge influence on ENB‘s 2021 GAAP earnings: depreciation. Coming in at $3.8 billion, it was an absolutely colossal charge off of net income that had nothing to do with cash flows at all.

Enbridge

So, ENB‘s operating cash flows should have been much higher than GAAP earnings. When we turn to the cash flow statement, we see that that was in fact the case.

In 2021, Enbridge reported the following key cash flow metrics:

-

$9.2 billion in cash from operations.

-

$10 billion in distributable cash flow.

Both of these are more than enough to cover ENB‘s $6.8 billion in common share dividends. That suggests a dividend that is well covered by day to day cash flows. On the other hand, Seeking Alpha Quant reports $1.2 billion in negative free cash flow. That is a much less rosy sign. But it isn‘t necessarily indicative of the long term reality. Enbridge is currently making massive capital expenditures in order to expand its pipeline capacity. Many of these expenditures will have a positive impact on revenue in the future; for example, the Line 3 replacement will replace the existing 33 inch pipe with 36 inch pipe. That will allow more oil to be transported and will ultimately lead to higher revenue.

Valuation

Having looked at ENB‘s financials, we can now turn to its valuation.

Enbridge is a relatively cheap stock compared to the market as a whole. Based on trailing 12 month data, it trades at:

-

20 times earnings.

-

2.5 times sales.

-

2.2 times book value.

-

12 times operating cash flow.

Despite these low multiples, Enbridge sports a healthy 25.3% three-year CAGR growth rate in diluted EPS. This suggests that if ENB keeps growing at the rate it has been, it will catch up with its current valuation at a rapid pace. And with energy being in such short supply right now, we have a strong macro indicator that oil and gas will continue to be hot commodities in the future.

Risks and Challenges

As we‘ve seen, Enbridge is a profitable company whose dividend is well covered by operating cash flows. This suggests that the dividend is not at risk of being cut any time soon. However, there are some risks and challenges facing anyone who chooses to buy the stock. These include:

-

Political risk. Enbridge‘s new pipeline projects (including replacements and expansions) are constantly facing political opposition. One of ENB‘s competitors, TC Energy, had its biggest pipeline project cancelled by the U.S. government. Last year, Michigan Governor Gretchen Whitmer tried to shut down Enbridge‘s Line 5. That effort didn‘t go anywhere, but smaller legal challenges have succeeded in slowing down Enbridge‘s pipeline building. This is a very real risk to investors because the longer it takes to build or replace a pipeline, the longer the company goes without recovering its investment in the project. A pipeline doesn‘t generate revenue until it is built.

-

High capital expenditures. Enbridge has been running enormous capital expenditures for years now. Last year, net CAPEX was over $5 billion. Although ENB‘s operating cash flow more than covers its dividend, free cash flow does not. If the projects Enbridge is investing in right now don‘t pay off in the medium term future then the company‘s finances could take a serious hit.

-

High leverage. Enbridge is a pretty heavily indebted company. It has $67 billion in long term debt, on shareholder equity on $60 billion in equity. That gives us a debt-to-equity ratio of 1.11, or 111%. So there is more debt than book value here. Additionally, Enbridge‘s cash position ($280 million) is miniscule compared to current liabilities ($18 billion). So, there could be some liquidity issues at play here.

The Bottom Line

The bottom line on Enbridge is that its dividend is well covered by its day to day operating cash flows. The payout ratio is technically above 100%, but operating cash flows more than cover the dividend payments. Free cash flow does not. Thanks to ENB‘s enormous capital expenditures, its FCF is negative. That is not a good look, but on the other hand, if these capital expenditures pay off, they could be accretive in the future.

I think that anybody who buys Enbridge for the dividend alone will likely continue receiving it for the foreseeable future. They may even experience dividend hikes, as they have in the past. We would definitely want to see this company pay off some of its debt and start making those capital expenditures pay off. If it does so, then investors can expect solid results in the future.

Be the first to comment