Solskin

The iShares Global Healthcare ETF (NYSEARCA:IXJ) has been resilient this year, proving a relatively good way to have parked money – indeed, there is a chance of earnings growth even when there are recessionary pressures. But we believe that the investors in IXJ are not acknowledging the conclusions of other very smart money in the Treasury markets. The earnings yield on this ETF is just too low to justify investment. It’s a pass.

IXJ Breakdown

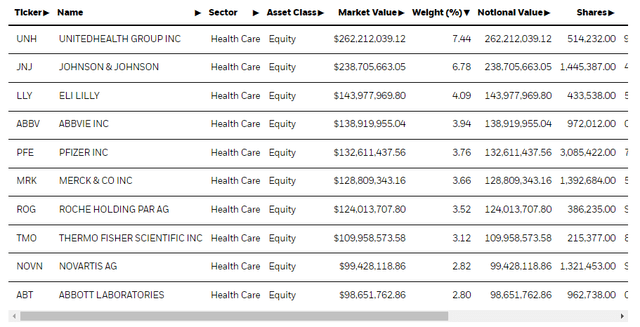

The top holdings give a decent idea of what to expect from this ETF.

Top Holdings (iShares.com)

There are some insurance exposures which have insurance economics to perhaps achieve growth in a higher yield environment. Higher yields mean better returns on reserve portfolios, because reserve portfolios are by mandate substantially invested in short-term fixed income instruments. These tailwinds cover the UnitedHealth Group (UNH) which accounts for 7.4% of the allocations. Demographics support growth in covered lives, and also supports the biopharma and medtech market growth in the longer-term, where long-term growth rates are difficult to harass even with a recession.

The vast majority of the portfolio is driven by medtech and biopharma which ultimately have a similar go to market in terms of products and FDA approval, and often a degree of recurring revenue with replacements in medtech as well as disposables, and periodic treatment for chronic disease in biopharma. Reversion to the mean effects from a recovery in diagnosis and physician visit rates have also been a tailwind as the world moves on from COVID-19. In other words, the IXJ contains stocks that can likely keep a solid rate of long-term EPS growth rate going. While there are some minor pressures from regulators, the reality is that things are probably going to stay pretty solid.

If there’s going to be any pressure on earnings in the major holdings, it might be from overcoming patent cliffs. AbbVie (ABBV) is in the process of that with Humira. Merck (MRK) has its own patent cliffs coming, but already seems to have enough blockbuster drive to be able to avoid the erosion. Other companies that became reliant on the COVID-19 vaccine like Pfizer (PFE) and to a much lesser extent Johnson & Johnson (JNJ), and companies that do quite a bit of diagnostics like Abbott Laboratories (ABT) and Roche (OTCQX:RHHBY), will also see some earnings pressure as other growers need to overcome a rapidly shrinking category after the 2020-2021 surge. About 10% of the portfolio is exposed to varying degrees to these trends – with only a proportion of these businesses being levered to COVID-19 severity and cases, the overall IXJ impact is very limited.

Remarks

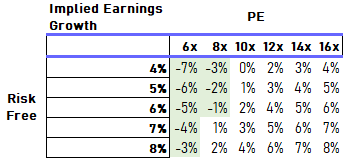

In general, the biopharma bet is a safe one, and UNH carries almost 10% of the portfolio with insurance economics. Earnings growth is entirely possible on the whole with this portfolio. The problem is still valuation. A 5% earnings yield implied by the 20x PE is way too high when longer-term rates are getting pretty high, as implied by the bond market. Bond market tends to be a pretty smart indicator of what’s actually to come with the economy, and the flat yield curve with 4% yields at least for the next 10 years should be a concern to equity investors.

What would you rather buy? A 4% flat yield guaranteed over the next 10 years by the US Treasury or an equity portfolio like the IXJ with today’s earnings yield at 5% and the promise of some modest but not knockout growth. We think a fair multiple for a portfolio that can maybe delivery about 4% earnings growth perpetually is about 16x, not 20x, and that’s assuming that rates don’t go higher, which they very well could. Markets are already coming to a consensus that long-term rates will be a bit higher due to cost-push factors outside of the control of the free market like onshoring, energy supply cuts, more war etc. But inflation spiral and other factors could still shift that curve up some more.

Value Chart (VTS)

We just don’t see what is compelling with this portfolio.

Thanks to our global coverage we’ve ramped up our global macro commentary on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment